Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

QuickBooks integrations level up Intuit’s small business accounting software and the way small business owners handle not only their books, but other areas of their business, too. When everything can work together smoothly, productivity increases and workflows smooth out in so many areas—from payroll to payments to invoicing and expenses and beyond.

So, longtime fans and new QuickBooks users, here are the top integrations on the market that’ll make small business owner life that much easier.

Ways QuickBooks integrations help small business workflows.

- Easier data transfer between your tools.

- Lower chances of there being a mistake thanks to taking manual data entry out of the equation.

- Better client and project management because the information flows between systems.

- Easier to get a sense of the bigger picture for your small business when things are synced.

QuickBooks integrations to simplify small business tasks.

1. Wagepoint

Wagepoint is a cloud-based payroll software that helps Canadian small businesses handle paying their employees, calculate and pay payroll taxes, and deal with employee forms like Records of Employment (ROEs) and year-end forms like T4s and T4As.

How the QuickBooks integration works

Wagepoint’s QuickBooks Online integration lets small businesses sync their payroll and accounting into a single dashboard without any manual entry from one into the other.

With this integration, all payroll-related information, such as wages, deductions, and tax withholdings, effortlessly flow into your QuickBooks Online account.

The integration lets you generate detailed financial reports, analyze payroll costs and comprehensively view your business’s financial information and performance.

For instance, you can map your chart of accounts to make sure all payroll transactions are correctly categorized in QuickBooks. This means more accuracy, eliminates duplication of efforts and provides a holistic approach to financial management for your company.

“The QuickBooks integration in Wagepoint is wonderful because it helps me keep track of payroll transactions automatically. I love it and so does my accountant.”

— Karen Gendron, CEO and Founder, Stickernut and TaphandlesToGo.com

Pricing

Free trial: 14 days

Solo: CAD $20/month + $4 per employee/contractor

Unlimited: CAD $40/month + $6 per employee/contractor

2. Time by Wagepoint

Time by Wagepoint is another tool in the Wagepoint ecosystem, this one with a specific focus on tracking and scheduling employee time. It has features like calendars, location setup, geofencing capabilities, and paid time off tracking so that small business owners can ditch spreadsheet time tracking once and for all.

