Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Ensuring timely and accurate payroll remittances helps maintain compliance with federal and provincial regulations, avoiding unnecessary penalties and interest charges. This comprehensive guide covers essential aspects of payroll remittances, including schedules, deadlines, reconciliation, penalties, and payment methods.

Before we get to the “schedule” component of remittances, let’s first review what a payroll remittance is, because managing your remittance obligations is a critical responsibility for Canadian small businesses and the professionals who support them, such as bookkeepers and accountants.

What are payroll remittances?

Payroll remittances in Canada refers to the process of deducting certain amounts from employees’ pay and submitting them to the Canada Revenue Agency (CRA) as part of an employer’s tax obligations. Employers must remit deductions following their assigned remittance schedule (noted below in next section) to ensure compliance and avoid penalties. These deductions consist of 2 categories:

Employee withholdings: Taxes and additional amounts calculated on applicable earnings, that employers withhold from employees paycheques.

Employer contributions: Amounts that an employer must calculate based on applicable employee earnings and withholdings, in addition to employee amounts.

These contributions and withholdings include:

- Income tax: Amounts withheld from employees’ wages based on federal and provincial tax rates.

- Canada Pension Plan (CPP) contributions: Employee and employer contributions to the Canadian Pension Plan, calculated on the employees pensionable earnings.

- Employment Insurance (EI) premiums: Employee and employer premiums, calculated on the employees insurable earnings.

If you’re an employer in Québec.

Québec has its own provincial pension plan, the Québec Pension Plan (QPP), provincial income tax and the Québec Parental Insurance Plan/Provincial Parental Insurance Plan (QPIP/PPIP). If you have employees in Québec, you must deduct these payments and remit them to Revenu Québec.

What is a payroll remittance schedule?

Now that we’ve covered what a payroll remittance is, the payroll remittance schedule defines how often and by what deadlines employers must deduct and submit the remittances to the Canada Revenue Agency (CRA) or Revenu Québec.

In order to determine your remittance schedule, first, CRA needs to determine your remitter type.

What is a remitter type?

A remitter type categorizes businesses based on when a payroll account is opened, the volume of payroll withholding amounts, and the business’s compliance history with CRA. Your remitter type sets your remitting frequency (AKA schedule) and due dates.

Take note, the CRA conducts an annual review of payroll accounts in November to determine remitter types. So, if this is not your first year with payroll or your business circumstances have changed, you may receive a change notice from CRA, so be on the lookout.

Important notes about your remitter type.

- If an employer has multiple payroll accounts or is part of an associated corporation, any changes to the remitter type will apply to all related payroll accounts.

- Remitter type does not impact pay periods. A change in remitter type only affects when you must submit remittances, it does not require you to change how often employees are paid.

How is a remitter type determined?

CRA uses the employer’s average monthly withholding amount (AMWA) from 2 calendar years ago. The AMWA is calculated by:

Total of all required payroll deduction remittances in a calendar year

Number of months (maximum 12) that required a payroll deduction remittance in that calendar year

Which payroll remittance schedule should I follow?

Quarterly remitters – New small employers

Definition: A new employer whose payroll account has been opened for less than 12 months.

New small employers will automatically default to a quarterly schedule, there is no need to apply. To be eligible or to remain a (new small employer) quarterly remitter, the following conditions must be met:

- The total remittance owed is less than $1,000 in one calendar month AND

- Over the previous 12 months:

- A perfect compliance record is maintained on all payroll accounts

- No late remittances or late remitting penalties

- No failure to remit penalties

- No failure to deduct penalties

- No overdue T4-type information return(s)

- A perfect compliance record is maintained on all HST/HST

- No balance owing

- No overdue returns

- No credit balance with a refund hold

- A perfect compliance record is maintained on all payroll accounts

When a new small employer no longer meets the conditions above, the CRA will send a written letter advising the employer that, starting the next calendar quarter, they will be considered a regular remitter, which requires a change of frequency in the remittance schedule.

Quarterly remitters – Small employers

Definition: An existing employer whose payroll account has been opened for at least 12 months and has been notified in writing by CRA, that they qualify to be quarterly remitters.

