Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

This is the US version of our small business tax guide for sole proprietors. For the Canadian version, click here.

February 2019 Update: The tax brackets for individuals have changed. Be sure that you’re filing and paying accordingly. The standard deduction has also nearly doubled, meaning that in many cases you can skip itemizing and take the simpler, standard deduction instead. If you have children, you’ll be happy to know that the child tax credit has also nearly doubled.

January 2018 Update: The Tax Cuts and Jobs Act (TCJA) that passed into law December 2017, will affect your filing in January 2019. In order to help you stay informed, we added a section on a potential new tax deduction for sole proprietors. (See the quick links below).

Quick Links

In a hurry? Click on any of the links below.

Are you a sole proprietor?

A potential new 20% tax deduction (2018 tax year|2019 filing)

Tax season goals

Filing deadline

Preparation checklist

Overview of Schedule C

Mistakes to avoid

Best practices

5 minutes of fun (or more)

“The tax world can be a scary place for small business owners, especially sole proprietors that are running the show alone most of the time. With the ever-changing tax code, owners struggle to keep up with the do’s and don’ts of income tax, and it’s so important to stay up to date (or hire a CPA) to get it done right.”

— Emily Dear, Co-Founder, regroupTAX

Taxes. They’re only one letter away from being a four-letter word. Frankly, it’s close enough in most people’s books.

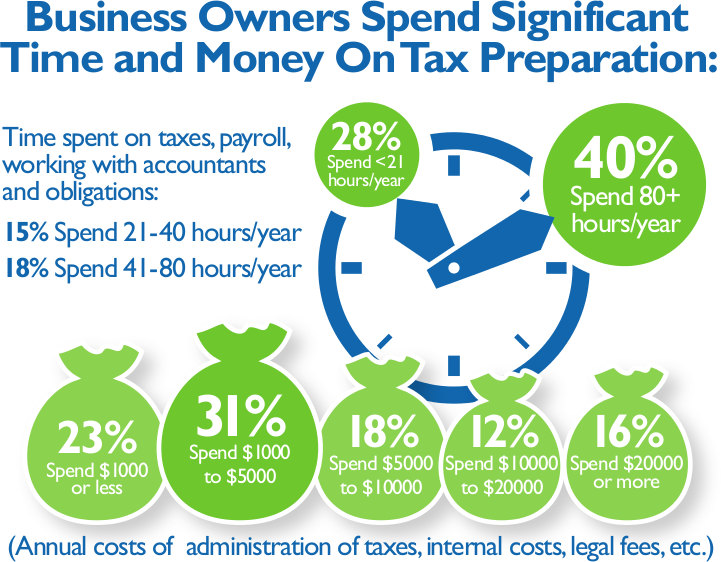

According to studies, 60% of small business owners feel that administrative burdens, like mundane paperwork and attempting to understand seemingly undecipherable tax laws, are the most unpleasant part of tax season. It’s also a task that consumes an average of 80 hours (3 ⅓ days) each year.

Further complicating things 40% of small businesses fail to provide their tax providers (accountants, bookkeepers and tax professionals) with the proper records and documentation. Perhaps this is why almost 50% of small businesses end up filing extensions.

Source: Score Infographic Accounting and Taxes

Your Guide to Small Business Taxes as a Sole Proprietor

While we can’t change the laws or that fact that have to file taxes, we can create this guide to help walk you through what you need to prepare and better understand the process.

Before we start, we want to emphasize that this guide is intended for small businesses operating as sole proprietorships (sole proprietors) who will file their business taxes along with their personal taxes using a Schedule C Profit or Loss From Business and Form 1040 Individual Income Tax Return.

Also, if you take any part of this guide to heart, remember this one point: It is to your advantage to work with a tax professional. Having an accountant, bookkeeper and, if necessary, a tax attorney, on your side can make a world of difference to your during tax season and throughout the year. (Yes, startups, we’re talking to you too.)

“For most small business owners, taxes end up at the bottom of a very long list of things to worry about. Having a professional handle your taxes can take an important load off of your shoulders (and off your mind), allowing you to stay focused on growing your company.

