Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Deciding you’re ready to hire is a milestone for every small business. It means you’ve brought your business concept to life and now you’re ready to build a team. It’s exciting, energizing and, depending on your risk tolerance, terrifying all at the same time.

Just like anything in business, there’s a lot involved in not only making the decision to hire, but going through the process of doing so. This guide will help walk you through some of the basics.

If you haven’t read it yet, we recommend starting with our first guide, Payroll 101: How To Become An Employer & Set Up Payroll For Small Businesses (Canada). Take some time to read that, then pop back here when you’re done.

Ready? Let’s go!

Are you really ready to hire your first employee?

First thing’s first, take the time to evaluate your decision beyond the thought of “I need help with my business.” There are several key questions you should ask yourself to see if you’re really ready to hire your first employee:

- Do your hiring goals match your business goals?

Look at your strategy as it relates to your business and ensure that you’re looking for the roles that support this strategy. If you need a carpenter, don’t search for a florist. - Why are you hiring someone?

Hiring someone for the sake of hiring someone doesn’t help you or your business. Instead, identify any knowledge or skill gaps you need to fill. Check trends and ensure that these skills are defined the same way as when you first discovered you need them. - Are you prepared for the costs of hiring an employee?

The average cost of hiring a new employee is around the $4,000 mark. Granted, this varies by business and industry, but this includes the costs of recruiting, hiring, training, equipment, benefits and more. You should also look at your business finances and ensure that you’ll have the cash flow to cover these costs. - Can you pay them?

Another cost to consider is whether you can actually afford to pay the person once they’re on your payroll. Whether you’re paying minimum wage or above, you need to make sure you can actually afford to have another set of hands working for you. - Do you know exactly what you need from this person?

A good exercise for this is writing a job description. You can also check job boards for similar roles. If you’re able to easily outline the required skills and key objectives, then you know you’ve thought this through. - Does this kind of person exist?

The role and the skills need to match. You can’t hire a manicurist to do machine work. If you are creating a new kind of role, allow for more training as part of the onboarding process. - Do you have a clear hiring process?

Bringing on someone new isn’t necessarily as straightforward as it sounds. Knowing how you’ll manage and sift through the applications you’ll receive to narrow it down to the best candidate is something that’ll save you from headaches later.

Should you hire an employee or contractor?

The answer to this question isn’t always easy to answer. Each term represents a specific employer-employee relationship. You have to know what’s right for your business and the person you’re working with. It’s also important to consider the legal and tax implications.

Here’s a brief breakdown of these two types of workers:

Employee

An employee is someone you hire to work directly for your company who receives a regular salary or wage and works regular hours. From a payroll perspective, you as the employer are responsible for collecting and remitting payroll taxes from each pay run.

Contractor

A contractor is an independent worker or business owner who is hired by your company to fulfill a specific job or project. While you pay them for their work, the contractor is the one responsible for their own payroll taxes and other things like benefits.

It can feel subtle, but knowing the difference between an employee and a contractor is important and a key part of keeping your business’s books and workers and the government happy.

Should you hire a full- or part-time employee?

This relates back to the nature of your business as well as the talent pool. If you track your own hours, look back on past records to see if this can inform how much time a new employee will need to work. Use whatever tools and information you have available to make a good estimate. But, if you plan for a full-time role but can only find two part-time workers, maybe there’s room to improvise.

👍 Rule of thumb: In Canada, full-time work is generally defined as 30 or more hours a week.

Should your new employee be paid hourly or given a salary?

Beyond the textbook definition that an hourly employee is paid on an hourly basis and a salaried employee is paid a set wage, there are a few other aspects to keep in mind:

- Hourly workers are only paid for the hours they work while salaried workers are paid the same amount regardless of how many hours they work.

- Overtime is a bit more self-explanatory with hourly employees, but salaried employees can also be eligible for overtime (unless they’re managers).

- How you pay someone also impacts how paid time off, like sick days, are handled, how benefits are administered and more.

This short list of bullets is only a light version of the hourly vs salary debate. In the end, it comes down to the nature of the role and the needs of your business.

🧠 Pro tip: Businesses with salaried workers that have a set rate of pay and no one-off payments can let their payroll run itself with Wagepoint’s convenient auto-approve feature.

How often will I pay my employee?

Often referred to as pay frequency, you’ll want to think about how often you’ll pay your employee before hiring. This helps you set the expectation with the potential employee during the interviewing and onboarding process and sets you up to know how often you’ll need to run payroll, remit payroll taxes and ultimately make sure there’s money in the bank to compensate your worker for their efforts.

How will I pay my employee?

