Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Indianapolis has become an ideal stomping ground for startups and new businesses.

This Midwest city has worked its way onto many top lists for its vibrant culture, job growth, and affordability. Nestled amongst the Midwestern flyover states, Indianapolis has been quietly supporting tech sector innovation since before the recession.

In 2015, The Tax Foundation spotlighted Indiana among the 10 states with the best business tax climate. In particular, the tech industry has seen huge growth with an employment increase of 50.4% between 2001-2013. This growth has only continued, helping Indianapolis land a spot on Forbes’ list of cities creating the most technology jobs.

Indianapolis ranked second of all American cities on Business Insider’s list of The 20 Best US Cities For Culture. With six cultural districts, it boasts one cultural attraction for every 705 people.

And where there’s culture, there will be startups and innovation.

Indianapolis also makes an appearance on Fast Company’s list of The Next Top 10 Cities For Tech Jobs. It’s no New York or Silicon Valley yet, but Indianapolis is growing quickly and certainly getting a lot of attention this year.

For businesses, especially startups, to win customers, raise money and succeed in Indianapolis, they need to focus on keeping it real. The city delivers solutions for real-world business problems, which makes it ideal for B2B software firms, rather than consumer apps for hipsters.

With a growing tech industry, and low-cost market, Indianapolis has a lot to offer new businesses:

-

The success stories of Angie’s List, Aprimo, ExactTarget, and other exits means funding is recycled back into a very supportive community of entrepreneurs.

-

The Johnson Center for Entrepreneurship & Innovation at Indiana University and Purdue University are two of the best schools in the country for business and engineering students, giving you easy access to top tier talent.

-

A low cost of living for everything from rent to transport to food and beer makes this a great city for early-stage and bootstrapped entrepreneurs.

-

As of July 2015, Indiana’s corporate income tax rate is at 6.5%, which is significantly lower than other business states.

There are still a few less desirable aspects of such a newly developed industry:

-

Although the ecosystem is supportive, it is relatively tiny compared to New York, San Francisco, and Silicon Valley.

-

Equally, raising money here is much harder. Startups can expect smaller valuations and funding rounds, with it being more difficult to raise from outside the state because you are an outsider in another ecosystem. It is far easier to generate revenue!

Steps for Setting up your Payroll in Indianapolis, Indiana

As a small business owner, you have three action items you need to complete properly in order to be set up in Indianapolis:

-

Business registration

-

Tax payments

-

Compliance requirements

Let’s take a closer look at each one and see what’s involved.

Business Registration

You will need to start by setting up your business with all of the necessary governmental departments, namely, the IRS and the Indiana Department of Revenue. Find out if your business needs to register with the Indiana Department of Revenue here.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of Indiana: Register as an employer with the Department of Revenue with a Business Tax Application.

-

State of Indiana: Register and pay for Unemployment Insurance.

-

State of Indiana: Register with the New and Small Business Education Center for small business assistance.

-

State of Indiana: Review Indiana County Resident and Nonresident Tax Rates.

We also recommend taking a look at the Entrepreneur’s Guide to Starting a Business in Indiana because it contains a number of helpful start-up and small business resources as well as a guide to important terms you should know.

Tax Payments

With your business registration out of the way, let’s look at the next phase i.e enrolling your business with the appropriate tax agencies (local, state, and federal).