Note: If the employer has multiple payroll accounts, at least one of the payroll accounts must have been open for at least 12 months.

To be eligible or to remain an (existing small employer) quarterly remitter, the following conditions must be met:

- The AMWA is less than $3,000 in the calendar year before the previous calendar year.

- The employer has a perfect compliance record on all payroll and GST/HST accounts over the previous 12-month period.

When an existing small employer no longer meets the conditions above, CRA will send a written letter advising the employer that starting the next calendar year, they will be assigned a new remitter type, which could change the frequency for their remittance schedule.

Regular remitter

Definition: An existing employer who has not been assigned another remitter type and meets all of the conditions below.

- The AMWA is less than $25,000 in the calendar year before the previous calendar year.

- You are a new employer, but do not qualify to remit quarterly as a new small employer.

Accelerated remitters – Threshold 1

Definition: An existing employer who has not been assigned another remitter type and has an AMWA between $25,000 – $99,999.99, in the calendar year before the previous calendar year.

Accelerated remitters – Threshold 2

Definition: An existing employer who has not been assigned another remitter type and has an AMWA of at least $100,000, in the calendar year before the previous calendar year.

When is my payroll remittance due?

While your remitter type sets your remitting frequency, your due date to pay the remittance varies depending on your remitter type.

Here is a breakdown of remitting periods with their corresponding due dates.