There are many options for paying an employee: paper cheque, e-transfer and direct deposit are the most common. Again, deciding how you’ll do this ahead of time sets the right expectation for you and your potential employee, and you’ll know what other kinds of details you’ll need from them once they’re hired. For instance, if you choose to pay by direct deposit, you can request a direct deposit slip or void cheque from them prior to their first payday.

How will you recruit, hire and onboard your first employee?

The hiring process is its own unique skill set, starting with the job description. Putting time and thought into the job description will help you clearly define the role and responsibilities. It’ll also help you attract the right applicants.

The Business Development Bank of Canada recommends that a job description include a job title, company description, role summary, list of key qualifications and how to apply.

Once you have a job description, you can start to advertise or promote the position. There are many ways to do this, from using job boards to working with professional recruiters. Don’t forget simple tools as well, like your own careers page on your website or, if you’re a retail store or restaurant, posting the listing in your front window.

Interviewing, onboarding and management guides:

As attracting talent is only part of the picture, here are a few additional resources to help you with interviewing, getting your new employee started and providing effective management.

Make sure your new employee completes a TD1.

When you hire a new employee, they must complete a form TD1, also known as a Personal Tax Credits Return form. There are both federal and provincial/territorial TD1s, which you can find updated yearly on the Canada Revenue Agency (CRA) website.

Essentially, a TD1 helps you figure out how much an employee should be paid. It lets you know how much in taxes should be deducted from an employee pay cheque. For instance, a TD1 will tell you if the employee qualifies for age, caregiver, student or other tax exemptions.

These are individuals who’d need to fill out a TD1 form:

- Someone with a new employer or payer

- Someone who wants to change amounts from previous claimed

- Someone who wants to claim the deduction for living in a prescribed zone

- Someone who wants to increase the amount of tax deducted at source

Essentially, whenever an employee’s tax status changes, they need to update their TD1. Completed TD1s stay with the employer and don’t need to be sent to the CRA. Contractors don’t use TD1s as they’re responsible for their own payroll taxes.

What information do you need from each employee in order to pay them?

Using Wagepoint as an example, we require the following information for employees:

- Legal first and last name

- Birthdate

- Hire date

- Social Insurance Number (SIN) (Link also includes tips on verifying a SIN.)

- Current address

- TD1

- Vacation and paid time off amounts

- Personal banking information — either a voided cheque or direct deposit form with the transit, institution and account number.

- An email address — used to invite the employee to the employee portal.

For a contractor, you’ll need the same information as you’d need for an employee (minus the TD1!). A key difference is that if the contractor is incorporated, you’ll need their business number. If they’re a sole proprietor, you’ll need their SIN.

👍 Rule of thumb: Whenever an employee’s tax status changes, for instance if they get married or have a child, they’ll need to submit a new TD1. At least once a year, it’s also a good idea to verify your employee details, such as their address. A lot of businesses choose to do this annually at the end of the year.

Paying your employee or contractor.

This is where the pieces start to come together. If you skipped out on reading the first Payroll 101 guide earlier, now’s a good time to stop and do that. Things like knowing federal, provincial and territorial tax laws and regulations alongside payroll compliance will be put into action when paying your employee or contractor. These will be used to calculate how much your employee gets paid and how much you remit to the government.

Whether you decide to manually calculate your pay runs using spreadsheets and the Payroll Deductions Online Calculator or use a payroll software like Wagepoint, putting those things into action happens at this step. Once you’ve done that, congrats! You’ve officially hired and paid your first employee.

Why payroll really matters.

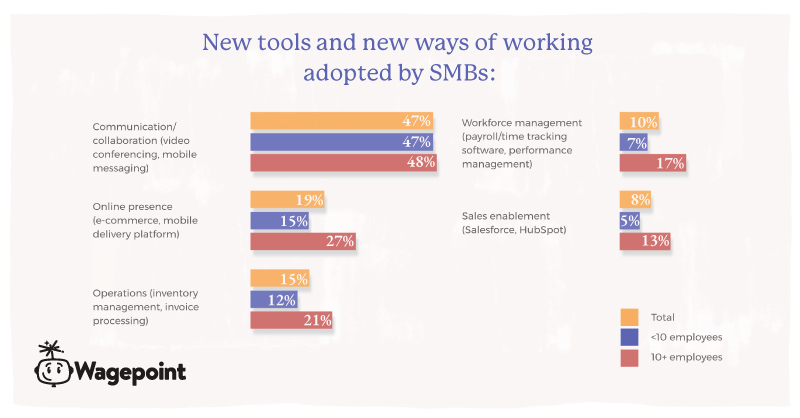

When it comes to payroll, the adage, “time is money,” truly applies. During the pandemic, Wagepoint routinely surveyed Canadian small business owners.

