Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

As a Canadian small business owner, staying compliant with the Canada Revenue Agency (CRA) is a crucial part of your role, and your employees rely on you to get it right. In 2025, this now includes navigating updates to CPP2, the second phase of the Canada Pension Plan (CPP).

Much like the endless follow-ups to Scream, you might be wondering: does CPP really need a sequel? With multiple names like “CPP enhancement” and “second additional CPP,” plus a host of new guidelines to learn, understanding this update can definitely feel like a scary movie.

But, unlike questionable movie sequels, CPP2 deserves your attention. It directly impacts your payroll and introduces new responsibilities for you as an employer.

So let’s untangle the jargon and explore how these changes affect your business, your employees, and your CRA compliance.

What is CPP2?

CPP2, the second phase of the Canada Pension Plan (CPP), enhances retirement security for Canadians. Starting in 2024, workers earning above a certain threshold contribute to a new, second earnings ceiling, which increases their future retirement benefits.

This update reflects the rising cost of living and longer life expectancies for Canadians. Think of it as adding an extra layer to an employee’s retirement safety net. Employers and employees contribute equally to these additional amounts, resulting in higher pension payouts, potentially covering up to 33.33% of an individual’s average lifetime earnings.

For Canadian small business owners, this means slightly higher costs today, but it also supports your team’s financial future, helping them retire with greater peace of mind.

Understanding CPP and CPP2 contributions

To fully understand how CPP2 affects your payroll, it’s important to first get familiar with the different types of CPP contributions. Here’s a breakdown of how the current system works.

CPP base contributions

This is the original CPP you’re already familiar with — the “old school” version. It’s pretty straightforward. Employees contribute to the CPP if they are over the age of 18, work in Canada (outside of Québec), and earn more than $3,500 a year. Employers match employee contributions dollar-for-dollar.

CPP first additional contributions

Introduced in 2019, these contributions kick in after base contributions, up to the Year’s Maximum Pensionable Earnings (YMPE), also known as the first earnings ceiling. This ceiling is set by the CRA and changes annually. Employers match these contributions as well.

- The total contribution rate for the base and first additional CPP is currently set at 5.95% with no plans for a change in the near future.

- If an employee earns less than the first earnings ceiling, they will not make CPP2 contributions and will only contribute to base and first additional CPP contributions (matched by their employer).

CPP second additional contributions (CPP2)

Introduced in January of 2024, CPP2 applies to income above the YMPE and up to the Year’s Additional Maximum Pensionable Earnings (YAMPE), or the second earnings ceiling. This ceiling is also set by the CRA and changes annually. Employers also match these contributions.

- The rate used to calculate the CPP2 contribution is currently set at 4.00% with no plans for a change in the near future.

In short, CPP2 doesn’t replace the original CPP, but builds on it. Contributions made under both the base CPP and the CPP enhancement are combined to calculate an employee’s total benefits when they retire. It’s like upgrading to a deluxe package: better perks, but with a slightly higher cost.

What’s new in 2025

Now that you understand the building blocks of CPP, let’s take a look at the updates for 2025 so that you can accurately plan for the year ahead.