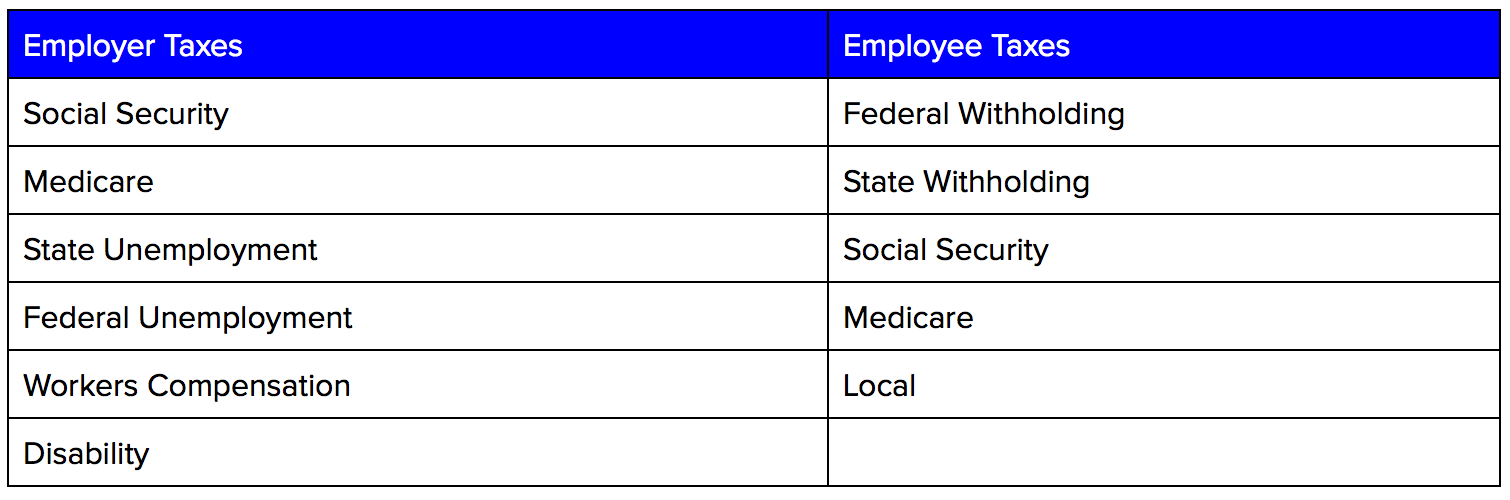

Here’s a quick outline of the various taxes you’ll have to pay for your business and your employees:

Once that’s done, it’s time to figure out your tax payment schedule for all levels of government. For that, you’ll need to know how much payroll you paid your employees in the previous year and/or quarter.

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS)

(Note: These are based on your previous quarterly payroll payments.)

-

You’ll pay Semi-weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly, if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

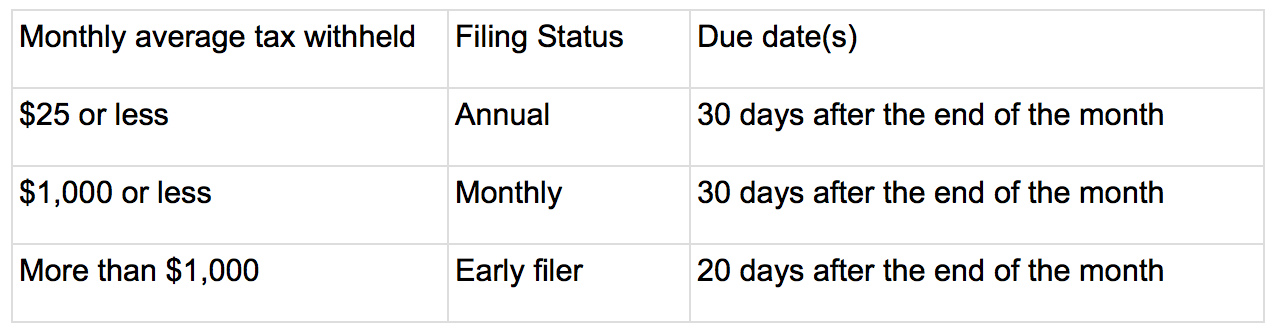

State Taxes:

And finally, you’ll pay your state and Federal unemployment taxes quarterly.

Compliance Requirements

Payroll regulations and compliance apply to all companies, regardless of location. The final step of setting up your business to be fully payroll-compliant in Indianapolis is to ensure that you have completed all of the necessary government tax forms.

Upon hiring, you’ll need to complete the following forms for each employee:

-

W-4 Federal Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that the second group of forms are necessary for every employee, whether or not they’re still working for you at the end of the year.

-

At year-end, for every employee that works for you throughout the year, you’ll need the following forms: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

After you’ve completed everything outlined above, you’ll be registered with all of the appropriate tax agencies. You’ll also have an understanding of your tax payment schedule, and you’ll even have your employee forms ready for incoming staff.

You can rest easy knowing that you’ve done everything you need to regarding payroll administration and that you’ve built a solid foundation for your business.