Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Mistakes happen. However, there are some lessons that are much better taught than experienced. Payroll is one of those.

Payroll errors add up, literally. They aren’t just annoying or embarrassing, a wrong keystroke can carry heavy consequences for your business. It could mean wasted hours and resources to fix the problem — or worse, legal trouble, fines, and penalties.

Payroll mistakes take a heavy toll on employees, and that strain can destabilize a business. Of those who’ve experienced payroll issues and delays, 38% report feeling unappreciated by their employer and a staggering 91% would seek another job if their pay was regularly inaccurate.

In this checklist, we’ll walk through the most common payroll mistakes small business owners and bookkeepers make at each stage of the payroll process — from setting up to processing and, finally, reconciling.

Setting up payroll

1. Misclassifying workers (employee vs contractor)

Why it matters: It can pose big risks, including legal trouble, penalties, and back taxes.

▢ Determine if they are an employee or a contractor by checking out the RC4110 Guide from the CRA.

2. Missing or incomplete TD1 Forms

Why it matters: It ensures that the CRA receives the correct tax deductions — preventing your employees from over or underpaying on their payroll taxes.

▢ Complete both TD1 forms, also known as a Personal Tax Credits Return form. There is one for provincial and another for federal.

▢ Ensure new employees, both salary and hourly, are the ones to fill and complete both forms.

▢ Existing employees with a tax status change need to complete both forms.

▢ If you have a commissioned based employee, they must complete a TD1X form.

