Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

A professional services firm walked into Gondaliya CPA‘s downtown Toronto office in the middle of tax season — not for their usual tax planning or advisory services, but because payroll was eating them alive. Six to eight hours every pay period. Manual calculations in spreadsheets. Two CRA penalty notices totalling $420. Employees questioning their pay stubs.

This kind of situation is nothing new to Sharad Gondaliya, CPA, Principal at Gondaliya CPA. His firm works with startups and growing companies across Ontario, helping them streamline everything from tax planning and bookkeeping to payroll. More and more, clients come to him ready to move past manual processes and into systems that actually work.

Finding the Right Payroll Solution

Before Wagepoint, payroll was becoming a barrier for both Gondaliya CPA and their clients. Some used spreadsheets; others relied on outdated software. None were efficient, and the firm found itself spending valuable time troubleshooting systems rather than providing strategic guidance.

“We’d see owners spending hours on calculations, worrying about remittances, and losing confidence every pay period,” says Sharad. “They needed something dependable that didn’t require a finance degree to use.”

After evaluating several platforms, Gondaliya CPA chose Wagepoint for one critical reason: it handles the compliance details that keep accountants up at night—remittances, year-end filing, audit trails—while remaining accessible enough that clients can operate it independently after a single training session.

The multi-client dashboard became essential for managing dozens of accounts from one login and Wagepoint made the mid-year payroll switch easy, keeping records accurate through year-end.

“We can input all previous earnings and deductions, ensuring T4s will be accurate at year-end regardless of when we start,” explains Vandana Goel, CPA, Accounting Specialist at Gondaliya CPA.

A Platform Built to Scale

Gondaliya CPA serves diverse clients—from solo consultants to teams with multiple pay types across various industries. Managing this variety requires a payroll solution that can handle complexity without adding administrative burden. Several Wagepoint capabilities proved essential:

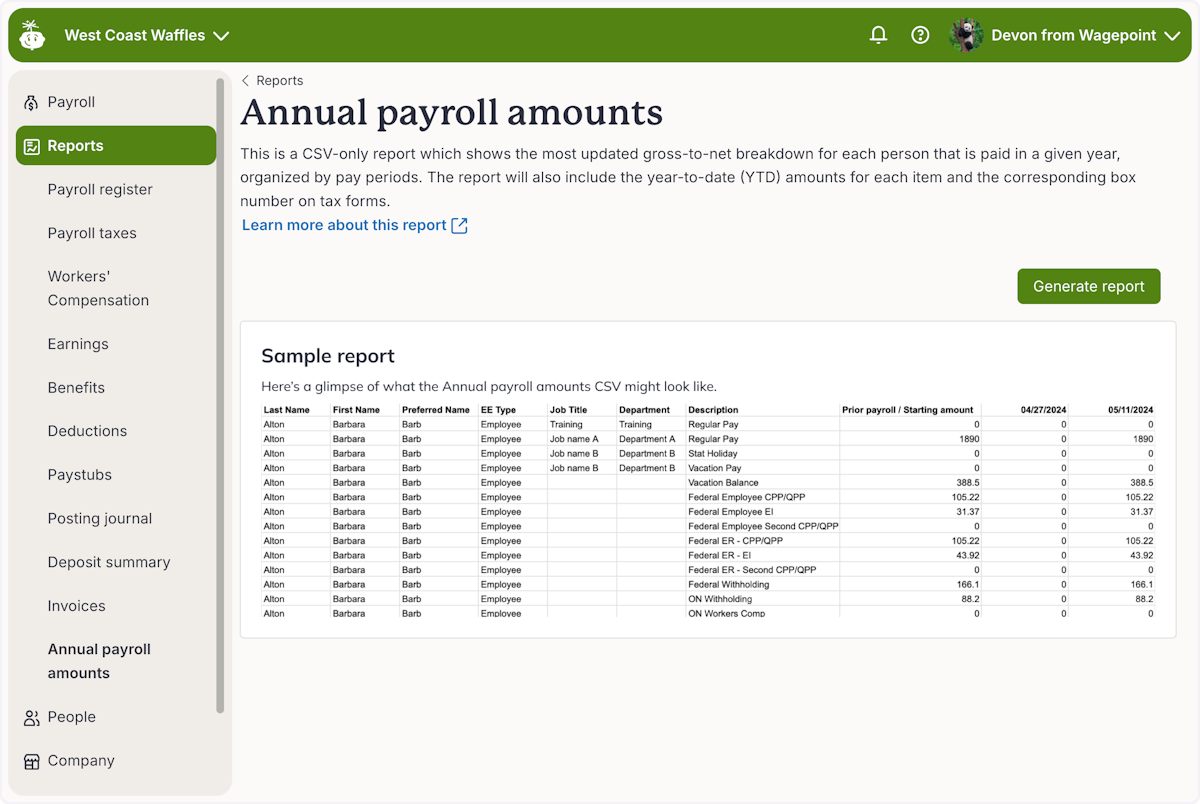

Comprehensive reporting

Comprehensive reporting provides real-time visibility across all client accounts, making it easy to spot issues before they become problems.

