Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Payroll is a tall order for businesses of all sizes, but especially small business owners.

The payroll process is complex. It’s filled with time-consuming tasks, lots of legislation and rules, remittances to the Canada Revenue Agency (CRA) — all on top of running your business.

To help simplify the payroll process, there are a variety of software offerings available to assist small businesses in ensuring their employees receive their pay cheques.

Best payroll companies in Canada: The shortlist

- Wagepoint: Built for small businesses and provides the payroll features you need without paying extra.

- Payment Evolution: Payroll for individuals, small businesses, and beyond.

- Humi: Small business payroll, HR, time tracking, and more, all in one platform.

- Knit: Small and medium-size business payroll, HR, and vendor payments.

- Wave Payroll: Small business payroll add-on to Wave’s accounting software.

How payroll companies benefit small business owners.

Payroll technology and automation leads to increased efficiency and a host of other benefits every step of the way. Including:

- Lower compliance risks: Payroll providers are very familiar with the Canada labour standard regulations and keep their software up-to-date, which reduces the risk of non-compliance. Automating payroll also minimizes errors, increasing data accuracy and confidence that your numbers are right.

- Time savings: Using payroll software saves time spent on calculating pay, preparing cheques, generating reports, handling taxes, and other payroll tasks. It can even help save time in the human resources department with better data organization and distribution of forms like Records of Employment and year-end documents.

- Ability to scale: Most payroll companies offer custom services designed to suit your unique business’s needs, allowing you to scale affordably as you grow.

- Accurate reporting: Many payroll software solutions integrate with other HR software, making it easier to track employee information accurate reporting.

Best payroll companies in Canada.

With the benefits of a payroll company in mind, you have the tools to find the best fit for your business.

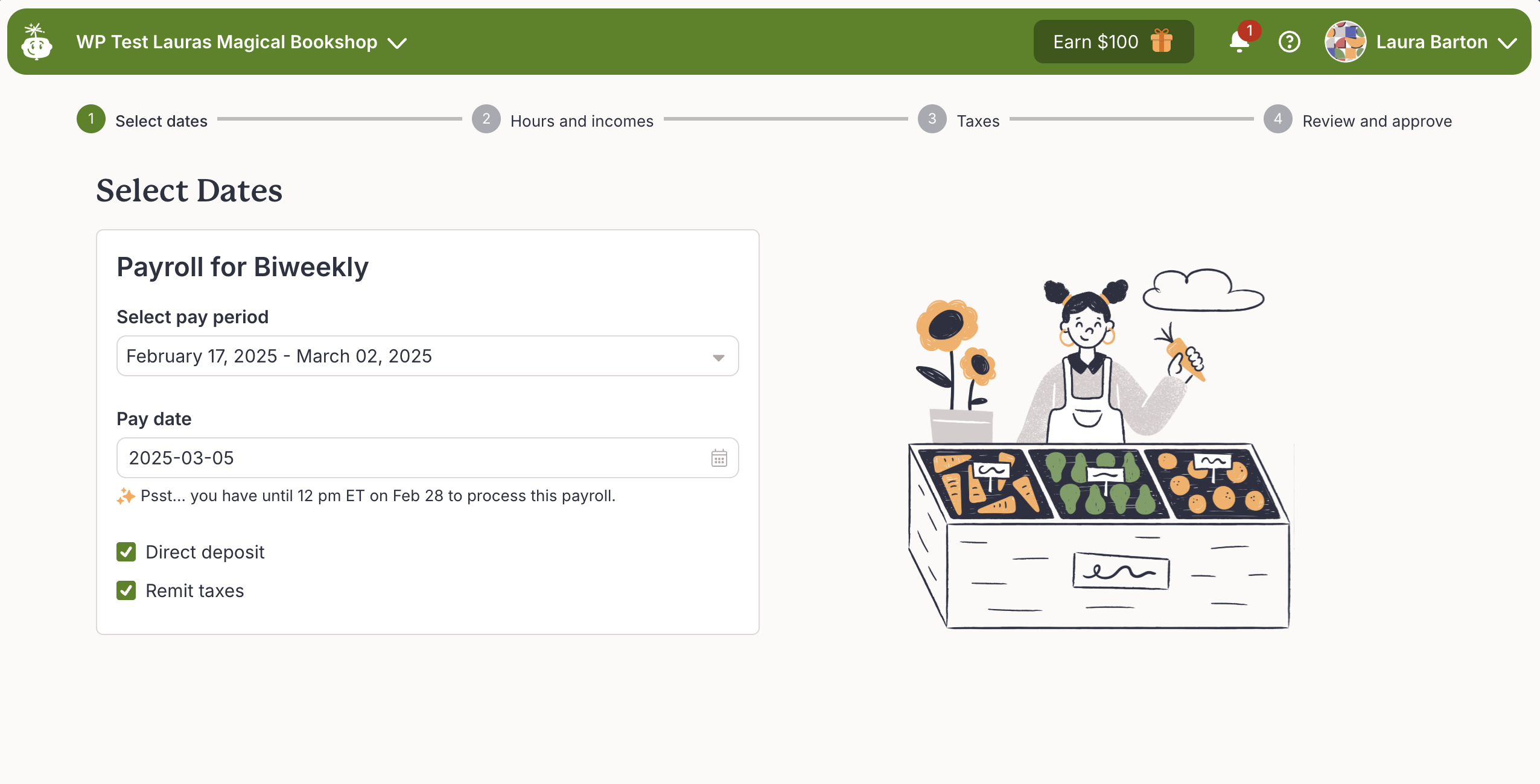

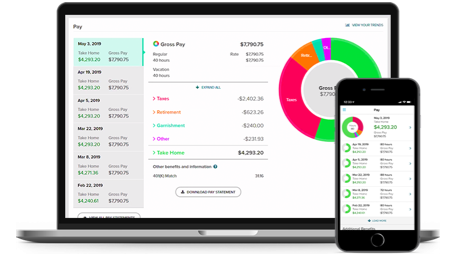

1. Wagepoint

Wagepoint is a standalone payroll software built for small businesses in Canada — you could say it’s in our DN-Eh. This online solution simplifies payroll processing while being backed by the world’s friendliest North American customer support team and payroll experts.

It’s covers all the essentials, including:

- Direct deposit for employees and contractors

- Bonus: Deposit to multiple bank accounts at no extra charge!

- An employee self-service portal

- Automated payroll calculations

- Payroll tax remittances and payments

- Year-end forms

Plus these other core features (AKA, you don’t pay anything extra)

Adjustment capabilities

Made a mistake in finalizing a pay run? No need to panic, or contact support. With Wagepoint’s adjustment tool, you can make corrections yourself and move on with confidence.

You can adjust the most recent finalized pay period and update year-to-date values on reports for your latest runs. As part of this process, you’ll also get access to two reports:

- One showing only the adjusted amounts

- One showing the original report while highlighting adjustments made

Plus, you can track who made the adjustments so everyone is on the same page.

See a pay period adjustment in action.

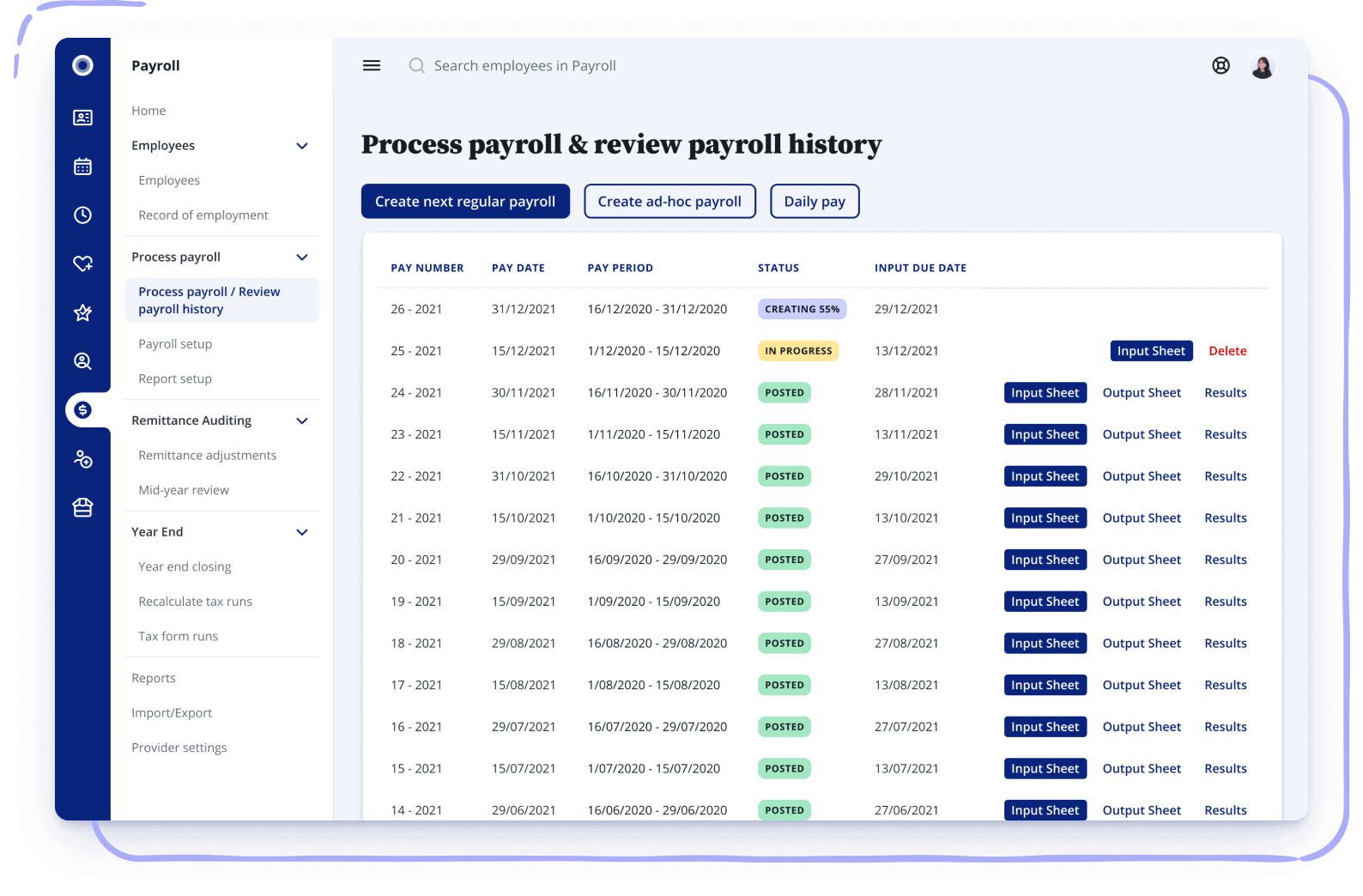

Real-time reporting and customization

Most reports are generated as soon as you approve payroll, and others are generated as soon as Wagepoint processes the payroll and debits your company bank account.

Not only are there a variety of reports available, but you’re able to customize them to see the information you need without combing through every single number. Reports available include:

- Payroll Register Report: Gross-to-net by employee(s) or contractor(s) and cost centres.

- Payroll Taxes Report: Remittances by tax type and tax agency by payroll.

- Workers’ Compensation Report: WSIB/WCB calculations by province for each employee.

- Earnings Report: By employees/contractors per payroll.

- Benefits Report: Employer contributions toward benefits by employee per payroll.

- Deductions Report: Deduction payments withheld by employee per payroll.

- Paystubs Report: Gross-to-net pay by employee.

- Posting Journal Report: Payroll expenses and liabilities by payroll.

- Deposit Summary Report: Recap of net pay transactions by employee/contractor per payroll.

- Posting Journal Report: Payroll expenses and liabilities by payroll.

Records of Employment

Canadian employers can both generate and submit Records of Employment (ROEs) through Wagepoint without having to pay extra.

