Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

While ADP Payroll is one of the better-known options for payroll services, we’re here to guide you through the best Canadian ADP Payroll alternatives on the market and why people look for alternatives in the first place. You’re a busy business owner, and you need the best possible fit in payroll software.

Let’s dive into the juicy details on their key features, advantages and disadvantages. You’re sure to find the best payroll software that aligns with your needs.

Here’s a quick glance at the ADP Payroll alternatives we’ll be exploring later:

- Wagepoint

- Knit

- Rippling

- Sage Payroll

- Dayforce

- QuickBooks Payroll

- Wave

- Payworks

Why businesses look for ADP Payroll alternatives.

A key part of the payroll process is making sure employees receive their money on time, accurately, and with no delays. ADP Payroll has some stand-out features, but it isn’t the right fit for everyone. Here are a few key reasons businesses have explored other options:

1. Pricing

“ADP Payroll pricing was NOT transparent. We never knew exactly what we were going to pay.”

While this reviewer had strong feelings on the matter, it’s something others have mentioned, too. Similar issues include unfavourable pricing tiers for smaller businesses (common with enterprise-focused products) and the lack of a free trial.

2. Customer service

Hiccups are inevitable in any customer service experience. However, ADP Payroll does attract some customer service complaints in both speed and knowledge, with one reviewer mentioning that “it takes days to get a reply,” and another suggesting that the “products/support teams do not work together well.” Onboarding issues are also mentioned, with one client noting, “The implementation process could be better.”

@ADP your service today has been totally unacceptable and unsatisfactory! I’ve been in Human Resources over 20 years and have never experienced such horrible customer service!

— Marcus G. Morton (@marcusgmorton) July 5, 2024

3. Ease of use

ADP Payroll provides a wealth of tools, modules, and customization perfect for those who need all the features. However, this isn’t right for everyone, as with this reviewer:

“There are also a number of features and views that are not utilized by our company so the robustness of the software is lost.”

Running reports can occasionally be clunky, with one user noting that “reports can be hard to create.”

Others would like more warning before implementing updates, stating, “I would like it if better communication was sent out about new product updates.”

If ADP Payroll doesn’t sound like a good match for you, then these trusted and reliable ADP alternatives with similar options might be what you’re looking for.

Top ADP Payroll alternatives.

1. Wagepoint

Wagepoint addresses the pain points and specific needs of small business payroll, offering an easy and intuitive payroll product that’s ready to hit the ground running. As your business grows, you can add the Time and People products to your core payroll to build a simple, yet infinitely effective, basic HR and payroll suite that fits your needs. Additionally, you don’t have to run a specific accounting package to use Wagepoint. Sounds great, right?

Key features

Canadian focus (with easy payroll tax built-In)

Wagepoint was built for the Canadian market, including automatic payroll tax calculations and tax filings (like your annual T4s, T4As and RL1s). Even your regular remittances are calculated and can be filed from directly within the program, so there’s no need to go to the Canada Revenue Agency portal to take care of that reporting.

Ease of use

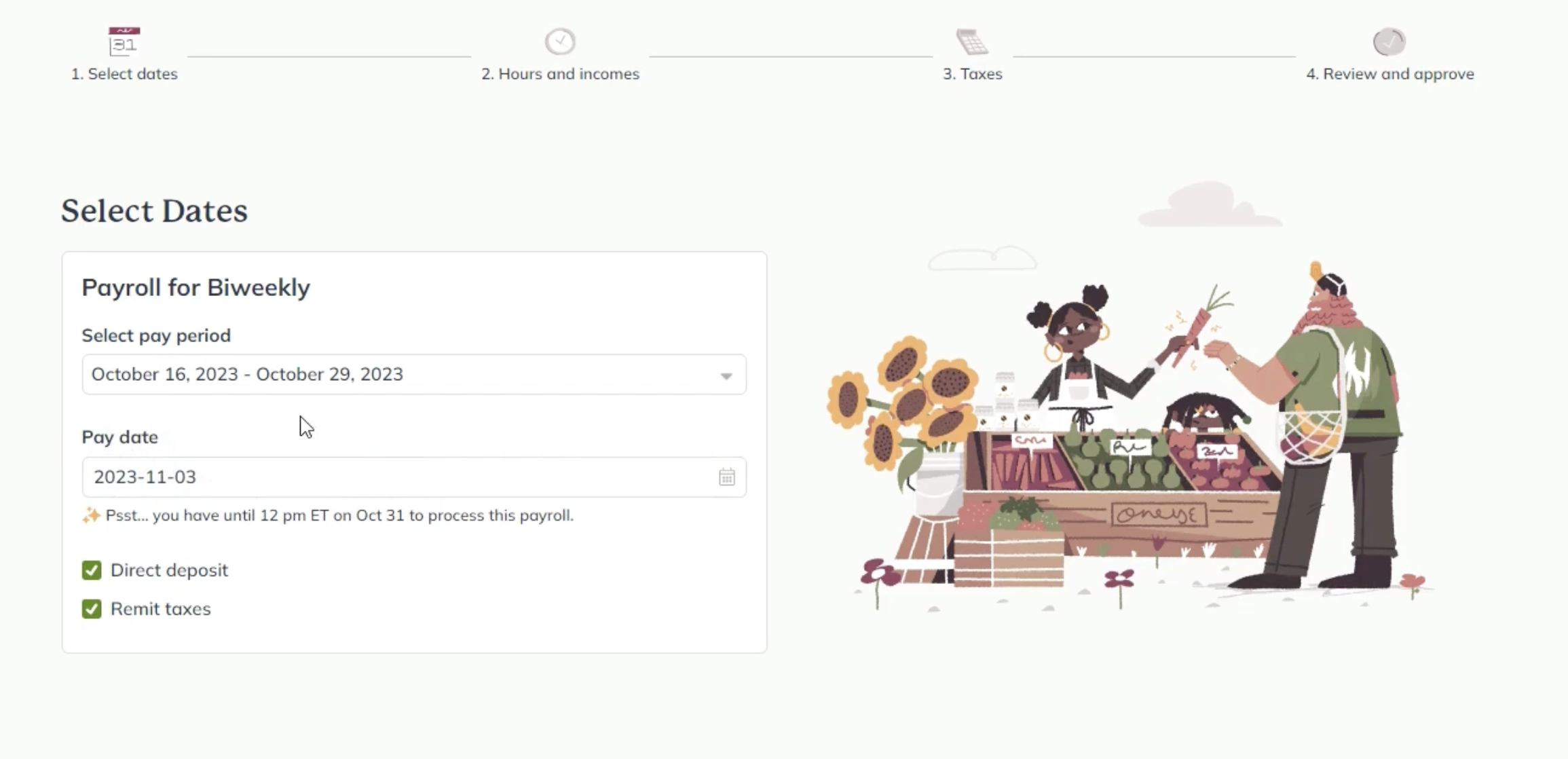

Here are just a few of the ways Wagepoint makes payroll life easy:

- Four-step payroll processing that can be completed in minutes

- Direct deposit to pay employees and independent contractors, even to multiple accounts at no extra charge

- Make adjustments without having to get in touch with support. (See adjustments in action!)