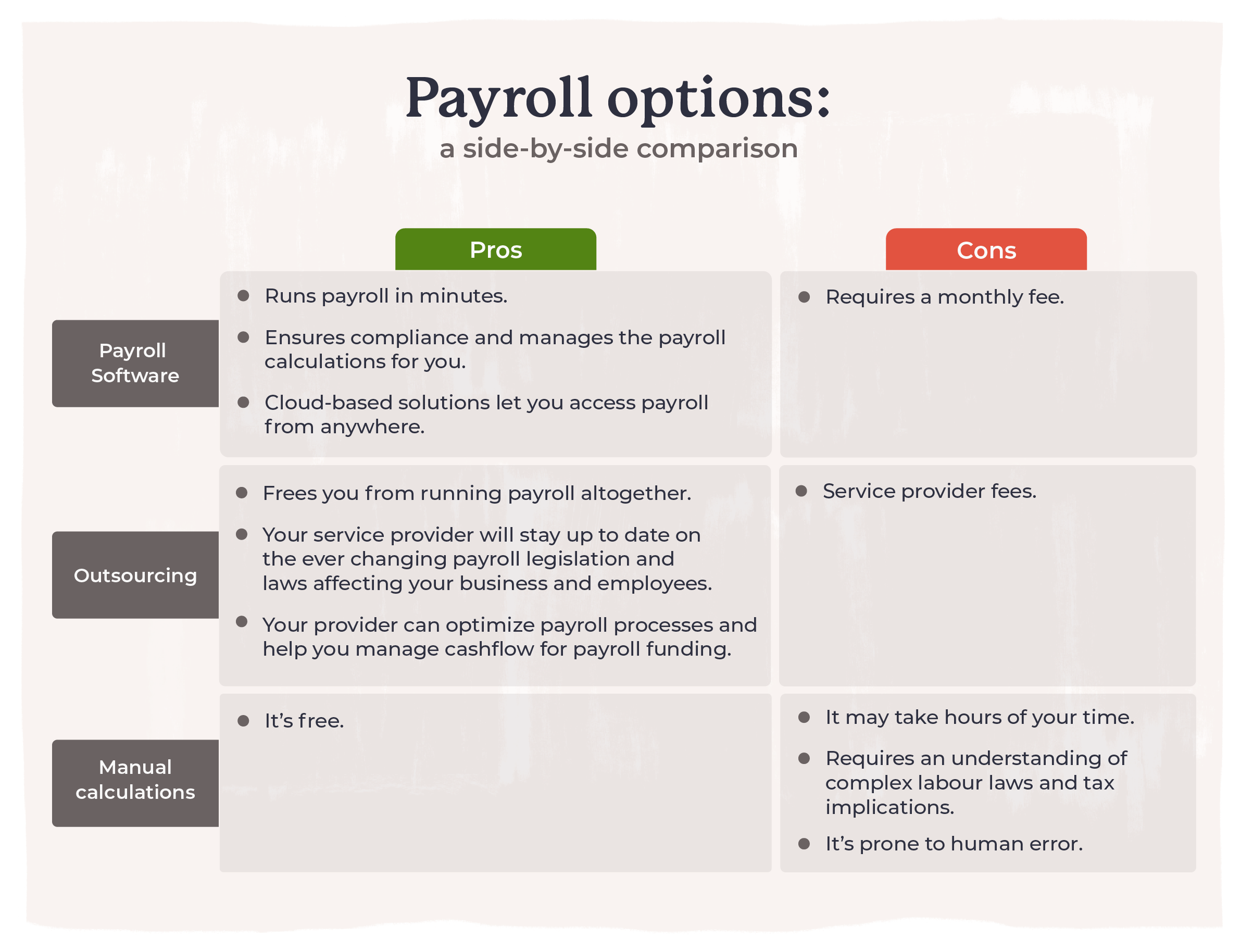

3. Choosing the wrong payroll solution

Why it matters: Choosing the wrong solution could end up costing you time, money, and compliance headaches. From tax errors to processing delays, a bad fit can create stress for both you and your employees.

Processing payroll

1. Late remittances to the CRA

Why it matters: Late payroll remittances can result in penalties and interest charges.

▢ Follow the correct remittance schedule for your business. If you’re unsure of when you should be paying your remittances, check out our blog for a complete walkthrough: Payroll Remittance Schedules and Deadlines: A Complete Guide for Employers.