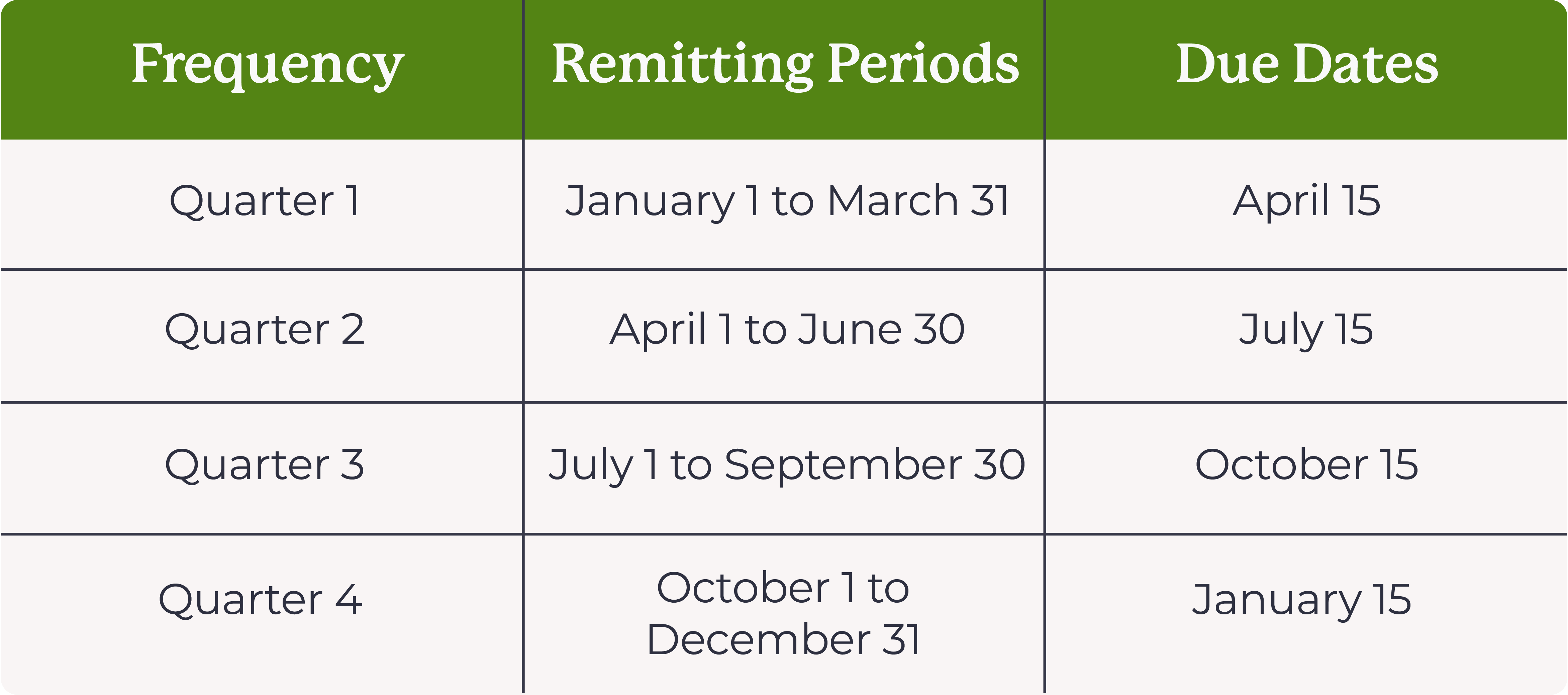

Quarterly remitter remittance due dates

(Both new and existing small employers with a perfect compliance record)