- Once-a-month or unlimited pay runs (pick the plan you need!)

- Customization from income to deductions to reporting views to structure payroll your way

Extra security

Wagepoint is built with top-tier encryption for payroll data security, using banking standards to protect your personal information and keep employee data safe. Using Wagepoint, you’re backed by:

- Multi-factor authentication

- 2048-bit encryption using TLS 1.3 or 1.2

- Industry- and bank-grade processes

- A support team that’s regularly trained on best practices to protect data on all fronts

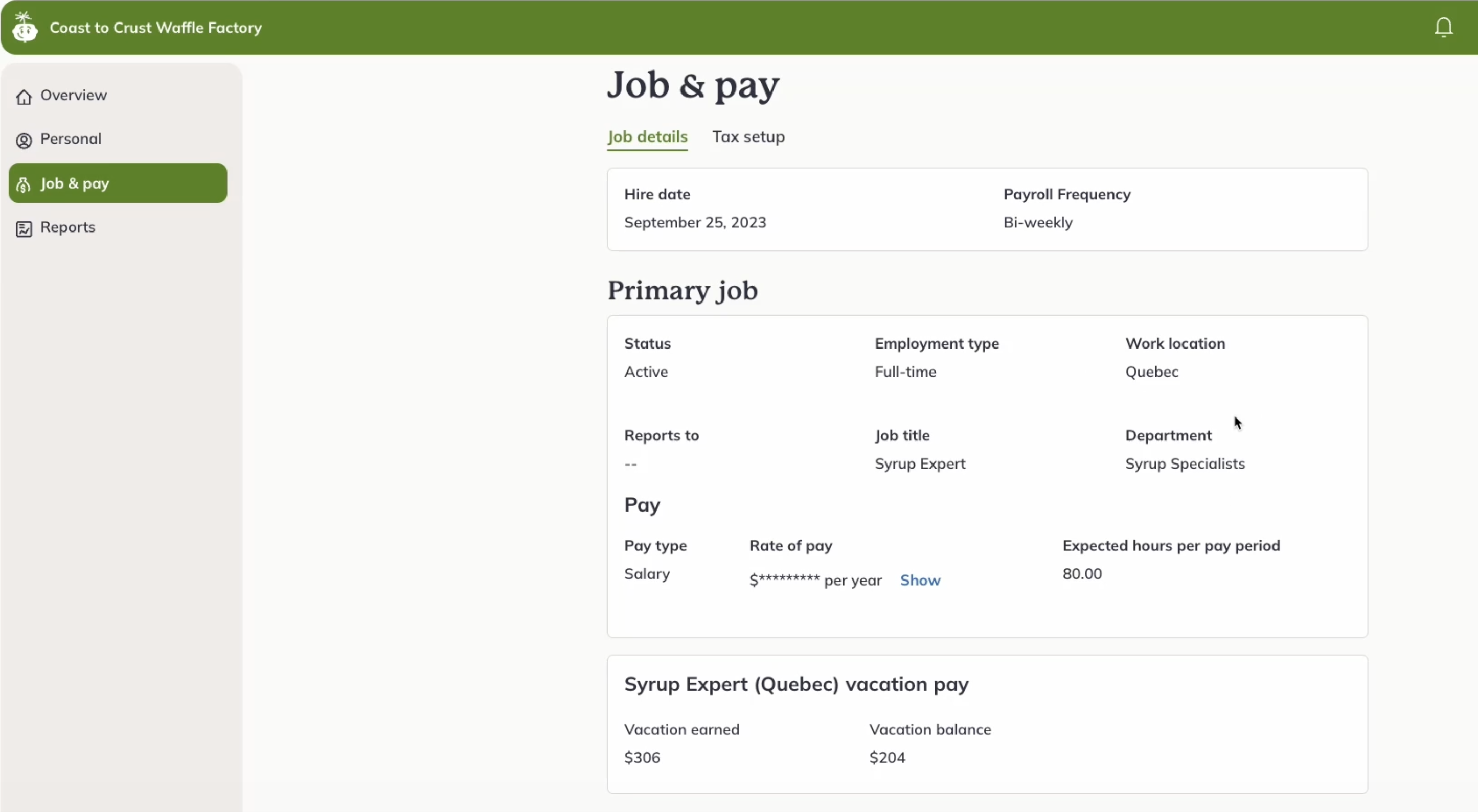

Self-service portal

Employees have easy access to their pay stubs and year-end forms, to see their job breakdown and even update their own information if you’ve toggled it for them. Even better news: They can log in via web browser or on their mobile device to get the info they need.

Not to mention that your payroll admin employees will be able to easily switch their account view from the employee portal to process payroll without having to log out and back in.

Integrations

Integrate with QuickBooks Online to seamlessly manage both payroll and your small business books. Plus, Wagepoint also integrates with Time by Wagepoint for employee time tracking, including PTO, scheduling and geofencing. In other words, no more manual data entry from one software to another!

Transparent pricing

No hidden costs or fees, regardless of which plan you pick. Whether you’re going with the Solo or Unlimited option, the features are laid out crystal clear on the pricing page. Plus, there’s a pricing calculator right on the page, so you can see how much you’ll pay before you commit.