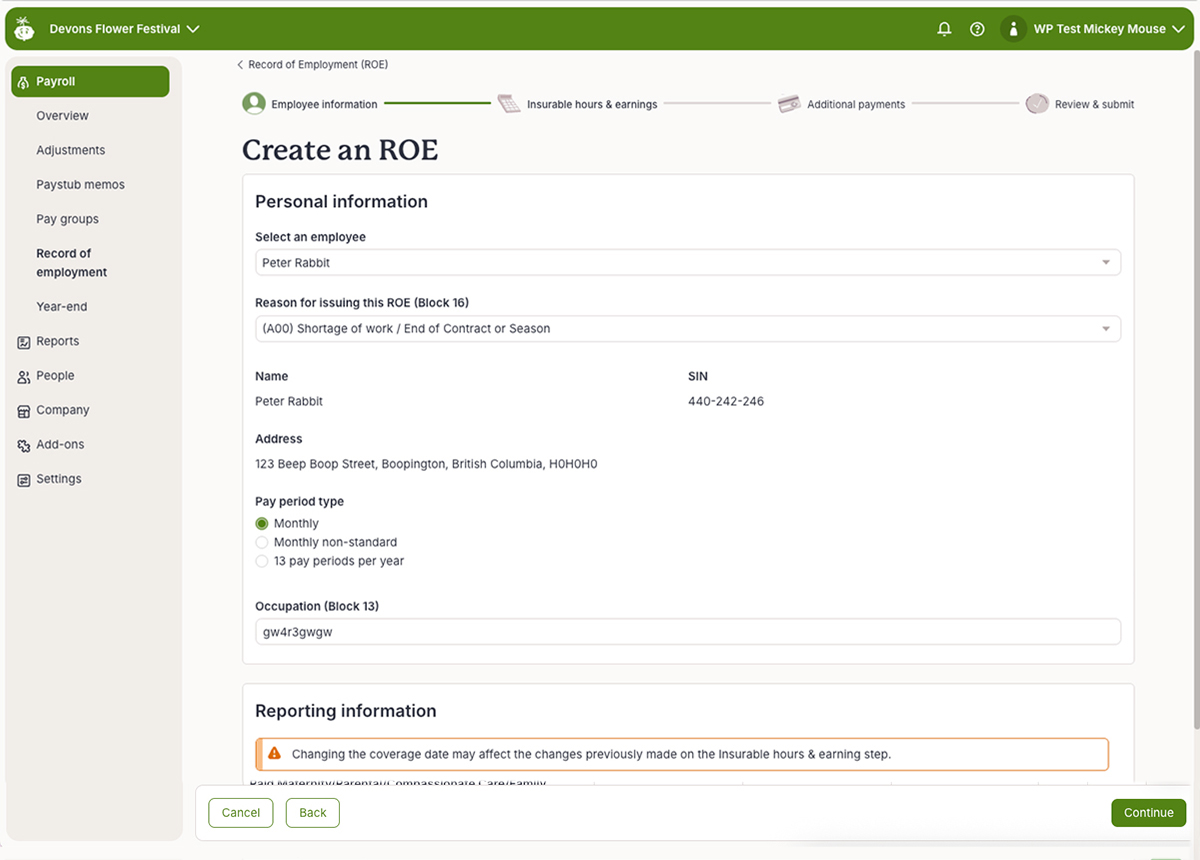

Automatic ROEs

Automatic ROEs are filed directly with Service Canada, eliminating a manual task that used to require careful tracking and follow-up.

