Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Offering bonuses is a great way to reward and retain top talent—but it often comes with questions from employees about why so much is withheld for taxes. As an employer or payroll service provider, understanding bonus tax in Canada allows you to answer those questions confidently, ensure compliance, and even optimize how bonuses are processed for better employee satisfaction.

In this post, we’ll walk through how bonuses are taxed in 2025, compare the key CRA-approved tax calculation methods, and share practical tips to help you handle bonus payments accurately and efficiently within your payroll system.

Are bonuses taxed differently than salaries?

Not really. From a payroll perspective, bonuses are treated the same as regular employment income and are subject to the same federal and provincial/territorial taxes.

That said, employees may feel like they’re being taxed more heavily on their bonus—especially if it’s a sizable, one-time payment. This is because Canada’s marginal tax system applies higher tax rates to income that exceeds certain thresholds. A bonus may temporarily push an employee’s total earnings into a higher tax bracket, which results in more tax being withheld on that portion of income.

As an employer, it’s helpful to understand (and explain) that while the tax treatment is consistent, the size and timing of a bonus can affect the perceived tax impact on an employee’s pay.

Payroll Taxes on Bonuses in Canada

In Canada, bonuses are considered taxable income. As a result, they are subject to the same mandatory payroll deductions as regular wages or salary, including:

- Canada Pension Plan (CPP) contributions

- Employment Insurance (EI) premiums

- Federal and provincial income tax

In most cases, bonuses are taxed at source in the same way as regular earnings, unless special rules or exceptions apply.

Payroll Tax Exceptions on Bonus Payments

There are a few important exceptions and planning opportunities that can affect how much tax is withheld from a bonus payment. Understanding these exceptions can help both employers and employees optimize bonus payments.

CPP and EI Contribution Limits:

If an employee has already contributed the maximum annual amount for Canada Pension Plan (CPP) and/or Employment Insurance (EI), no further deductions are required for those items.

CPP Exemption on Separate Bonus Payments:

If a bonus is paid separately from regular earnings, do not apply the annual basic exemption amount for CPP on that bonus. This rule ensures the full bonus is subject to CPP, up to the annual maximum.

Optional: Redirecting a Bonus payment to an RRSP

Some employers offer the option to deposit a bonus directly into an Registered Retirement Savings Plan (RRSP), helping the employee to defer income tax on the payment.

Important: CPP and EI deductions (if applicable) must still be withheld before the bonus is transferred to the RRSP.

To do this:

- The employee must have sufficient RRSP contribution room

- They must provide written confirmation (e.g. a Notice of Assessment or MyCRA printout)

- The employee must notify payroll in advance, so the bonus can be transferred before taxes are withheld.

This option can be a valuable way to maximize the after-tax value of a bonus while supporting long-term financial goals.

How Is Income Tax Calculated on Bonuses in Canada?

