Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

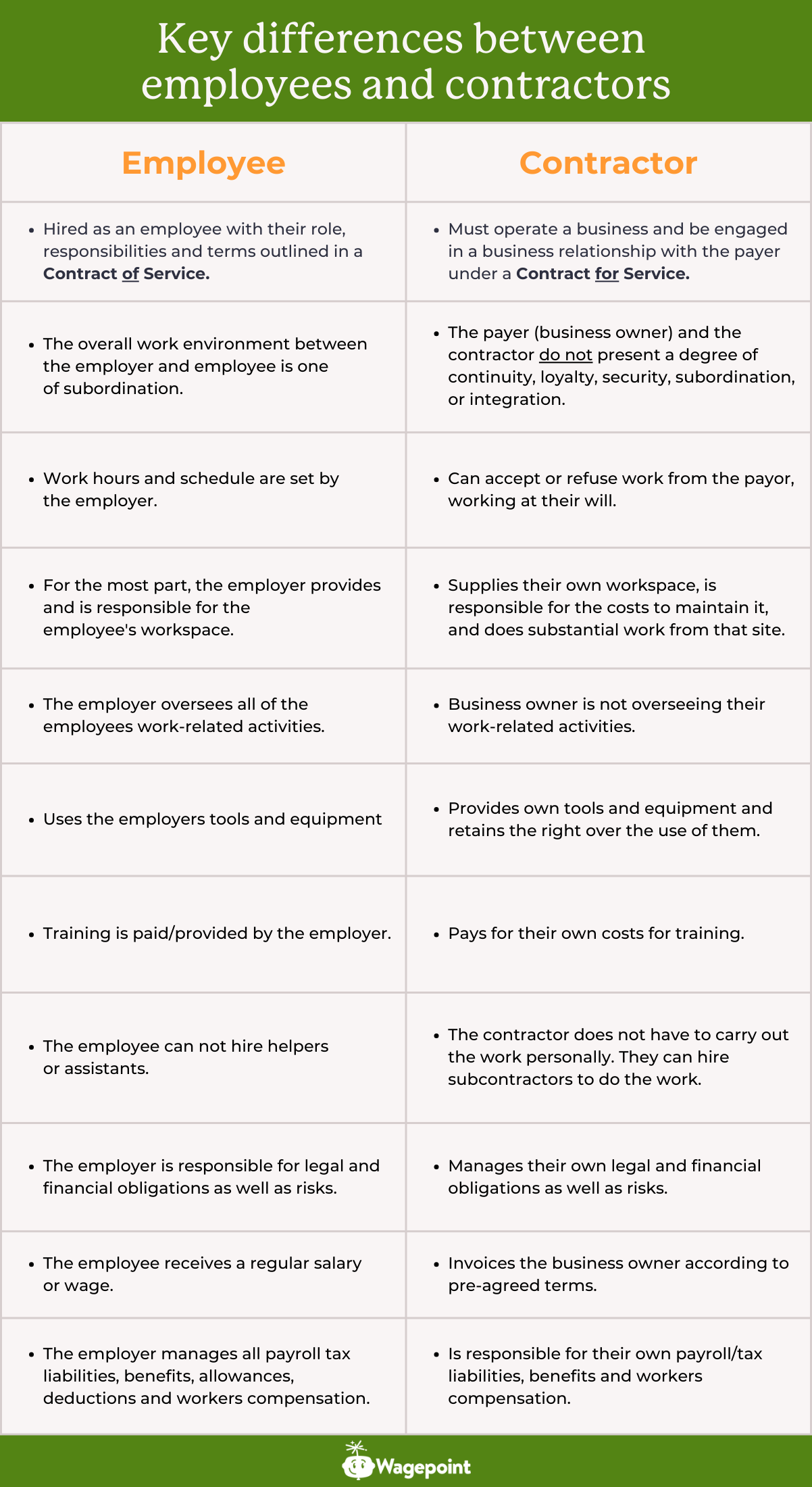

Whether you’re bringing on your first hire or your fiftieth, it’s important to know the difference between an employee and a contractor. Why? Because misclassifying workers can lead to payroll headaches, tax troubles, legal issues and compliance issues. The Canada Revenue Agency (CRA) holds employers responsible for getting this right, so understanding the key differences is crucial.