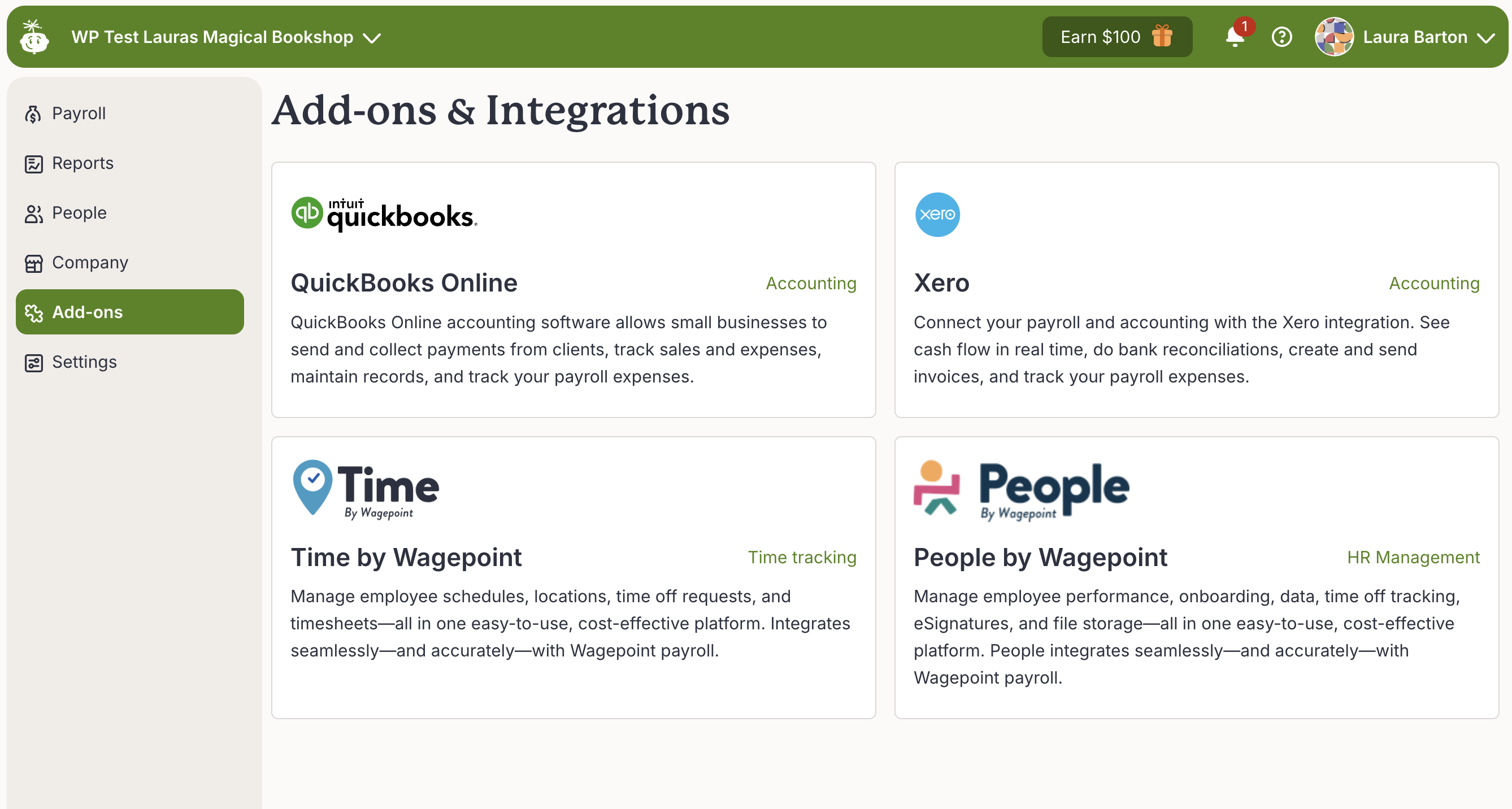

Integration with accounting software

Seamlessly sync your payroll data with your bookkeeping using Wagepoint’s accounting software integrations. No extra data entry, fewer errors, and less time spent on payroll.

Time-tracking integration

If you’re looking for a time-tracking add-on, Wagepoint also integrates with Time by Wagepoint. Like the payroll product, this is a simple software designed for small business owners and has features like scheduling, location setting, geofencing, and more.

HR tracking integration

For an integrated HR experience, People by Wagepoint connects to Wagepoint, allowing you to sync employee information and payroll. This product has features like PTO tracking, employee performance, onboarding, and more.

Canadian customer support

Whenever you reach out to Wagepoint’s customer support team, you’ll connect with someone in Canada. Plus, many of our team members have earned their Payroll Compliance Certification through the National Payroll Institute — so you’ll always have expert support when you need it.

Want to see Wagepoint in action? Check out our 5-Minute Walkthrough!

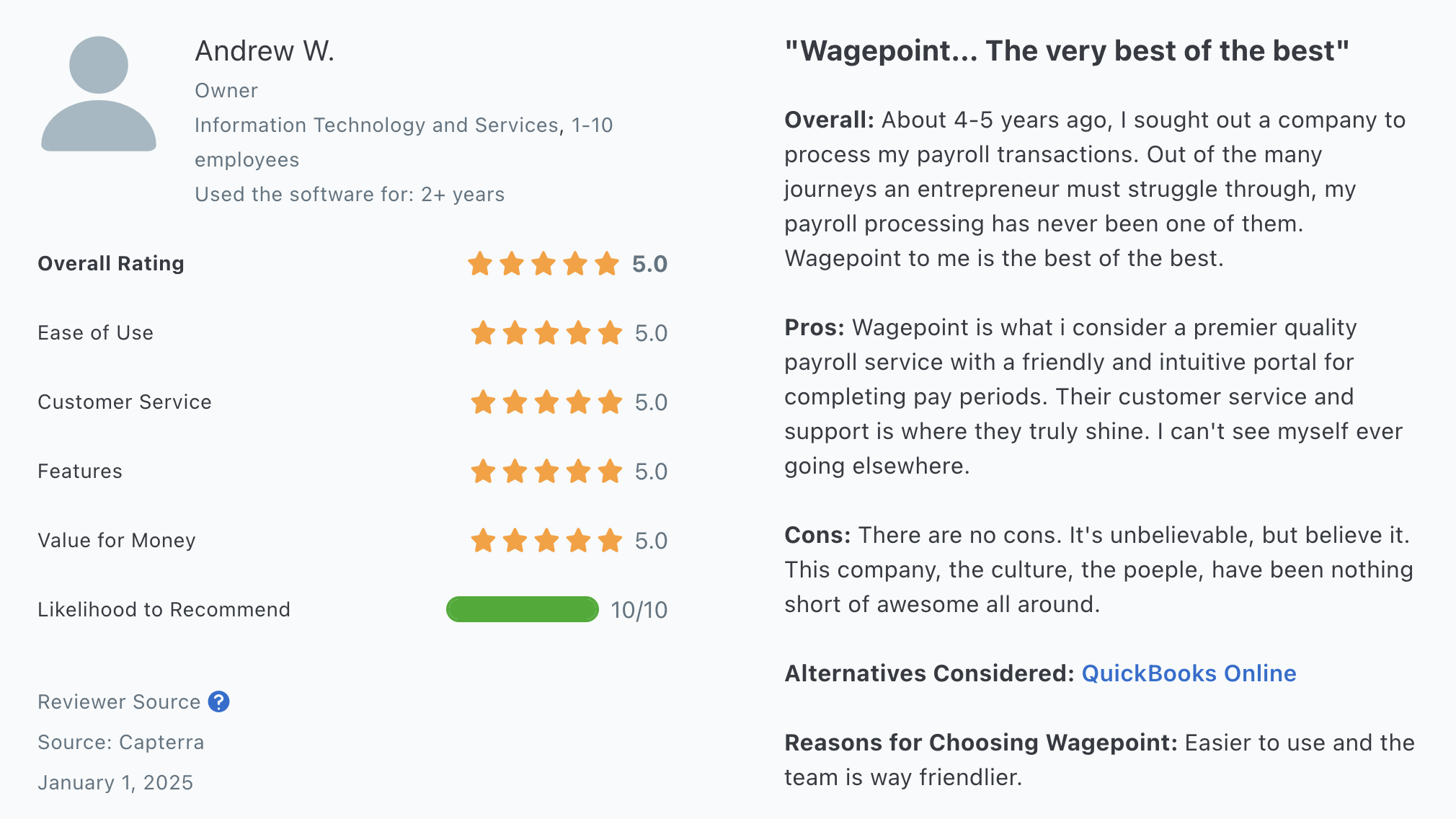

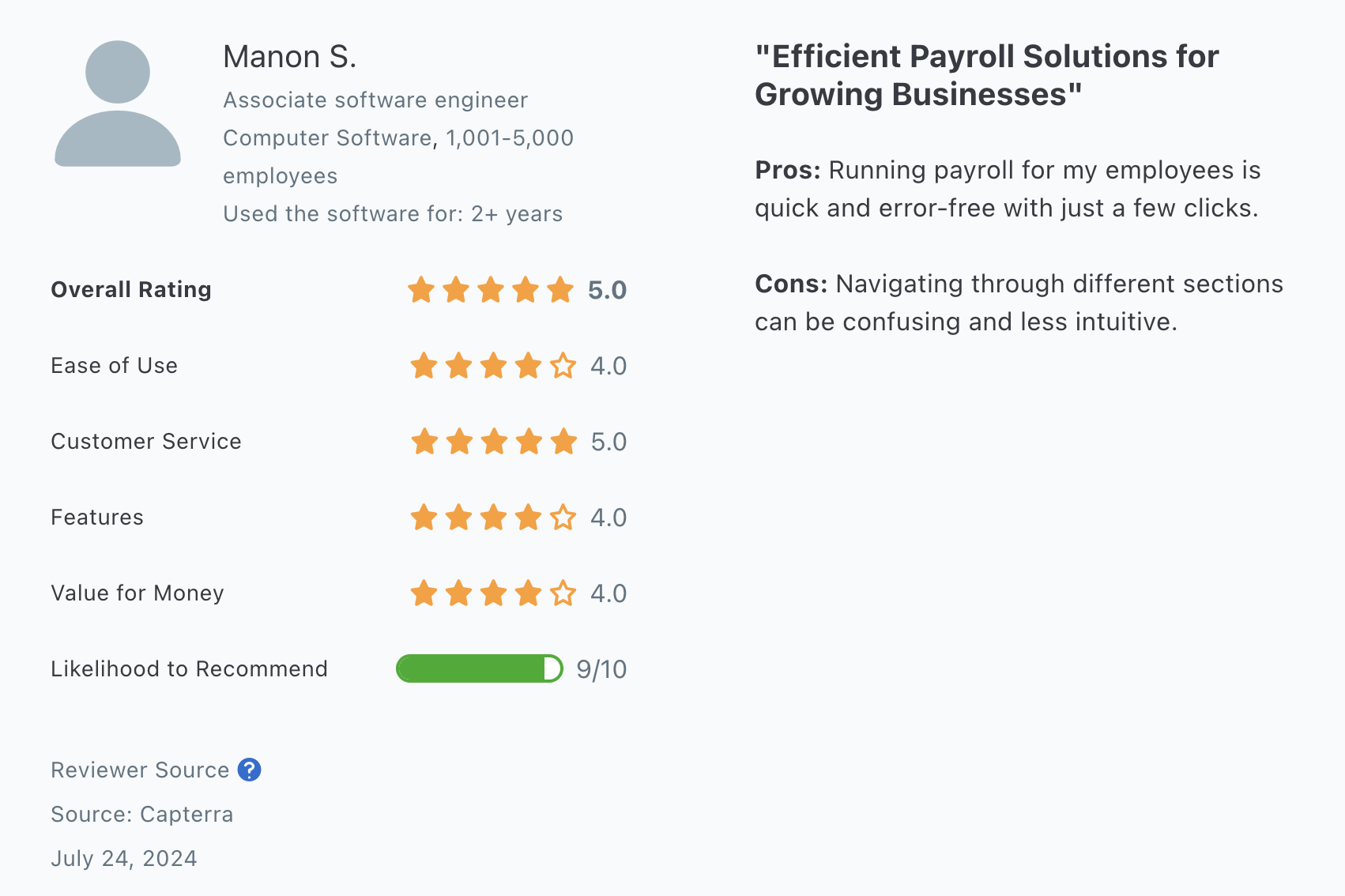

What customers say about Wagepoint

Pricing

14-day free trial

Solo: $20 CAD per month + $4 CAD per employee/contractor

Unlimited: $40 CAD per month + $6 CAD per employee/contractor

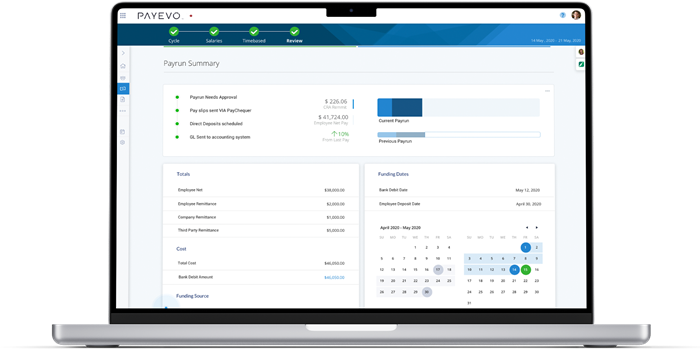

2. Payment Evolution (PayEvo)

Image: Payment Evolution

Payment Evolution (PayEvo) is a company with a suite of products, one of them being payroll. Its features offer a customized solution for individuals, small to mid-sized businesses, bookkeepers, accountants, enterprises, and developers.

