Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

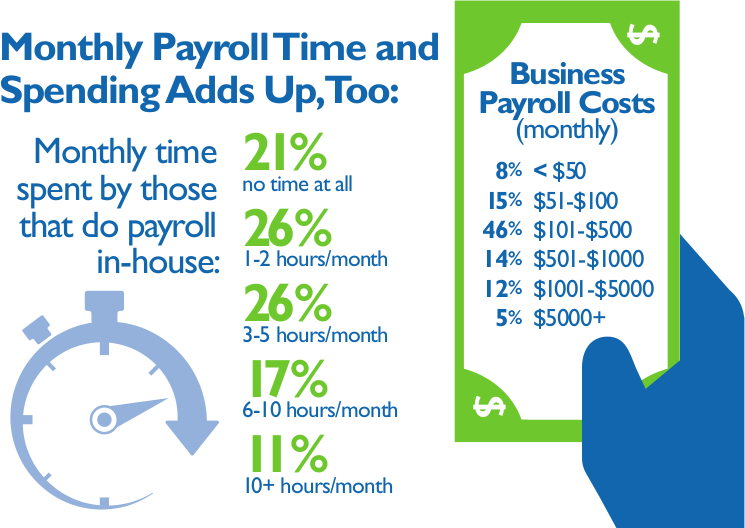

If you’ve been processing your business’ payroll manually, you might not be aware just how much time that takes. A SCORE (@SCOREMentors) study indicates that some in-house employees at small businesses are spending up to 10 hours a month processing payroll.

If that doesn’t sound like much, consider this: Over the course of a year, you or your team could be spending 120 hours on payroll. That’s the equivalent of 15 eight-hour work days or three entire work weeks. This begs two questions:

- Is this the most efficient way to handle payroll?

- Would your payroll needs be better served by using payroll software?

Chances are, automating your payroll needs is the way to go. Payroll software can improve your bottom line by saving time, money, and properly handling complicated tasks like federal, state and local taxes, as well as employee benefits. It also makes your business more efficient by helping you calculate overtime, set up direct deposit, and give employees self-service access to pay stubs. On top of that, payroll software can make your business more efficient.

Here are four ways that illustrate how payroll software can improve your productivity by:

- Saving time. Payroll complexity increases as a business grows. As your number of employees increases, processing payroll in-house will take more time, and that will cost you in terms of man-hours and physical costs. According to the 2015 report from Training Magazine, larger companies spend about 17 times as much as midsize companies on payroll, and midsize companies spend about three times as much as small ones. If you’re able to move your payroll to a software platform, you can shave hours every week from the process and make it easier to collaborate with the accountants and bookkeepers who help manage your finances.

- Keeping an eye on hours worked and wages paid. Tracking employee hours is a time-consuming part of calculating payroll manually. Many payroll software programs include a time-tracking module or add-on where you can keep track of when your employees work. At the end of the month, your payroll software will calculate these hours automatically, saving your team plenty of time and reducing the likelihood of calculation errors and arduous administrative work. Plus, you can determine at a glance if your team is showing up late, clocking out early, or missing too many days. The best payroll software platforms will guarantee accuracy and reduce your chances of an expensive IRS audit or fine.

- Taking the guesswork out of payroll taxes. This is a tricky job and perhaps the area of payroll processing most vulnerable to errors. Every tax item follows a unique set of payment and reporting rules, making it far too easy to slip up and calculate the wrong amount. Even the smallest error can cause IRS penalties and compromise your employees’ trust. Many payroll solutions offer resources for calculating deductions built right into the software.

- Streamlining and automating the payroll process. Payroll solutions that offer built-in automations like set-and-forget approvals, direct deposit, and recurring deductions will vastly reduce the amount of time you have to waste on manual processes at the end of every pay period. That means you can focus on more critical aspects of HR administration, and your employees can get their checks delivered faster. What’s more, if you find a payroll app that integrates with your current accounting software, you can push hours and pay rates directly from your timesheets to the payroll app, and pull financial updates back into your accounting system.

Is Payroll Software Worth the Cost?

Our answer to this question is an emphatic yes. Payroll software can offer considerable ROI, considering many programs are inexpensive. Investing in payroll software will reduce employee hours spent on processing payroll. This is a scenario where spending money will help you save money in the long run. Is now the right time to invest? If your business finds it difficult to grow because manual processes are holding you back, yes.

Wagepoint would like to thank Technology Advice (@Technology_Adv) for this informative summary and for making it easier for people to compare software reviews.