Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

When I first started my bookkeeping business, I was using about ten different software for bookkeeping, payroll and organization. Not to mention programs for email, HR and other administrative tasks.

Oof. Thinking about it gives me a headache!

I knew I had to simplify things — not just for myself, but for my clients as well. Surely they didn’t want to use multiple software either. Switching between each of them for different tasks simply takes too much time. Talk about a loss in productivity. I’ve always tried to make bookkeeping easier for my clients and not a headache.

So, I started working on what I’m calling the Simplified App Stack, where I use five-to-seven of the best apps for bookkeeping that I could find for my business.

Why build a Simplified App Stack?

Whether it’s accounting apps, payment apps, mileage apps or whatever else you can think of (there’s probably an app for it!), there’s a wide variety of solutions out there built for real-time results and efficiencies.

However, in order for business owners to be efficient, we actually need to reduce the amount of apps we have, not add more.

Have you ever tried to go do something and realized you’re in the wrong software for that? I have. Then you have to login somewhere else to find the most basic thing. Not something I recommend.

I ran my business by myself plus a casual employee for the first four years. It was thanks to building up so many efficiencies with a minimal amount of apps and processes that I could handle most of it without getting burnt out.

With the right bookkeeping apps and software, we can run our businesses and lives more smoothly. I always like to say that you should be using a software to its very limit before you expand to something else. The Simplified App Stack method will definitely help with that and making sure you have the best options and right software for your bookkeeping and clients’ needs.

What to consider when choosing your apps.

When I choose a new app for my business (or even recommend one to other bookkeepers or my small business clients) I try to ask five questions.

Do I already have something that could do this?

For example, why pay for Zoom when I already have Google Meet? Why pay for a social media scheduler when I can schedule inside Meta? Why learn something new when I’m already used to the tech I have?

What is the cost for this and is it a reasonable price?

Does this save time or money? If I’m going to have to spend twice as long formatting emails, can I make it easier by using another product that costs $2/month more instead? Considering how the pricing plan is structured, such as whether it’s a monthly subscription or otherwise, is important, too.

What is customer support like?

If or when I run into issues, are they able to help me? Is customer service strictly knowledge base articles or can I talk to an actual human? Is the customer contact information easy to find? Will the customer support team take time to learn about my pain point and get to the bottom of it? Am I treated like an individual or just a number? (As you can see, this one comes with a lot of questions!)

Will this make my life easier or harder?

Apps should make the lives of bookkeepers, other small business owners and really all users simpler. If you find task switching overwhelming or maybe you just don’t want to have ten different tabs open to do one task, it’s time to find something to make it easier.

Who does this impact?

When I chose to use Wagepoint exclusively in my firm, I had to consider all the pros and cons of doing that. It meant that I was making a choice for my clients and future clients. It’s important to find apps that not only work for you and your business, but also for your clients and their employees. For me, having an app that works for everyone in a positive way is a win-win, and how can I say no to that?

Best bookkeeping apps to include in your simplified stack.

These are the five apps I have in my Simplified App Stack that keep me efficient and headache-free as I work with my team and my clients.