Core features

- Pay employees and contractors

- Flexible options to pay employees

- Employee self-service portal

- Integration with other software such as FreshBooks, QuickBooks, and Sage

- Email support

- Automated tax filing

Extras

- Electronic payment setup (one-time fee)

- Specialized onboarding

- Remittances to other third parties

What customers say about PayEvo

- It’s easy to use, but comes with a learning curve

- Export options to other programs, but it can be glitchy

Pricing

15-day free trial

Growth: $3.50 CAD per employee per month (max 3 employees, no base fee)

Business Basic: $2.50 CAD per employee per month ($25 CAD minimum per month)

Business Plus: $2.00 CAD per employee per month ($75 CAD minimum per month)

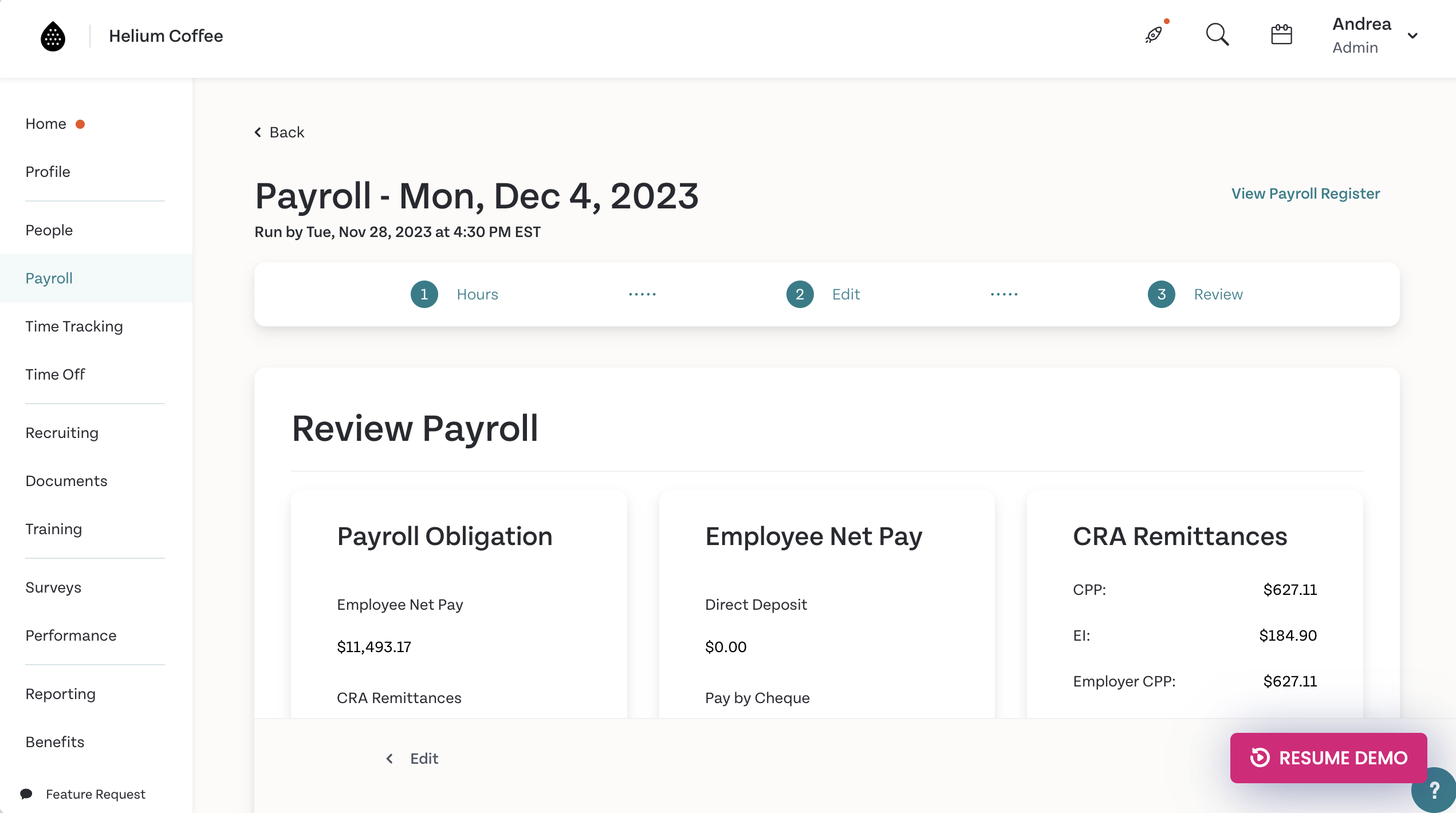

3. Humi

Image: Humi

Humi promotes itself as a platform for small business payroll, HR, benefits, time off, and beyond. Essentially, if it’s part of having an employee, they cover it with one of the feature sets in their product.

Core features

- Automatic payroll calculations

- Manage additional income types

- Year-end and terminated employee filing

- Payroll reporting

- Digital pay stubs

Extras

- Managed payroll with access to consultations, audits and payroll administration

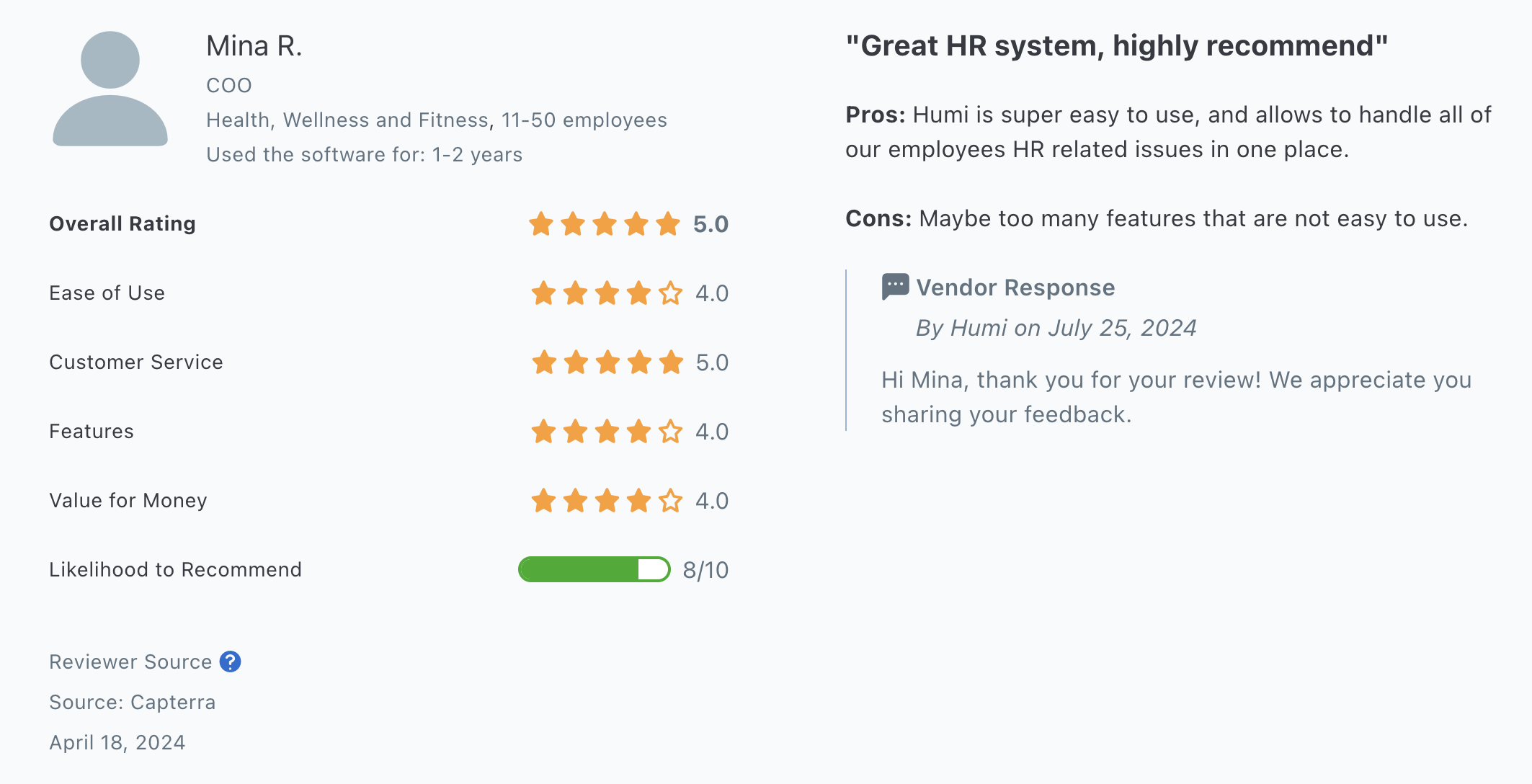

What customers say about Humi

- Add-on options can be pricey

- Lots of features, but not always easy to use

Pricing

Contact sales.

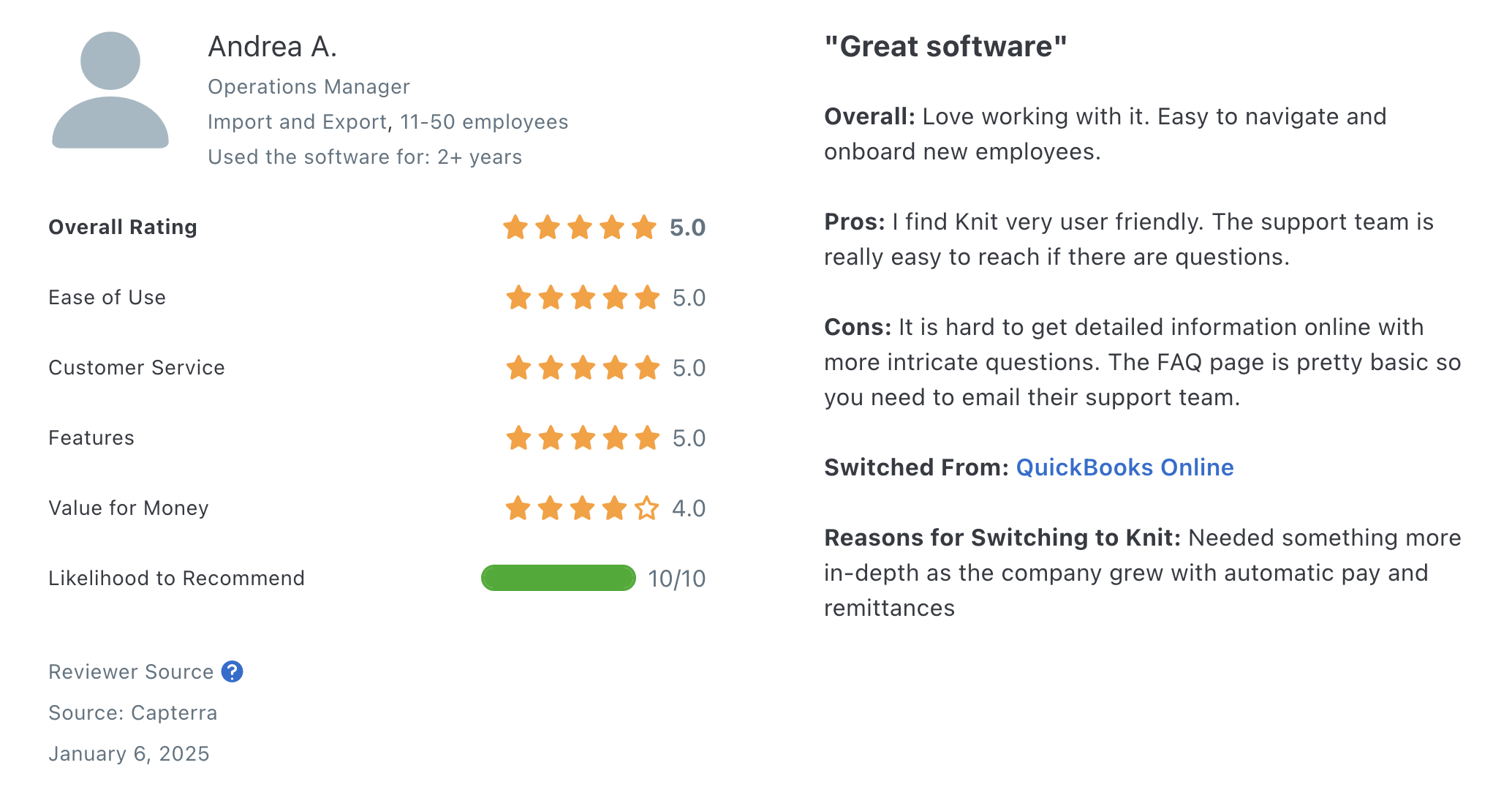

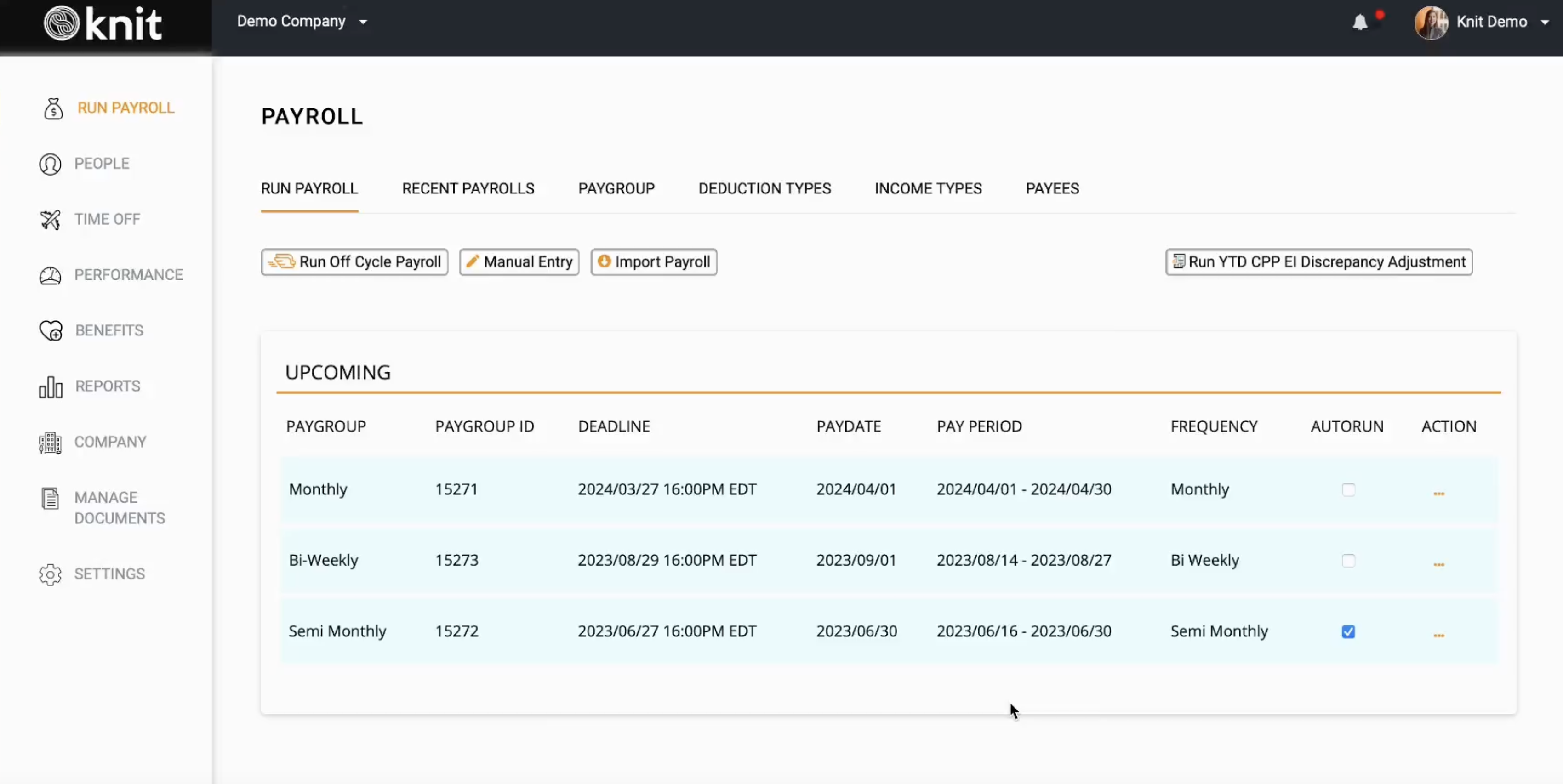

4. Knit

Image: Knit

Knit is tailored for small and medium-sized businesses in Canada, helping them run their payroll as well as manage HR and vendor payments in one place.