Pros

- Easy to navigate and very intuitive

- In-built scalability and expansion

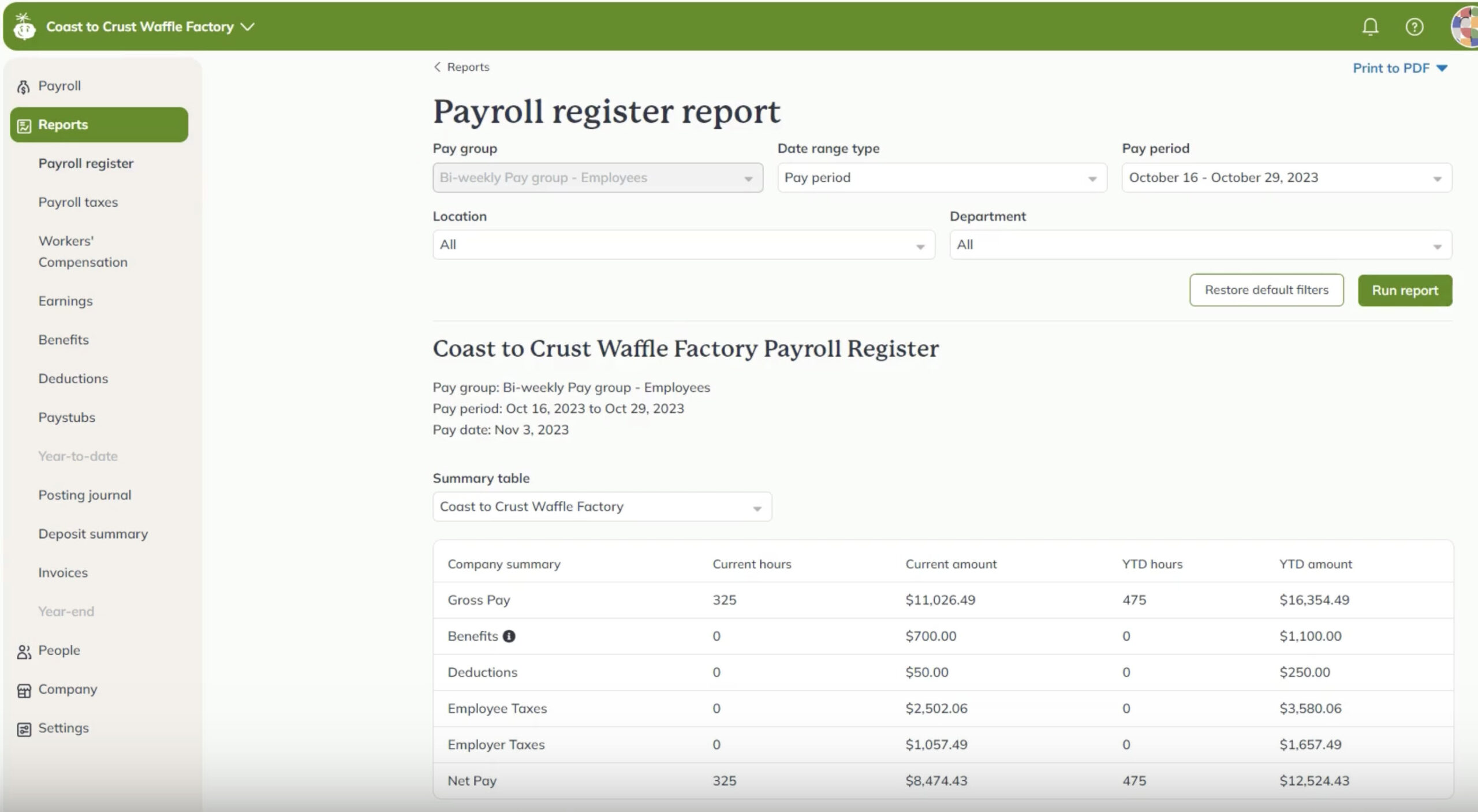

- Strong, but simple-to-use, reporting options

- Cloud-based, standalone payroll

- Free 14-day trial on offer

- Same-day customer service with a great reputation

Cons

- The core of Wagepoint lies in simplicity and accessibility for small businesses. However, larger businesses may want additional features

- Limited HR capabilities on the base package, but the People expansion addresses that

Pricing

Wagepoint Solo is $20 a month plus $4 per employee or contractor

Wagepoint Unlimited is $40 plus $6 per employee or contractor

Who Wagepoint is best for

Wagepoint is ideal for small and micro businesses looking for a secure and robust payroll management solution that’s easy to use but with strong functionality.

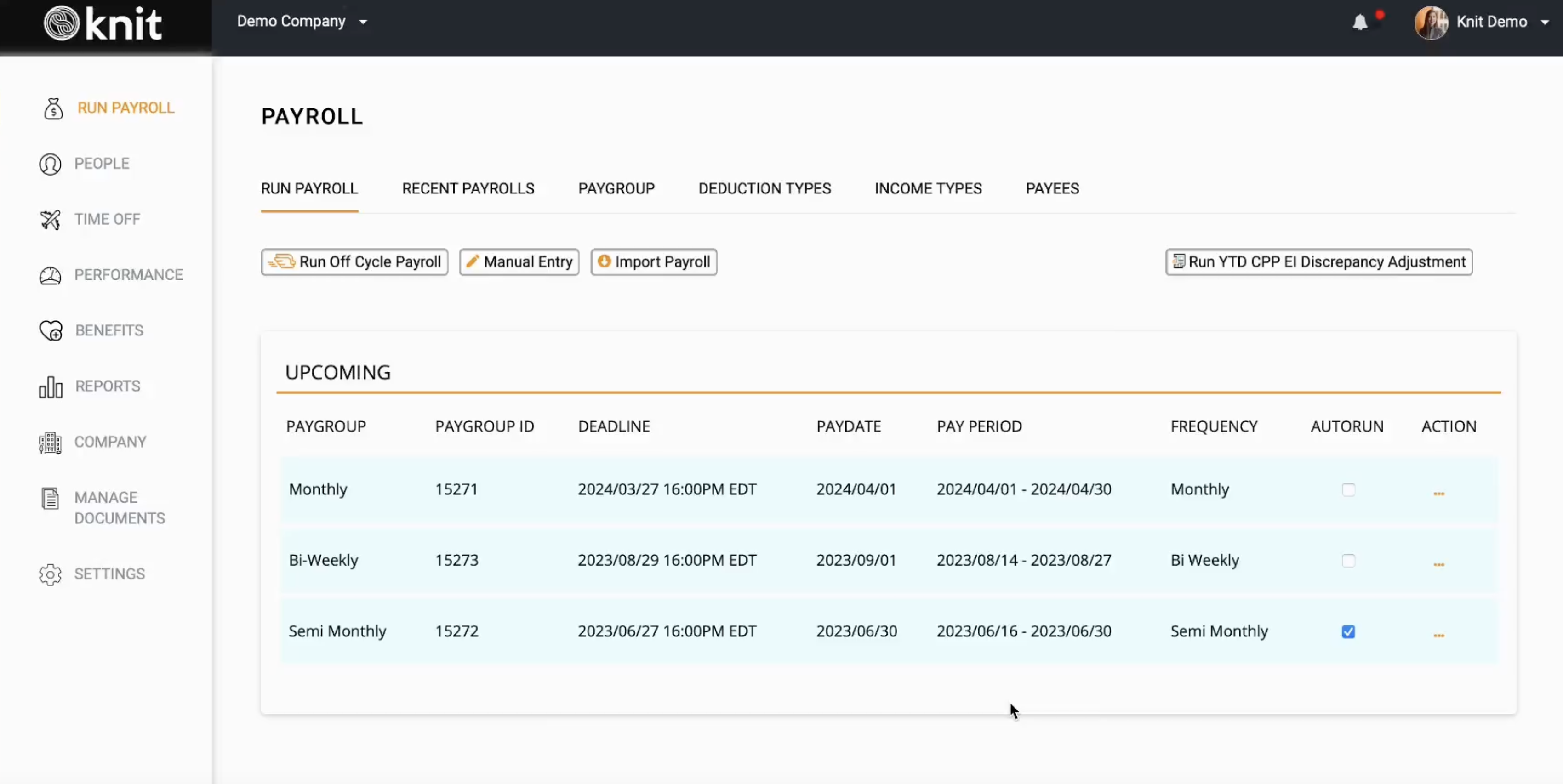

2. Knit

Knit is a Canadian-centric payroll and HR solution. It’s making a name for itself by offering tools from the onboarding to the off-boarding employee cycles

Image: Knit

Key features

Employee self-management

Knit lets new hires self-onboard and upload all their details so a payroll admin doesn’t have to. They also have an employee-friendly self-service portal that lets employees access their pay info and other documents without needing someone to do it for them.

Basic HR solution

With a generally user-friendly interface (once you are used to it), Knit offers payroll services, compliance tools and employee self-service capabilities, with software designed for local taxes and regulations. There is one reviewer, however, that feels Knit’s default is too geared toward Ontario legislation and that it’s a bit challenging to set up for other provinces.