- 40% said that having flexible payroll was essential to their pandemic response.

- 67% said their business model had changed forever.

- 34% adopted new technologies, like payroll software.

Get a copy of the report 👉 2021 Business Resilience Report

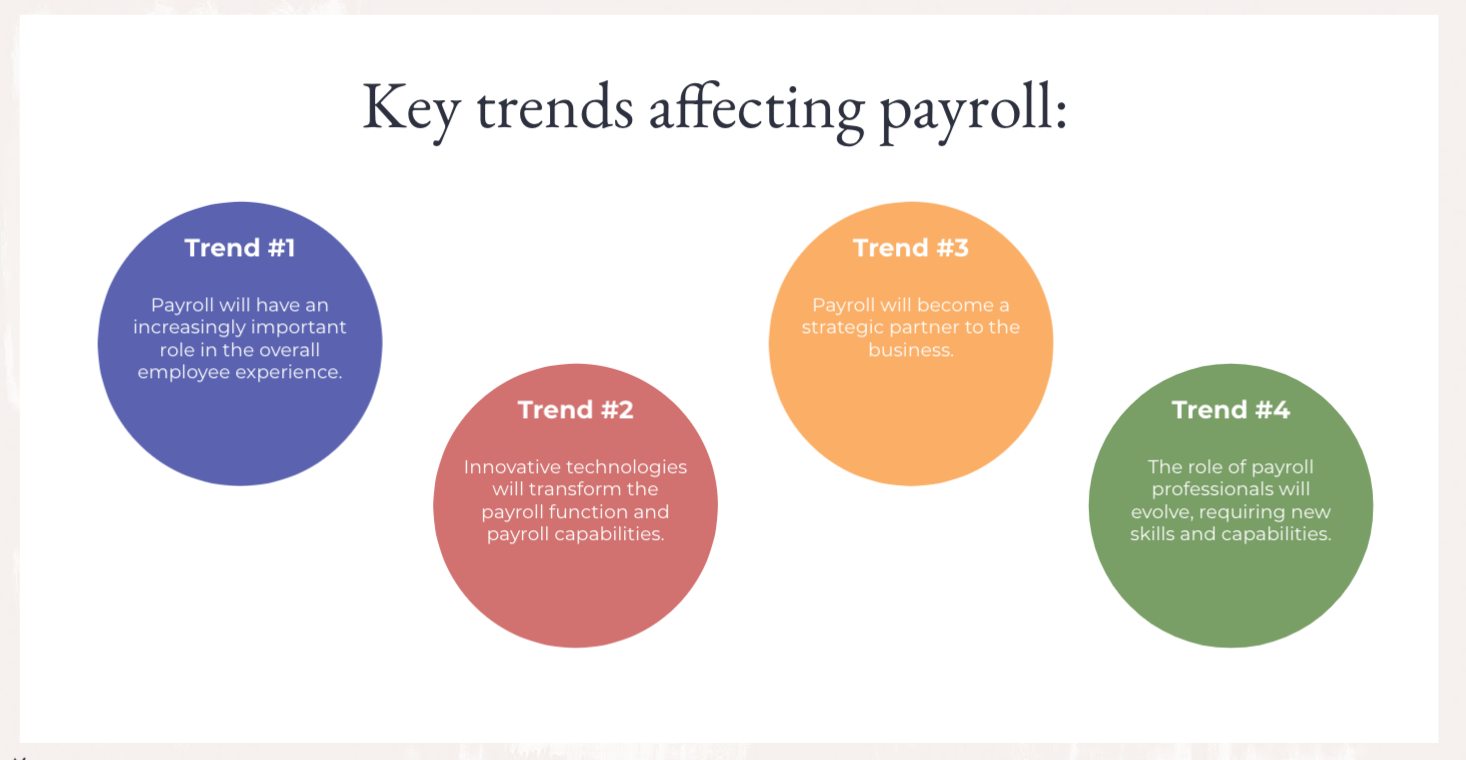

In a conversation with the National Payroll Institute (formerly the Canadian Payroll Association), we identified 4 key trends that will affect payroll:

- An increasing impact on the employee experience.

- Innovative technologies, like cloud-based payroll.

- It will become an increasingly strategic business function.

- The role of payroll professionals and admins will continue to evolve.

Streamlining your payroll process with online software, like Wagepoint, helps you save time and money. Paying employees correctly and on time builds great trust and gives you the space to focus on your business, rather than back-office tasks.

Streamline your small business payroll with Wagepoint

While every care has been taken to ensure the accuracy of this content, the relevant laws undergo constant revision. It is a best practice to stay informed on these topics and consult with experienced professionals. Any errors or inaccuracies brought to our attention will be corrected as quickly as possible.