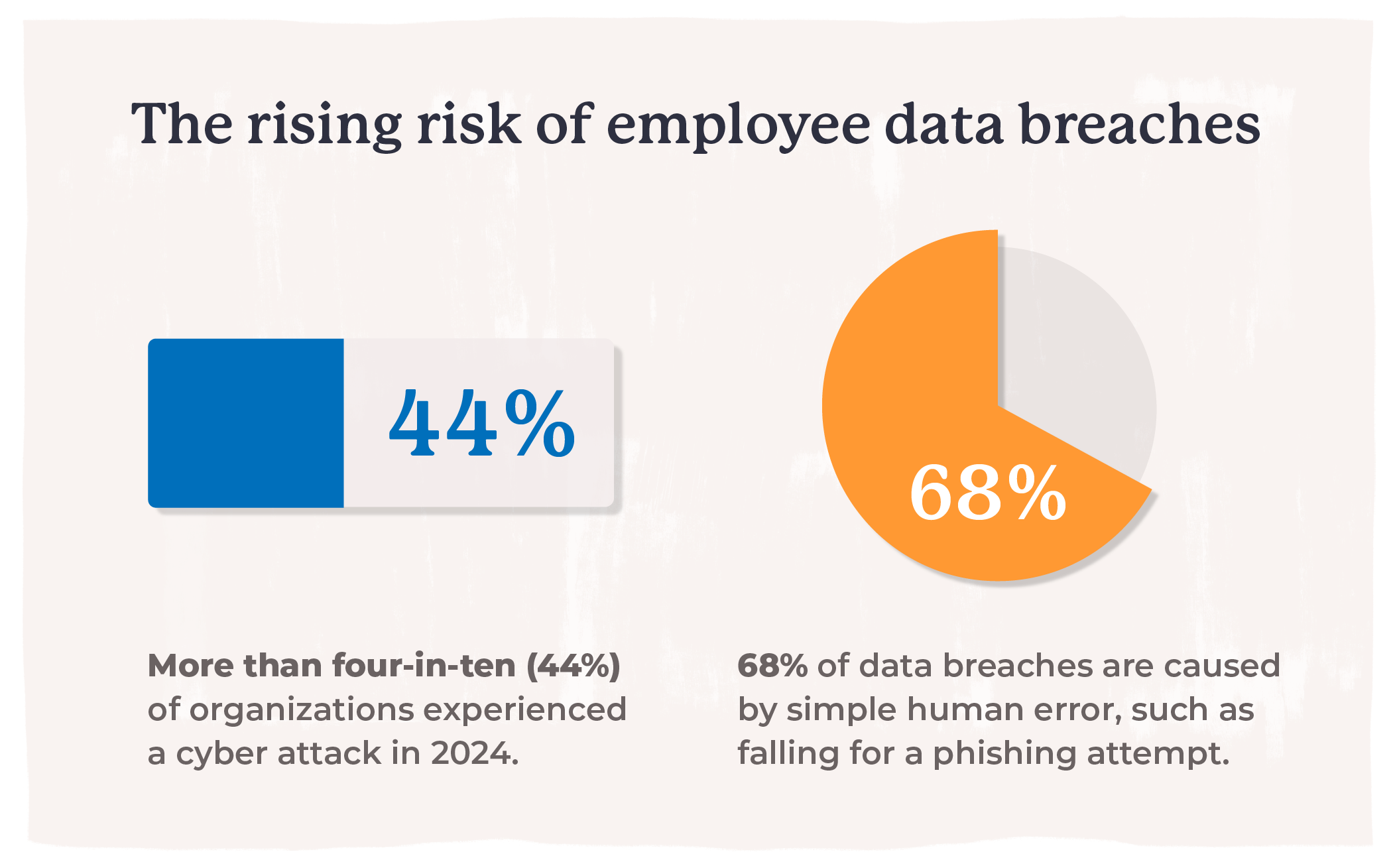

2. Failing to protect employee records

Why it matters: The consequences run deep. Think identity theft, money laundering, and an entire slew of nightmare scenarios.

▢ Use a secure payroll solution to keep your employee information, such as full names, SINs, or bank account details, safe from cyber attacks.

▢ Conduct regular payroll security audits by checking user activities, transaction logs, and payroll records.

▢ Implement direct deposit to pay employees and contractors to reduce the threat of theft and forgery.

▢ Use a secure payroll solution that allows you to control different levels of permission and access to users.

More than four-in-ten (44%) of organizations experienced a cyber attack in 2024. Additionally, 68% of data breaches are caused by simple human error, such as falling for a phishing attempt.

3. Confusion around stat holiday pay

Why it matters: Not only can you face legal consequences, but you can damage employee relationships.

▢ Determine eligibility by reviewing length of employment and number of days worked.

▢ View the official days and guidelines for your specific province.

4. Miscalculation of employee benefits (taxable vs non-taxable)

Why it matters: Errors in calculating taxable and non-taxable benefits can impact both employer and employee contributions to EI, CPP, and tax deductions. Incorrect calculations may result in inaccurate tax filings, penalties, and unexpected tax liabilities.

▢ Identify if the benefit, reimbursement (ex. Fuel costs to drive to a job site) or allowance (ex. Meal allowance for a company trip) are taxable or not.

A taxable benefit is an economic advantage an employee receives that can be measured in money, such as a gift certificate, paid by the employer

Is it a reimbursement or an allowance?

Reimbursement – Money given back to an employee for something related to the business that the employee covered with their own money. (Ex. Fuel costs to drive to a job site.)

A reimbursement is not considered a taxable benefit to the employee when the following conditions apply:

▢ The reimbursement is for expenses they spent for using their own money (or vehicle) in the course of or in connection with their office or employment.

▢ The amounts reimbursed are reasonable and you can justify your position.