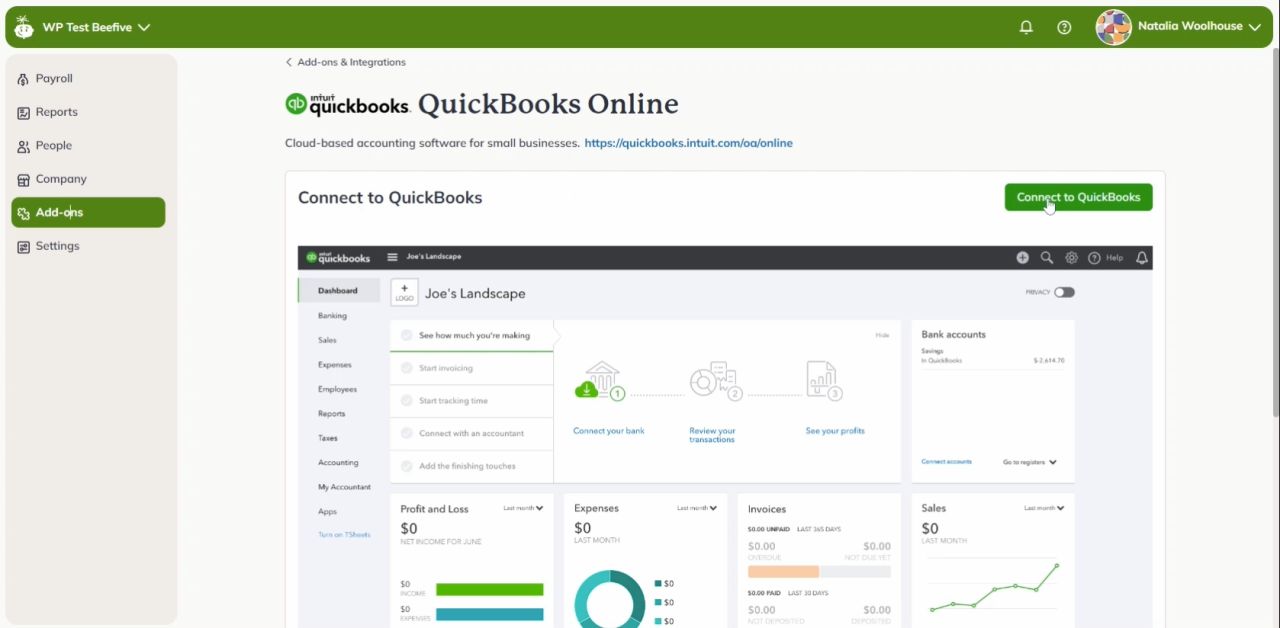

How the QuickBooks integration works

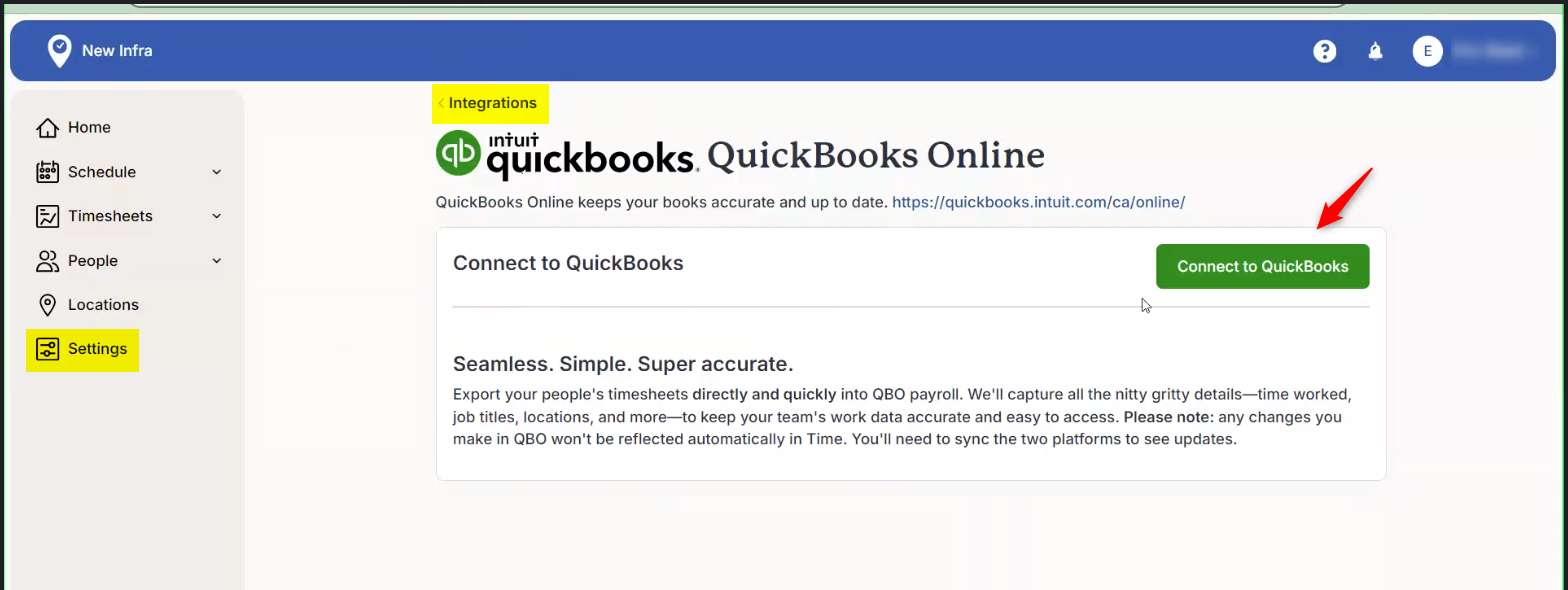

Time by Wagepoint’s connection to QuickBooks Online lets you take your timesheet information and sync it with QuickBooks Payroll. Details like name, time worked, job titles, location, and more are imported in so you don’t have to do the manual lift.

The setup is super simple too, and the integration will flag duplicates or missing details during that process so you don’t have a cleanup to deal with after.

Pricing

0-5 users: CAD $20/month (flat fee)

6+ users: CAD $4/month/active user

3. Plooto

Plooto is an online payment platform designed to streamline sending and receiving payments for businesses. It’s commonly used by small and midsize enterprises (SMEs) in Canada and the US.

With this handy app, small businesses can make payments directly from their bank accounts, such as vendor bills and employee salaries. The platform also supports electronic fund transfers (EFTs), giving users the option to send payments conveniently and efficiently.