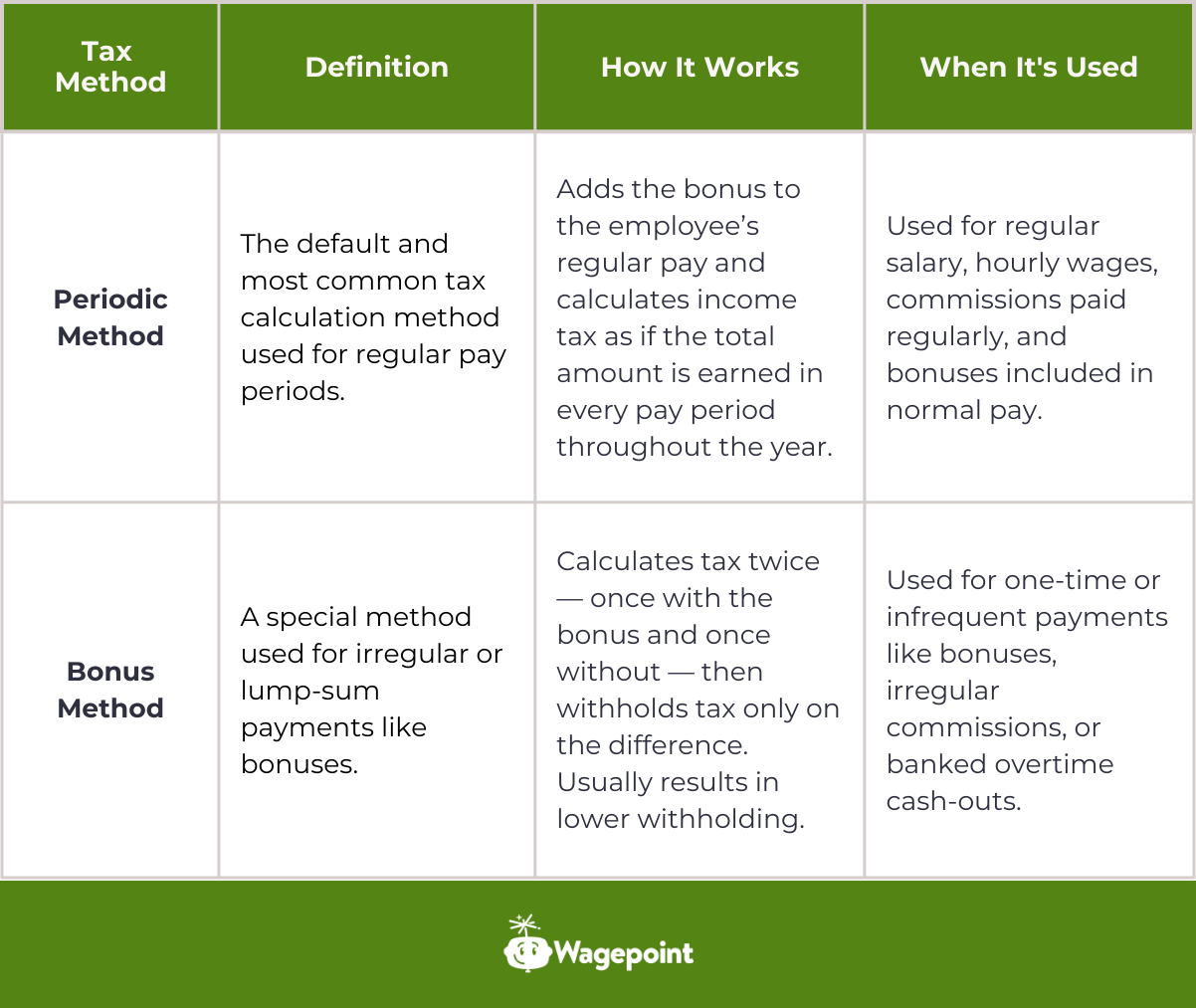

When it comes to taxing bonuses, the two most commonly used by Canadian payroll systems are:

- Periodic Method (default)

- Bonus Method

What’s the Difference Between the Periodic Method and Bonus Method?

Understanding which method to use can help employers manage bonus payouts more effectively — and help employees take home more of their hard earned money.

Payroll Bonus Tax Calculation Examples

To keep this example simple, we’ll limit our example to showing just the tax portions.

Here are the details we need to perform the payroll calculations shown in this post:

- Rate of Pay: Employee receives a $1,600 salary every pay.

- Bonus Amount: Employee is receiving a (one-time) bonus of $5,000 on this pay.

- Pay Schedule: Employee is paid bi-weekly (26 pay periods)

- Claim Code: Federal tax claim code is 1 (basic), $16,129

- Withholding Status: Employee is CPP and EI exempt.

- Annual Tax Owing Rate: Ontario

- Canada Employment Amount: Not included

- Taxation Year: 2025

(This example is illustrative—use figures relevant to your own payroll)