Core features

- Automated payroll calculations

- Direct deposit

- Automated tax filing

- Integrations with QuickBooks and Xero

- New hire self-onboarding

Upgrade features

- Workers’ compensation and EHT remittance and reporting

- Documents and e-signatures

- Time off management

- Talent management

What customers say about Knit

- User friendly, but onboarding can be tricky

- Some delays in payroll changes, but customer support is helpful

Pricing

30-day free trial

Lite: $40 CAD per month + $6 CAD per employee per month

Complete: $50 CAD per month + $8 CAD per employee per month

Concierge: Contact sales

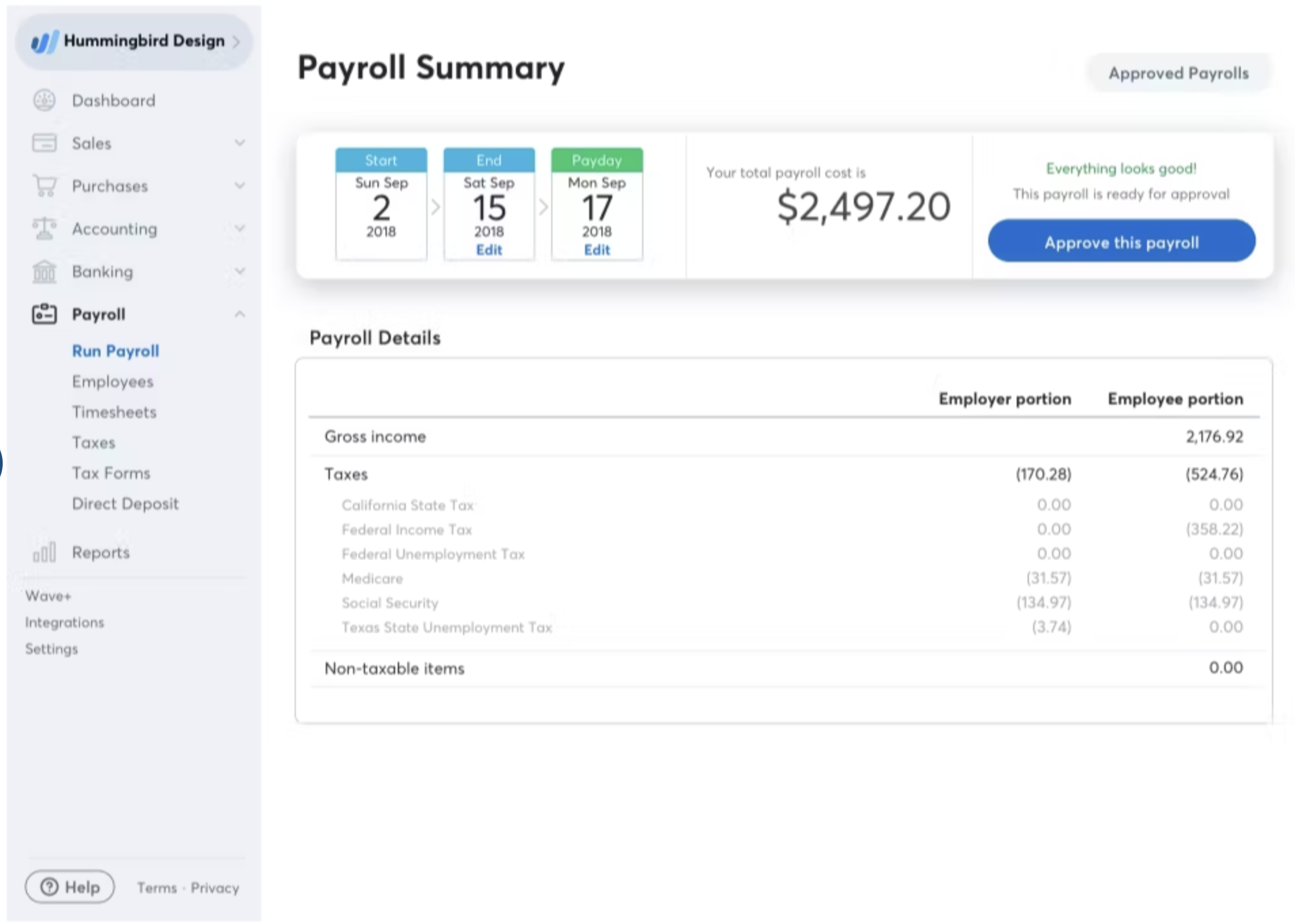

5. Wave Payroll

Image: Capterra

Wave Payroll is an add-on to Wave’s accounting software and designed to ease small business payment processes. While the Wave accounting software has a free option, the payroll add-on comes at a cost.

Core features

- Direct deposit

- Automated tax remittances

- Employee self-service portal

- Pay employees and contractors

- Automated payroll journal entries

Exclusions

Not available in Québec

What customers say about Wave Payroll

- Good platform, but it doesn’t integrate with platforms in some industries

- It’s easy to use, but has limited payroll features

Pricing

30-day free trial

$25 CAD per month + $6 CAD per employee/contractor per month

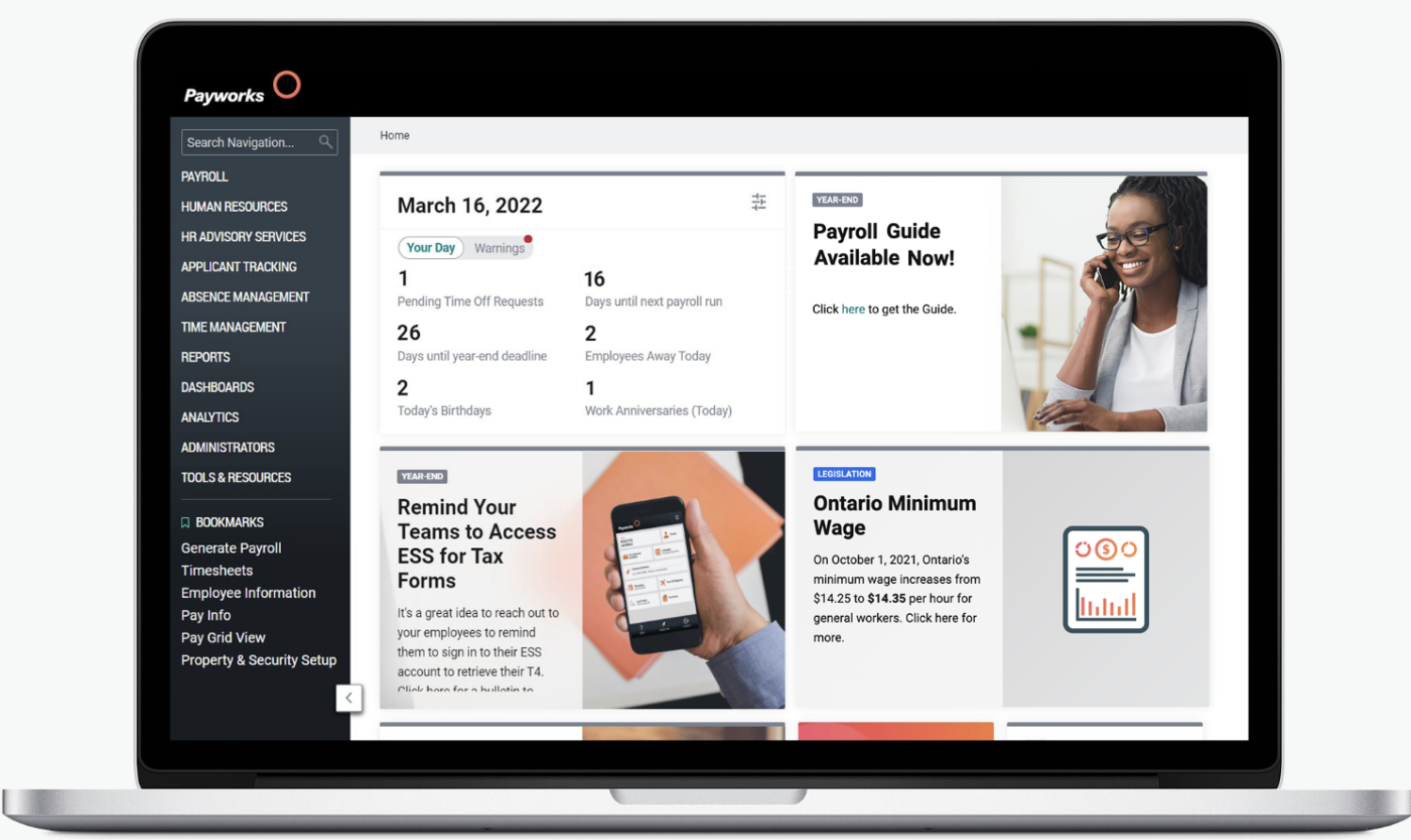

6. Payworks

Image: Payworks

Payworks offers a variety of HR solutions, including payroll. On the payroll side of things, business owners have the option to choose a self-managed or managed payroll services option where the Payworks team takes on the payroll administration load.

Core features

- Direct deposit

- Unlimited payroll previews before approving payroll

- Multiple location and business number capabilities

- Auto filing for payroll taxes, WCB premiums, and ROEs

Extras

- Managed payroll services

- HR management

- Time management

- Absence management

What customers say about Payworks

- Able to see payroll data through many reports, but it’s not user friendly

- Easy to do payroll, but some bookkeeper assistance required

Pricing

Get a quote from the generator on their website.

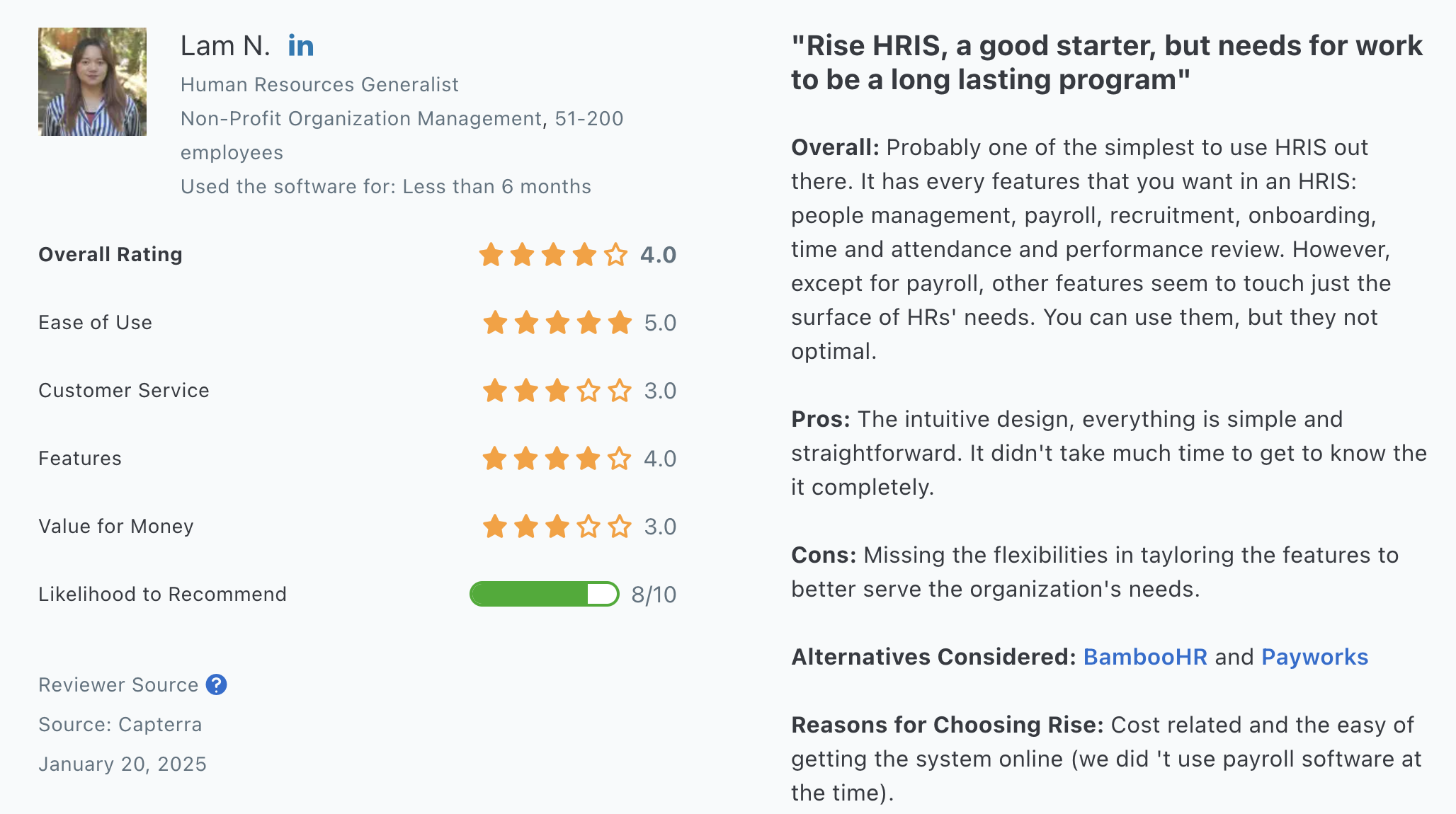

7. Rise

Image: Rise

Rise offers flexibility in payroll management and brings HR, benefits, and time-off management together in one platform. It allows you to run your payroll at your convenience in a few simple clicks.