— Anjum Tunulim, Chief Tax Officer, Early Growth Financial Services

Sole Proprietorship and Your Small Business Taxes

A sole proprietorship (sole proprietor) is the most common form of small business ownership. As implied by the word sole, it a single-owner business. In the eyes of the Internal Revenue Service (IRS) and similar organizations, it is also considered an unincorporated business. (In other words, you’re not being publicly traded on the Nasdaq stock exchange.)

As a sole proprietorship is not considered a separate entity from the owner, business taxes are filed along with the owner’s personal taxes. You must file business taxes when your net earnings reach $400 or more.

While that sounds pretty straightforward, sole proprietorships often face higher scrutiny with over 2% of sole proprietor returns with receipts of $25,000 were audited — more than double the .8% audit rate for individual tax returns.

Should you have questions about your business structure and what’s best for you, it’s best to consult with a small business lawyer, accountant or both as the choice you make has legal and financial implications.

If you are a sole proprietor with less than $5,000 in business expenses, you may qualify to file a Schedule C-EZ. The requirements are very specific and if you’re unsure, it’s best to contact a tax professional.

Sole proprietors with of more than one business must fill out a Schedule C for each business.

How the new TCJA will Affect Sole Proprietors

Unlike corporations (C corps), sole proprietors, partnerships and S corporations are considered pass-through entities. This means that the profits from the business pass through to the owners, who then pay business taxes as part of their personal taxes.

Under the new law, corporations will be taxed at a flat rate of 21%. However, pass-through entities will be subject to varying rates based on income brackets, which means their tax rates can be as high as 37% at the top end of the tax bracket.

This is why the TCJA created a new 20% deduction for pass-through entities, known as Internal Revenue Code Section 199A (new IRC Sec. 199A). With this deduction, the business owner pays taxes on the remaining 80% of business income, in turn lowering their tax bracket and rate.

For those with a joint income between$315,000 | $157,500 single and $415,000 | $207,500 single, the total amount of the deduction is lessened or “phased out.”

Once income exceeds the maximum, the deduction can’t be any greater than 50% of the owner’s applicable share of the W-2 employee wages paid by the business or 25% of the owner’s share of the W-2 wages paid by the business plus 2.5% of the original purchase price of long-term property or equipment used in the production of income for the business.

Service businesses, where the principal asset is the reputation or skill of the owner(s)(doctors, lawyers, accountants, etc.), can’t claim the deduction once their income exceeds $415,000 | $207,500 single.

It goes without saying that you’ll want to work with a knowledgeable professional to make the best choices for your business. The summary above is based on the detailed overview provided by Nolo. If you like to look at more than one resource, there’s this summary from JD Supra.

As this is a new law, it’s still undergoing clarification. On February 21, 2018, The American Institute of CPAs sent an urgent request to the Internal Revenue Service and the Treasury Department, asking for “immediate guidance” on several aspects of this deduction.

The Goals to Aim For Every Tax Season

In addition to getting your taxes finished on time, your goals should be:

- Getting the reports, receipts and documents you need together ahead of time.

- Avoiding mistakes like missing or incorrect information that can lead to processing delays or even audits.

- Lowering your tax bill by maximizing your small business tax deductions.

“As tempting as it is to ignore, it’s worth catching up on overdue bookkeeping well before tax season rolls around. Having tax-ready books can help you comply with IRS recordkeeping requirements and file an effective tax return.”

— Bryce Warnes, Content Coordinator, Bench

The Filing Deadline for Your Schedule C as a Sole Proprietor

The deadline for filing your Schedule C with Form 1040 is typically April 15 (a good rule of thumb to use as a target). When this date falls on a weekend, your filing is due the next business day. And when the Monday following the weekend is a holiday across the country or simply in Washington DC, this pushes the date one my day. The filing deadline for 2018 is Tuesday, April 17.

Other deadlines:

- If you owe business taxes, the deadline for paying these taxes is the 15th day of the 3rd month after the close of the fiscal year — March 15, June 15, September 15 and December 15. (If the 15th falls on a holiday or weekend, payment is due the next business day.)

