Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Updated October 2019

How time flies! Can you believe it’s time for year-end routines already?

In order to ensure a stress-free wrap-up of your fiscal year, we’ve outlined eight steps that will work for anyone — whether you’re a payroll DIYer, working with your accountant or bookkeeper — or using payroll software to manage your company’s payroll.

By following these basic steps, both you and your employees can minimize any of the surprises or stressors that typically come year-end — the overpayment of CPP/EI, incorrect SINs or employee details and missed remittances among other things.

Psst… Wagepoint users also receive a helpful year-end reminder email each year.

1. Confirm statutory holiday payouts are being handled in a timely manner.

In Canada, there are nine statutory holidays that apply to all companies federally:

- New Year’s Day

- Good Friday

- Victoria Day (National Patriots’ Day in Quebec)

- Canada Day

- Labour Day

- Thanksgiving Day

- Remembrance Day

- Christmas Day

- Boxing Day

Additionally, there are certain holidays that only apply to specific provinces and territories.

- 3rd Monday in February

- Islander Day — Prince Edward Island

- Heritage Day — Nova Scotia only

- Family Day — Alberta, British Columbia, Ontario and Saskatchewan

- Louis Riel Day — Manitoba

- The Friday before the last Sunday in February

- Heritage Day — Yukon

- June 21 (First day of summer)

- National Aboriginal Day — Northwest Territories only

- June 24

- Quebec’s National Day (St John the Baptist Day) — Quebec

- July 9

- Nunavut Day — Nunavut

- Monday closest to July 12

- Orangeman’s Day — Newfoundland and Labrador

- First Monday in August

- Civic Holiday — All except Quebec and Yukon

- 3rd Monday in August

- Discovery Day — Yukon

👉 As an employer, you are legally required to pay out statutory holiday pay for employees who work on that holiday, but those requirements can vary based on your province or territory.

A good first step is to ensure that your company’s payroll calendar accounts for those holidays. Then, if your employees meet eligibility requirements, you should make sure that they have been paid out for those holidays.

Wagepoint users should also update/load their statutory holidays before running their first payroll of the new year.

2. Maintain accurate employee details.

👉 As an employer, you are legally required to collect and record your employees’ SIN within three (3) days of their hire date.

As part of your year-end process, it’s a good idea to check with your employees to see if they need to update any of their personal details. You want to ensure that for all of your employees:

- The SINs are correct

- First and last names are correct

- Addresses are current and accurate

If you are using an online payroll solution, employees can access and update their personal details like address, date of birth, etc. online — which is a lot easier than you making those edits individually.

👉 Another aspect to consider is ensuring that you have your employees classified properly as either an employee or contractor. Mistakes from misclassification, such as failing to withhold the proper tax amounts, can add up quickly.

3. Verify your business number and/or Québec remittance account number.

One of the first steps of setting up your business is to register your company with the government, and through the registration process, you get a unique business number for your company.

This business number forms the basis for all your program accounts with the government, including your payroll account (it typically follows the 123456789RP0001 format).

As all of your tax remittances are paid out to the payroll account, associated with your company — your business number is a piece of information you never want to get wrong. Otherwise, the CRA can’t properly correlate your remittances with your business.

👉 While we strongly recommend checking this during and immediately after getting your business set up in software, like Wagepoint, it’s something you can always check again at the end of the year.

4. Review your WCB, WSIB and/or CSST account numbers and rates.

This may or may not apply to your company specifically, but if you are required to register your company for Workers’ Compensation, you will be assigned an account number and a percentage rate by the Workers’ Compensation Agency in your province or territory.

👉 In addition to checking the account number and the rates, you should also make sure that all the applicable employees are enrolled in the program from a payroll standpoint. In a payroll app, like Wagepoint, it’s as simple as assigning the right Workers’ Compensation rate to a specific employee within their Job Tab.

👉 This is also a good time to make sure that you are fully caught up on all Workplace Safety & Insurance Board (WSIB)/La Commission de la santé et de la sécurité du travail (CSST) reporting. Because these agencies typically deal with the company directly, the employer is responsible for completing and submitting these reports, usually on a quarterly basis. You should always confirm your reporting frequency with the Workers’ Compensation board in your province.

If you’re using Wagepoint, we can provide a handy report of all the remittances that have been made on your behalf, which is a handy report to accurately complete your WSIB/CSST filings.