Core features

- Direct deposit

- Employee document access

- Automated payroll processing and tax remittances

- Benefits deductions

- Integration with FreshBooks, Xero, and QuickBooks

Extras

- Scheduling and time tracking

What customers say about Rise

- Nice to have the payroll, HR, and other features under one platform, but it creates complexities

- Has the payroll features users want, but it’s not too user friendly

Pricing

Start: $8 CAD per employee per month (required base fee not listed)

Grow: Contact sales

Optimize: Contact sales

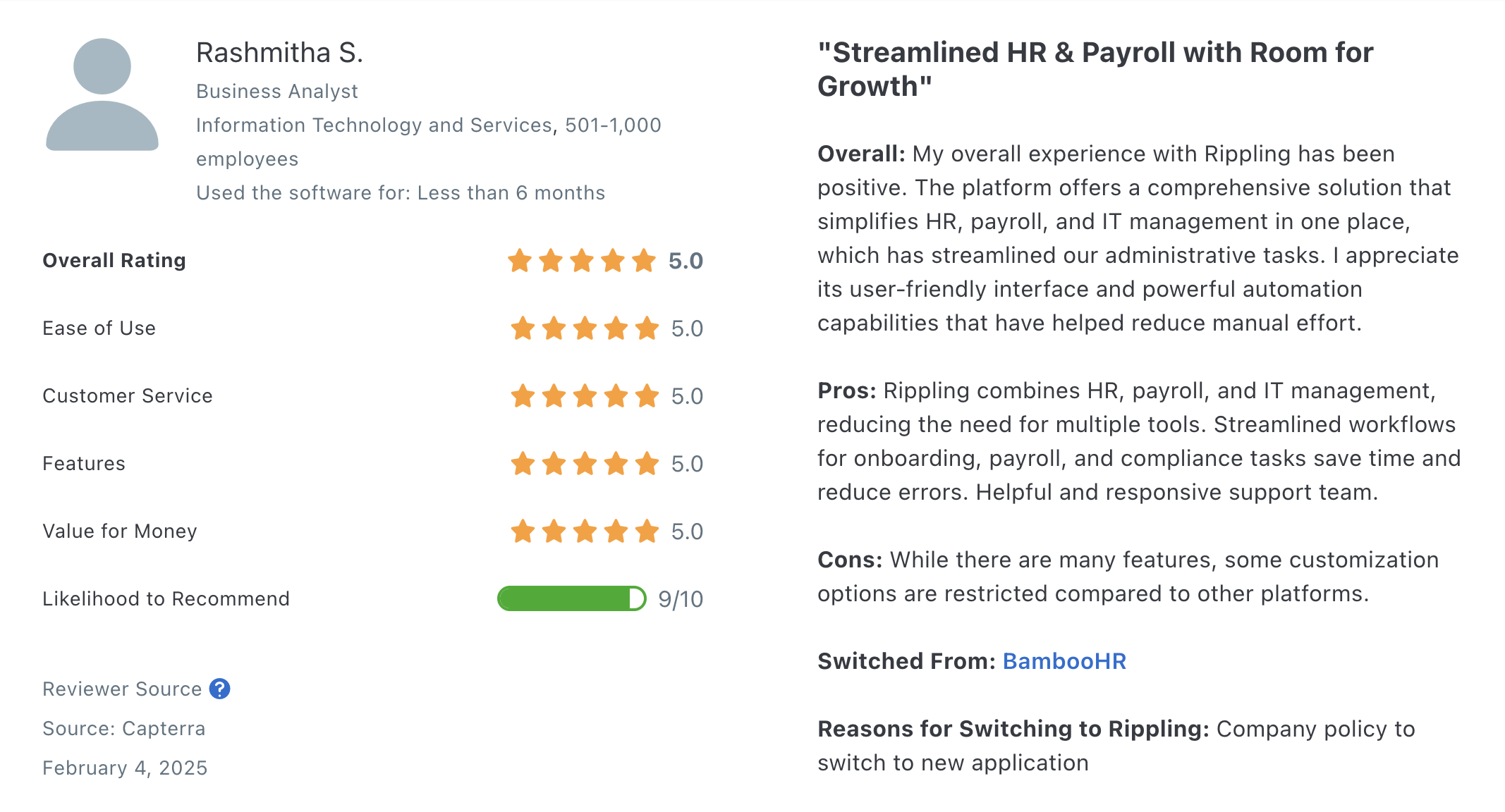

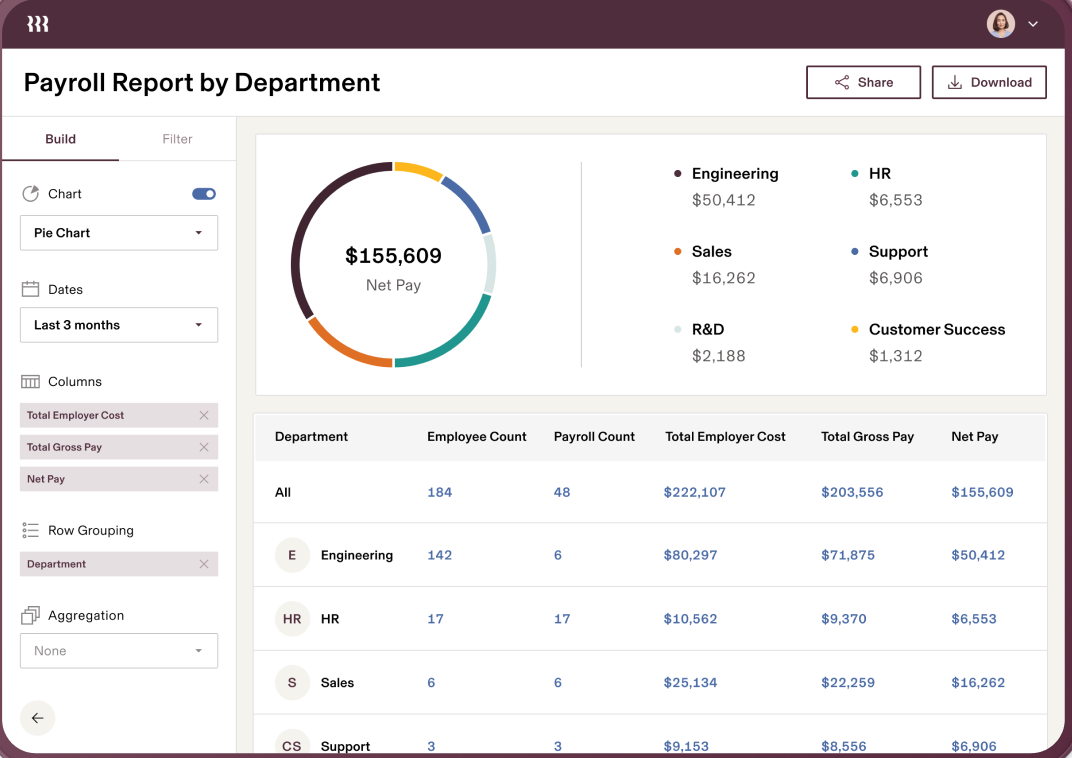

8. Rippling

Image: Rippling

Rippling has payroll services and workforce management tools designed for global operations, including payroll, expenses, and financial management.

Core features

- Fast payroll processing

- Automatic tax and year-end filing

- Dedicated mobile app

- Payroll analytics

- Workflow automation

Other services

- Employer of Record

- Workforce management

- HR management

- Talent management

- Benefits administration

What customers say about Rippling

- It has some intuitive features, but the overall interface isn’t user friendly

- Users enjoy the variety of features, but some wish for more customization

Pricing

Contact sales.