▢ The reimbursement is supported by your employee record’s, such as receipts, expense reports, vouchers, log books and other documentation.

Allowance – Money given to an employee to cover an anticipated company expense that the employee will be making. (Ex. A meal allowance for a company trip.)

An allowance is not considered a taxable benefit to the employee when the following conditions apply:

▢ The allowance is based only on business (employment-related) kilometres driven in the course of their employment duties.

▢ You did not reimburse your employee for expenses related to the same use of the vehicle.

▢ For vehicle allowances, the per-kilometre allowance must be considered reasonable by using CRA’s prescribed per-kilometre rates.

5. Mismanaging overtime

Why it matters: A lack of clarity around how overtime is calculated, taxed, and applied can lead to frustrated employees and larger issues down the line.

▢ Confirm the overtime classification for your province.

▢ Confirm overtime pay period. If overtime is paid in a later pay period than when it is earned, it can be considered a bonus and taxed accordingly.

▢ Make sure you review applicable provincial regulations and if applicable, union agreements for employees asking to take time off in lieu of overtime pay.

For a deeper dive, we break it down in our blog Overtime and Tax in Canada: Common Misconceptions Debunked.

6. Late and/or inaccurate ROEs

Why it matters: An ROE has various purposes, but ultimately, it helps determine an employee’s eligibility for Employee Insurance (EI) benefits. Failure to submit an ROE may result in a fine of up to $2,000 and/or up to six months imprisonment.

▢ Confirm that the employee’s insurable earnings and insurable hours are accurate.

▢ Meet the deadline for issuing ROEs (paper and electronic submissions have differing requirements).

For more information on how to complete and submit ROEs and guidelines associated with them, the CRA has put together a guide, Employer’s: How to complete the record of employment (ROE) form.

Reconciliation

1. Errors on T4s, T4As, and RL-1

Why it matters: Accurately filing year-end forms is crucial for tax season. Missing the February deadline not only leads to penalties from the CRA or Revenue Québec for the employer, but also creates delays in tax filing for employees and contractors. Errors will trigger a PIER report from the CRA and can require amendments and resubmissions, taking up valuable time during an already busy period.

▢ Submit copy of T4 to employees and the CRA

▢ Submit copy of T4A to independent contractors and the CRA

▢ Submit copy of RL-1s to Revenue Quebec for workers of the province, and send T4s or T4As to CRA.

▢ Submit the T4 Summary – Information for employers to CRA

For a detailed overview of each of these forms, read our blog A Canadian Small Business Employer’s Guide to T4s, T4As, and RL-1s.

If there’s a mistake, you’ll likely receive a PIER report from the CRA. It sounds scary, but in essence, it’s a review process. A PIER is there to bring to light any differences between the Canadian Pension Plan (CPP) contributions or Employment Insurance (EI) premiums expected by the CRA compared to what was reported on year-end T4 statements.

To avoid the risk of receiving a PIER, make sure that you:

▢ Double-check that taxable benefits are set up and taxed correctly.

▢ Ensure that the employee’s age is entered correctly or that a change in age hasn’t impacted their pensionable status.

▢ Pay close attention to year-to-date totals if you begin using a different payroll system.

For a detailed guide on preventing a PIER, head over to our blog How to Avoid a PIER: A Small Business Guide.

2. Not utilizing integrations

Why it matters: Payroll integrations save you time and resources while offering a more detailed picture of your business’s financial health.

▢ Create a single source of truth by integrating your payroll and accounting software to reduce errors, product accurate financial reports, and improve budget accuracy.

Parting Words

In many cases, most payroll issues can be traced back to manual error. Keeping up with payroll taxes, changes to legislation, due dates — it can be overwhelming, especially when your focus is on running your business.

Automating your processes can initially feel like a daunting task, but what you get back in efficiency and peace of mind will continually pay dividends. If you’re looking for more reasons to make the tech switch, this might just convince you: The 7 Benefits of Automated Bookkeeping You Need to Know.