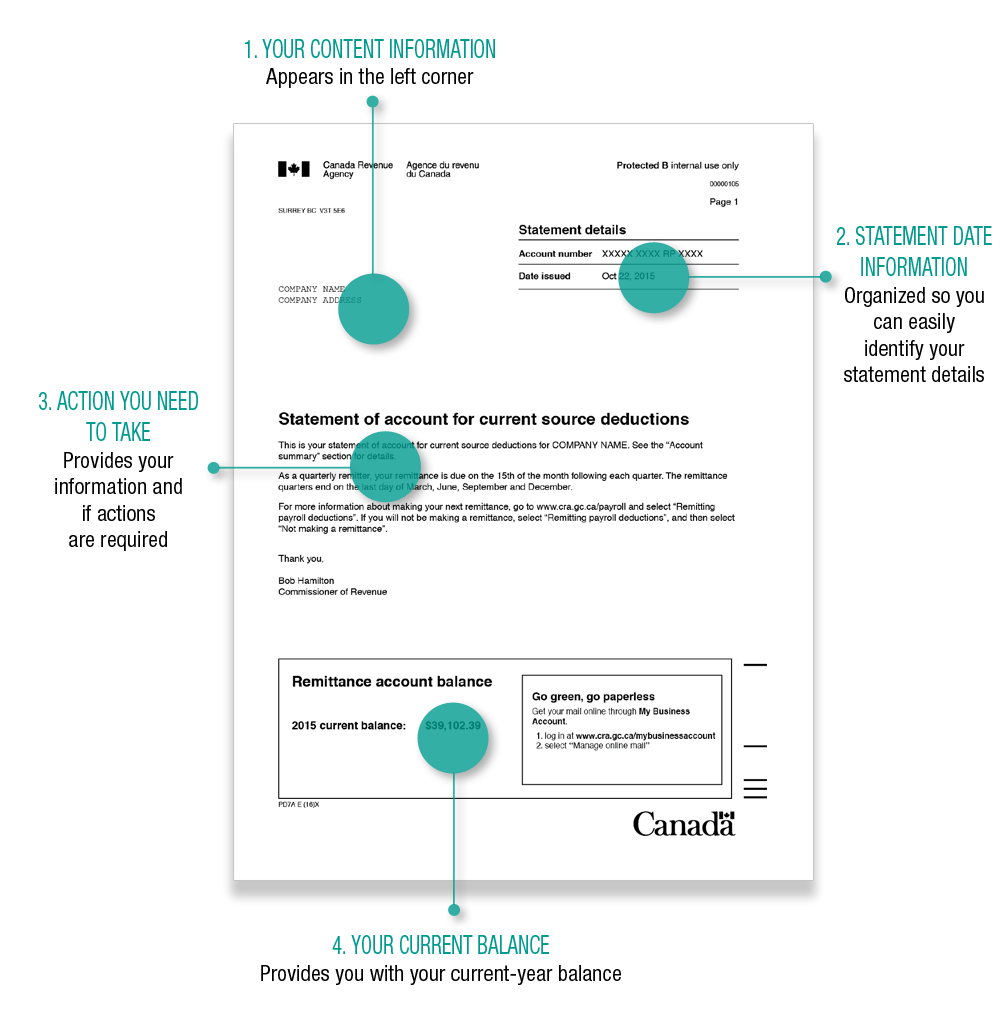

5. Confirm that your CRA/Revenu Québec Statement of Account matches your remittances paid out to date.

Assuming your bookkeeper or payroll provider is handling government remittances on your behalf, they should be able to provide you with a Receiver General Report that outlines all the remittances that have been paid out to date.

You should compare the Receiver General Report with the Statement of Account you receive from the CRA/Revenu Quebec.

This will help you spot any missed remittances, detect over or underpayments and catch up your payments well before you rack up any serious penalties.

6. Ensure you’re using the right remittance frequency and updating it as needed.

Most companies typically fall in the New or Regular Remitter Frequency, where your remittances have to be paid by the 15th of the month following the month you paid your employees.

Once your Average Monthly Withholding Amount (AMWA) starts to increase, your company might be required to remit taxes more frequently than a New or Regular Remitter.

👉 It’s really important that you notify your bookkeeper or update the frequency in your payroll software as soon as you receive the notice from the CRA. The penalties for missed remittances can be pretty severe and the interest compounds quickly.

7. Update your company’s Employment Insurance (EI), Québec Parental Insurance Plan (QPIP), Health Services Fund (HSF) or Employer Health Tax (EHT) rates.

Any notices you get from the government are important.

👉 If you get reduced rates for EI, QPIP, HSF or EHT, you have to notify your bookkeeper or update these fields in your payroll software immediately so that there are no discrepancies at year-end.

If the rates change for any reason, you also have to update them in your account. The CRA is the best source to refer to for current rates.

8. Make sure your year-to-date (YTD) and accrued vacation amounts are accurate.

YTD amounts include cumulative totals for:

- Gross earnings

- CPP and EI

- Vacation

- All incomes and deductions

YTD amounts have to be entered for all employees who are on payroll, especially if they have been paid previously in the year. These amounts all tally up at the end of the year and are reflected in the T4s / T4As.

👉 If your YTD amounts are incorrect, you might end up either over- or underpaying taxes and other source deductions.

You should also check accrued vacation amounts to make sure that the amounts match up to what they should be for your employees. Typically, vacation is accrued at 4% of your gross annual wages, but some employees might be accruing vacation at a higher percentage, say 3-weeks, which works out to 6% of annual gross wages. You should also ensure that any time taken as vacation time was reported and deducted from their balances.

You also need your YTD amounts to get set up when starting with payroll software (and if you’re switching software). You will also need YTD when issuing ROEs.

Bonus pro tip for an easier payroll year-end.

If you’re using Wagepoint to pay your employees and contractors, you want to ensure that you’ve set your “auto-submit” status to “YES” (in your account settings) so that we can file your year-end forms on your behalf.

Measure twice, cut once.

By following these eight steps, your year-end reporting should run smoothly for you and your employees. Plus, you minimize the risk of any penalties or discrepancies and that’s always a good thing!

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.