Higher earnings ceiling

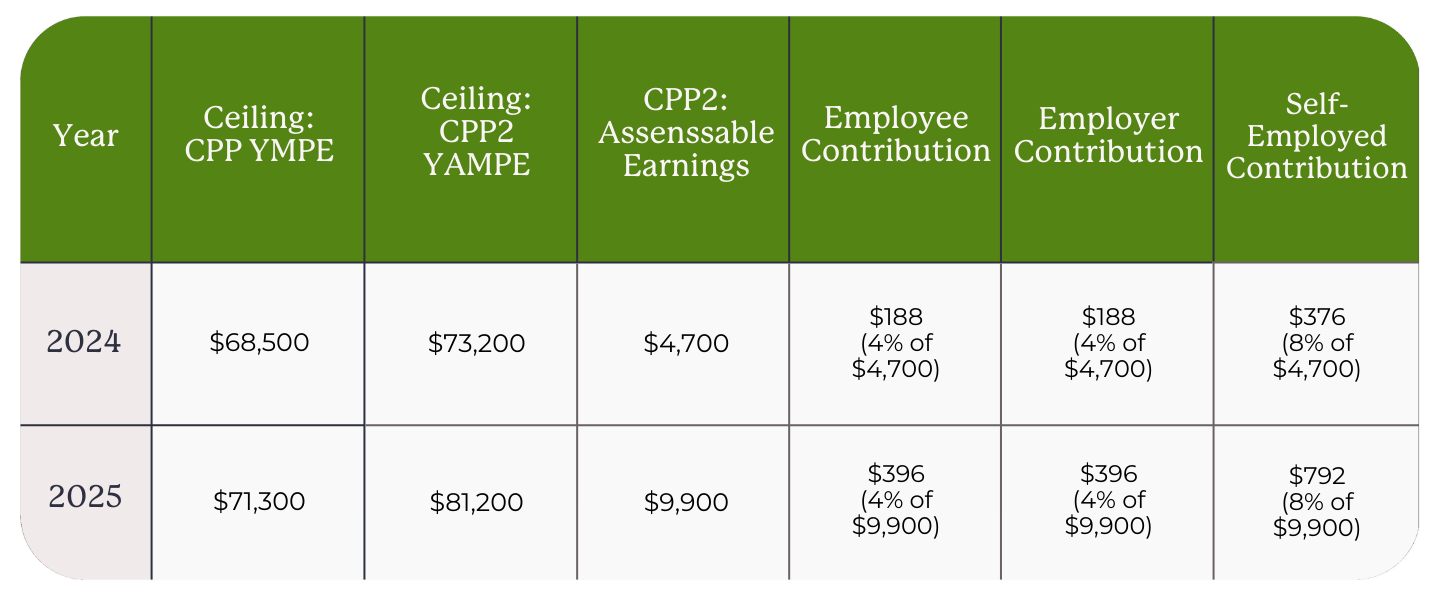

In 2025, the earnings thresholds increase to ensure retirees receive improved financial support. Here’s the year-over-year comparison:

2024

- CPP YMPE = $68, 500 (First earnings ceiling)

- CPP2 YAMPE = $73,200 (Second earnings ceiling)

- This means that CPP2 contributions were applied on earnings between $68,500 and $73,200, resulting in CPP2 assessable earnings (essentially, a difference) of $4,700.

2025

- CPP YMPE= $71,300 (First earnings ceiling)

- CPP2 YAMPE = $81,200 (Second earnings ceiling)

- This means that CPP2 contributions will apply on earnings between $71,300 and $81,200, resulting in CPP2 assessable earnings of $9,900.

Contribution rates

For both 2024 and 2025, CPP2 contributions are calculated at 4.00% of the CPP2 assessable earnings for employees and employers and 8.00% for self-employed individuals. But with the higher earnings ceilings in 2025, contribution rates will increase. For example:

- In 2024, an employee earning $73,200 will pay a maximum of $188 under CPP2, matched by their employer with self-employed individuals contributing $376.

- In 2025, an employee earning $81,200 will pay a maximum of $396 under CPP2, matched by their employer with self-employed individuals contributing $792.

Here’s how the math breaks down:

Employer checklist: staying compliant with CPP2 updates in 2025

As a small business owner, CPP2 introduces some important new responsibilities for your payroll processes. Follow these actionable steps and tips for staying compliant with the new changes.

Budget for increased matching contributions

- With CPP2, both you and your employees will be making higher contributions. Be sure to adjust your financial planning to account for this.

- If you’re self-employed, remember you’ll need to cover both the employee and employer CPP portions. It might seem like a lot now, but remember: future you is high-fiving present you for those contributions!

Make sure your payroll systems are updated

Ensure that your payroll systems are updated to handle the new CPP contributions, including:

- Deducting the correct contributions from employee paycheques (base CPP, first additional, and CPP2 contributions).

- Matching employee contributions correctly, including the new CPP2 tier.

- Remitting the employer share of contributions on behalf of employees who contribute to CPP2.

- Stopping deductions once an employee hits the annual contribution limit.

If you’re using Wagepoint’s online payroll software, you’re in good hands. Our system is already updated to reflect the 2025 changes.

Keep your team in the loop

- Be proactive! Share details with your employees so they’re not caught off guard by slightly smaller net pay on their paycheques.

- Explain why CPP “contribution holidays” (those pay periods when CPP deductions stop) might happen later in the year, or not at all for some higher earners.

- Provide resources to help your employees understand the changes. Transparency makes all the difference.

“Let employees know that they’ll receive a little love back from the CRA. This includes a non-refundable tax credit at a rate of 4.95% for base contributions, and a tax deduction at rates of 1.00% and 4.00% for first and second additional contributions, respectively.”

– Samantha Derocher, Payroll Compliance Lead, Wagepoint

How does CPP2 impact payroll year-end?

Year-end is your chance to ensure everything is balanced and compliant. As an employer, you’ll need to confirm that the correct CPP2 contributions were deducted from your employees’ pay throughout the year. This means reviewing and balancing their year-end totals prior to filing their tax forms.