How the QuickBooks integration works

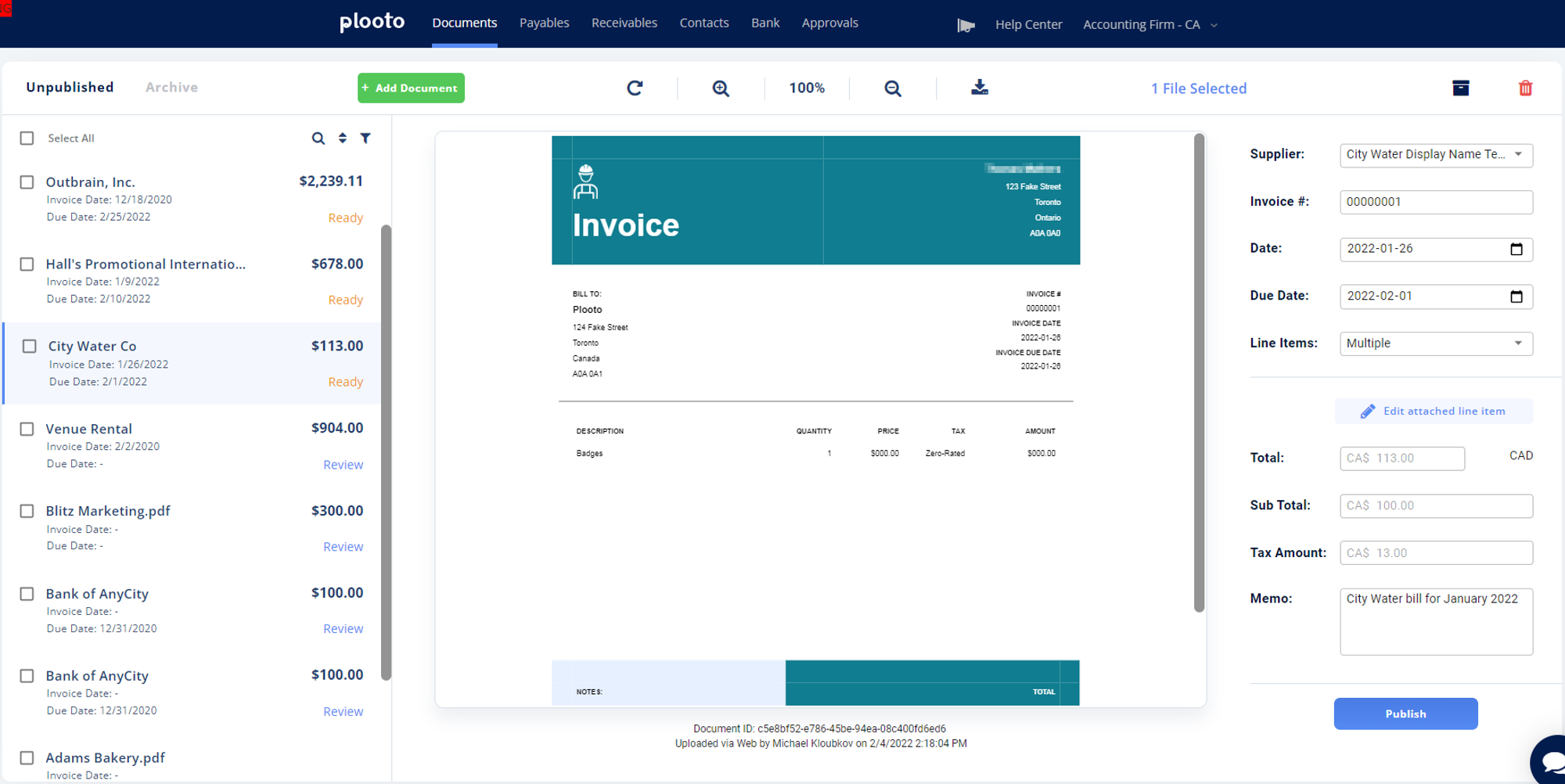

Image: Plooto

This integration takes Plooto’s features and automates workflows for invoice and payment management. No more stressing about reconciliations, approvals, or audits because the integration has it handled.

In a nutshell, all payments made via the app are automatically reconciled in whatever version of QuickBooks you’re using, whether that’s QuickBooks Online or QuickBooks Desktop. Plus, the integration supports multi-user collaboration to maintain payment processing transparency.

Here’s a breakdown of the process:

- Bills import into Plooto

- Plooto emails whoever’s responsible to approve it

- The approver gives the go-ahead on the payment

- Plooto finalizes the payment

- Plooto records payment

- The important details are automatically reconciled in QuickBooks

Pricing

Go: CAD $9/month

Grow: CAD $32/month

Pro: Contact sales

4. Method

Method is a customer relationship management (CRM) software. It offers a variety of tools to streamline customer interactions, sales processes, and business operations.