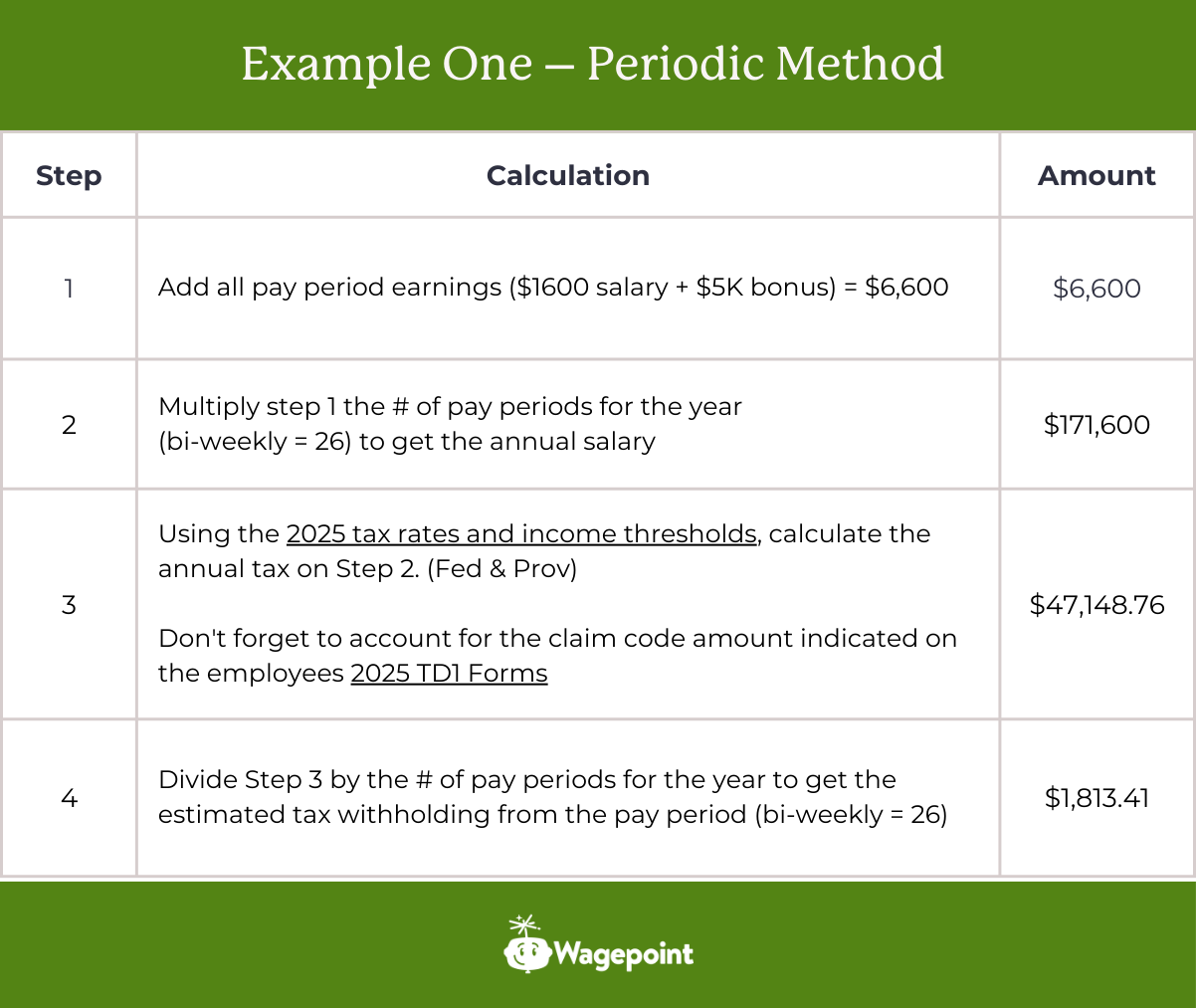

Example One – Periodic Method

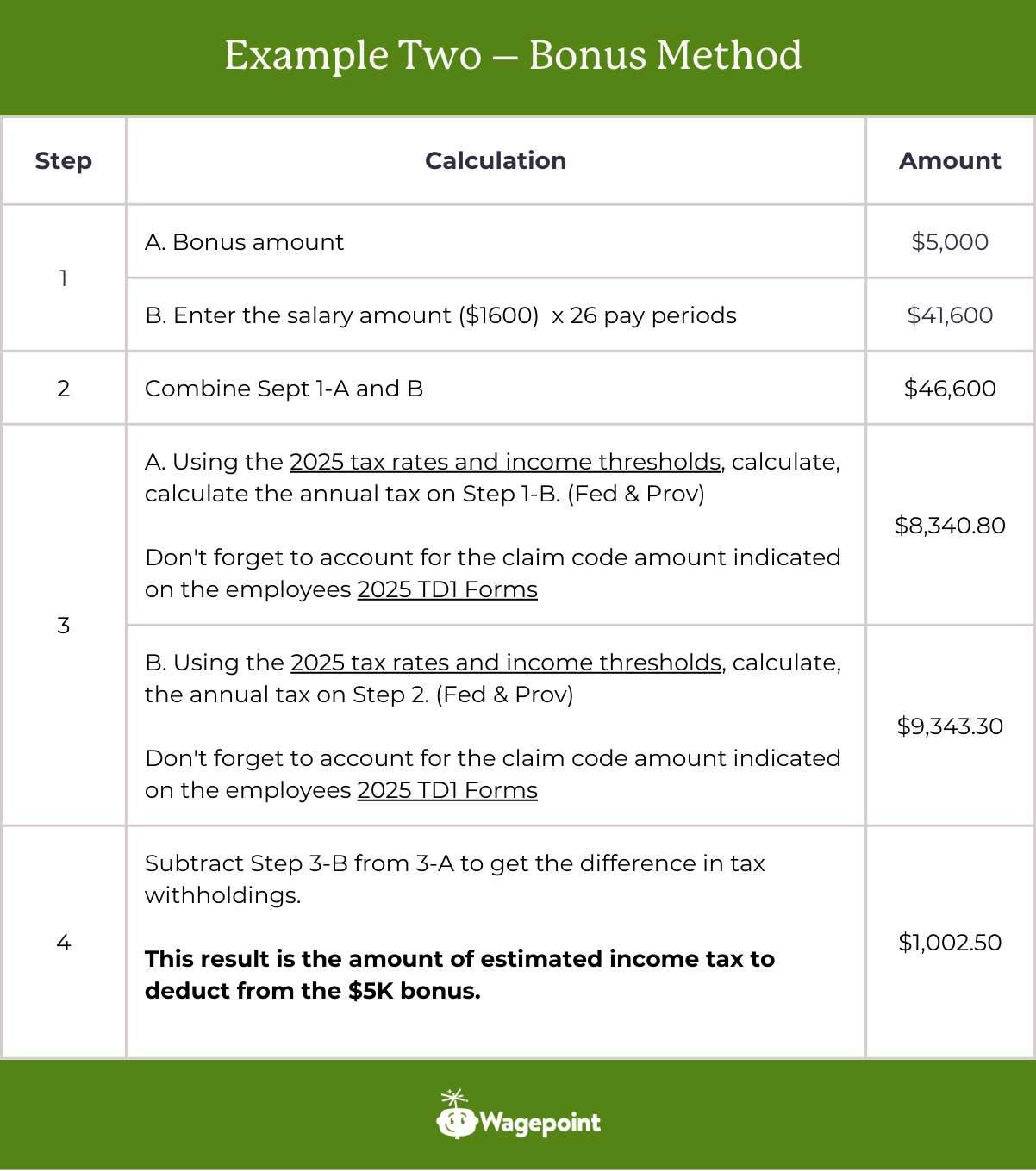

Example Two – Bonus Method

Bonus Tax Calculation Summary

Using the periodic method, the employee would pay $1,813.41 in income tax. Using the bonus method, the tax withheld would be $1,002.50

In summary: The bonus method reduced the tax withheld by $810.91, making it a more favourable option for one-time bonus payments.

Note: If you are processing multiple bonus or lump-sum bonus payments in a year please see here for more information.

Bonus taxation in a nutshell

While most payroll software follows the periodic method, those wanting to use the Bonus Method are encouraged to use the CRA’s Payroll Deductions Online Calculator (PDOC) as it provides an easy workaround to calculate taxes on the bonus.

Wagepoint customers are welcome to contact the Wagepoint support team should they require assistance adjusting taxes on a payroll bonus.

This post was produced in collaboration with Alan McEwen, a Vancouver Island-based HRIS/Payroll consultant and freelance writer with over 20 years of experience in all aspects of the industry.