- If, for any reason, you need to file an extension for your small business taxes, using Form 4868 submitted on or before the April deadline for personal income taxes.

Your Schedule C Preparation Checklist

While a Schedule C (Form 1040), Profit or Loss From Business is only two pages, it requires a surprising amount of information (little red wagon not included):

- Schedule C (Form 1040)

- This sounds obvious, but print a copy and use it as your checklist.

- You’ll also find the next section where we walk through the key parts of the Schedule C helpful.

- Business and personal identification:

- Your social security number (SSN).

- If you’ve registered your business for an employer identification number (EIN), you’ll need your registration confirmation document.

- If you’ve registered your business with any state and local departments of revenue or labor, you will also need these identification numbers.

- Your business address, as it appears in your registration documents for your EIN.

- Business and personal tax information:

- Any communications from the IRS

- Any amounts your business has paid in installments.

- If you’ve had any previous fines or audits, let your tax professional know and provide relevant records.

- Previous tax returns — If this is the first year you are working with your tax professional, it is helpful to provide a copy of last year’s returns.

- Ideally up to three (3) years back.

- Remember to include any state tax returns too.

- As you are filing your business and personal taxes together, you will also need to provide personal income information, including:

- Your tax filing status — single, married filing jointly, married filing separately, etc.

- SSNs for your spouse and any dependents

- Your W2s or 1099s

- Bonuses and commissions earned

- Income from trusts, investments and other sources.

- 401(k) contributions

- Charitable donations

- Medical and dental receipts

- Medical/health insurance statements

- Child care information

- Home mortgage payment statements showing interest

- Any communications from the IRS

- Financial statements/reports/documentation:

- General business

- Profit and loss (P&L) statement showing gross revenue (income)

- Balance sheet

- Purchase documents — If you acquired your business within the previous tax year.

- Employee/payroll reports

- Total wages paid to employees (W-2s)

- Total paid in employer taxes (Quarterly Form 941)

- Total paid to contractors (1099s)

- Bonuses and commissions paid

- If you are using small business payroll software, you will be able to pull reports containing this information.

- General business

- Business use of your home expenses

- Square footage calculations:

- The square footage of your home.

- The square footage utilized by your home office.

- Phone, internet and utility bills.

- Mortgage or lease payments (showing interest paid)

- Property tax statements

- Property insurance statements

- Repairs and Maintenance

- Square footage calculations:

- Costs of goods sold (COGS)

- Beginning and ending inventory amounts

- Raw material costs

- Labor costs

- Amounts for discounts, allowances and returns

- Vehicle (car and truck) expenses

- Month, day and year in which your vehicle was placed in service for business purposes

- Total number of miles driven — broken down into business, commuting and other.

- If you plan to claim actual expenses, you will also need:

- License and registration

- Loan or lease payment statements (showing interest amounts)

- Insurance statements

- Maintenance records and receipts

- Fuel and car wash receipts

- Parking receipts

- Form 5262 if claiming depreciation or amortization

- Sorry, you can’t deduct parking or traffic tickets. (Nice try, though.)

- General expenses/tax deductions:

- Phone and utility bills

- Bank receipts/transaction records/fees

- Business checking and savings account interest

- Interest on loans, leases and debts

- Costs for employee benefit programs

- Employer contributions

- Fees

- Invoices/receipts for:

- Advertising

- Professional services (including tax advisors and lawyers)

- Travel meals and entertainment

- Insurance (other than health, home or auto)

- Office supplies

- Repairs and maintenance

- Other Expenses

- Depreciation and amortization records

- Proof of qualified research activities

Understanding Your Schedule C

Even if you’re working with a tax professional (as we strongly suggest), it’s valuable to know what a Schedule C is and how it’s completed. The IRS has a detailed guide, but our hope is that you’ll find our walkthrough is a bit more friendly.

Line 1 — Proprietor and Business Information

- Like most other tax forms, the top part of your Schedule C identifies you and your business.

- Name of proprietor — That’s you. Provide your full name, first and last.

- Social security number (SSN) — Enter your nine-digit social security number.