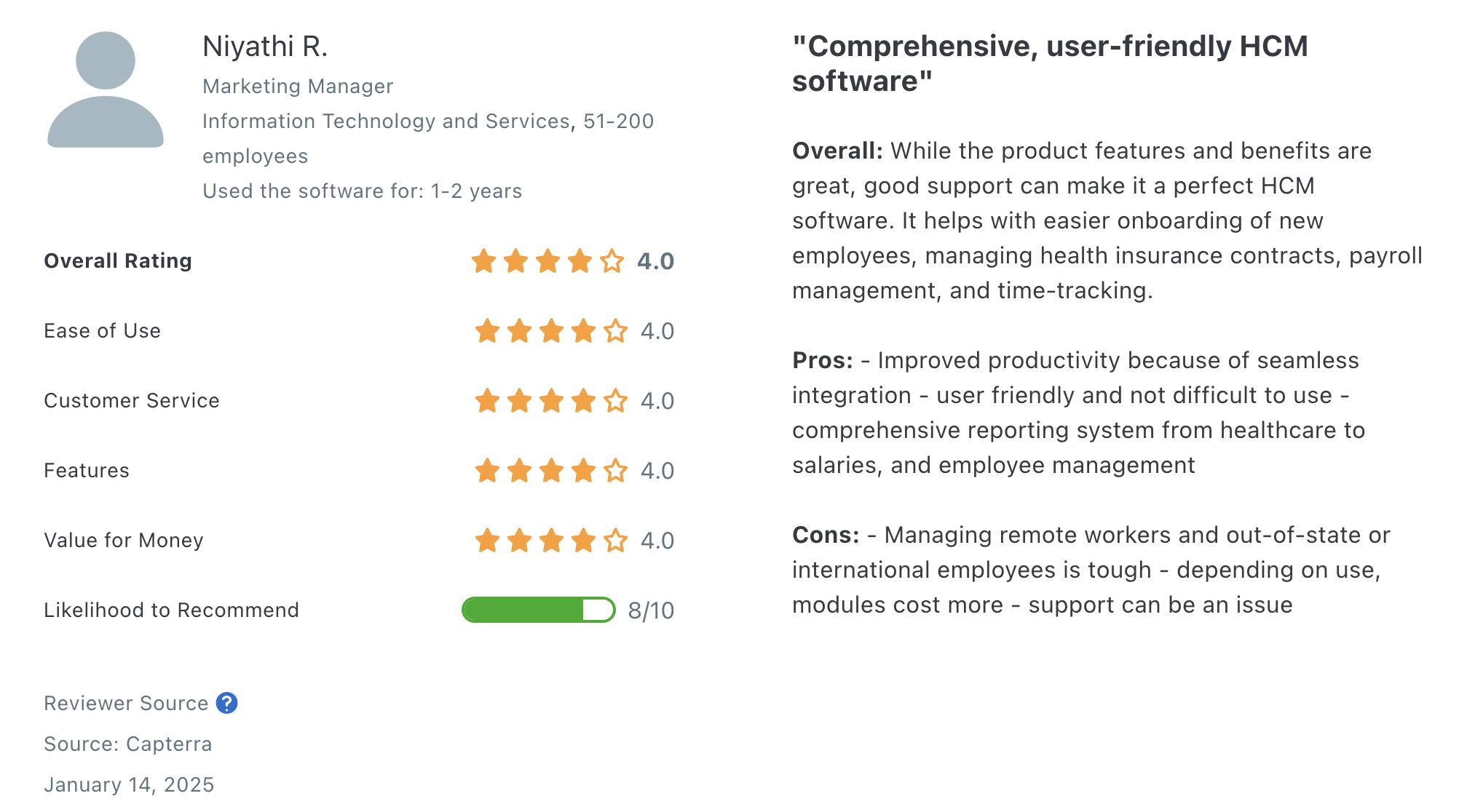

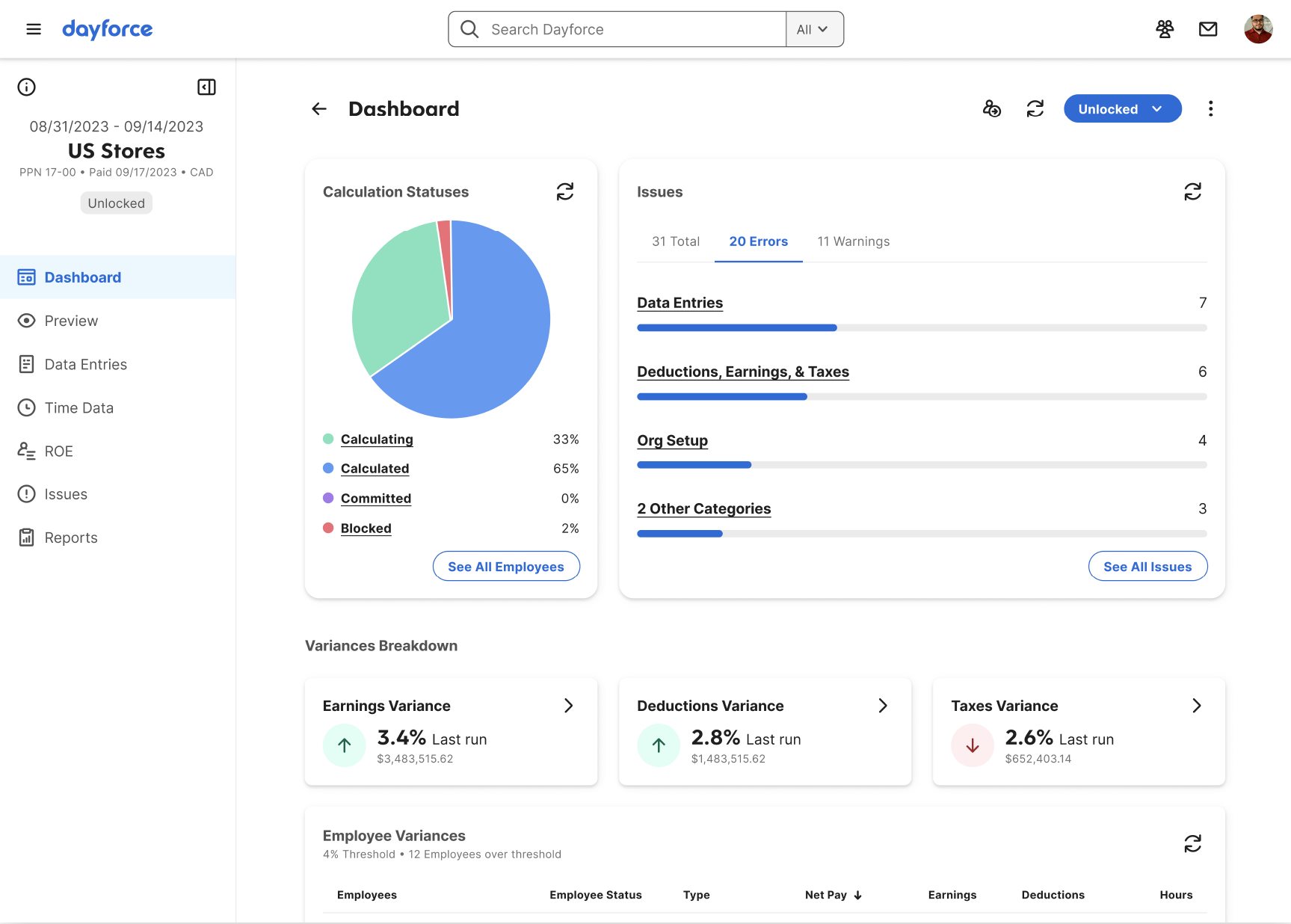

9. Dayforce (formerly Ceridian)

Image: Dayforce

Dayforce offers cloud-based payroll software, managed payroll service as well as a variety of other services. The solution helps small businesses simplify and increase the accuracy of their payroll processing.

Core features

- Automated payroll processing

- Mobile access

- Automated compliance

- Supported reporting

Other services

- Global payroll

- Managed payroll

- HR software

- Workforce management

What customers say about Dayforce

- There are plenty of reporting options, but that can feel overwhelming at times

- Nice to have an all-in-one platform for payroll, hiring, and time tracking, but it’s not well organized

Pricing

Contact sales.

10. ADP

Image: ADP

ADP is a payroll and HR combo solution that helps small, medium, and large companies process their payroll, pay employees, and other tasks within the people management space.

Core features

- Direct deposits

- Automated payroll tax calculations and remittances

- Paper cheque delivery to your business

- Year-end forms

- Employee self-service portal

Extras

- Time and attendance

- Global payroll

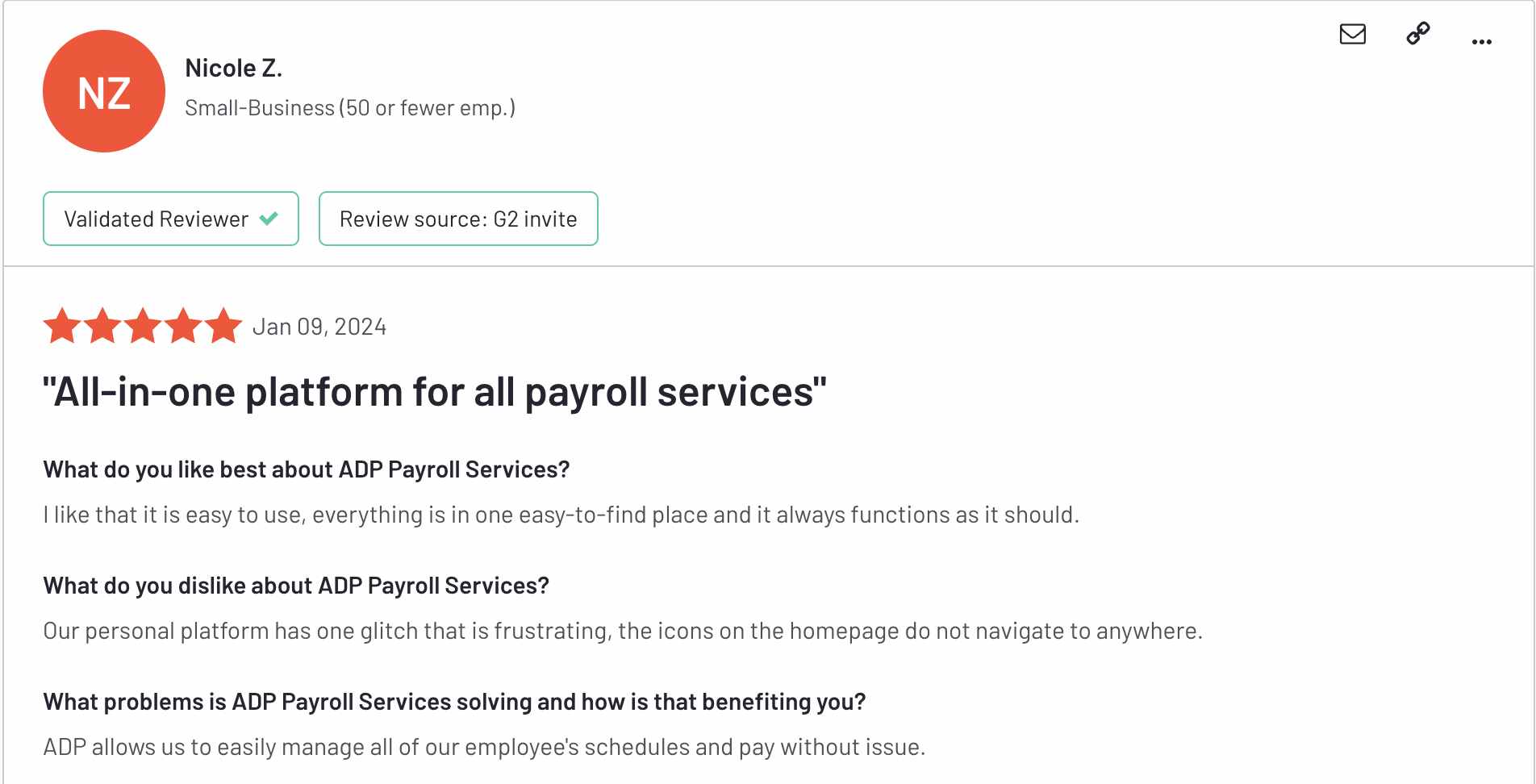

What customers say about ADP

- Easy to use, but if you do need help, there are many complaints about customer support

- Like the dashboard, but the interface overall feels outdated

Pricing

Contact sales

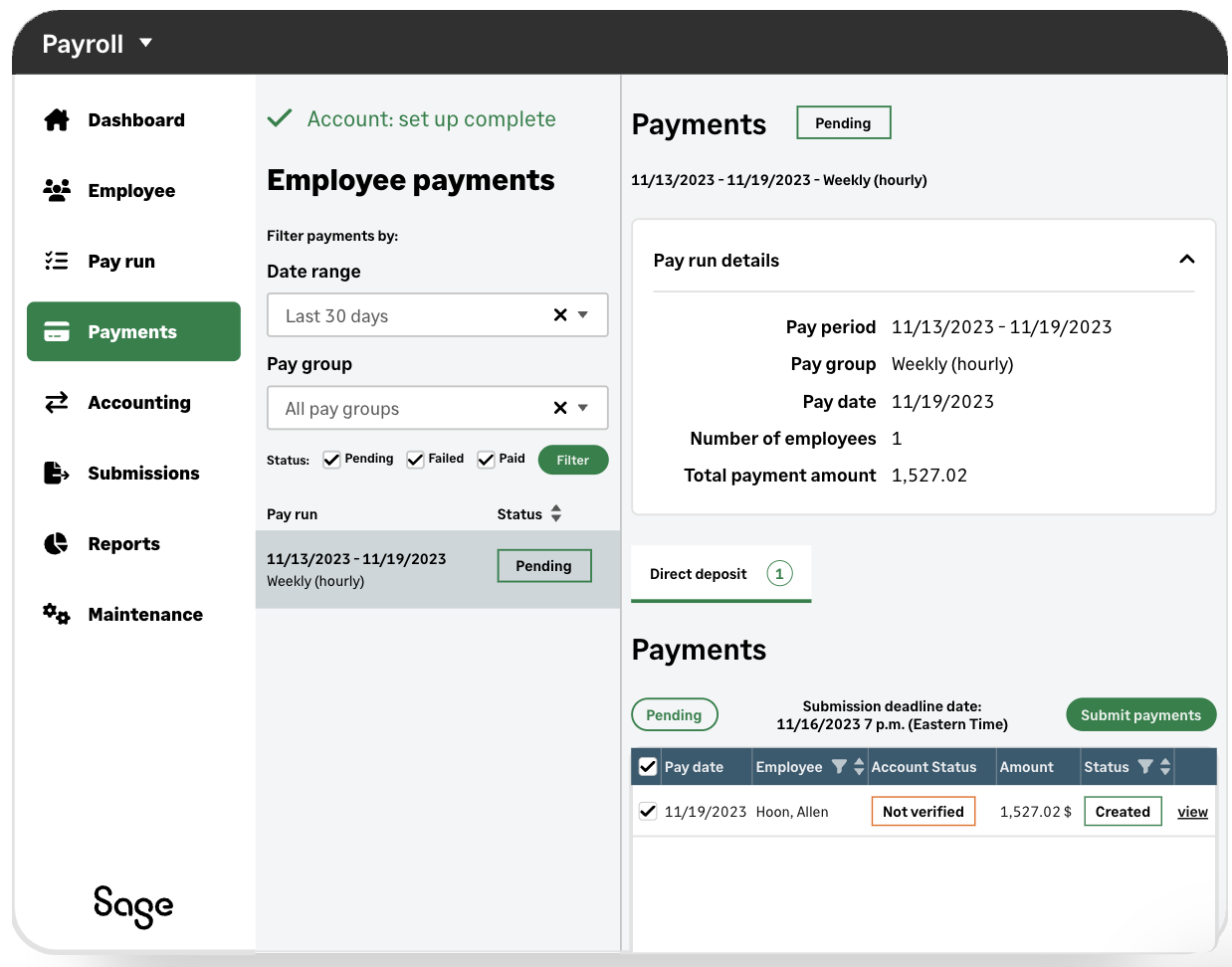

11. Sage

Image: Sage

Sage’s payroll software empowers businesses to prepare their payroll effortlessly and accurately. This is also an add-on feature to Sage’s accounting software.