How the QuickBooks integration works

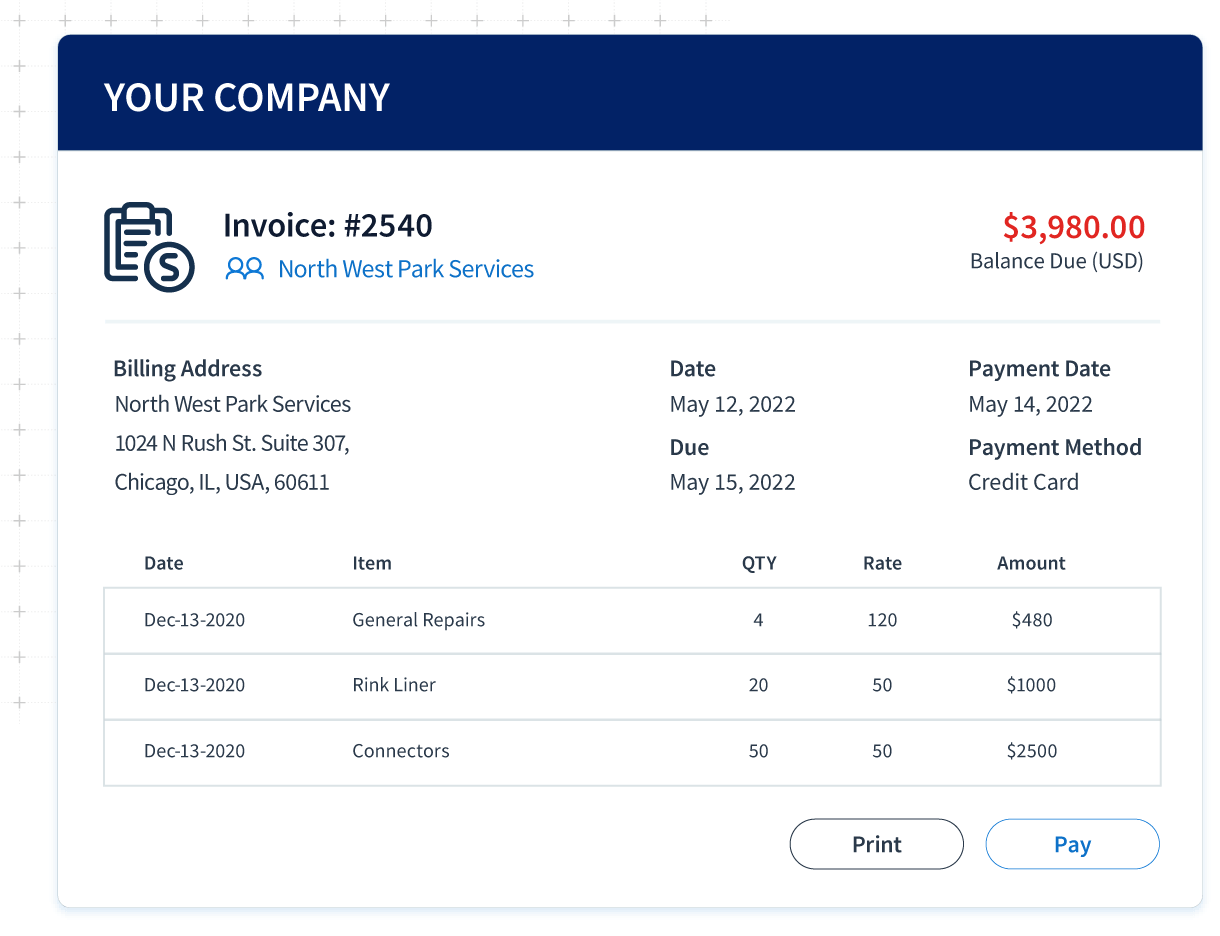

Image: Method

One of the interesting things about Method is they say they’re the first CRM to have integrated with QuickBooks—and that integration is still going strong. It works with either QuickBooks Desktop or QuickBooks Online.

Your sales team no longer needs direct access to your QuickBooks account. They can easily create invoices and sales receipts in Method, and the data syncs in real time with QuickBooks. Also, key data such as customers and payments are synced between Method and QuickBooks.

It doesn’t just stop at invoices and receipts though. This integration can also help you manage leads, get to know your customers by making sure their information is up-to-date, and even has a portal where your customers can update that information themselves. Plus, they’ll be able to see estimates and view and make payments.

Pricing

Contact Management: CAD $25/user/month

CRM Pro: CAD $44/user/month

CRM Enterprise: CAD $74/user/month

5. Lightspeed

Lightspeed is a cloud-based point-of-sale (POS) and e-commerce platform designed to empower businesses in retail, restaurants, and golf industries. This tool offers inventory management, employee management, sales reporting, and customer loyalty programs.

It gives business owners the tools to process transactions seamlessly, whether in-store, online or both.