- It’s best if the name you provide matches the name you have on your social security card. If your name has changed for any reason, include documentation with your return and notify the Social Security Administration (SSA) to update your information.

Lines A and B — Principal business or profession, including product or service and principal business or professional activity code

- This is the business or professional activity that was the main source of income. If you own more than one sole proprietorship, you will need to complete a separate form for each business.

- If you’re in wholesale, retail or production services, you should also give the type of customer or client, for example: “Wholesale sale of hardware to retailers.”

- The complete list of codes is found at the end of the instruction guide.

Line C — Business name

- If you do business under your own name and don’t have a formal business name, you may leave this blank.

- If you have a formal business name and you also have an employer identification number (EIN), make sure that the business name you provide is the same as the one on your EIN.

Line D — Employer identification number (EIN)

- Also known as a federal employer identification number (FEIN), the main reason a sole proprietor would have one is to register with tax authorities to pay employees.

- If you do not have an employer identification number, you may leave this blank.

Line E — Business address

- If you have an employer identification number, the address you list should match the one you provided in your registration information.

Line F — Accounting method

- This is where you indicate which accounting method you’re using.

- A cash method is when you claim your income the moment it’s received — subsequently paying taxes on that income the following calendar year.

- An accrual method is when you claim income before it’s received in your bank account. An example would be claiming the amounts on an invoice before payment is received. With this system, you there’s a likelihood that you’ll pay taxes on income you haven’t received.

- Each method has its pros and cons, the deciding factor is what’s best for your business.

- If you’re unsure which method you’re using, your accountant and/or bookkeeper can give you the answers.

- The IRS also accepts “other” valid accounting methods. For the sake of brevity, we only went into the two most common methods.

- Once you choose an accounting method, it’s best to stick with it. The IRS prefers this as well.

- Certain businesses are also required to use specific methods, so again, check with a tax professional.

- A detailed overview is also provided in IRS Publication 538.

Line G — Material participation in the business

- Material participation means being actively involved in a substantive way in the business. For example, there’s a difference if you’re you a full-time employee of this company versus an investor. It is also a defining factor in claiming deductions. Key determinants include:

- Working more than 500 hours at or for the company during the year.

- You participated in the activity for more than 100 hours (with no other person participating more than you, the taxpayer).

- You participated in this activity for at least 5 consecutive years of the past 10 years.

- If you own rental property, like a condo or apartment, it is generally considered passive income that is taxed differently. This is when your accountant becomes very handy.

Line H — If you started the business in the current tax year

- Yeah for a simple one. If you did, check the box.

Lines I & J — Did you make any payments that would require you to file Form 1099 and if you did, did you file your 1099s?

- Form 1099-MISC, Miscellaneous Income is most often used by small businesses to report income paid to independent contractors.

- If you paid a contractor $600 or more in the previous tax year, you will need to complete a 1099.

- 1099s (with nonemployee compensation payments in box 7) must also be submitted to the IRS by January 31 each year.

- A best practice is to request that your contractors complete a W9 prior to working for you.

- 1099s are a primary tool for the IRS to track unreported income, so err on the side of caution in getting these completed and filed on time.

- As your 1099s are due before your income taxes, you should have already filed them and have them on hand.

Part 1 — Income

- This is the section where you calculate your gross profit and income (before deductions).

- Line 1 — Gross receipts or sales. (See instructions and check the box if this income was reported to you on Form W-2 and the “Statutory employee” box was checked.)

- In accounting terms, receipts are any money you take in while sales are literally from sales of a product. In human speak, this is the amount of money you earned this year.

- Statutory employees are classified as full-time life insurance agents, certain agent or commission drivers and traveling salespersons, and certain homeworkers.

- If you had both self-employment income and statutory employee income, you must file two Schedules C.

- Line 2 — Returns and allowances

- A return is exactly what you think it is — an item or product that was returned.

- An allowance is a discount is a reduction in the selling price in place of a refund.

- These are amounts given by you to your customers or incurred by you through returns.

- The amount you enter must be reported as a positive number.

