Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Does overtime get taxed more in Canada? No, it doesn’t. There are no special rules. No hidden rates — in fact, it’s taxed at the same rate as regular pay.

So why might you have employees in your office with their pay stub demanding to know why you taxed them so much for putting in overtime?

It can be tricky to explain to your small business team why it seems like they got taxed at a special overtime rate. So, let’s break this down, along with other overtime pay misconceptions to highlight what you need to know about overtime compensation in Canada. That way, you’ll be able to explain it to your team with confidence, and they’ll have a better understanding of what they’re seeing on their paystub.

Key takeaways

- Overtime is taxed at the same rate as regular pay.

- Additional income from working overtime can push employees into a higher income bracket, which makes it seem like there’s special taxation on overtime.

- Overtime hour thresholds, rates, and regulations vary from province to province.

- Overtime can’t always always be paid out as a bonus.

- All employees, even salary and commission workers, may be eligible for overtime.

Understanding overtime pay in Canada

What constitutes overtime?

Overtime is the number of hours worked in excess of normal working hours. The normal hours threshold may be different depending on the province or territory. Using a 40-hour work week threshold as an example, any work over that 40 hours would be considered overtime.

What are overtime rates?

One way overtime differs from regular wages is that it’s paid at a different rate.

Examples of overtime rates include:

- Time and a half: 1.5 times the normal hourly rate

- Double overtime: 2 times the normal hourly rate

Federal and provincial regulations and calculations

As a small business owner, you’ll generally only have to make note of provincial or territorial regulations when it comes to the number of hours considered to be overtime. Federal standards apply to industries regulated by the federal government (for example, banks).

In many areas, overtime starts after 40 hours of work in a week, but not everywhere. For instance, if you’re in Nova Scotia, overtime kicks in after 48 hours. For every hour worked over that, an employee receives 1.5 times their normal hourly rate.

So, an employee earning $18 per hour who worked 50 hours over the last work week would have a gross income of:

(48 x $18) + (2 x $27) = $918 for the week

But, if you’re in a province like British Columbia, employees are paid overtime if they work more than 8 hours in a day. Even if they don’t hit that 40 hour threshold by the end of the week. Plus, any hours over 8 worked in a day is paid at time and a half up to 12 hours. But, any hours worked the same day over 12 hours is paid two times their base hourly rate.

Other provinces that have their own specific overtime laws include New Brunswick and Newfoundland where the overtime pay rate is calculated based on minimum wage, rather than the employee’s regular rate.

Given variances from province to province, you, as an employer, need to make sure you’re up to date on the applicable laws and employment standards for your province or territory.

Overtime in Canada: Common misconceptions

Now, we’ll dive deeper to debunk a few misconceptions surrounding overtime pay, including breaking down why it seems like overtime gets taxed more.

Overtime pay gets taxed more in Canada

![]()

This is one of the most common misconceptions about overtime pay, but there isn’t any sort of special or increased taxation on overtime pay. So, what’s happened when your employee notices higher taxes?

What’s likely occurred is your employee’s extra earnings have pushed them into a higher tax bracket (called income brackets in Canada). This means their overall income is being taxed differently than what they’ve come to expect.