- Wagepoint

- Time by Wagepoint

- Xero

- Hubdoc

- Google Suite

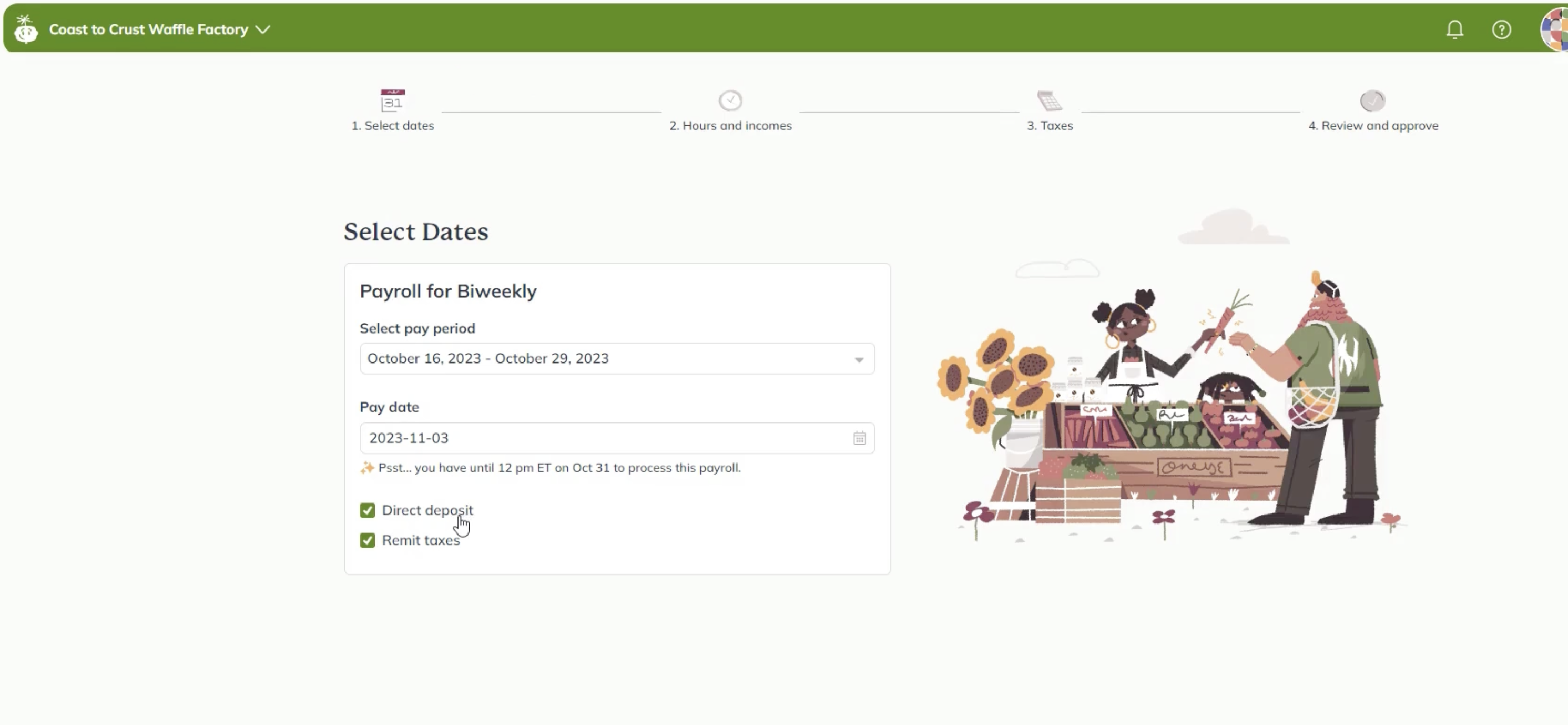

Wagepoint

For all my payroll and HR needs, I always recommend Wagepoint. Before, I was using five different payroll solutions. Now, it’s just one, and it has been a game changer as a bookkeeper.

Why did I choose to use Wagepoint for my bookkeeping business and make all my clients use it? Simple: It’s efficient, effective and easy to use.

One of the best things about Wagepoint is the auto-run feature. If you have regular salaried employees, you can turn on auto-run for your payroll file and it processes payroll without manual input. It cuts down on the time it takes to manage payroll, and you don’t have to remember to process payroll.

Finally, for my clients, I also consider the end user — the employees and/or independent contractors. It’s really helpful that they can explore their pay stubs themselves, get their copies of year-end forms come tax season or even just update their personal data. It saves so much time for payroll administrators — or even my clients — to let the employees or contractors self-serve.

Wagepoint keeps payroll simple. You can easily handle tax deductions as well as add bonuses, non-payable taxable benefits (like Wellness Spending Accounts), vacation pay and retro-pays. If you forgot something, you can reverse the pay run and redo it. Plus, it has the payroll reports you need to make sure everything is in order and even help you with payroll advisory for your client.