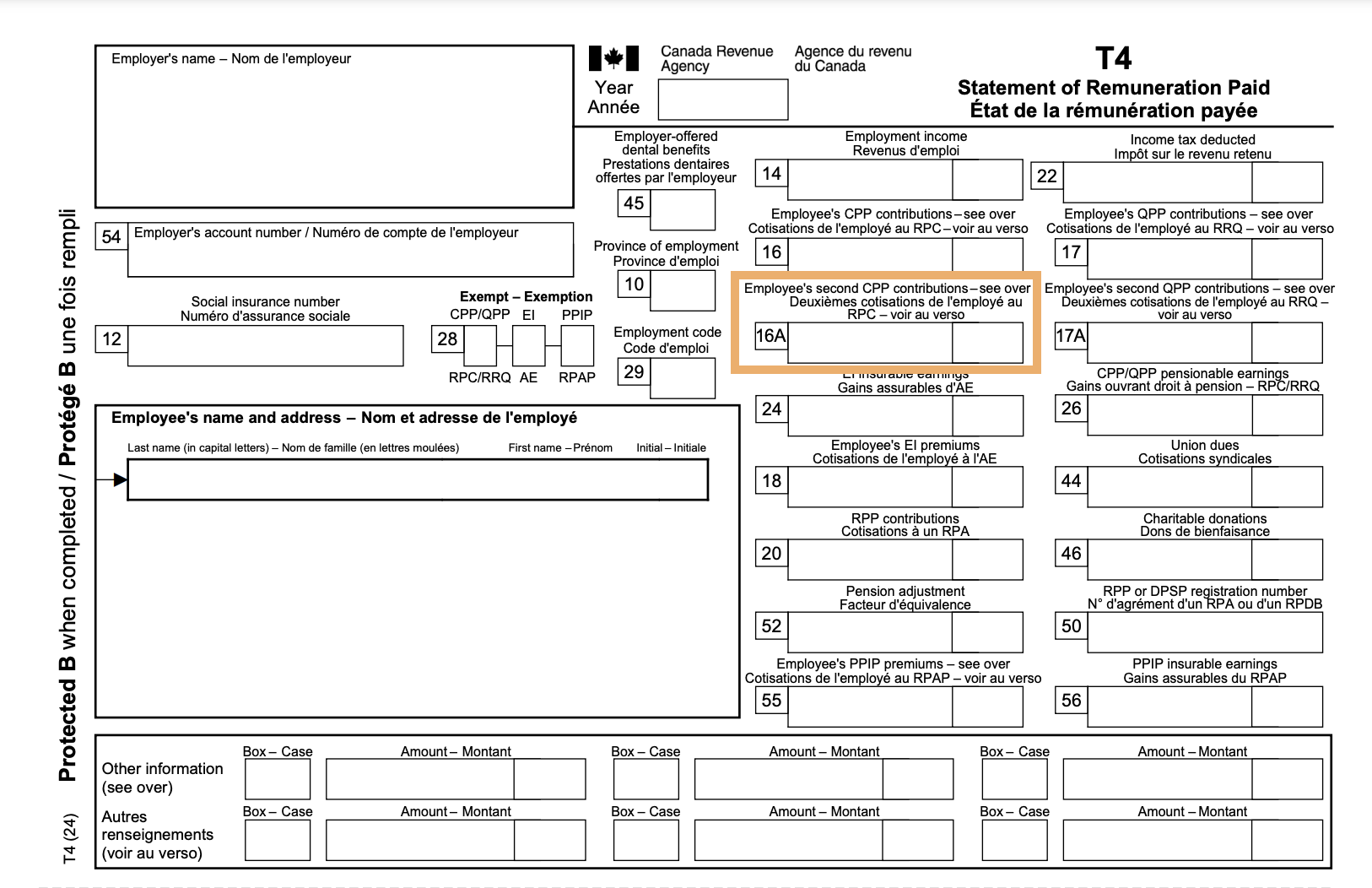

Recording CPP2 on T4s

When it’s time to prepare your employees’ T4s, CPP2 contributions must be reported separately from base and first enhanced CPP contributions. Here’s what you need to know:

- Box 16: Record base and first enhanced CPP contributions here.

- Box 16A: Use this new box to report CPP2 contributions.

- If no CPP2 was deducted, leave Box 16A blank.