Before we break down the differences, let’s take a quick look at how the job market in Canada is evolving.

The Side Hustle Boom – AKA Gig Work

Did you know that 51% of gig workers take on extra work without their permanent employer knowing about it? Yep… The main reason is to make extra money.

In fact, as of 2024, about 7.3 million Canadians — roughly 22% of the adult population — are participating in gig work as contractors. This includes everything from rideshare and delivery services to freelance projects.

With companies like Uber and Upwork leading the way, more workers are choosing flexible, contract-based jobs. However, there have been several legal challenges to this because there are times when the lines between employee and contractor get blurred.

But gig work isn’t the only alternative to traditional employment—many Canadians are also choosing to go fully independent. That brings us to…

The Rise (and Reality) of Self-Employment in Canada

In 2023, 13.2% of Canada’s workforce — about 2.65 million people — were self-employed. That’s a big number, but not as massive as some earlier predictions, which guessed nearly 45% of workers would go solo.

Why hasn’t self-employment exploded even more? Well, while being your own boss sounds great (hello, flexible hours and unlimited coffee breaks ☕), it also comes with extra risks and responsibilities. Understanding these differences is key to staying compliant and avoiding costly mistakes.

How the difference between an employee and a contractor affects small businesses.

For small businesses, choosing between hiring an employee or a contractor can affect costs, flexibility, and legal responsibilities. Contractors can help businesses save on payroll taxes, benefits, and long-term commitments, making them a great option for short-term projects or specialized work. Employees, on the other hand, provide stability, long-term growth, and stronger company culture.

However, misclassification is a big risk. If an employer hires a worker who is treated as a contractor but the new hire legally qualifies as an employee, their business could face penalties, back taxes, and legal challenges.

Take for example, this case with Pizza Hut Canada.

In January 2022, a class-action lawsuit was filed against them, alleging that delivery drivers were misclassified as independent contractors. The claim seeks entitlements under the Employment Standards Act, 2000 (ESA), such as minimum wage, overtime pay, and vacation pay.

For small businesses, the key is understanding classification rules to ensure compliance while making the best hiring decisions for growth and sustainability.

Determining whether someone’s an employee or contractor.

Don’t be ashamed if you don’t know the answer off the top of your head. It’s a question that trips up even some of the most experienced business owners.

As a starting point, it’s best to consult the Canada Revenue Agency (CRA)’s RC4110 Guide. Basically, the CRA uses a 2 step approach to help employers identify whether a worker should be classified as an employee or contractor.

- The first step is to determine the intent of both parties when entering into the relationship. CRA will look to see if:

- The written agreement is a “contract of service” — which signals an employer-employee relationship or

- The written agreement is a “contract for services” — which signals a business relationship.

- The second step is employers are required to assess factors like:

- Control

- Does the payer direct how, when, and where the work is done?

- Can the worker work for other clients?

- Tools and Equipment

- Does the worker provide their own tools and cover maintenance costs?

- Does the payer supply and control the use of tools?

- Subcontracting & Hiring Assistants

- Can the worker hire others to do the work?

- Must the worker personally complete the tasks?

- Financial Risk

- Does the worker have unreimbursed expenses or fixed costs?

- Is the worker financially liable if the job isn’t completed?

- Investment & Management

- Has the worker made capital investments in their business?

- Do they manage staff or operational decisions?

- Opportunity for Profit or Loss

- Can the worker increase earnings by managing expenses or negotiating contracts?

- Is the worker paid a guaranteed salary regardless of business performance?