How the QuickBooks integration works

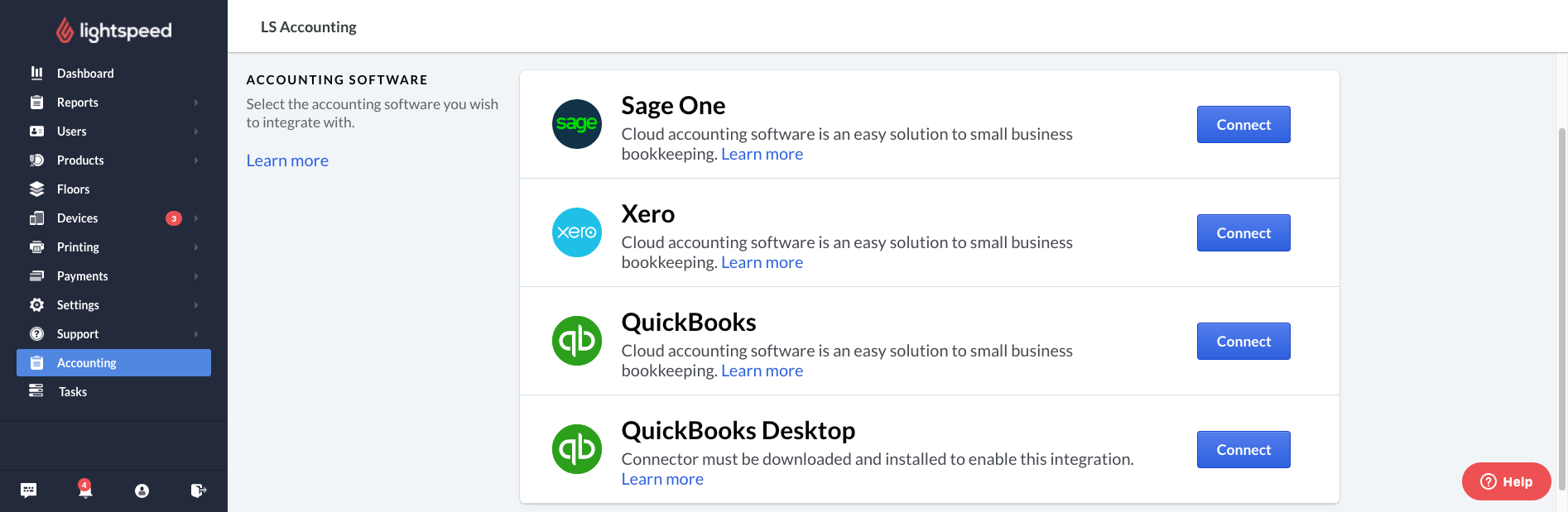

Image: Lightspeed

The Lightspeed and QuickBooks integration eliminates the tedious task of juggling between your POS system and accounting software. For example, this integration automatically reconciles money in or out, tips, revenue, gift cards, and more directly to QuickBooks. No more manual headaches!

Lightspeed lists its key benefits of the QuickBooks Online integration as

- Simplifying closing registers at the end of the day

- Managing and accounting for store credits

- Managing gift cards to stay on top of liability

The integration also features an extensive records dashboard so you can verify every transaction without breaking a sweat.

Pricing

Pricing varies per supported industry.

6. Mailchimp

When you think Mailchimp, you probably think of its newsletter and emailing feature. Over the years, the software has grown into an all-in-one marketing platform for creating impactful email campaigns as well as websites, a social media presence, and overall taking care of your audience. Intuit actually acquired Mailchimp in 2021.

How the QuickBooks integration works

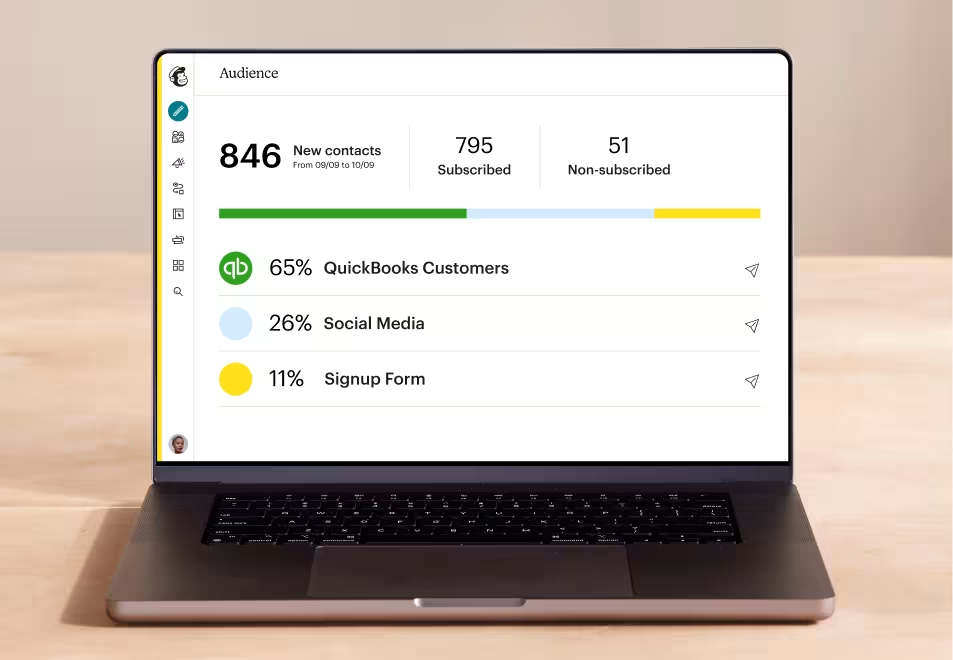

Image: Mailchimp

Integrating Mailchimp and QuickBooks brings your email marketing tools and financial data into one place.

By syncing revenue data from QuickBooks Online to Mailchimp, you gain the power to segment your customers based on their purchasing behaviour. Want to target high-spending customers with a special promotion? No problem! With this integration, you can segment new and existing customers based on their revenue for a more personalized and targeted approach to your marketing campaigns.

You can also say goodbye to manual contact and purchase data entry. Contact profiles and purchase data sync automatically, saving you time and effort.

Pricing

Free trial: 1 month

Essentials: USD $13/month for 500 contacts

Standard: USD $20/month for 500 contacts

Premium: USD $350/month for 10,000 contacts

7. HubSpot

HubSpot is one of the most popular CRMs among small businesses in Canada. It has a number of tools to take your business to the next level, including marketing, lead generation, and customer service. It is on the pricier side and may be a bit much for small businesses just getting started, but if you’re ready and able, Hubspot can be a great asset for your business.