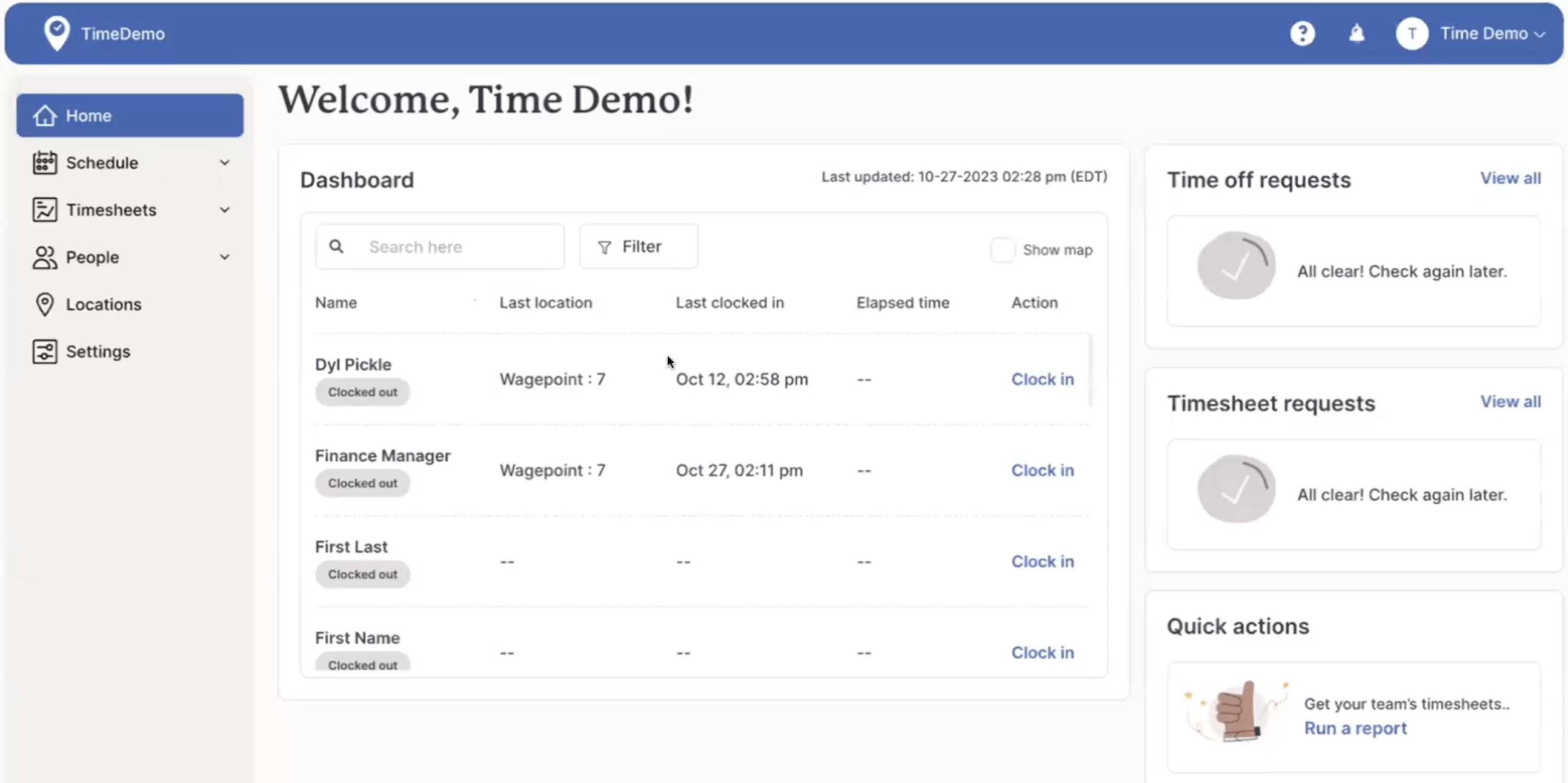

Time by Wagepoint

I recently switched to Time by Wagepoint to track my employee hours. It shows the efficiency of my staff plus what they are generally working on. A massive plus here is that it also works with Wagepoint (obviously).

Typically, you’d need several different software depending on your business type to track employee hours and schedule them. Time by Wagepoint does all of that. You can schedule your employees, you can assign them to jobs or locations and you can also just have regular “let the clock run” jobs.

The other perk to Time by Wagepoint is that employees can request time off in the same app. You can approve it there and don’t worry about forgetting that people are off when creating schedules.

Finally, if you’re using it with your clients, they have to approve any timesheets before they get sent to payroll, so this eliminates any issues around controls and sign-offs.

Keep it simple and keep your payroll and schedules in one spot.