Core features

- Automated payroll processing

- Employee self-service portal

- Mobile access for employers and employees

- Tax filing and payments

- Basic HR tools even in the payroll-only package

Add-ons

- Sage accounting software

- Core HR for advanced HR management beyond the Payroll + HR package

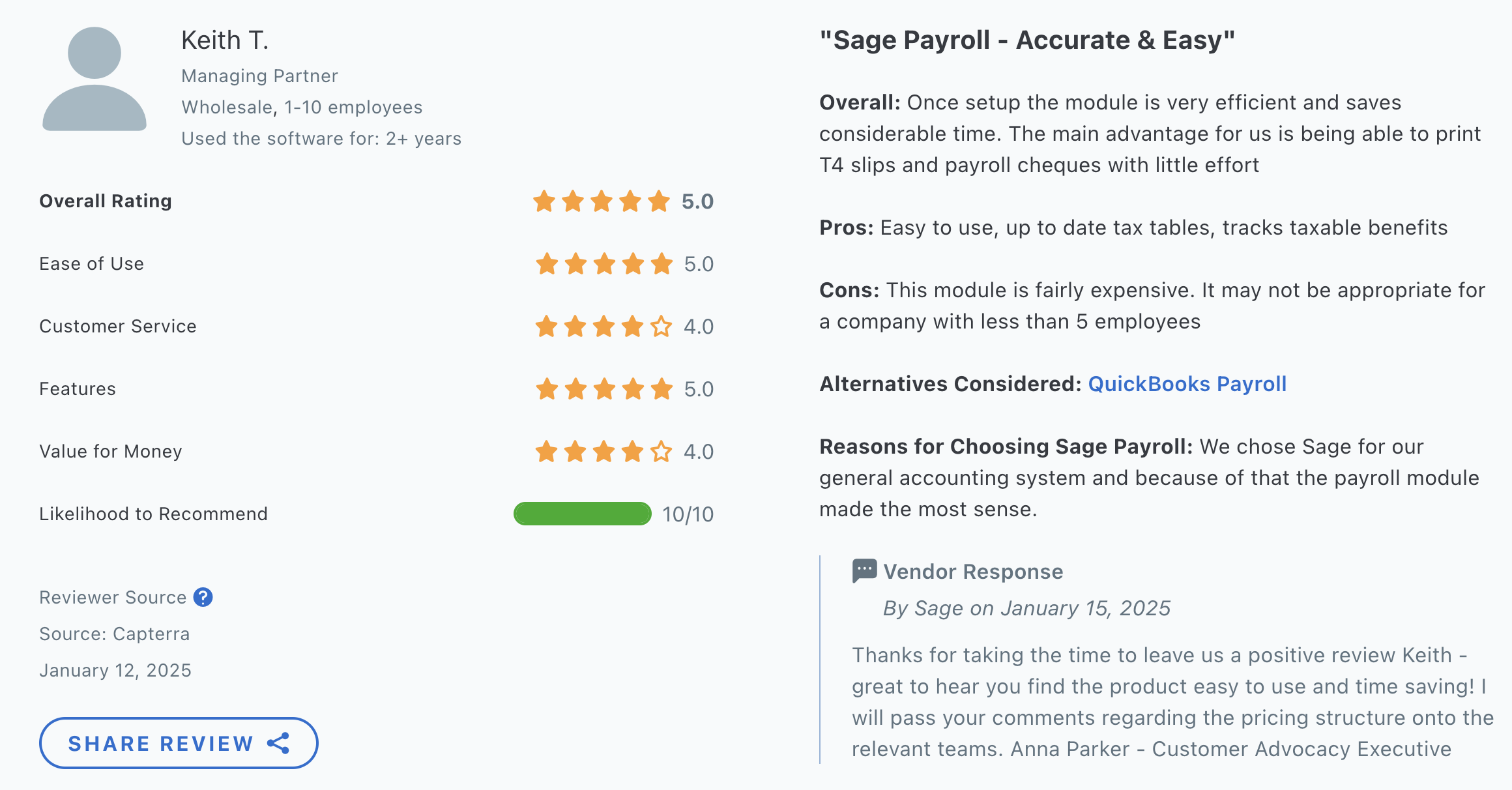

What customers say about Sage

- Intuitive, but it can be challenging to correct post-payrun mistakes

- Enjoy that it’s in the cloud, but connection can be slow

Pricing

One month free trial

Payroll Essentials: $23 CAD per month + $3 CAD per employee per month

Payroll Standard: $30.50 CAD per month + $10.50 CAD per employee per month

Payroll Premium: $36.50 CAD per month + $16.50 CAD per employee per month

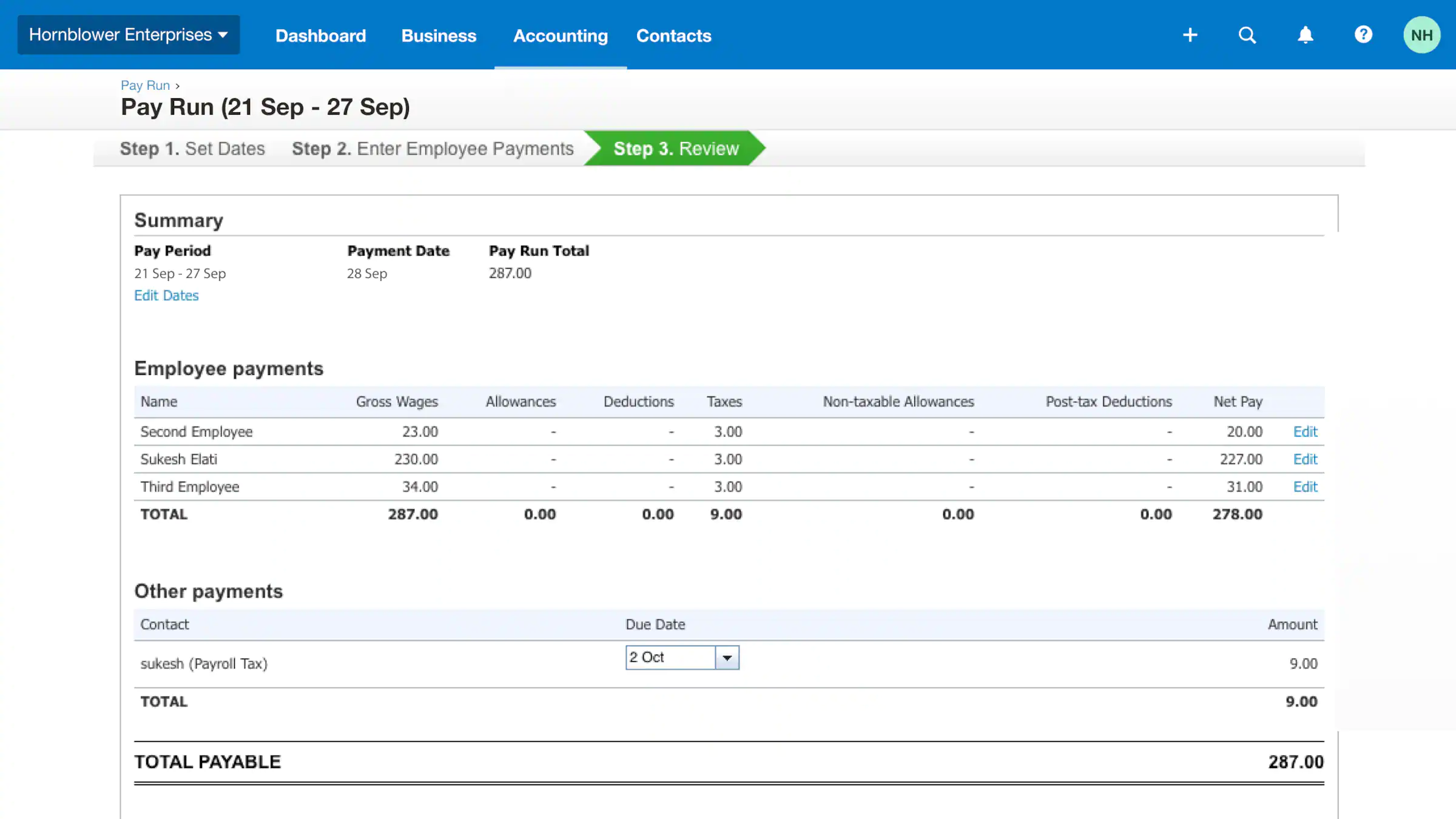

12. Xero Pay Run

Image: Xero

Known best for its accounting software, Xero also offers a basic payroll feature that focuses on regular pay runs for accurate recordkeeping and a small number of employees.

Core features

- Basic payroll processing for employees’ hours, hourly rates, taxes, and deductions

- Use prior pay run data and settings for current pay run

- Email or print pay stubs

Add-ons

- Payroll integrations for more advanced payroll needs

What customers say about Xero Pay Run

It’s challenging to find Canadian user reviews of Xero Pay Run, but other users worldwide like the basic features for what they are.

Pricing

Unclear whether this feature is included in the standard pricing for Xero packages or if it’s an add-on.

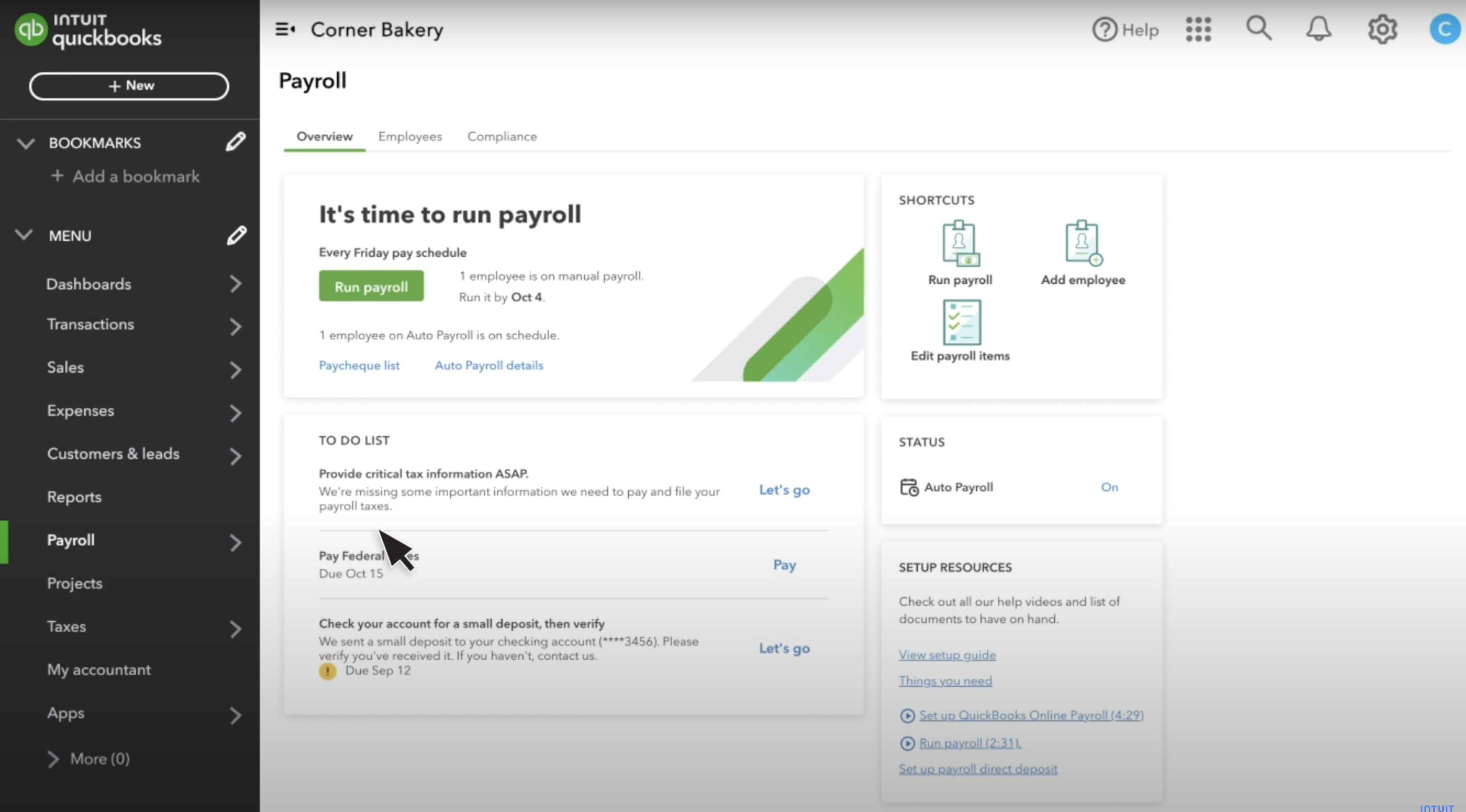

13. QuickBooks Online Payroll

Image: QuickBooks

QuickBooks Online Payroll is best known as an add-on to the QuickBooks Online solution. If you use it that way, rather than as a standalone service, it gives you the power to manage your small business books and run payroll without having to reenter your data into your accounting software.