Global payroll

If you’re looking for payroll processing that spans across borders, Knit is an Employer of Record that facilitates easy payments to foreign employees or for other foreign transactions.

Pros

- Simpler interface

- Compliance with Canadian tax regulations

- Free trial

- Additional HR features

Cons

Pricing

Knit Lite is $40 per month, with $6 per employee

Complete is $50 plus $8 per employee

Concierge can be tailored to fit your business needs, so you’ll need to contact Knit.

Who is it best suited for?

Knit is aimed at small businesses, offering a straightforward package that is focused on payroll processes for the Canadian market and includes basic HR tasks.

3. Rippling

Best characterized as a workforce management platform, Rippling brings HR management, payroll, expense tracking and basic financial management together. It also offers an applicant tracking system for new employees.

Image: Rippling

Key features

Manage your workforce

Rippling offers a full-service HR platform, including comprehensive employee benefits. This makes it ideal for larger businesses looking for a one-platform HR, time tracking and payroll solution. More specifically, gives a wide scope of your workers via onboarding, learning management, payroll processing, performance management and other such tools.

Software integrations

Rippling integrates with common third-party software you may already use, including Zendesk, GitHub and Google Workspace for an easy user experience managing them all without having to switch back and forth between various platforms.

Remote team management

If your team is united by their expertise, not their physical location, then the remote team management Rippling offers will make for an easier experience for you all. With features like employee surveys, you’ll know how your employees see you and your company even without having a face-to-face sit-down with them.

Pros

- Easy set up

- Compliance with Canadian tax regulations

- Mobile app offered

- Robust HR solution

Cons

- While it has many features, the lack of focus or specialization can result in issues

- Some issues contacting support for time-sensitive matters like payroll processing or billing issues

Pricing

Rippling quotes on a company-by-company basis.

Who is it best suited for?

Ideal for medium to larger businesses looking for an integrated workforce management platform alongside payroll software.