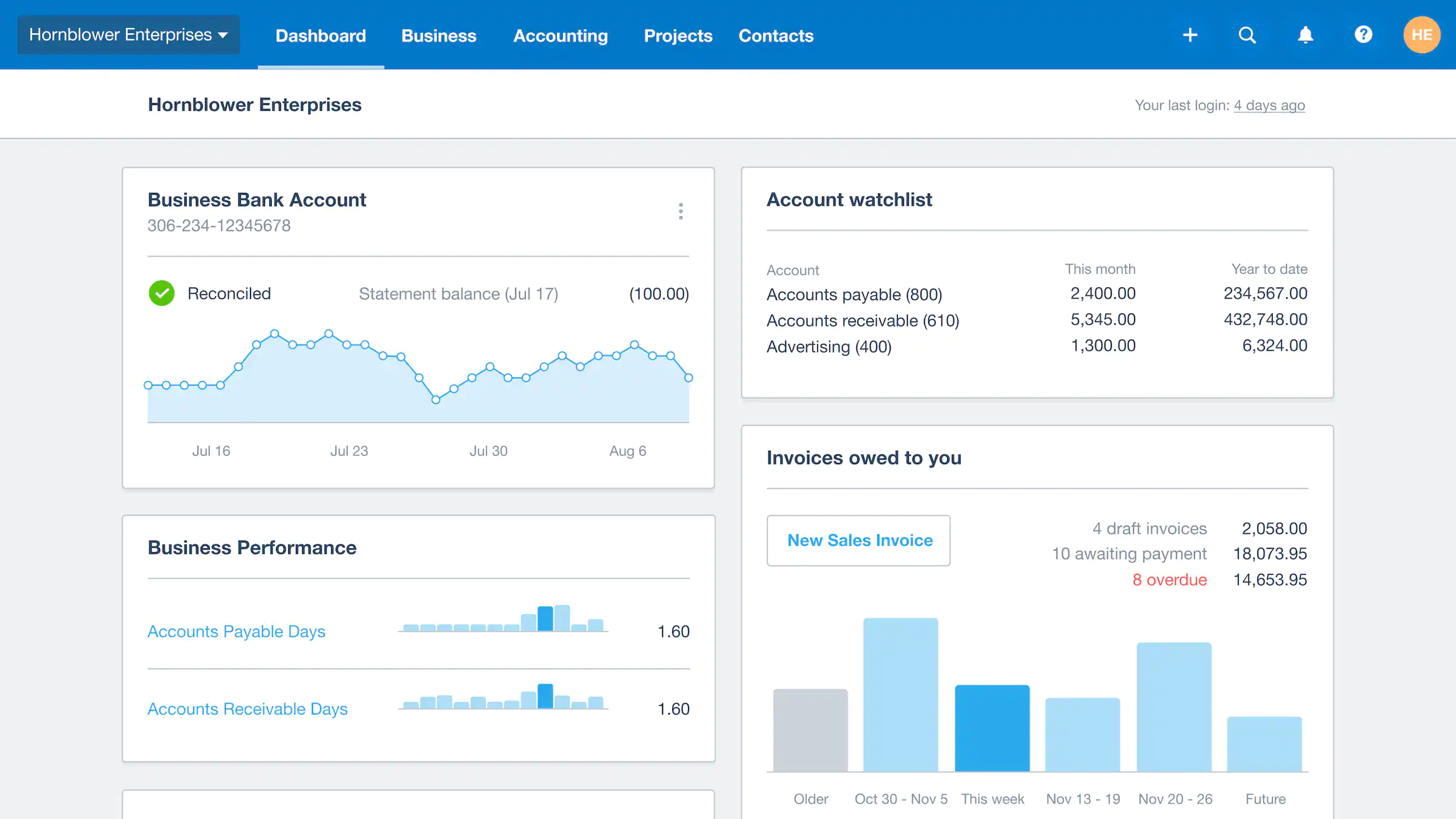

Xero

Image: Xero

For all my bookkeeping and accounting software needs, I use Xero and only Xero. As a remote-first small business, I needed something that could work the best in the cloud. Xero is the best and easiest accounting software to handle invoices, expenses, financial reporting and other financial data.

Apart from these accounting features, you can use Xero’s “Ask” feature to get payroll documents or other information and documents from your clients securely. Xero also integrates with practically everything, so it also reduces hours spent on a file to something more manageable.

Speaking of payroll and integrations, the Wagepoint and Xero Integration will publish your payroll journal as a bill so that you can quickly reconcile and move on. No need to worry about mis-typing something, exporting .CSVs or even job costing. You can do all that with the integration in a way that makes it so simple and easy to do.