Regular remitter remittance due dates

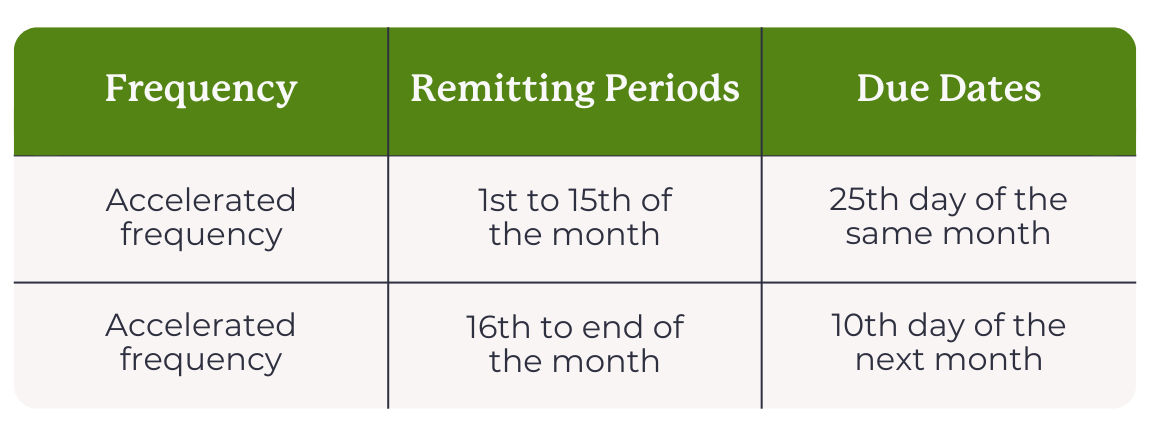

Threshold 1 remitter remittance due dates

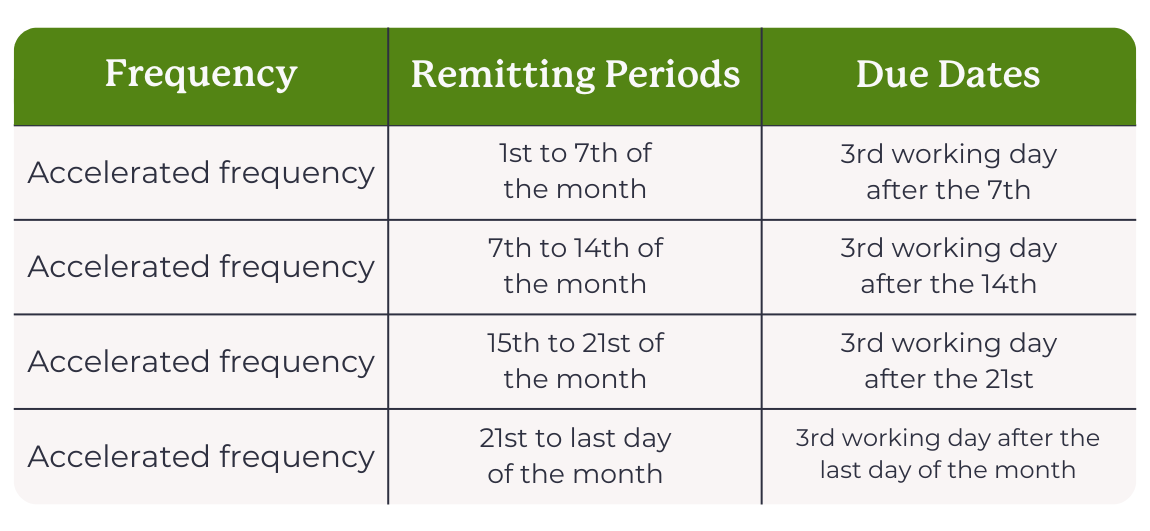

Threshold 2 remitter remittance due dates

Remitting more frequently

If you remit more frequently than required by your assigned remitter type, the CRA will accept early payments. However, the remitter type will not be changed.

Nothing to remit

If you happen to have no employees who worked during your remittance period or you have seasonal workers, and you have not made any source deduction payments for that period, you are still required to report a NIL remittance by the due date indicated on your remittance schedule.

Will this be your final remittance?

If you have a change of business your final remittance is due within 7 days of the following:

- Business stops operating

- Sole proprietor or partner dies

- Legal status changes

- Bankruptcy or entry into receivership

- Business is restructured, reorganized or amalgamated

CRA must be notified if your business status changes.

Want to change your remitter type?

Regular remitters can apply to change their remitter type if either of the following applies.

- You have had your payroll account for 12 months or more

- You meet the conditions to be a quarterly remitter, small employer

OR

- You are an accelerated remitter, and using last year’s AMWA would lower your remitting frequency.

