Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Year-end is once again upon us. Don’t worry, surviving year-end as a small business owner whose strength is making business magic happen and not payroll isn’t impossible. Especially since we’ve brought back our webinars, guides and feel-good content to get you through it while keeping it together. (In other words, reducing stress, headache occurrences and making room to enjoy the holiday cheer.)

In this webinar, Wagepoint Product Marketing Manager, Ryan MacDougall, walks you through year-end in Wagepoint as a small business owner. There are plenty of golden nuggets he unveils, so be sure to watch the webinar above to get the full scope of what you’ll want to keep in mind while checking items off your payroll year-end to-do list.

Here are a few of the key points he touches on.

Don’t go into year-end unprepared.

When taking on something like payroll year-end, it’s good to go in prepared. The same is true if you’re using a payroll software like Wagepoint, and here’s a short list of things you’ll want to do right now in November to get your year-end processes ball rolling.

- Finalize at least two pay runs in Wagepoint during the 2022 calendar year.

- Toggle on or off the Auto-submit tax forms feature in your settings per your preference.

- Review reports, such as the Year-to-date, Remittance and the T4/T4A/RL-1 export reports.

- Verify employee details.

- Think early about bonus runs.

Ryan goes over each of these in more detail during the webinar, or you can also read through and bookmark 5 Really Important Things You Must Do Now to Prepare for Year-End from our Year-End Survival KIT!

Don’t miss important dates and deadlines.

Knowing the when of year-end tasks is a big part fastforwarding to the cheer part of holiday cheer. There are a number of important dates and deadlines you’ll want to consider for things like year-end forms, processing pay runs to be included for the 2022 tax year and more.

Check out Ryan’s breakdown in the webinar or check out these handy blogs in our Year-End Survival KIT.

- Timelines and Tips for 2022 Year-End Documents (T4, T4A, RL-1s)

- When Should I Process Payroll for the 2022-23 Winter Holidays?

What does year-end in Wagepoint look like?

Year-end in Wagepoint involves steps like processing pay runs in time for year-end form generation, toggling remittance options and updating figures for 2023 calculations. Consider this a short navigation guide on how to tackle a few key tasks in Wagepoint.

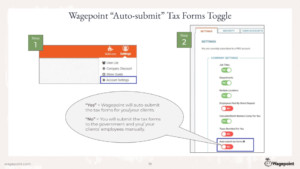

Wagepoint Auto-submit tax toggle

- Navigate to Settings in Wagepoint.

- Choose Account Settings.

- Under Company settings, toggle the Auto-submit tax forms option.

Toggling to Yes means you’d like Wagepoint to auto-submit your year-end tax forms for you or your clients directly from within the program.

Toggling No means you’d like to handle submitting these forms yourself manually.

Note: You won’t be able to change this setting during the submission period — February 20, 2023 at 12 am ET until March 1, 2023 at 12 am ET — so be sure to make your decision before then!

Relevant knowledge base article: Company & payroll settings.

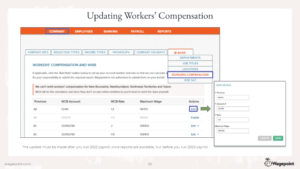

Updating Workers’ Compensation

Before you dive into these steps for updating Workers’ Compensation rates, note that you’ll want to make the update after your final 2022 pay run, but before your first 2023 pay run.

- Select Company from the orange banner bar.

- Choose More from the tabs.

- Click Workers’ Compensation.

- Find the province you’d like to update and choose Edit in the Actions column.

- Update the rate and click Save.

Relevant knowledge base article: Add employment details.

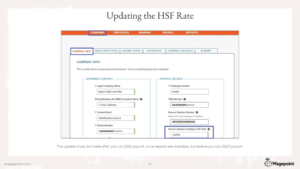

Updating Health Services Fund rates

Like with workers’ compensation, you’ll want to update this figure after your final 2022 pay run, but before your first 2023 pay run.

- Select Company from the orange banner bar.

- Select the Company info tab.

- Enter the new rate in the Revenu Québec Employer HSF Rate field.

Relevant knowledge base article: Add company and payroll information.

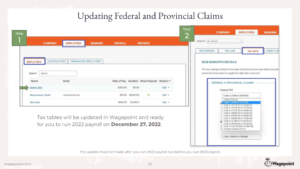

Updating federal and provincial claims

Updated payroll tax tables will be available on December 27, 2022 in Wagepoint, which is the earliest you’ll be able to run payroll for 2023.

- Select Employees from the orange banner bar.

- In the Employees tab, select the name of the employee whose federal and provincial claims you’d like to update.

- Go to the Tax info tab.

- Select from the Federal TD1 drop-down menu.

Relevant knowledge base article: Add employee tax details.

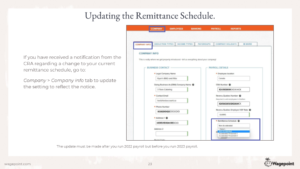

Updating your remittance schedules

This is another instance where you’ll make this update after your last 2022 pay run, but before your first 2023 pay run. If you have received a notification from the Canada Revenue Agency regarding a change to your current remittance schedule, follow these steps.

- Select Company from the orange banner bar.

- Select the Company info tab.

- Choose your new remittance schedule from the Remittance Schedule drop-down menu.

Relevant knowledge base article: Remittances.

Loading stat holidays for the new year

Hold off on loading your 2023 stat holidays until after your final pay run of 2022, but do it before your first pay run of 2023.

- Select Company from the orange banner bar.

- Choose the Company holidays tab.

- Click Load stat holidays.

- Click Add a holiday if your company observes a holiday that’s not already listed.

Relevant knowledge base article: Add company holidays for statutory holiday pay calculations.

Thanks for another great year!

Once again, the full webinar above will give you all the must-have details to tackle year end! There are a few we didn’t cover in this blog, so you won’t want to miss out on those. Don’t worry if you don’t have time to watch right now — the webinar is available on this blog and on demand throughout the entire year-end season!

Thanks for being with us during 2022! We can’t wait to bring you more amazing opportunities and watch your business continue to shine in the new year.

We’re here to help.

Contact Wagepoint’s customer support by submitting a ticket directly within the app, or sending us an email to support@wagepoint.com.

Sign up for Wagepoint.

Wagepoint is a simple payroll software built just for small business owners like you. If you’re not already working with Wagepoint to track, remit, pay and complete all your small business payroll needs, here’s a great opportunity to give it a go! Use code KEEPITTOGETHER to get one month of Wagepoint free.