Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Starting a small business is a lot of work, and there are a lot of little things you need to do to make sure that you’ve got everything covered.

Especially with the government.

As is the case with most businesses that start out, you’ll have at least one employee or contractor on your small business payroll. But before you can start paying your team, you need to do a couple of things to register your business with the government.

Because these are all important steps related to hiring your first employee or contractor, we’ve created a free Comprehensive Guide to Hiring your First Employee, which provide information, forms and useful resources all in one place.

Employer Identification Number (EIN)

The first step is to register for a Federal Employer Identification Number (FEIN or EIN).

Actually, you need to do this step even if you don’t have any employees because this is the ID that is used to identify a business entity that is separate from you e.g. corporations, partnerships, etc.

The only people who are exempt from having to register for an EIN are sole proprietors who have no employees; however, if they have pay excise or payroll taxes, they will also have to get an EIN.

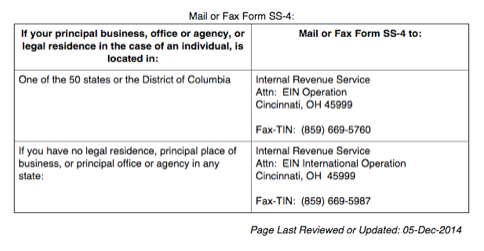

It’s easy to apply for an EIN now that you can do it all online by completing IRS Form SS-4. In fact, it is the preferred method. Just make sure you have a valid Taxpayer Identification Number on hand to complete the form.

This is a free service provided by the IRS, and you can complete your application online or send it in by fax / mail.

Registering Your Business for Payroll With Your State

Whether your business is structured as a sole proprietorship, a corporation or a limited liability corporation (LLC), you will need to register your business with your specific state to secure any business licenses or permits you need to run your business.

For any state you are doing business in (with either a physical location or where your employees work from), you must register your business.

There are typically two state agency registrations you must complete – your state Department of Revenue and your state Department of Labor. Each state may have a unique name for those departments.

The Department of Revenue allows your registration, not only for employment taxes, but also sales and use taxes. The Department of Labor registration covers your obligation for State Unemployment Insurance (SUI) coverage.

Most times, you register your business in the state that it operates in, but if you run an internet-based company or some other kind of business that doesn’t have a brick and mortar location, you have the option of registering your business in states like Delaware, Nevada or Wyoming.

This isn’t a solution for all small business owners, because chances are you have to pay state taxes if you reside there or do business in that state. You might also need to “foreign qualify” your business and pay taxes in more than one state if you conduct business in any state where you didn’t incorporate.

For a complete list of state government websites, you can click here to find information on doing business in your state.

The Electronic Federal Tax Payment System (EFTPS)

If your payroll provider or accountant is managing all the tax payments for your business, it is a good idea to enroll your business in this system and keep track of all your filings. You should also check with your provider to understand what tax payments are being handled by them directly.

Key Takeaways

- Register to get your business EIN number – it’s easy to do especially since you can do it all online.

- You should do your homework to determine your state-specific requirements. There might be licenses or permits you need to apply for in order to do business in your state.

- The EFTPS is a free service provided by the U.S. Department of the Treasury. It is recommended you enroll your business to pay and keep track of your tax payments.

To help you navigate the confusing waters of hiring your first employee, download our free Comprehensive Guide to Hiring your First Employee. We’ve also gathered some of our best how-to posts into a free Guide to Small Business Payroll.

To help you navigate the confusing waters of hiring your first employee, download our free Comprehensive Guide to Hiring your First Employee. We’ve also gathered some of our best how-to posts into a free Guide to Small Business Payroll.

![]()