You can request a remitter type review by calling 1-800-959-5525

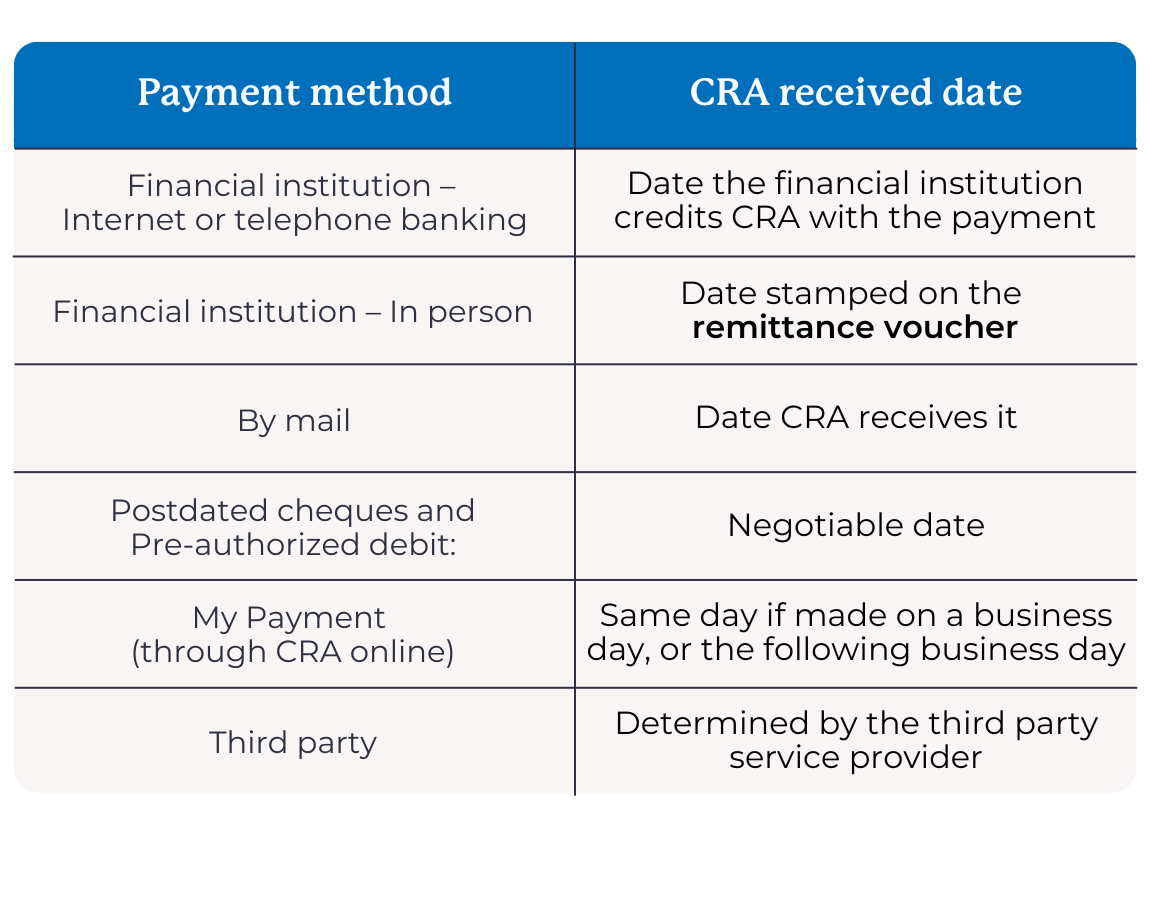

Making remittance payments on time.

If your remittance due date falls on a Saturday, Sunday, or a CRA-recognized public holiday, your payment will be considered on time if it is received by the CRA or processed by a Canadian financial institution on or before the next business day.

Learn more: How to remit (pay).

Remittance vouchers and payment forms.

A remittance voucher or payment form ensures the CRA can correctly apply your payment. These vouchers must be included when making payments in person at financial institutions and should accompany any payments sent to the CRA by mail.

- Statement of account for current source deductions – Regular and quarterly remitters – PD7A

- Statement of account for current source deductions – Accelerated remitters – PD7A(TM)

Learn more information on ordering or downloading remittance and payment forms.

Best practices to prevent remittance errors and/or penalties.

Your payroll remittance (source deductions) must be held in trust in a separate account from your normal operating account.

Late, missed, and gross negligence payments will result in fines, penalties, and interest.

I might be biased…but using a payroll software like Wagepoint that will manage source deductions, calculations and remittances for you, takes a lot of this responsibility and penalty risk off your plate, just saying.

Reconciling payroll remittances at year-end

Congratulations! You’ve made it to the end of the calendar year…and almost to the end of this deep-dive blog. As each year wraps up, employers (or their payroll service provider) must reconcile all payroll deductions and withholdings to what CRA has on record. This crucial step ensures accuracy in employees’ T4s and prevents potential issues with the CRA.

If any discrepancies or errors in payroll remittances have occurred throughout the year, adjustments need to be made before T4s are generated and distributed to employees and the CRA. Missing errors could result in a Pensionable and Insurable Earnings Review (PIER) from the CRA.

Next Steps: Verifying your remittances

Once you’re confident that all necessary adjustments have been made and you’re in the clear from receiving a PIER, the next step is to compare your total remittances paid for the calendar year with your record of account with the CRA.

- Regular and quarterly remitters who pay by mail: You will receive a PD7A – Statement of account for current source deductions as soon as your remittances are received or processed by the CRA. Keep these records, as they are essential for ensuring your payroll remittance records match the CRA’s records at year end.

- For all other remitters and those who pay electronically: Your payroll remittance records for the calendar year will be available through CRA’s online services.

Taking the time to reconcile your payroll remittances regularly throughout the year will help ensure a smooth year-end process and avoid unnecessary complications with the CRA.

Final thoughts: Staying on top of payroll remittances

Managing payroll remittances can feel complex, but staying informed about your obligations, deadlines, and best practices will help ensure compliance and avoid unnecessary penalties. Whether you’re a new small employer or a high-volume accelerated remitter, understanding your remittance schedule and reconciling payments regularly will keep your payroll process running smoothly. Leveraging payroll software and working with a payroll professional can further simplify compliance, giving small business owners peace of mind.

Want to learn more about the kind of deductions in remittances? Check out our small business guide to CPP2.