- Control

Misclassifying a worker as an employee or contractor is a serious legal issue with costly consequences. The CRA advises that contract disputes may be interpreted under different legal systems depending on where the contract was formed, unless stated otherwise.

Employers who knowingly misclassify workers violate multiple laws and face harsh penalties. Contractors and third parties involved may also be held liable. To avoid risks, businesses should carefully assess worker status and if they are still unsure, request a ruling.

Request a ruling from the CRA.

While the CRA guide provides best practices to help determine the working relationship it does not replace a formal request for a ruling. Workers and employers can request a ruling to determine whether a specific period of employment is pensionable, insurable, or both. You can do this by any of the following:

- Logging into your CRA account and selecting “Request a CPP/EI Ruling.”

- Ask your authorized representative (ex. bookkeeper/accountant) to request a ruling.

- Print and complete Form CPT1.

Important: You must request a ruling by June 29 of the year following the relevant employment period. If employment conditions change after a ruling, a new request may be necessary.

View this post on Instagram

Determining worker status in Québec.

If you’re a business owner in Québec and you and your worker have a disagreement over the worker’s status, then either of you can request for a ruling from Revenu Québec. Regardless of the applicant, the following forms must be filed:

- Form RR-65-V — Application for Determination of Status as an Employee or a Self-Employed Worker

- Form RR-65.A-V — Questionnaire to Determine the Status of an Employee or a Self-Employed Person

Employees versus contractors — the pros and cons.

In this section, we’ll discuss the pros and cons of each working relationship. However, we’re putting the terms in quotations because every business is different. A pro for one business might be a con for another and vice versa.

The pros of hiring employees

- More control over deliverables and outcomes. As a business owner, you have direct oversight of employees’ work, allowing you to guide projects, set clear expectations, and track key performance indicators (KPIs) to ensure quality and consistency.

- More control over work hours. Employees adhere to set work schedules as outlined in their contracts, providing consistency in availability and making it easier to manage labor costs. This structured approach minimizes scheduling challenges and ensures a reliable workforce.

- Stronger workplace relationships – Employer-employee relationships are often easier to manage than client-contractor dynamics, particularly in collaborative office settings. With direct supervision and the ability to measure work performance more effectively, teams can develop stronger connections, fostering a more cohesive and productive work environment.

- Take advantage of available tax credits and incentives.

- Apprenticeship Job Creation Tax Credit (AJCTC) which allows employers to claim up to $2,000 per year for each “eligible apprentice.”

- The Co-operative Education Tax Credit in Ontario lets eligible employers claim between 25% to 30% of the cost of hiring a student through a co-op work placement for up to $3,000 as a tax break.

- As well as many other provincial tax credits and incentives especially as they relate to hiring apprentices.

The cons of hiring employees

- Increased management responsibilities Employers need structured processes and KPIs in order to effectively manage employees. Additionally, all in-house training and associated costs fall under the employer’s responsibility, requiring time, effort, and financial investment.

- Greater financial commitment. Employers must comply with minimum wage laws in their province or territory and cover salary costs, payroll withholdings, employment taxes, and other government-mandated contributions. Additionally, expenses for employee benefits, such as healthcare, pension plans, and paid leave can significantly impact overall labor costs.

- Limited talent pool. Depending on the role, skills and seniority, the talent pool can be limited to the business’ locale. This means even where talent is plentiful, there’s usually a talent war amongst competitors, which impacts an employer’s ability to recruit the best talent.

The pros of hiring contractors

- Lower equipment and training costs. Contractors supply their own tools, office space, and training, reducing business expenses. Additionally, contractors are also responsible for all their own training in order to have the necessary skills to complete a job.

- Less financial responsibilities. Unlike employees, contractors handle their own taxes and benefits, which helps businesses save on payroll costs and administrative burdens.

- Minimal supervision required. Experienced contractors work independently and deliver results without the need for constant oversight or instruction, allowing businesses to focus on other priorities.