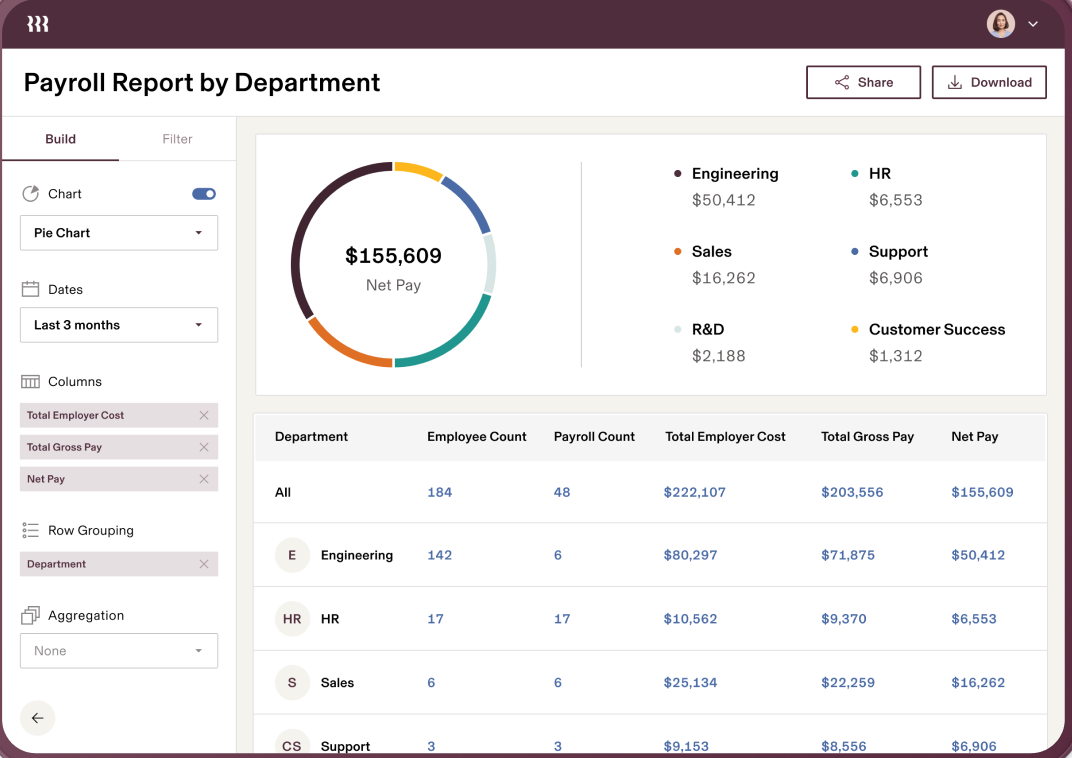

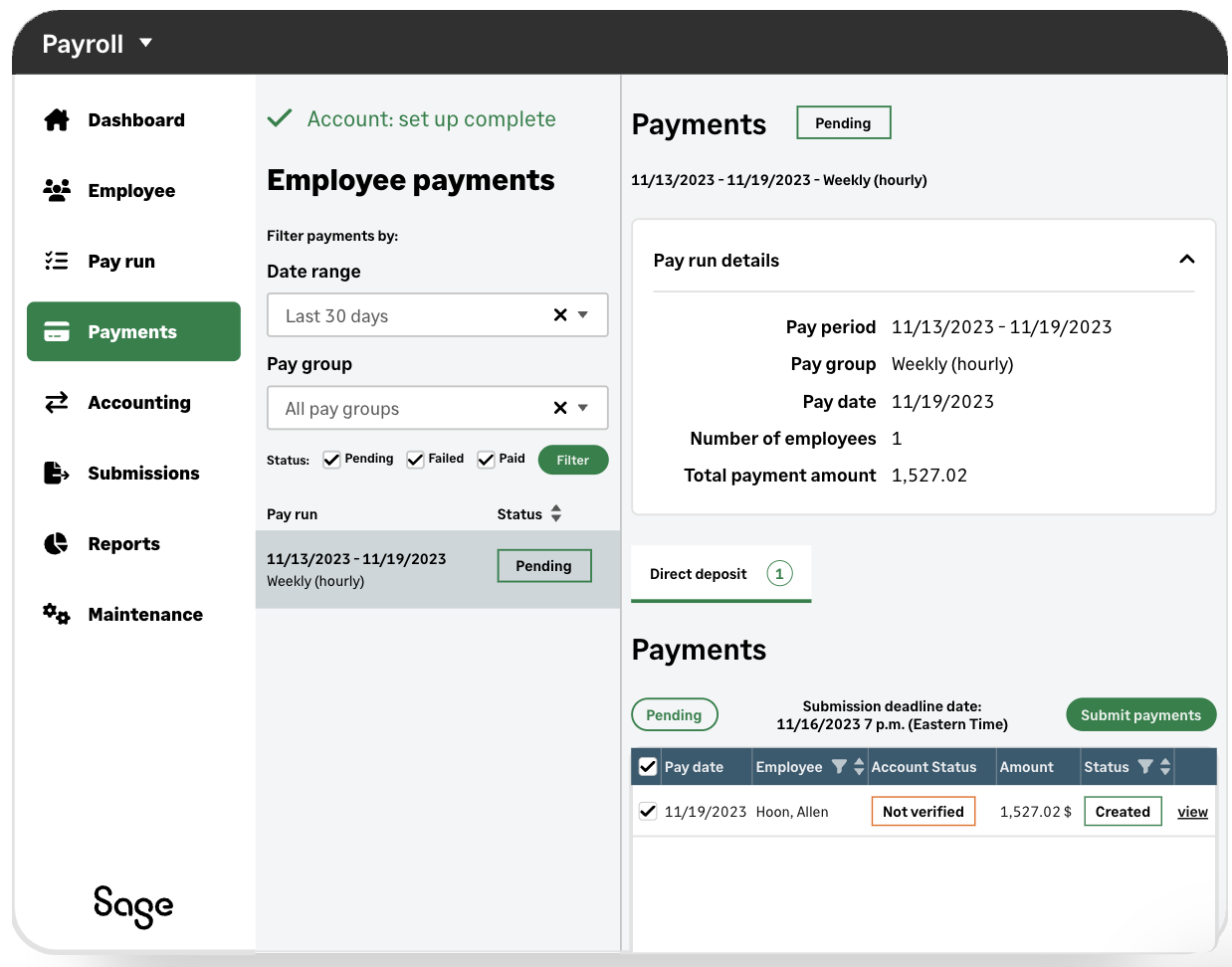

4. Sage Payroll

Sage Payroll stems from a service provider that is best known for its accounting packages. You can add up to 20 new users, and localized tax data and calculation is built in. It also integrates easily with existing Sage accounting software and offers fast, accurate reporting.

Image: Sage

Key features

Payroll reports

Sage has reports to cover a detailed breakdown or summary of your payroll, a journal report or a view of your remittance information. For year-end, the software also generates XML files so you can hop over the CRA website and submit them.

Easy payment and processing

Processing payroll takes only a few steps, and you’ll have a breakdown of the pay run and total cost, including taxes, deductions and other expenses. Once your banking is set up, Sage withdraws the payroll amount from your bank account for direct deposit directly into your employees accounts come payday.

Self-service portal

Sage Payroll comes with a mobile app for the employee portal that lets your team see detailed breakdowns of their paystubs and gives them access to their tax forms as well.

Pros

- Integration with Sage accounting

- Cloud synching allows real-time remote access with ease and cloud backups

- Drag and drop report designer

- Basic HR options

- User-friendly interface

- The modular system is customizable and scalable at an extra cost

Cons

- It is an add-on to the wider Sage ecosystem, and may not suit those not already using Sage

- It can be a bit clunky to navigate and isn’t always intuitive when it comes to making changes

Pricing

2-month free trial

Payroll Essentials: $20 CAD per month + $3 CAD per employee per month

Payroll Standard: $20 CAD per month + $10.50 CAD per employee per month

Payroll Premium: $20 CAD per month + $16.50 CAD per employee per month

Who is it best suited for?

Sage Payroll is the right solution for small and medium businesses looking for easy integration with Sage accounting products and added payroll services with some HR functionality.

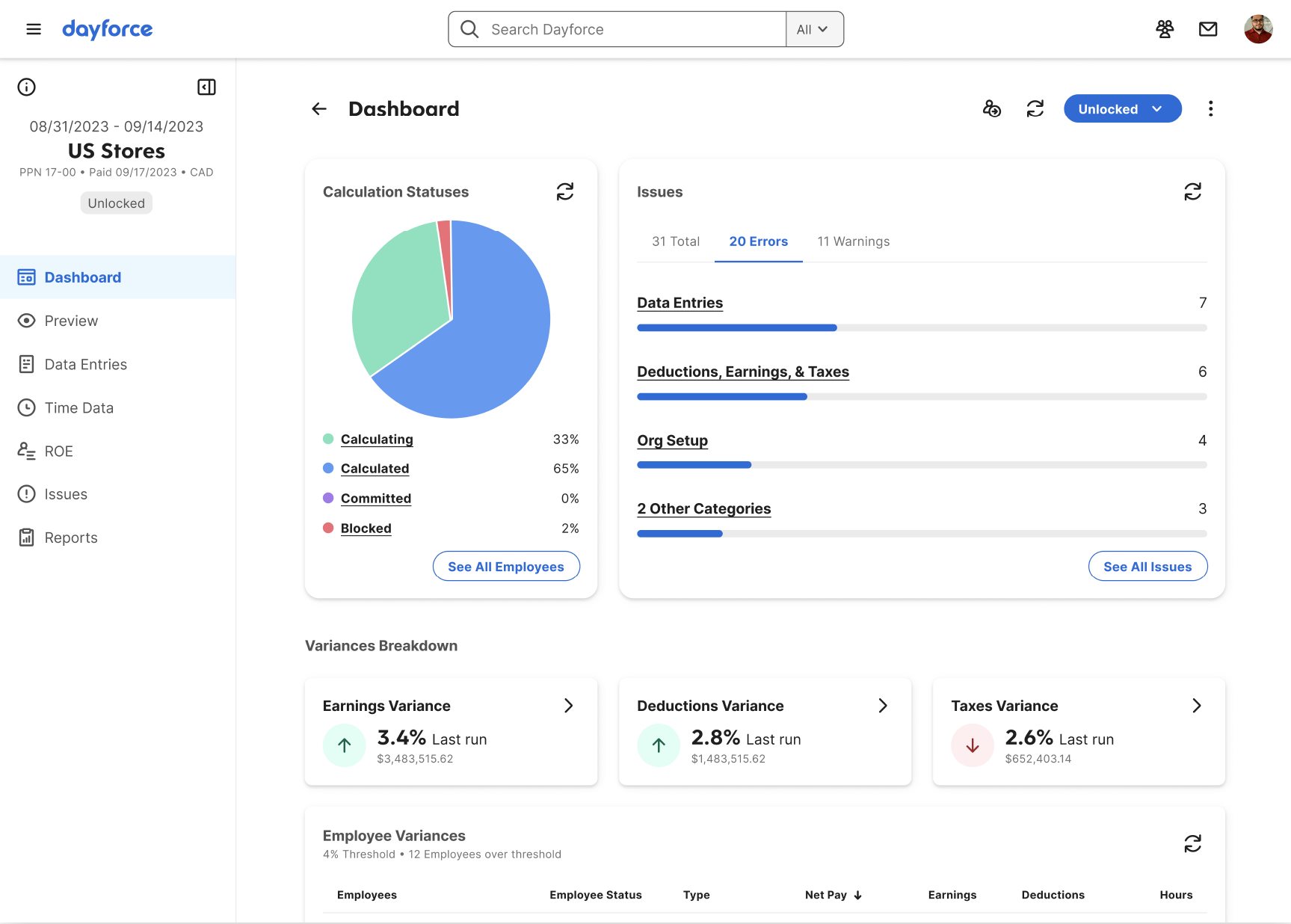

5. Dayforce

Dayforce offers service across more than 160 countries and is a viable international payroll platform for companies working over borders.

Image: Dayforce

Key features

Comprehensive HR management

Ceridian Dayforce offers a wealth of HCM (human capital management) tools for a smooth employee experience. Easily onboard new hires and provide the HR experience that’ll make employees stick around. Apart from getting your employees paid on time with the payroll features, you can build schedules that work for your employees, provide them with financial and mental wellness tools and give them an overall engaging experience.