Core features

- Automated payroll calculation and processing

- Direct deposit payments

- Time-tracking integrations

- Automated tax remittances

- Employee self-service portal

Exclusions

- Contractor payroll and payments

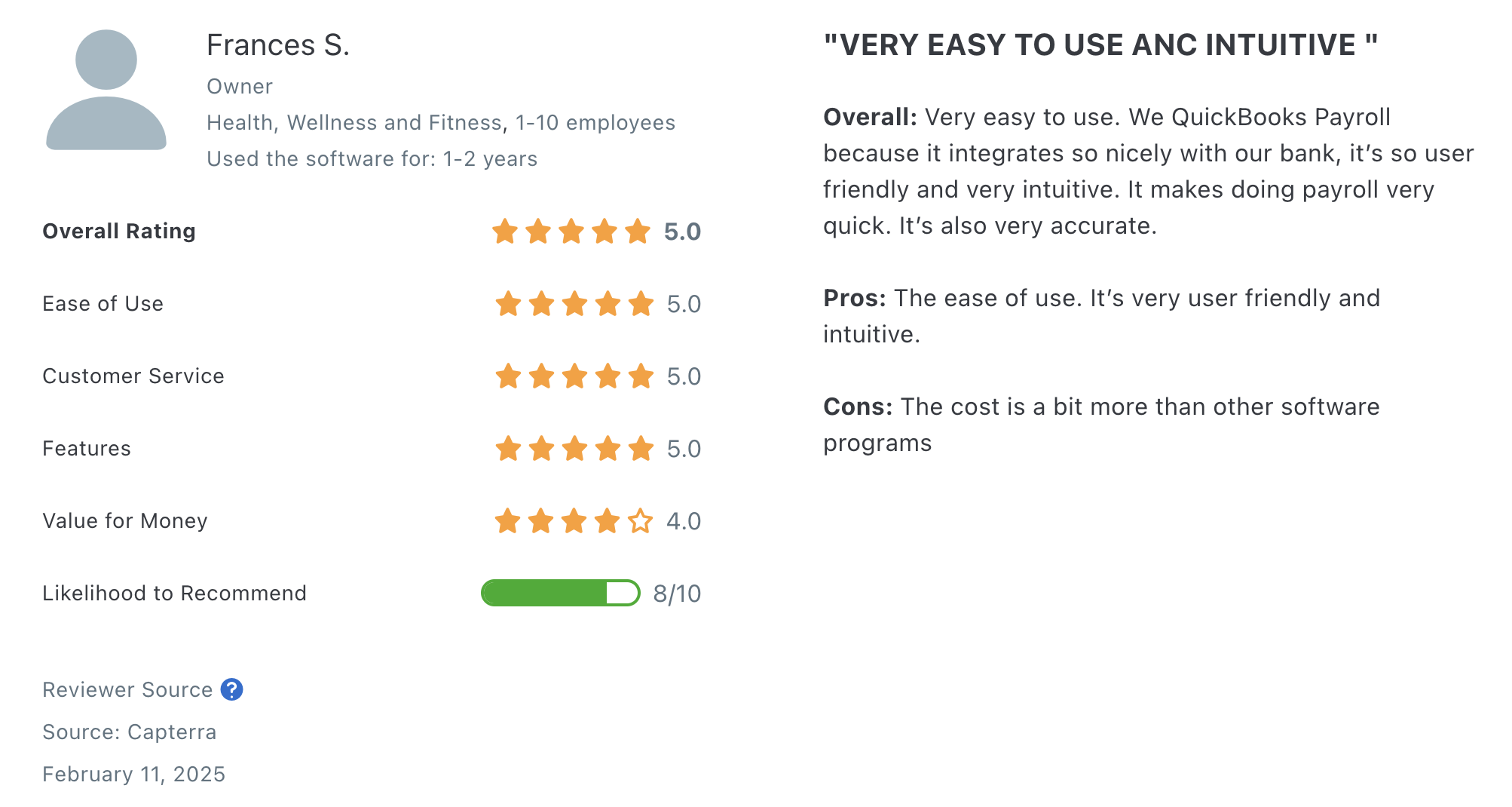

What customers say about QuickBooks Online Payroll

- Generally easy to use, but often have to contact support for issues

- Some love the automation, but another user raised concerns about the accuracy of calculations

Pricing

30-day free trial

Payroll Core: $25 CAD per month + $4 per employee per month

Payroll Premium: $55 CAD per month + $8 per employee per month

Payroll Elite: $80 CAD per month + $15 per employee per month

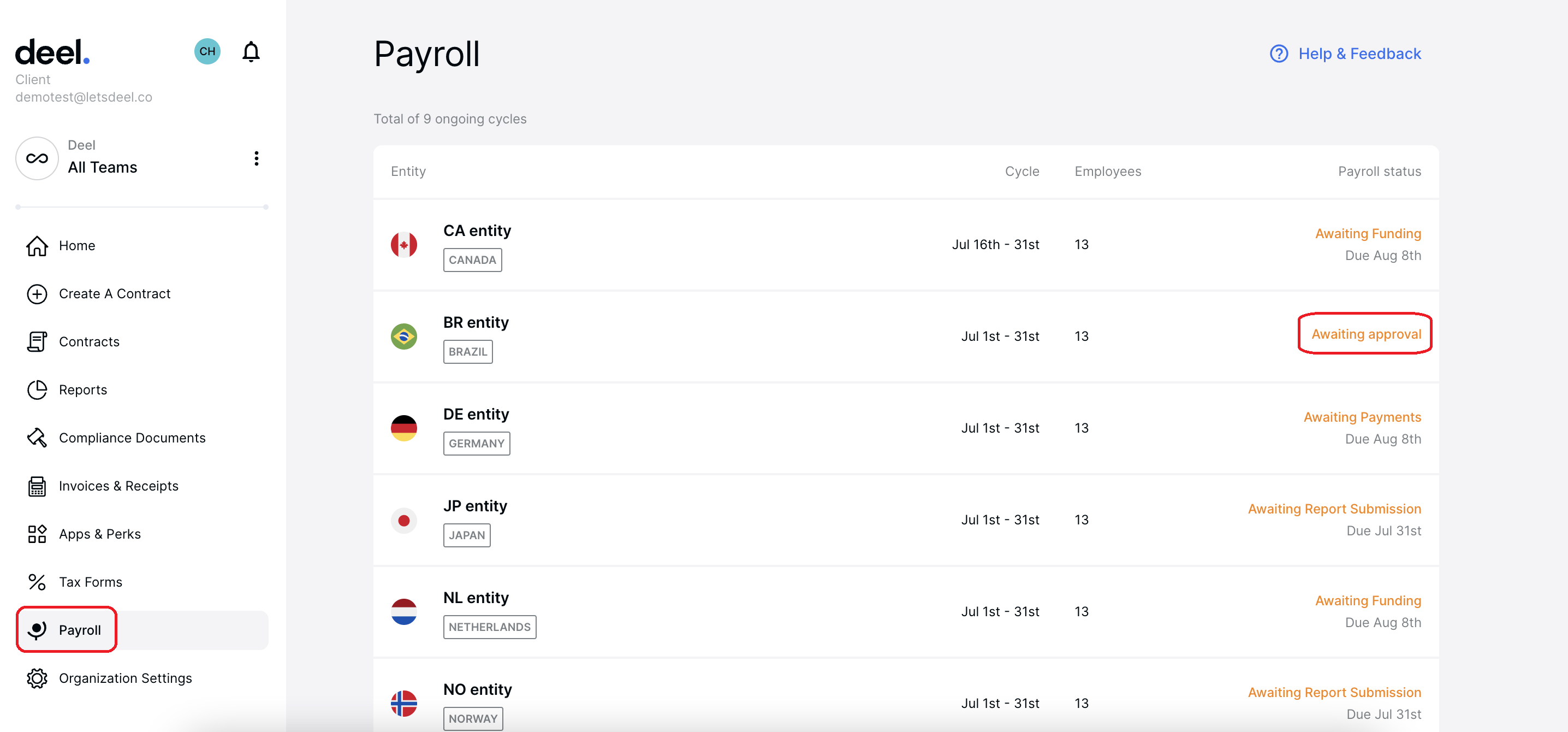

14. Deel

Image: Deel

Deel is a platform offering global payroll as well as a suite of other features for employers. Their focus is on helping smaller companies with staff beyond local borders.

Core features

- Payroll and HR combo

- Around the clock support

- Employee benefits and deductions

- Payroll tax remittances

- Salary and tax payments

Extras

- Employer of Record services

- Contractor management

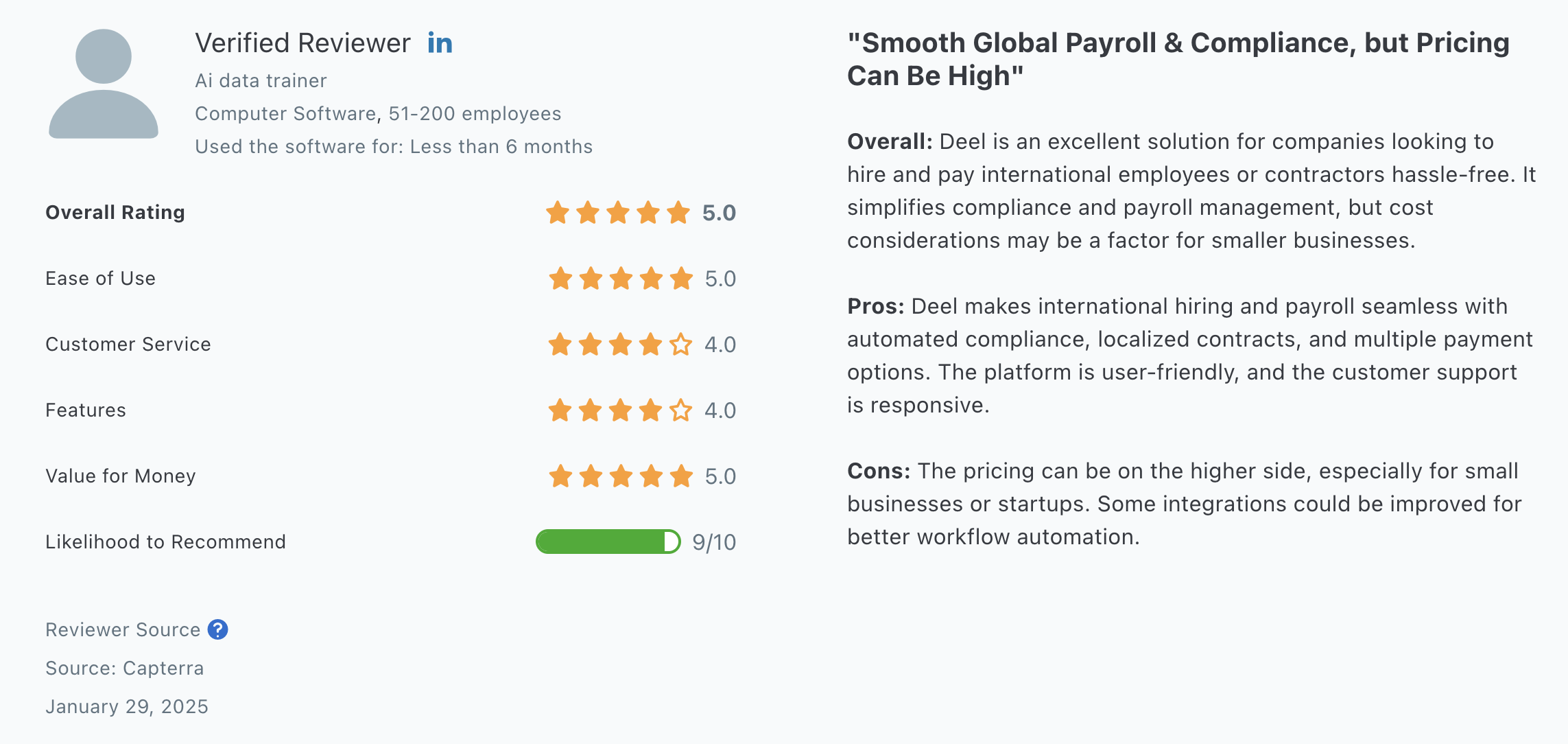

What customers say about Deel

- User friendly once you get used to it, but it can be difficult to navigate at first

- Easy set up, but it does take a few days

Pricing

$29 USD per employee per month

Factors to consider in choosing a payroll company.

There are a wide variety of payroll software and services options to choose from for the Canadian market. To make the best choice for your business, we recommend considering the following key factors:

- Cost of service

- Features and services offered

- Data security

- Ease of use

- Customer support

Cost of service

While important to select a provider that’s within your budget, it’s essential to assess the value that the solution is able to provide. Most payroll companies in Canada set their prices based on the offered services.

Find out what services are included in the base fee, if there are add-ons or extra users you’ll need to pay for, and the billing method.

Don’t forget to consider how any initial signup fees and continued fees will factor into your total business costs and weigh it against your budget.

Features and services offered

Do a side-by-side comparison of payroll companies and their offerings to see how they match up against one another. Start by thinking about your must-have features in a payroll system versus your nice-to-have features.

- What type of workers do I need to run payroll for? (Hourly employees, salaried employees, contractors, a mix)

- Can it properly calculate vacation and other pay types for my province or territory?

- Does the payroll software handle payroll remittances for taxes and year-end filing?

- Can I run payroll myself or is this a full-service option?

- Do I need it to integrate with other software? (Such as time-tracking or HR software)

Data security

Working with a payroll company means trusting them with sensitive employer and employee data. This isn’t just pay information like banking details, but also Social Insurance Numbers (SINs), home addresses, and more. Before settling for a provider, find out about their policies on data protection and the measures they have in place to curb potential data breaches.

Ease of use

The best payroll software should focus on easy access for both you and your employees. Typically, all you need is an internet connection and a device to log in on.

Apart from the part of the software that simplifies entering employee work hours, calculations, and making payments to both workers and the government, an employee self-service portal is another fantastic feature. It increases data and information accuracy and transparency, plus it means less work for you since employees will have access to their paystubs and year-end forms. Some self-service portals let employees set up their own employee profile.

Customer support

Talk to different companies and find out how they provide customer support. Do they offer training or online resources to use their product or service? Can you talk to an actual person? Is it easy to find out how to contact the team with your questions? Do they assign you a dedicated account manager or have advisory services?

Final thoughts on payroll companies in Canada.

As you can see, there are many payroll companies catering to Canadian businesses. Being mindful of the one you select can be the difference between a good choice and the best choice for your business.

Simplify payroll with Wagepoint

Get through payroll in minutes instead of hours, processing for employees and independent contractors alike without having to pay extra. Our friendly onboarding team is happy to help you get started, and you can try it totally free for 14 days.

FAQ

What is a payroll company?

In short, a payroll company is one that takes payroll and makes it simple. Whether it’s basic payroll needs or the most complex payruns, the company makes sure the calculations are accurate and employees for small to large businesses are paid on time.

This can include Canadian payroll service providers that handle the payroll for you or payroll software that gives you the tools to tackle payroll regardless of how many years of experience you have (or don’t have).

What’s the difference between payroll software and payroll services?

Payroll software puts you in the driver’s seat, meaning you manage the payroll process from top to bottom with the help of a tool that can make the calculations, payments, and remittances much easier. Payroll services, sometimes called managed payroll or full-service payroll, takes payroll administration off your plate and an external team handles the process. Learn more by reading our blog on payroll management.