Blog

Payroll made simple, one story at a time.

Tips, insights, and real small business experiences to help you run payroll with confidence (and maybe even enjoy it).

Managing a PIER report: Turn CRA reviews into client trust.

Managing a PIER doesn’t have to be stressful. Build client confidence by expertly guiding them and spotting advisory opportunities.

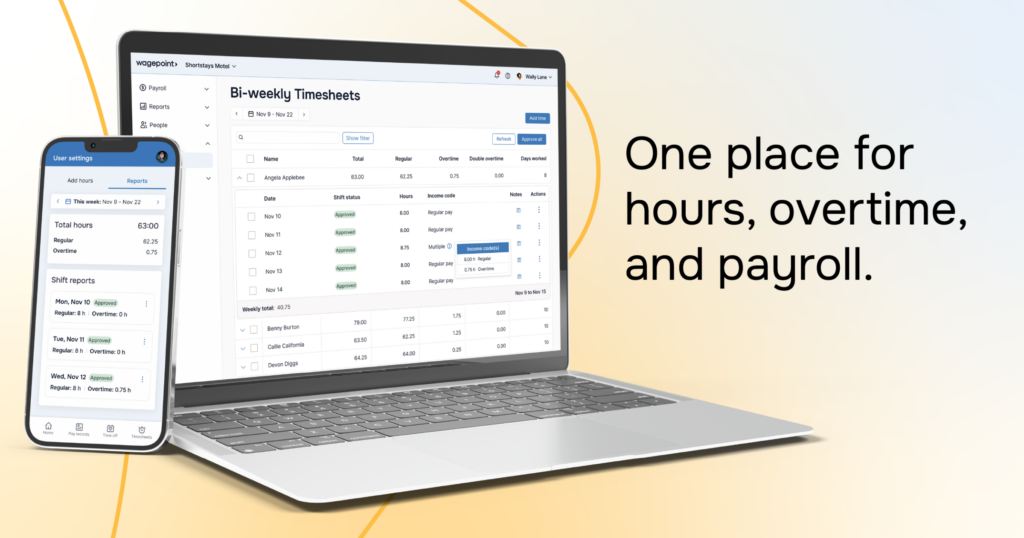

Timesheet chaos out. Stress-free payroll in.

Introducing Timesheets and the My Wagepoint mobile app. One connected system that brings time, pay, and mobile together.

Why simple wins: CEO Ben Richmond on Wagepoint’s future.

Six months into his role as CEO, Ben Richmond reflects on small business, the future of Canadian payroll, and how Wagepoint is building for what comes next.

Payroll year‑end handoff: what to ask clients for.

Use this payroll year-end handoff checklist to gather the right info from clients early—so T4/T4A prep is faster and cleaner.

Minimum wage by province 2026.

Stay compliant by knowing the current minimum wage in your province or territory, plus when Canada’s federal minimum wage applies.

Year-end payroll for remote and hybrid teams.

Remote or hybrid team? Here’s how Province of Employment works in Canada and what it means for tax deductions, T4s, and year-end payroll.

2025 in payroll: Insights from a year of connecting with the community.

A clear look at the payroll insights that shaped the industry in 2025: from compliance and FINTRAC shifts to AI and community learning.

Stronger systems, stronger businesses: What 2026 payroll trends tell us.

Learn the key 2026 payroll trends redefining accuracy, compliance, automation, and cross-department collaboration for payroll professionals.

6 Key takeaways from Wagefest 2025.

Discover how payroll automation and AI are transforming Canadian small businesses. These insights reveal what’s next for payroll.

CRA automobile benefits: Standby charge and operating expense benefits.

CRA automobile benefits can be tricky. Learn which mistakes the CRA flags most often and how to report them correctly.

CRA watchlist: taxable benefit mistakes you can’t afford to make.

Avoid costly CRA penalties. Learn the common taxable benefit mistakes Canadian employers make with vehicles, allowances, and social events.