- Access to specialized skills. Businesses can source niche expertise without committing to long-term employment.

- Flexible work arrangements. Contractors offer scalability, allowing businesses to increase or decrease workloads as needed. They can also subcontract tasks, providing clients with a broader range of services through a single provider.

- Easier contract termination. Additionally, both parties are free to cancel the working relationship, depending on the terms of the contract.

The cons of hiring contractors:

- Higher potential costs. Depending on supply and demand, hiring a contractor may cost more per hour than employing a full-time worker.

- Less control over work schedules. Contractors set their own hours, which may not always align with your business needs.

- Risk of misalignment in expectations. Without clear contracts, communication gaps may lead to inconsistent quality or unmet expectations.

- Inconsistent availability. Contractors work with multiple clients and may not be available when needed.

- Compliance risks. Misclassifying an employee as a contractor can result in penalties, back taxes, and legal issues if the CRA determines the worker should be treated as an employee.

Can a contractor become an employee or vice versa?

Yes, this transition is common. Contractors may become employees as businesses grow, while employees sometimes shift to independent contracting.

However, the change isn’t automatic — worker status remains the same unless the contract and working terms are formally updated. To transition, the original agreement must be modified from a “contract for services” to a “contract of service” or vice versa.

Switching from contractor to employee.

Transitioning a contractor into an employee requires following standard hiring and onboarding procedures. This includes having them complete the Form TD1, Personal Tax Credits Return, along with other required employment documents.

Beyond paperwork, it’s essential to understand how the working relationship will change. Here are key factors to consider:

- Payroll tax responsibilities. As an employer, you’ll now be responsible for deducting and remitting income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums to the Canada Revenue Agency (CRA).

- Benefits. Unlike contractors, employees typically expect benefits such as health insurance, vacation pay, and other workplace perks. You’ll likely need to enroll them in your company’s benefits plan.

- Employee handbooks. Most businesses provide employees with an employee handbook that outlines company policies, expectations, and legal rights. This document helps ensure clarity, compliance, and protection against potential disputes or claims.

Paying and managing year-end slips for employees and contractors.

Understanding the difference between employees and contractors is essential, but using payroll software that supports these role distinctions is just as important. Since they follow different payment structures, payroll software can simplify the process by automatically applying or skipping payroll taxes as needed.

When it comes to issuing year-end forms for both of these workers, employers are required to issue employees a T4 Statement of Remuneration Paid and contractors a T4A slip – Information for payers. Thankfully Wagepoint can manage both for employers and file them directly with CRA with a few clicks.

The consequences of misclassification.

Understandably, the Canadian government is strict when it comes to businesses avoiding paying taxes. When it comes to misclassification of workers, employers can potentially face serious damages imposed under the Canada Labour Code, Income Tax Act, Employment Insurance Act, Canada Pension Plan, as well, the provincially regulated Employment Standards, Workers Compensation and other employment regulating bodies.

In the minimum, failing to withhold the necessary source deductions ( CPP, EI, and income tax amounts), will result in a fine of either 10% of the amount not deducted or 20% of the amounts that were not deducted for a second or additional failures in a calendar year, if done so knowingly or under circumstances of gross negligence.

Late payment interest fees will also be applied to all amounts outstanding using quarterly prescribed interest rates.

Employers are deemed to hold funds in trust for the government, which means failure to pay those funds can result in a court judgment being made, allowing the CRA to potentially:

- Garnish wages or other income sources.

- Seize and sell assets.

- Use any other means allowed by the law to collect an amount owing.

Garnishment action allows the CRA to intercept funds payable to you by a third party, such as wages or other income sources, or from any other federal government department owing you money.

Make the right hire.

The problem for small business owners isn’t finding talent — it’s finding the right type of talent. Fully understanding the differences between employees and contractors can help you make the best choice. No matter which type of worker you choose, be sure not to misclassify them. The repercussions can be costly.

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.