Automated payroll calculations

Dayforce takes on automated calculations with continuous calculations that keep the numbers accurate in real time as time is captured. This feature reduces having to go back and make changes to time entries before running payroll.

Mobile app

Need to access your payroll and employee documents when you’re away from your desk? A handy mobile app will help you take your work with you wherever you go. Your employees also have access to a mobile app with the Dayforce Wallet app that breaks down their net earnings, deductions and contributions at a glance.

Pros

- A one-stop employee managementplatform

- Benefit management

- Time tracking features

Cons

- May run into snags during the setup process

- The array of features can be overwhelming for some users

Pricing

Contact sales to get a quote.

Who is it best suited for?

Dayforce offers enterprise-level people management and payroll ideal for customers with an international footprint where payroll crosses borders.

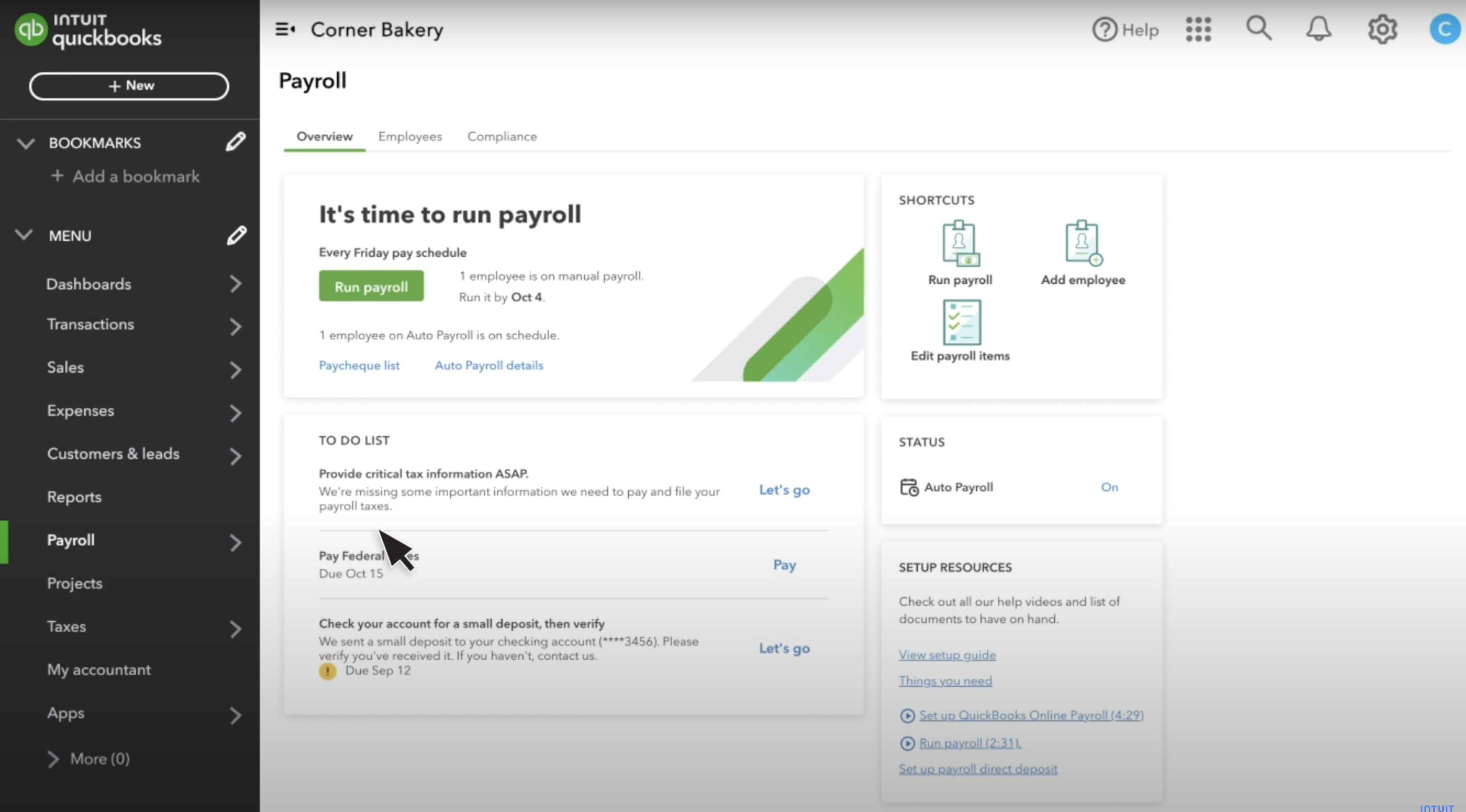

6. QuickBooks Payroll

Another payroll software that sprung from accounting origins, QuickBooks Payroll offers both desktop and online versions. You can choose from a variety of pricing tiers, depending on how many extras you need and the platform you pick.

Image: QuickBooks

Key features

Desktop and cloud versions

Many are familiar with QuickBooks Desktop, but there’s been a big push for the cloud-based QuickBooks Online over the past many years. The features do vary a bit between them, but one thing that is the same is QuickBooks Payroll is an integrated add-on for each one. In other words, QuickBooks Payroll isn’t a standalone product.

Time-tracking and basic HR features

On the higher price tiers, you can track employees’ time, too. Since it’s part of the QuickBooks accounting program, it can automatically share time-tracking information for reporting and job-costing so you don’t have to bounce back and forth between windows or tabs.

Basic to advanced payroll

When looking at QuickBooks Online in particular, employee direct deposit and unlimited payroll runs are just the start of the features you have access to. You also have remittance filing to take care of your payroll taxes and other features that might seem more complex, but users say that setup and using the product is still easy.

Pros

- Seamless integration with QuickBooks accounting

- Automatic tax filing

- Robust reporting

- Basic HRtools

Cons

- Time tracking and other features tied to higher tiers

- Easy setup leaves room for error if you don’t have payroll knowledge

- QuickBooks accounting is needed

Pricing (QuickBooks Online Payroll)

Payroll Core is $25 a month plus $4 per employee

Payroll Premium is $55 a month plus $8 per employee

Payroll Elite is $80 a month plus $15 per employee

Who is it best suited for?

QuickBooks Payroll is an excellent choice for medium and large businesses looking for simple payroll handling and already using the QuickBooks accounting package.