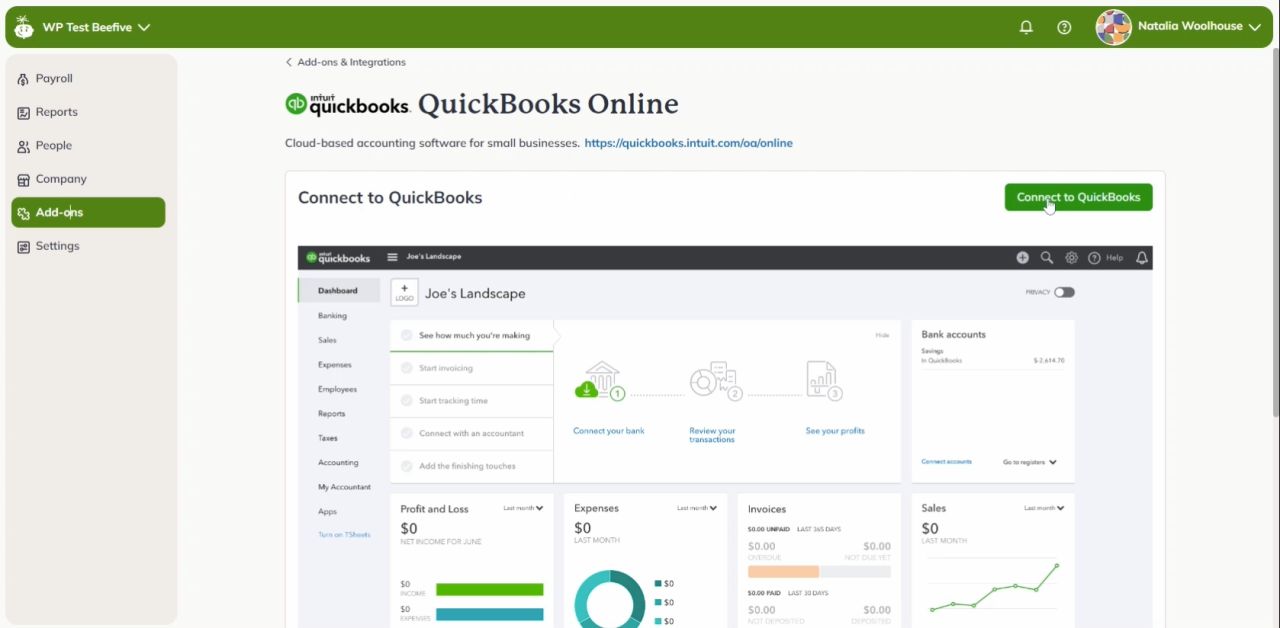

QuickBooks Online integration

The QBO integration syncs payroll data automatically, cutting reconciliation time from hours to minutes and reducing errors in monthly bookkeeping.

Transforming Year-End

February used to mean long days and tight deadlines for most accounting firms. For Gondaliya CPA, it’s now one of the quietest months of the year.

“Our year-ends are honestly uneventful now—and I mean that as the highest compliment,” says Sharad. “While other firms are scrambling to reconcile data and file T4s, we’re focused on tax planning and advisory work. Wagepoint has automated the entire T4 process.”

With CRA remittances handled automatically and employees able to access their own T4s through the portal, payroll no longer drains capacity during the busiest time of year. What used to be a time crunch is now an opportunity to focus on forecasting, tax optimization, and proactive advisory services.

From Chaos to Confidence: A Client’s Story

For the professional services firm that arrived during tax season—spending six to eight hours per pay period and facing CRA penalties—the solution came quickly. Gondaliya CPA introduced them to Wagepoint, and with Vandana Goel guiding setup, it took just an hour to get started. Within three pay periods, payroll had gone from an all-day ordeal to a quick, predictable routine.

“Vandana walked me through everything,” the owner says. “The interface is incredibly intuitive—if you can use online banking, you can use Wagepoint.”

The Results

The numbers told a clear story:

| Metric | Before Wagepoint | After Wagepoint | Impact |

|---|---|---|---|

| Time per payroll | 6–8 hours | 20 minutes | 90–95% time saved |

| CRA penalties | $420 annually | $0 | 100% eliminated |

| Payroll errors | 2–3 per year | 0 | Improved accuracy |

| Year-end workload | High stress | Minimal | Predictable, automated |

Beyond time and cost savings, the shift freed up the business owner to focus on growth rather than administration—a return on investment that compounds with every pay cycle. “My employees trust that they’ll be paid correctly and on time, every time,” the owner adds. “That trust is invaluable for morale and retention.”

The Bigger Picture: From Payroll to Partnership

For Gondaliya CPA, this client represents a broader shift in their practice. By adopting Wagepoint across their client base, they’ve transformed payroll from a time-consuming compliance obligation into a foundation for strategic advisory work.

“Payroll should run quietly in the background,” says Sharad. “Wagepoint helps us deliver that standard consistently—which means we spend less time managing transactions and more time guiding growth.”

And the professional services firm that walked in during tax season? They’re no longer losing nights of sleep to payroll anxiety. The business owner recently told Vandana: “I honestly don’t worry about payroll anymore. It’s just another task I handle in 20 minutes, and I move on with confidence.”

See how Wagepoint helps accounting firms simplify payroll, strengthen compliance, and build client trust. Explore Payroll for Accountants.

About Gondaliya CPA

Gondaliya CPA Professional Corporation is a Toronto-based CPA firm providing strategic financial support for startups and growing companies across Ontario. Led by Principal Sharad Gondaliya, CPA, the firm offers tax planning, bookkeeping, payroll, and advisory services designed to help business owners save time, maintain compliance, and focus on growth. Learn more about Gondaliya CPA’s accounting and payroll services here.