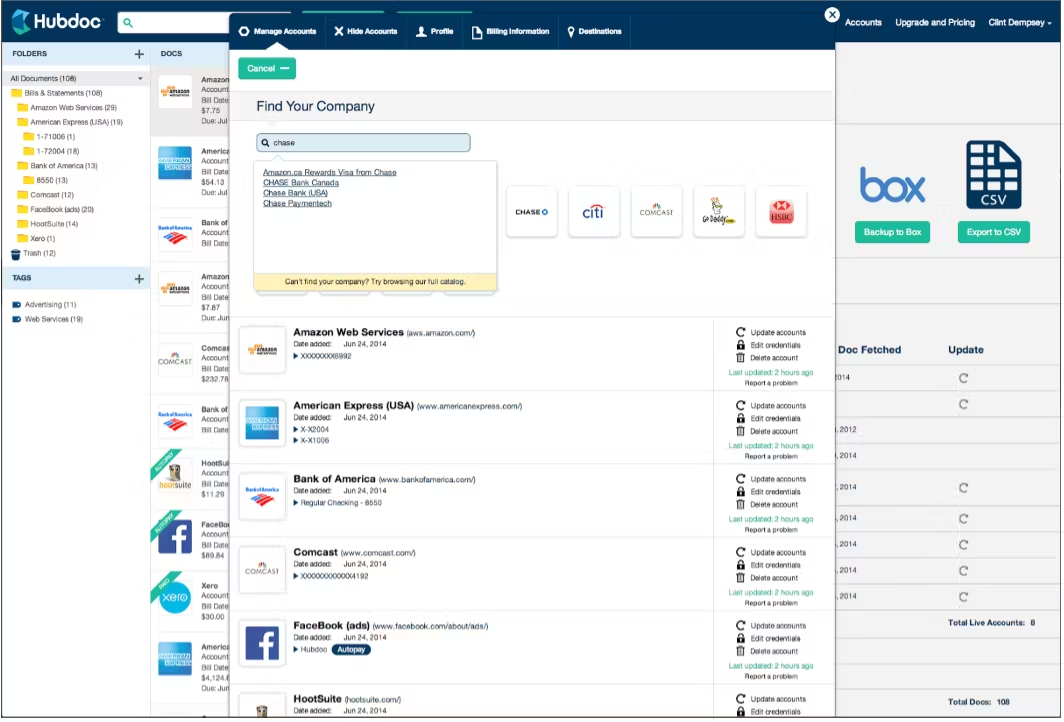

Hubdoc

Image: GetApp

As a remote-only bookkeeping firm, I needed to find a way to accurately and reliably get receipts from my clients. Source documentation is very important for financial records as we all know.

Since it’s as easy as snapping a picture with the mobile app, scanning and uploading receipts or emailing images or PDFs, I went from missing 80% of receipts to only a couple each month. I then push documents into Xero. With machine learning, it can take a year-long catch up file from days of work to just hours.

Plus, Hubdoc has bank statement extraction, so all we really need are PDFs or images of statements now to get the bank reconciliation done. So simple!

Google Suite

Finally, I use Google Suite for the rest of my business needs. While this may not immediately seem like a bookkeeping app, it has many great features that help with other bookkeeping tasks besides transactions, cash flow or balance sheets.

For example, since I already have to pay for the email address, I have video meetings using Google Meet. I find it’s better than alternatives because you don’t have to download a software just to have a meeting.

Also, rather than having Slack for company communications, we just use Google Chat. Again, it’s keeping everything in one place versus needing several solutions for one thing.

Finally, I use my calendar for everything, and since I already use Google Calendar personally, it was a natural fit.

On another note, I’m relatively tech savvy, but setting up email addresses is not something I’m particularly passionate about. Google makes it easy. Whether it’s for an individual or creating alias group emails (such as info@), it’s super easy to make it happen.

Finding your best bookkeeping apps and building your stack.

Ultimately, finding great apps that are right for your bookkeeping business might take a bit of trial and error.

At a minimum, when building your Simplified App Stack, you should consider customer support, ease of use and user interface when choosing an app. This is true whether you’re looking for the best accounting software, an app with all kinds of advanced features or just something with more basic features to make tax time a little easier.

As for payroll… I know that saying that payroll can be fun is a little weird, but using apps like Wagepoint makes it, well, fun. Friendly customer support and an easy to use, simple interface — these are all winning features. This simple solution is a great starting point for building the best bookkeeping app stack for your firm.

Learn more and get started with Wagepoint.