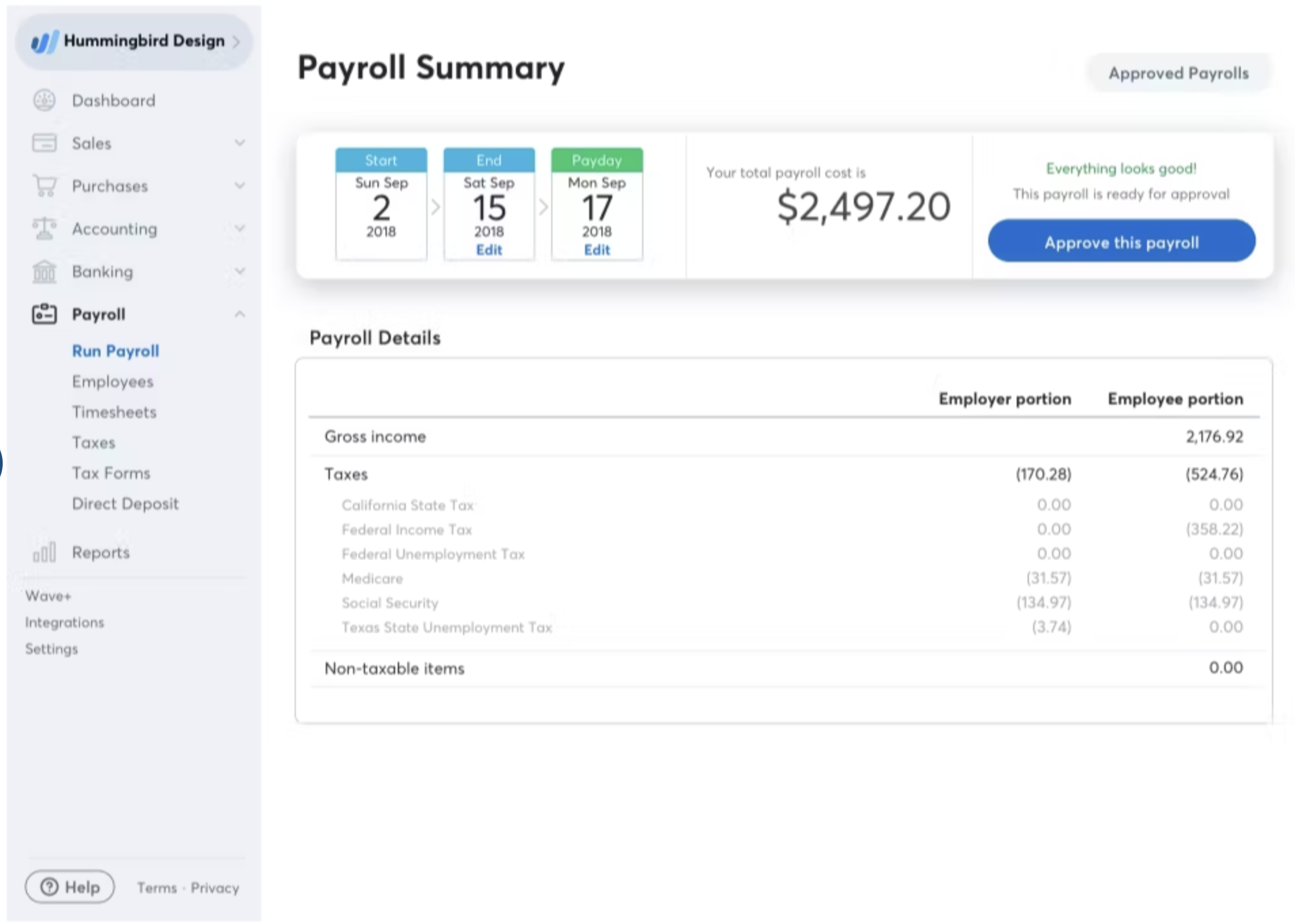

7. Wave

Wave has been creating buzz with its free accounting software that comes with a paid payroll add-on. This program is all about the basics for accounting, payroll and payment processing.

Image: Capterra

Key features

Simplified payroll management

Make direct deposits for seamless payment, use automatic tax calculation and filing to speed up remittance processing, easily differentiate employees and contractors and generally make handling payroll easier on your admin team. You can even pay yourself as the employer right from within Wave Payroll.

Up-to-date payroll data in your books

Because Wave Payroll is an integrated part of the Wave accounting system, payroll data automatically populates with the rest of your reporting. This can be useful not only for keeping everything in one place, but also for keeping track of and making decisions on things like labour costs, talent acquisition and more.

Employee self-service portal

Wave’s online employee self-service portal gives employees a place to see their pay stubs, tax forms and vacation balances. They can also update their banking and contact information themselves so that you don’t have to.

Pros

- Simple and intuitive to use

- Free trial offered

- Employee portal and time tracking

- Easy tax handling

Cons

- Not available for Québec payroll

- Customer support is difficult to connect with

Pricing

Wave Payroll is $25 per month plus $6 per employee and contractor

Who is it best suited for?

Wave is a great payroll solution for small businesses looking for simple, straightforward payroll software with a user-friendly interface and tax filing support.