How the QuickBooks integration works

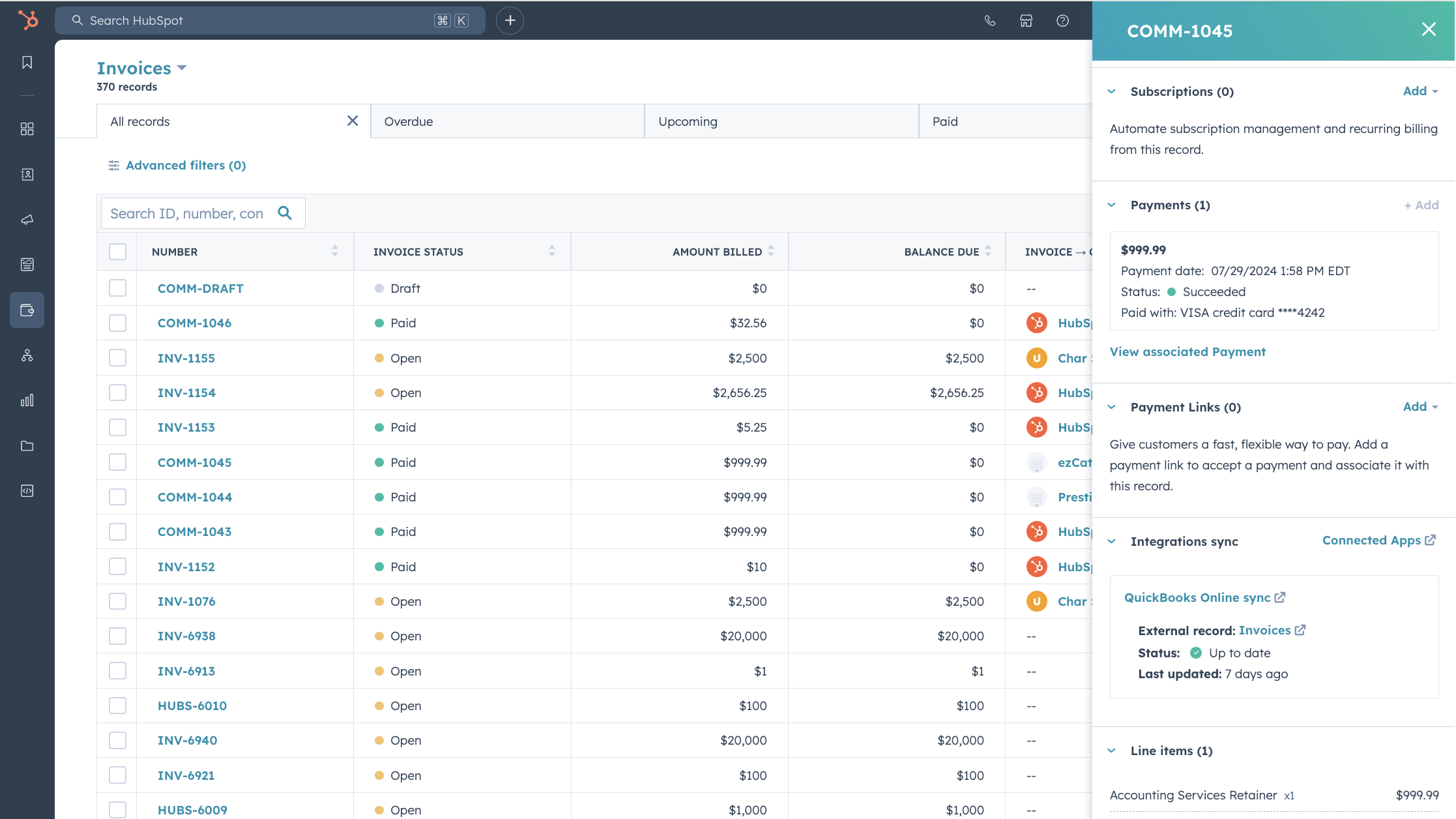

Image: Hubspot

HubSpot’s integration with QuickBooks creates bidirectional synchronization between the two systems. In other words, you can create invoices directly in HubSpot and both platforms update with this new information.

You can view invoices within HubSpot and manage the sync of invoices and contacts in QuickBooks. The integration also has customizable sync settings and rules for contacts, products, and invoices. That means better control over your data sync process.

Plus, you can review synced records and resolve any sync errors. Hello more accuracy and efficiency in your sales and accounting processes.

Pricing

Pricing varies depending on Hubspot product offering.

8. WooCommerce

WooCommerce is a customizable ecommerce platform built as a WordPress plugin. This open-source solution enables businesses of all sizes to create and manage online stores easily right through WordPress.