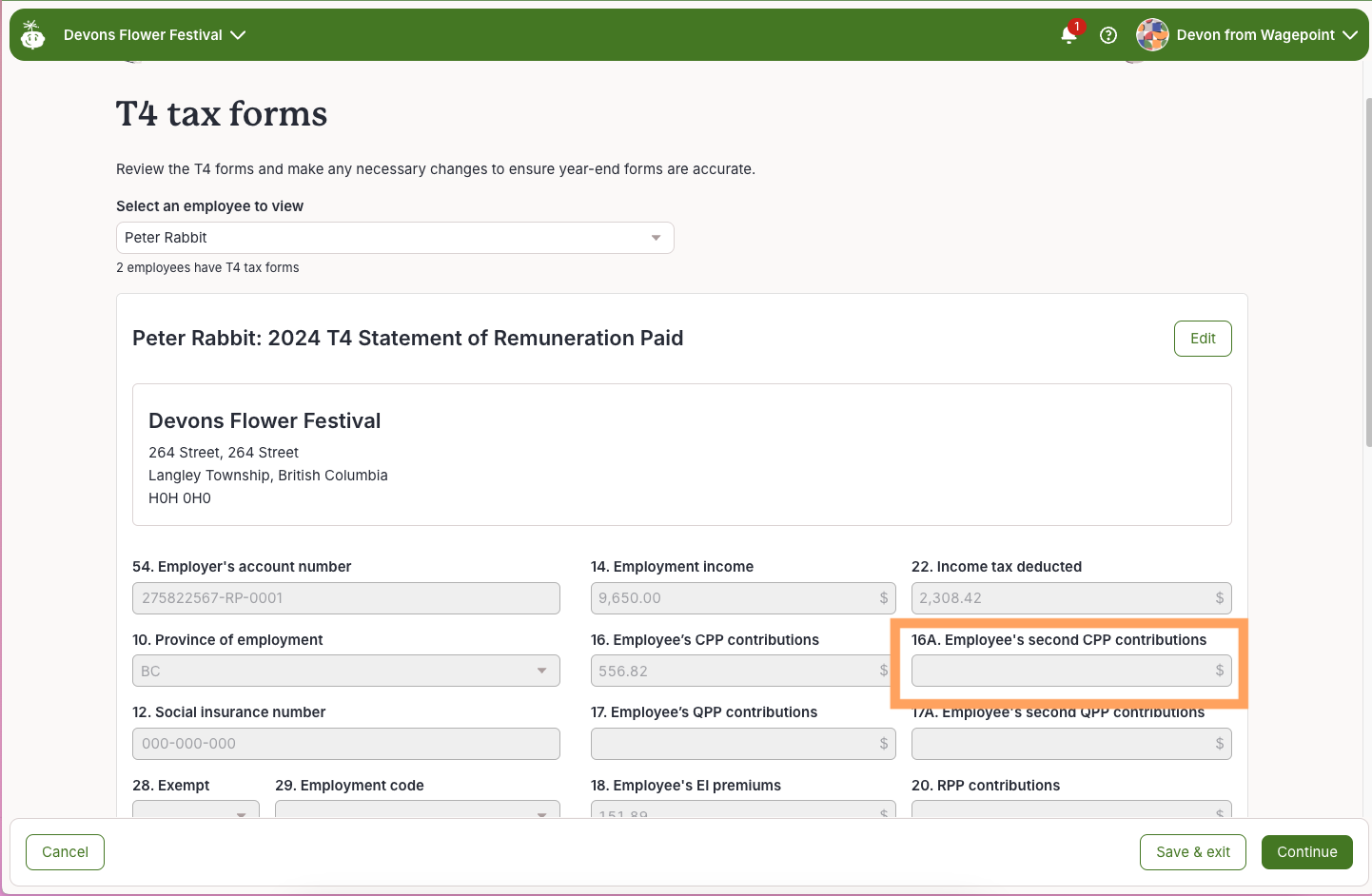

Make sure your payroll system has these new T4 fields set up and ready to go. If you’re using Wagepoint, our software handles these updates seamlessly, so your T4s will display everything correctly.

The new Box 16A on T4s is used to record CPP2.

T4s have been updated with the new Box 16A in Wagepoint.

Building a better retirement for your team

As a small business owner, you’re the unsung hero shaping your employees’ financial futures. Tackling updates to CPP and CPP2 might require a bit more work now, but the payoff is worth it: a more secure retirement for your team. By staying compliant and keeping them in the loop, you’re ensuring they’ll be financially secure long after the release of Scream 47: Retirement Scream-along. 😉

Now that you know how to tackle CPP2, learn more about payroll compliance for Canadian small business owners.