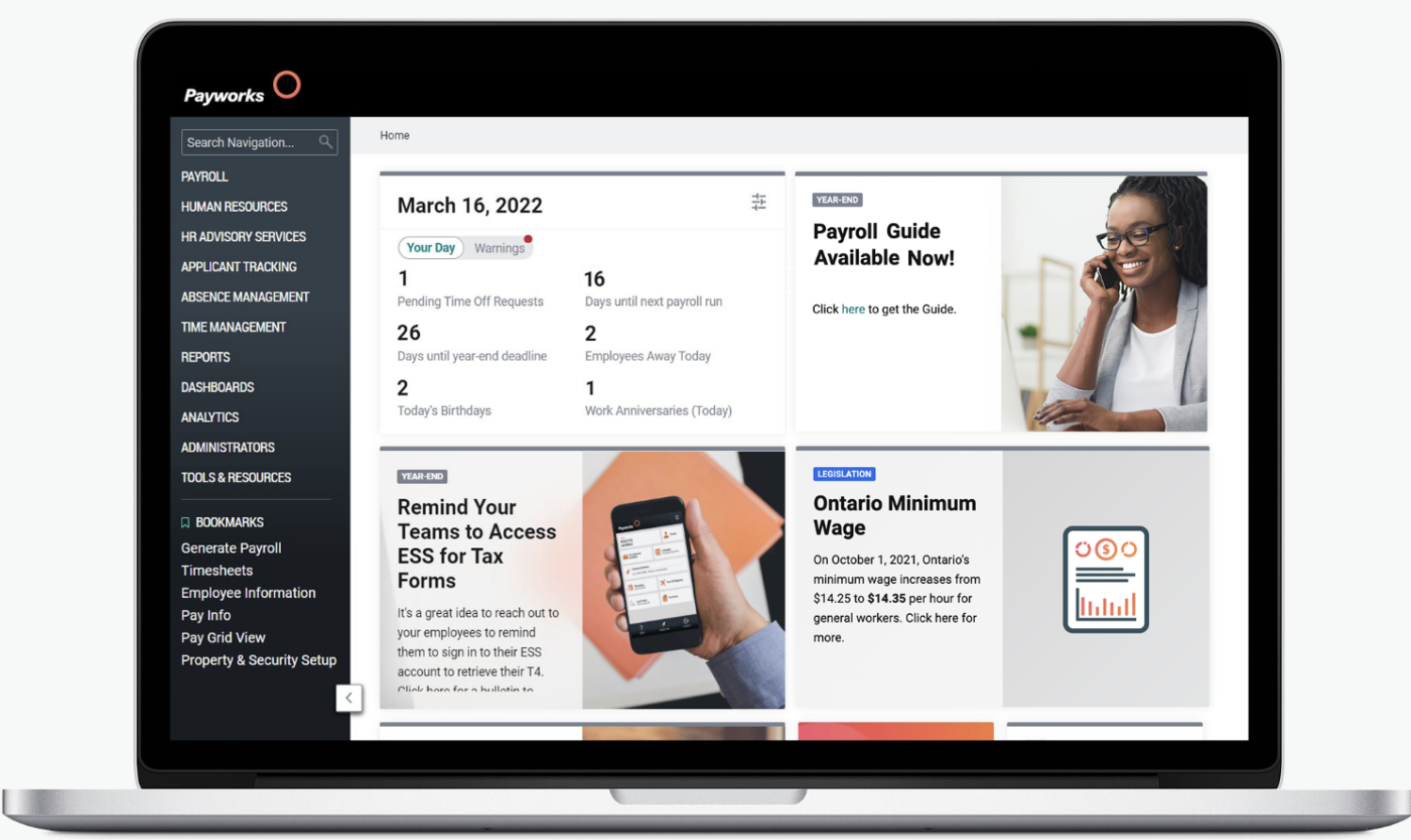

8. Payworks

Image: Payworks

Payworks offers a cloud-based payroll solution, with attendance tracking and HR-focused employee management tools. Their system is simple to use, and Payworks has been serving the Canadian market since 1967.

Key features

Simple interface

Many Payworks reviewers applaud Payworks’ straightforward and simple interface with no hidden menus and everything right before your eyes. This user lists it as a pro in their review, and yet also notes that the interface is a bit dated, which can make it a bit challenging to bring things back up.

In-product updates to enhance compliance

Payworks’ system automatically updates to keep up with the latest legislative changes. Likewise, the software has homepage reminders for remittance filing and a stat pay calculator so you don’t have to worry about crunching the numbers.

Build a business management solution

Payworks isn’t just about payroll. You can also take advantage of their human resource hub, time management features and even leave management. Adding these features gives you a single platform option for tackling all things employees instead of having to switch between platforms.

Pros

- Payroll and HR in one

- Simplified tax process

- Custom reports

- Strong customer service

Cons

- Because of the multi-feature approach, it can feel like a jack of all trades platform without focus

- It’s simple interface can be buggy

Pricing

Use their online calculator or contact their team to get a quote.

Who is it best suited for?

Payworks is a solid choice for small and medium businesses looking for a time-tested and reliable single-platform cloud-based payroll solution.

Other popular payroll choices.

While these aren’t Canadian-focused companies, you may also be familiar with these leading ADP Payroll alternatives. Here’s a quick look at what you need to know about these companies.

1. Paychex Flex

Paychex is a US-focused platform that offers payroll basics alongside some more advanced human resource options. They have a small business package but can also serve midsize to enterprise businesses.

Key features

- Comprehensive payroll reports

- Direct deposit and pay cards

- Accounting integration

- Benefits administration and HRtools

- Cloud-based

Pros

- 24/7 customer support

- Benefit and off-cycle payments

- Automated payrolltax filing and payments

- Leave, asset and employee management, and attendance features

Cons

- Dated appearance that impacts user experience

- Customer support difficult to reach

- The pricing may be steep for what you get

Pricing

Paychex Essentials is $39 per month plus $5 per employee

Paychex Select and Pro require you to get in touch to get a quote

Who is it best suited for?

Paychex is a good payroll software solution for smaller companies looking to scale up over time, or for established large businesses.

2. TriNet Zenefits

TriNet Zenefits is best thought of as a full-service HR software with added payroll functionality serving the US market.

Key features

- Robust HR tool

- Employee lifecycle management

- Hourly workers included

- Unlimited pay runs

- Feature-rich

Pros

- Strong HR modules in a simple package

- Easy employee onboarding

- Onboard and pay independent contractors

- Automation helps with efficiency and organization

- Great for those looking to manage benefits, time off, payroll and more in one place

Cons

- Payroll is secondary to the in-one HR platform and cannot be used as a standalone

- Users report slow loading times and glitches from time to time

Pricing

TriNet Zenefits Zen (the tier that includes payroll) is $33 per employee per month

Who is it best suited for?

TriNet Zenefits is a great choice for small and medium businesses with complex HR needs looking for an easy payroll add-on.

3. Papaya Global

Papaya Global is a workforce management platform with simplified payroll features and a strong international presence. It’s more geared toward the global market but does serve some Canadian provinces.

Key features

- International and cross-border focus

- Contactor-only plan

- Automation tools

- AI-led SaaS platform

Pros

- Extra payroll runs

- Easy cross-border payments

- Works for both employees or contractors

- Option to be an Employer of Record

- Fully customizable approval chains

Cons

- Pricing is high and there may be some hidden fees

- Long initial setup

- Limited global locations

Pricing

Full-Service Payroll is $12 per month per employee

Payroll Platform License is $3 per month per employee

Employer of Record fee is $650 per month per employee

Who is it best suited for?

Papaya Global is a good option for businesses of all sizes with an international footprint. It comes with a variety of subscription options to make sure you have what you need.

4. Square Payroll

Square Payroll aims to blend payroll with managing the employee experience, offering basic HR functionality. While Square is making its mark in Canada, their payroll option isn’t available here yet.

Key features

- Tax filing

- Time tracking

- Benefits administration

- Import tips and commissions

- Integration with Square products and third parties

Pros

- Mobile app offered

- Work with employees and indepedent contractors

- Free migration from other payroll programs

- Unlimited pay runs

- Process payroll in a few steps

Cons

- Customer service difficult to work with

- No free trial

Pricing

The employees and contractors plan is $35 per month plus $6 per person paid

The contractor only plan is $6 per person paid

Who is it best suited for?

Square Payroll is well suited to businesses in any industry that rely on hourly payments and pay structures.

5. Gusto

Gusto is another good choice if you focus on performance management and HR tasks while producing an accurate, simple payroll. It’s easy to use, with strong essential features for payroll. It’s primarily focused on the US market but does have some international capabilities.

Key features

- Automated tax payments

- Benefits administration and robust HR features

- Handles employees and contractors

- A wealth of employee-focused extras

Pros

- Unlimited pay runs

- Ease of use

- Extensive integrations

- Create and e-sign reports and HR documents

- State tax registration in all 50 states

Cons

- Mobile app is buggy

- Slow response times from support teams

Pricing

Gusto Simple is $40 per month plus $6 per employee

Gusto Plus is $80 per month plus $12 per employee

Gusto Premium has exclusive pricing that requires you to contact sales

Who is it best suited for?

Gusto is a solid option for small business owners looking for strong HR tools with added payroll functionality.

The bottom line on top ADP Payroll alternatives.

There’s a wealth of ADP competitors out there with similar features, offering versatility, flexibility and scalability through intuitive and easy-to-use packages. With the right payroll software, you’ll see a real difference and your payroll nightmares will turn into sweet dreams instead. It’s time to run payroll!

Try Wagepoint free

If you’re looking to try out the simplest, most small business-focused payroll software on our list for free, make Wagepoint your top choice! Here at Wagepoint, we know how important it is to find the perfect payroll match, with all the features you need and nothing you don’t.

Start your 14-day free trial of Wagepoint today. Obligation-free and at no cost to you! It’s the perfect chance to put Wagepoint through its paces your way.