How the QuickBooks integration works

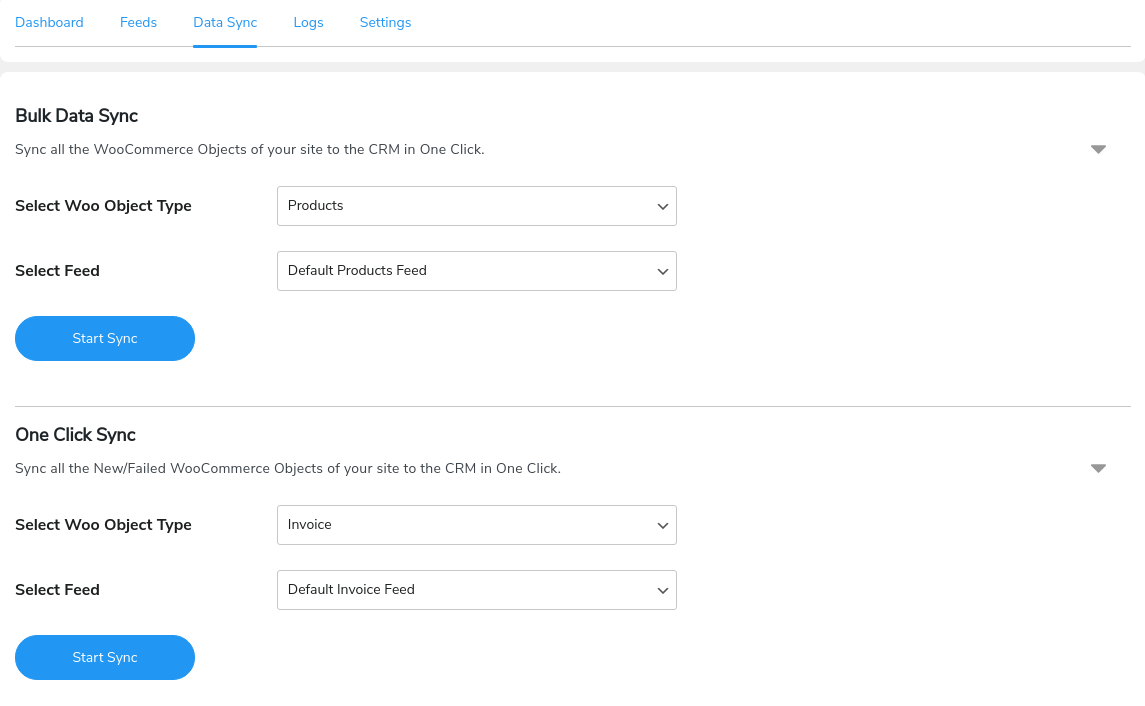

Image: WooCommerce

WooCommerce and QuickBooks integrate to form a powerful tool that brings ecommerce and financial data under one dashboard. Keep your orders, inventory, payments, taxes, and more in sync with a robust two-way integration that updates data quickly. Enjoy automatic syncing of payments and refunds while also having the freedom to customize settings.

Whether you use QuickBooks Online or Desktop, this integration aims to maintain data accuracy and consistency.

You can also connect multiple sales channels to QuickBooks Online, ensuring your stock levels are always up-to-date across all platforms.

Pricing

Pricing varies by what services you need.

9. Zapier

Zapier is all about taking workflow automation into your own hands without needing IT or developers to build connections between the tools you want to automate. The way it works is it connects two or more apps together so that you can work more effortlessly between them. It offers a number of solutions for various areas of business, like marketing, IT, sales, customer support, and more.

