Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

When your payroll and accounting tools don’t talk to each other, you’re stuck juggling spreadsheets, duplicate entries, and hours of reconciliation. Mistakes slip through, reports get messy, and cash flow feels like a guessing game that leaves you wondering if you’ll make your next payroll.

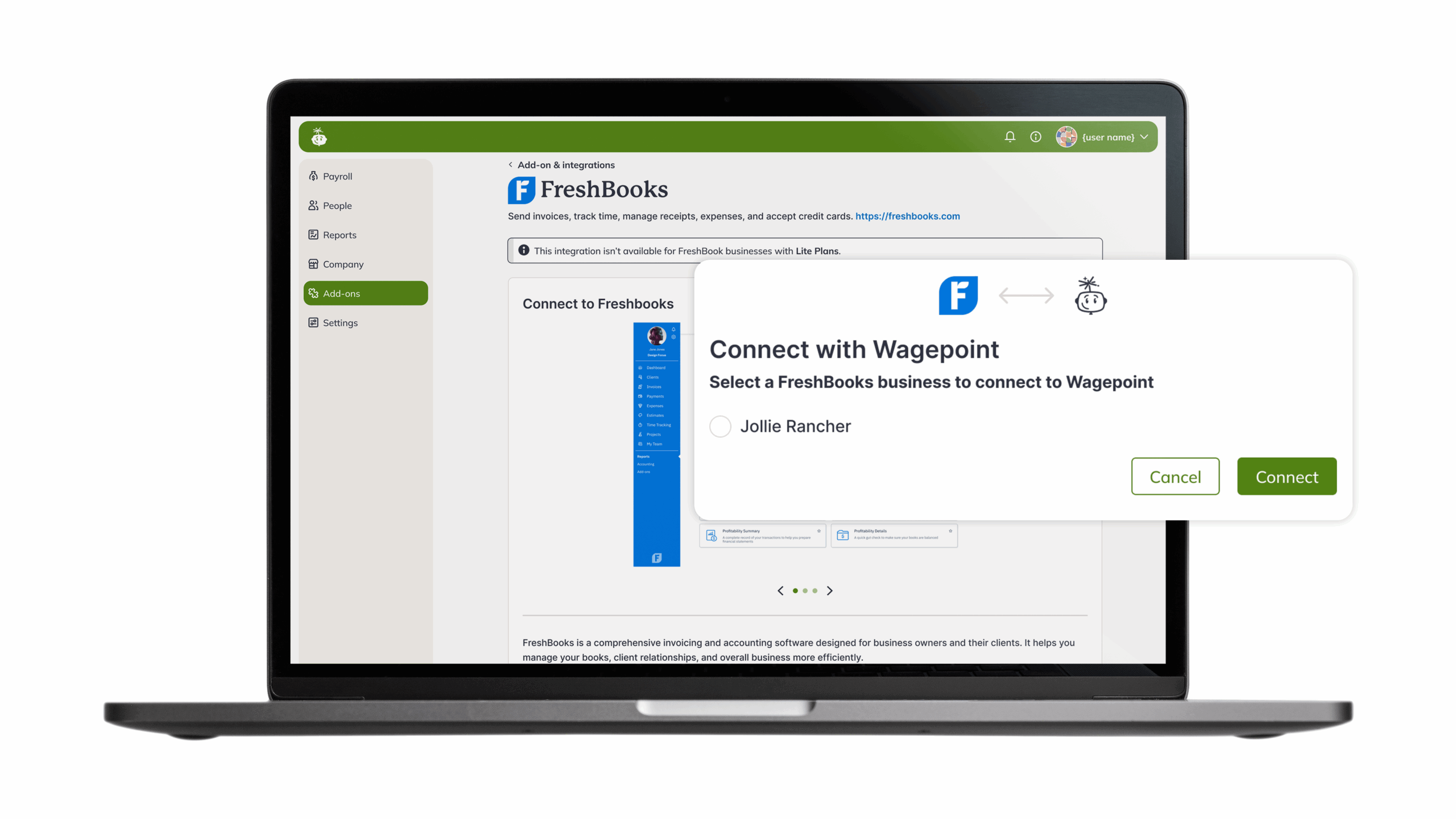

That’s why we’ve teamed up with FreshBooks — the Canadian accounting software that makes the hard parts of running a small business easy. Together, we’ve created a seamless integration that lets you run payroll and balance your books in one, smooth workflow.

Payroll and accounting, perfectly in sync

Running payroll used to mean running in circles. Process your payroll in Wagepoint, then head over to FreshBooks to manually enter every expense, reconcile accounts, and hunt down discrepancies before you can finally close the books.

Now you can run payroll once and your books update instantly. That’s it. No export files. No copy-pasting. No wondering if the numbers match. Just seamless, accurate books that stay in sync with every pay run.

When you connect Wagepoint to FreshBooks, here’s what syncs automatically:

- Wages and earnings – Regular pay, overtime, commissions, or any other income code you use

- Employee benefit – Company contributions to health plans, RRSPs, and any other benefits

- Payroll taxes – Employer portions of CPP, EI, and other payroll taxes

- Payroll tax remittances – Amounts owed to the CRA or Revenu Québec

- Deductions and benefit liabilities – Employee deductions and employer benefit contributions owed to providers

Turn payroll data into business intelligence

Payroll isn’t just about paying your team. It’s one of your largest expenses and a powerful source of insights. When payroll and accounting software work together, you can:

- Spot cash flow patterns

- Build smarter budgets

- Plan for seasonal shifts

- Track labour and overtime trends

Instead of relying on gut feel, you get financial data you can trust to make smarter business decisions and grow with confidence.

Built for Canadian small business

The Wagepoint and FreshBooks integration handles the busy work so you can focus on the work that actually moves your business forward. Your books stay accurate without the manual effort. Your records stay audit-ready without the last-minute scramble. And payroll becomes one less thing competing for your attention.

Ready to see how Wagepoint can help you run your business? Book a demo today.