Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Most small business owners find themselves trapped in a cycle of duplicate data entry, messy reports, and endless reconciliation. You run payroll in one system, then spend hours manually entering the same information into your accounting software. Sound familiar?

Here’s the reality: when your payroll and accounting systems don’t talk to each other, you’re not just wasting time, you’re missing critical financial insights that could transform how you run your business.

That’s exactly why we have the Wagepoint and QuickBooks Online (QBO) integration. It automatically syncs your payroll data, eliminates double work, and turns your payroll from a time drain into a strategic advantage.

Stop Double Work, Start Saving Hours

The old way: Run payroll. Export data. Manually enter expenses. Reconcile accounts. Fix errors. Repeat.

The new way: Run payroll once and the rest takes care of itself, automatically.

With our QBO integration, payroll data flows seamlessly from Wagepoint into QBO without any manual intervention. No spreadsheets. No copy-paste marathons. No late nights hunting down data entry errors.

The impact: Our customers save an average of 3-5 hours per pay period on bookkeeping tasks alone.

Clean Books, Accurate Numbers

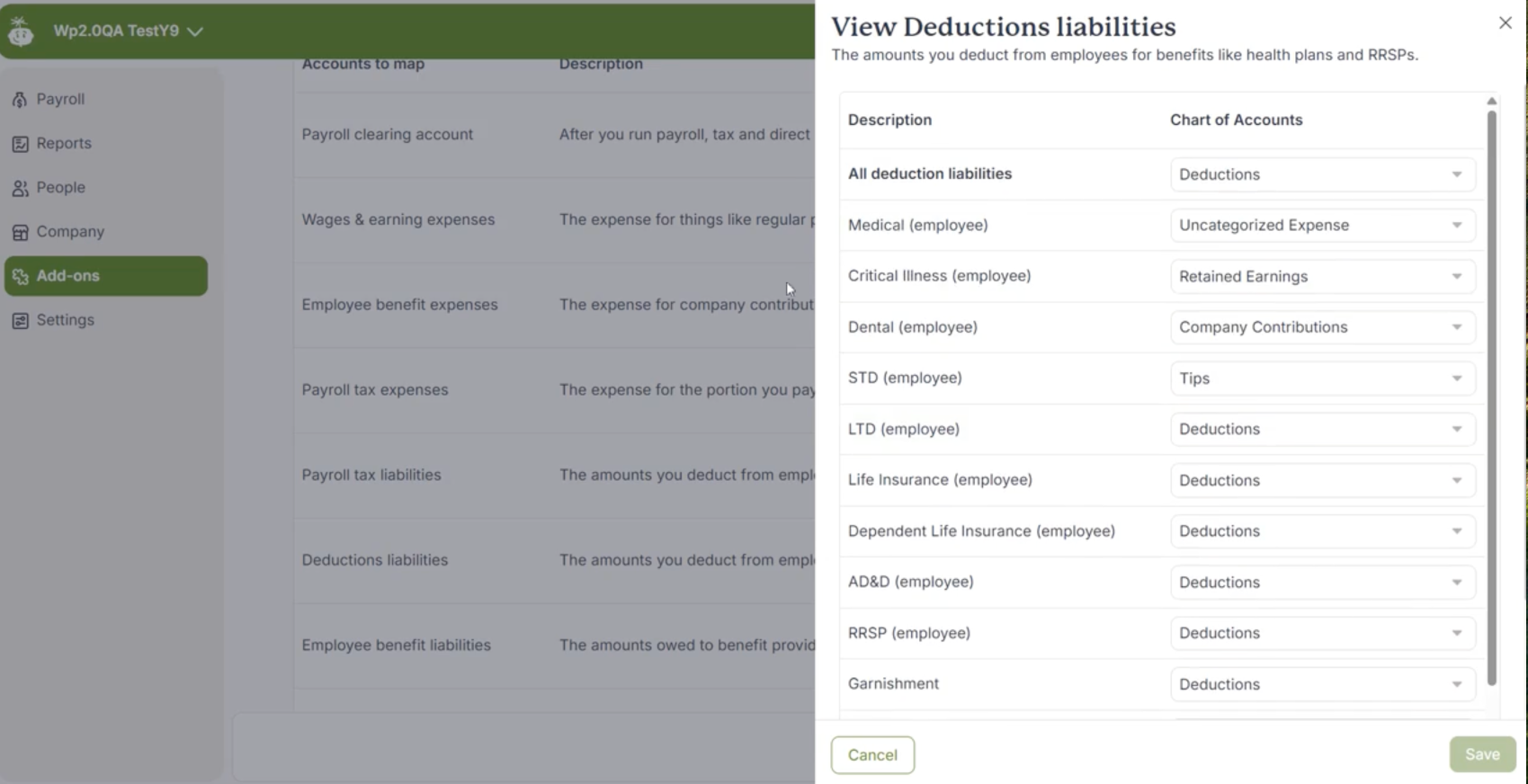

When you connect your payroll and accounting solutions, your numbers stay in sync. And now, thanks to our latest enhancement, Wagepoint’s QBO integration now automatically maps your payroll expenses and liabilities to your QuickBooks Online chart of accounts — including subaccounts.

Here’s how your payroll data gets organized:

- Wages and earnings – Regular pay, overtime, commissions, or any income code you use

- Employee benefit – Company contributions to health plans, RRSPs, other benefits

- Payroll taxes – Employer portions of CPP, EI, and other payroll taxes

- Payroll tax remittances – Amounts owed to the CRA or Revenu Québec

- Deductions and benefit liabilities – Employee deductions and employer benefit contributions owed to providers

Whether you prefer journal entry export or payroll bills, everything lands exactly where you’ve mapped the Chart of Accounts.

Your Business Financials in Clear View

Here’s where it gets interesting. Payroll isn’t just about paying your team, it’s one of your biggest expenses and richest sources of data. With Wagepoint connected to QuickBooks Online, you get a real-time snapshot of your cash flow.

So instead of running your business on gut instinct, this integration helps you make smarter financial choices, backed by numbers you can trust.

Here are a few ways to leverage payroll data for better business decisions:

- Cash flow patterns

- Setting a budget

- Seasonal insights

- Spotting labour and overtime trends

Wagepoint’s QBO Integration Means Payroll and Accounting Working Better Together

Your payroll and accounting systems should work as hard as you do. And when they’re connected through Wagepoint’s QBO integration, you get:

Hours back in your week

Accurate financial reporting without manual errors

Real-time insights to make smarter business decisions

Stress-free tax season with organized, reconciled records

Payroll and accounting are meant to go hand in hand. And thanks to Wagepoint’s QBO integration, they finally do — giving you back time, accuracy, and a deeper understanding of your business finances.

Ready to see how Wagepoint can work for you? Learn more about our integration, and book a demo today.