How the QuickBooks Integration works

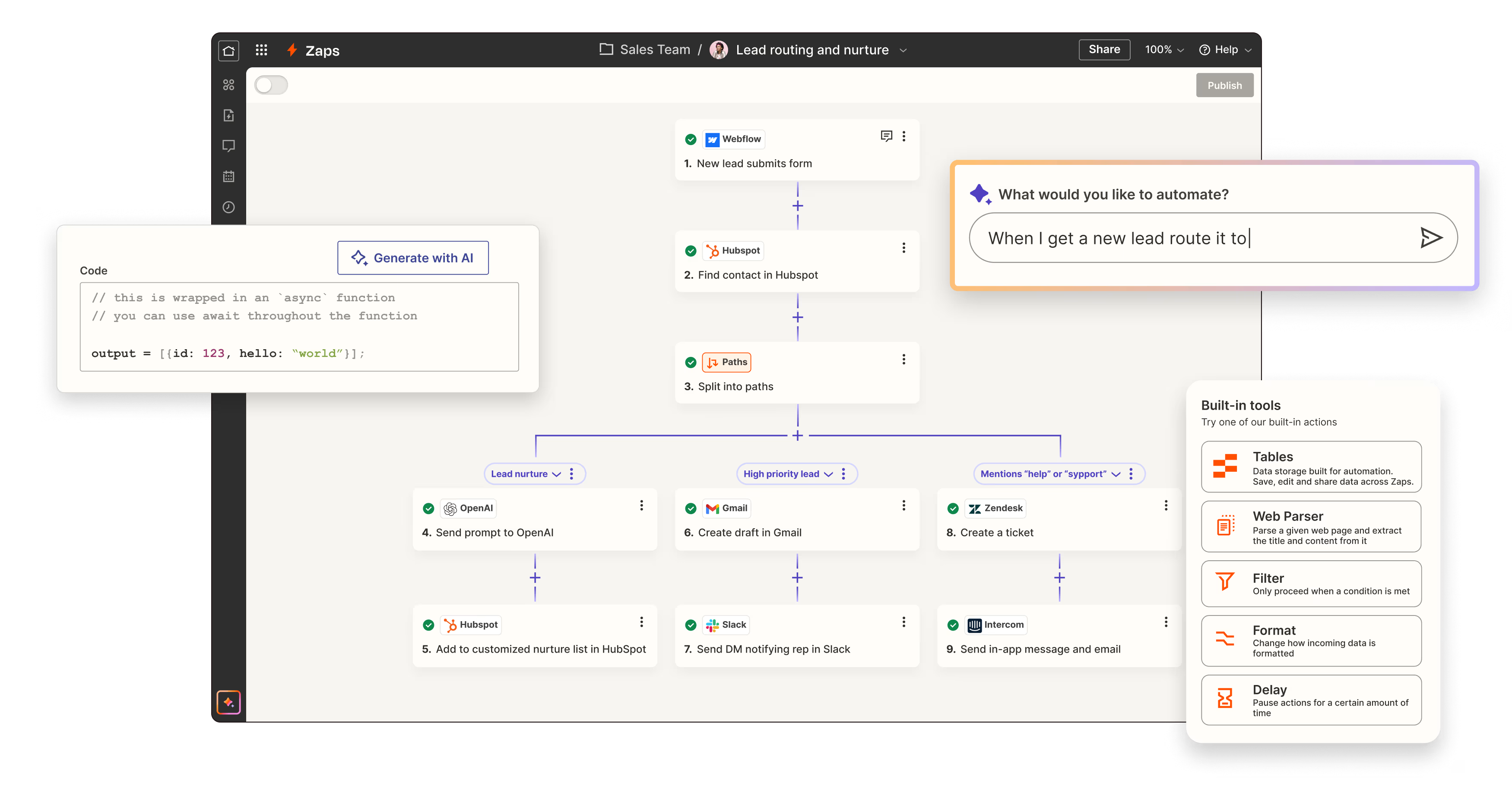

Image: Zapier

This is flagged as “Premium” integration in Zapier’s stack of connections, meaning it’s only available on a paid Zapier plan. With Zapier, you can connect QuickBooks Online to other apps in your tech stack to simplify tasks like dealing with invoices, expenses, customers, and so on.

Apart from that, it can also be used to connect to other tools, like Stripe, Google Sheets, Slack, and so much more to QuickBooks.

Pricing

Free version

Professional: CAD $42.39/month

Team: CAD $146.31/month

Enterprise: Contact sales

10. Financial Cents

For small business owners who are bookkeepers or accountants, Financial Cents is an easy to use practice management software for small to medium sized firms. This software solution lets firm owners track client projects, automate their accounting workflows, and manage staff and clients.

How the QuickBooks integration works

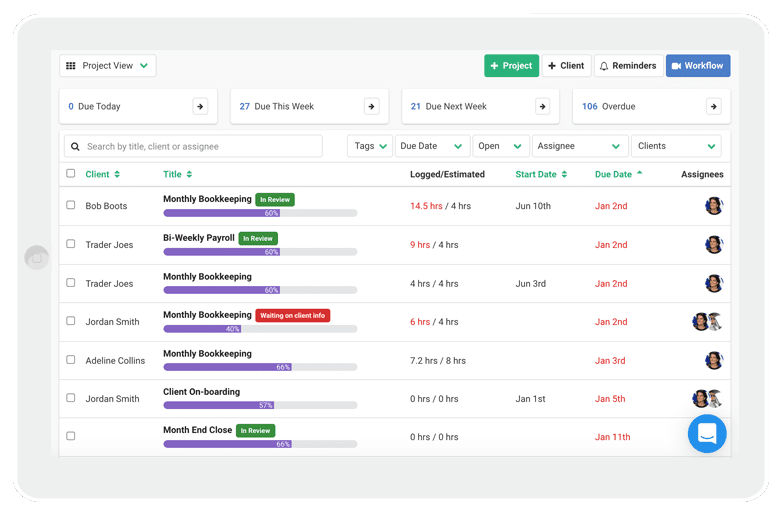

Image: Financial Cents

Financial Cents’ integration with QuickBooks lets accounting and bookkeeping firm owners to easily import and auto-sync clients from QuickBooks to Financial Cents in seconds, sync time tracked in Financial Cents with QuickBooks Online for invoicing, and add QuickBooks Online service items to Financial Cents for invoicing and reporting.

When you add new clients to your QBO account, it also automatically gets added to Financial Cents, and changes you make to existing clients in QBO automatically update in Financial Cents using this integration.

Pricing

Solo Plan: USD $19/month

Team Plan: USD $49/month/user

Scale Plan: USD $69/month/user

Final thoughts on QuickBooks integrations to optimize workflows.

As you can see, there’s no shortage of Intuit QuickBooks integrations for small business owners of all kinds to level up workflows and give insights into the bigger picture their companies. Meaning business growth, and who doesn’t want that?

Integrating QuickBooks and Wagepoint

One must-have integration is a QuickBooks integration for payroll. And you don’t have to search further with Wagepoint. Think of it as managing payroll the easy way.

Ready to experience the ultimate power of QuickBooks and Wagepoint? Get started today to simplify how you work with payroll and your other small business bookkeeping.