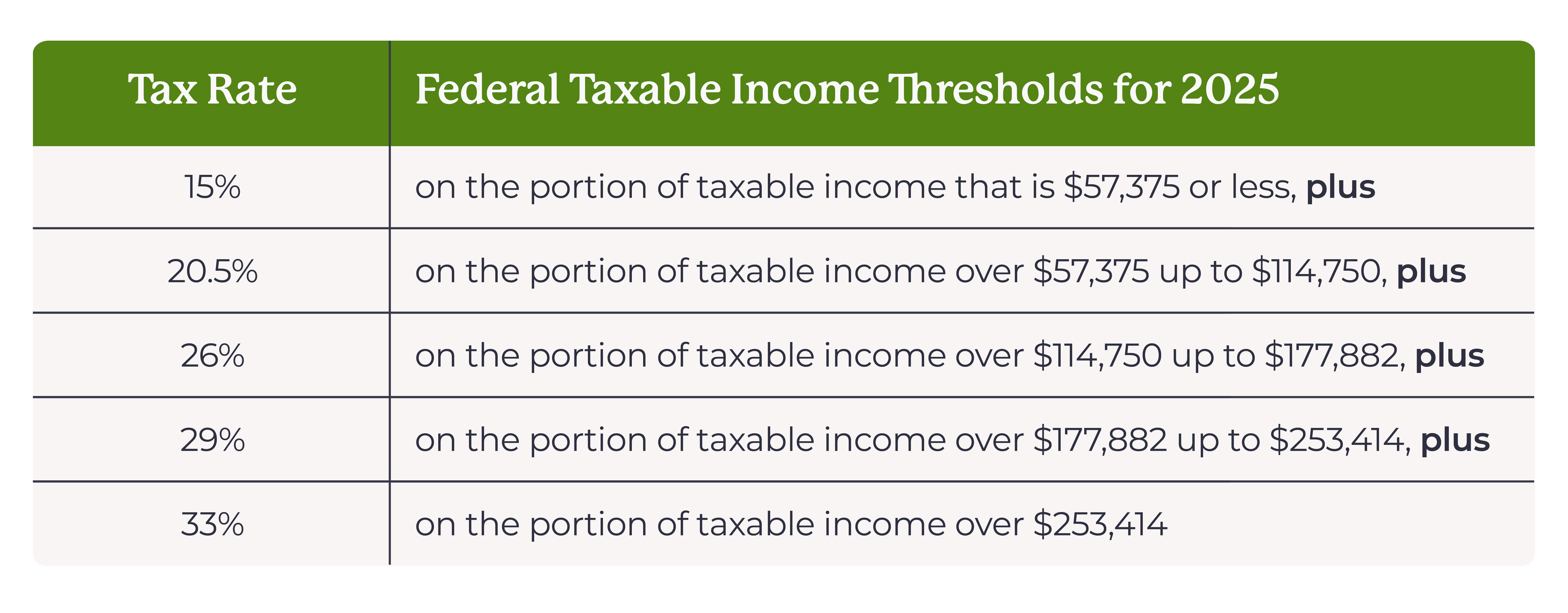

Income brackets

Income brackets refers to the percentage at which taxable income is, well, taxed. Taxable income, as a reminder, is gross income after deductions, credits, and exemptions have been applied.

As a progressive tax system, there are different income brackets and related tax rates at the federal and provincial or territorial levels.

We’ll use 2025’s federal income tax brackets and rates to explain how it works. To start, here are the rates.

With the above numbers in mind, say you earn $60,000 for the year. How it works is as follows:

- $57,375 will be taxed at 15%

- $2,625 (the remainder) will be taxed at 20.5%

In other words, a portion of the income is being taxed at a higher rate — but it’s not because of overtime. Whether you earn $60,000 for the year as your regular income or you’ve bumped up to that figure through additional hours worked, the taxation is the same.

To dive into the provincial and territorial income brackets and tax rates, read Tax rates and income brackets for individuals on the Canada Revenue Agency (CRA) website.

Overtime pay can be paid as a bonus

![]()

Whether overtime pay can be paid as a bonus depends on when the employee is paid for overtime hours. If they’re paid for the overtime hours in a later pay period than when they were earned, the bonuses, retroactive pay increases, or irregular amounts method should be applied to make the necessary tax deductions.

How does this work? It’s possible to bank hours. Any overtime hours not paid out in the same pay period in which they were worked are considered banked time and can be paid out in a later pay period. In most cases, these hours are compensated as paid time off in a later period. But, if unused within a period of time, they can simply be paid out.

An additional consideration, with relation to compliance, is the overtime hours need to be banked or paid at the correct rate, even in a later period. For instance, if the overtime hours would earn 1.5 times an employee’s wage, they need to be banked or paid at 1.5 times. Meaning, for every hour worked, the employee is entitled to 1.5 hours off or in pay.

Keep in mind there are varying rules around how time can be paid or banked, so you’ll want to check with your provincial or territorial regulations to avoid any mistakes that could cost you later.

Overall, the thing to remember when considering paying overtime as a bonus is overtime has hours attached to it, while bonuses do not. This is important because overtime hours are insurable and contribute to employment insurance. Meaning, they contribute to employee benefits when there’s an interruption in their employment, so you’ll want to be careful when handling overtime hours this way.

Only hourly employees are eligible for overtime pay

![]()

It’s worth noting that, despite talking about the hours associated with overtime pay, it’s not only hourly employees that are eligible for overtime. Salary and commission employees can earn it as well.

What tends to happen is hourly employees’ working hours are recorded more precisely because of punching in and punching out for work, so the overtime is clearer. However, there are cases where employers are still responsible for recording and calculating extra time worked by salary and commission staff.

As with all things payroll, there are regulations and exemptions surrounding who is eligible for overtime pay. These mainly relate to job sector or even job role or classification. Check with your provincial or territorial regulations to see if your staff are exempt or non-exempt employees.

Closing the book on overtime misconceptions

And with that, the book should be closed on the question: does overtime get taxed more in Canada? You now have the tools and knowledge to explain to your employees that no, overtime earnings do not get taxed more. Plus, extra knowledge about overtime in general and other misconceptions about this part of payroll.

Ready to learn more? Get the answers to more common payroll questions.

Additional resources

Employment Standards Act by Province/Territory

- Alberta Employment Standards

- British Columbia Employment Standards

- Manitoba Employment Standards

- New Brunswick Employment Standards

- Newfoundland Employment Standards

- Northwest Territory Employment Standards

- Nova Scotia Employment Standards

- Nunavut Territories Employment Standards

- Ontario Employment Standards

- Prince Edward Island Employment Standards

- Québec Employment Standards

- Saskatchewan Employment Standards

- Yukon Territory Employment Standards