- Line 3 — Line 1 minus Line 2

- Line 4 — Cost of goods sold (from line 42)

- Line 5 — Gross profit (Line 3 minus Line 4)

- Line 6 — Other income

- Other income can include interest from checking and savings accounts, debts that were written off but have now been claimed, prizes/awards and federal or state gasoline taxes/refunds.

- Line 7 — Gross income (Line 5 plus Line 6)

- Line 1 — Gross receipts or sales. (See instructions and check the box if this income was reported to you on Form W-2 and the “Statutory employee” box was checked.)

Part II — Expenses

- Often called the heart of the Schedule C, this is where you can claim your standard business tax deductions.

- With the claimed amounts, you must also have the proper documentation, such as invoices, receipts, utility bills, etc.

- Note:

- Home office expenses (itemized and simplified method) are calculated in Line 30 of this section.

- The cost of goods sold (COGS or inventory) is calculated in Part III.

- Car and truck expenses are calculated in Part IV.

- Other expenses not covered in Parts II – IV can be listed in Part V.

- (All are covered in more detail below.)

Part II — Line 30 — Expenses for the business use of your home

- This is where you can claim your home office deduction. While there’s a common myth that claiming this deduction will increase your odds of being audited, most experts wholeheartedly debunk this urban myth emphasizing that there’s no statistical evidence to prove this case.

- The requirements that determine if you qualify for a home office deduction:

- A part of your home has to be set aside for business.

- This area has to be used exclusively for business.

- You work regularly from this area — 4 to 5 days a week, no less than 45 minutes at a time.

- There are two ways that you can calculate your home office deduction:

- The simplified method — With this method, you calculate the square footage of the space that you use as your home office then multiply this amount by $5.

- The maximum allowable deduction is $1,500 (300 sq ft x $5).

- Actual expenses (the complicated method) — Is best used when your expenses are greater than the $1,500 limit for the simplified method.

- In this method, you calculate a percentage of all the expenses related to your home office, including utilities, mortgage or rent payments, insurance, maintenance and repairs, etc.

- The factor that complicates things is whether you claim these items as a direct or indirect expense.

- Direct expenses, like the cost of a repair to your home office, can be claimed in full.

- Indirect expenses, like utility bills and mortgage/rent payments, may only be claimed as a percentage of the total cost.

- All the nitty-gritty details of the home office deduction are outlined in IRS Publication 587. (A tax professional can also be your best friend on this one.)

Part III — Cost of goods sold (COGS)

- If your business is involved in producing or purchasing items for sale and your sales total more than $1 million, then you need to complete this section to account for the value of these items. (If your sales are less than $1 million, you may not have to complete this section. Let your tax professional be the ultimate judge of that one.)

- What makes calculating the cost of goods sold a bit different than inventory is that accounts for all the elements that go into creating this inventory, such as labor, materials and supplies.

- As the cost of goods sold can represent one of your largest expenses, ensuring this calculation is accurate is essential in lowering your taxable income.

- Valuation methods:

- You may value your inventory at cost, lower cost of market or any other generally accepted practice.

- If you use the cash method of accounting then you must use the cost method, which is simply the sum of your starting inventory and purchases minus your ending inventory.

- Lower cost of market (LCM) is when a business chooses to record the inventory cost that is lowest, either starting or current market price. This is most often used when a business has held inventory for a long time, when the inventory has become out-of-date or if market prices have dropped.

- If you use other methods, like first in, first out (FIFO) or last in, first out (LIFO), all you need to do is check other and attach an explanation.

Part IV — Information on your vehicle (car and truck expenses)

- You must complete this section if you have claimed car and truck expenses in Part II — Line 9 and are not amortizing or depreciating the cost or value of a vehicle using Form 4562.

- There are two methods for calculating car and truck expenses. (Because why have one when you can have two?)

- Actual expenses method — With this method you claim a percentage of costs, based on the amount you use your vehicle for business, based on every expense you incur to operate your car or truck, including fuel, maintenance, insurance and depreciation.

- Standard mileage method — In this simplified method, you multiply the amount of mileage associated with business by a standard mileage rate provided by the IRS. (Note: As the rates have changed every year since 2014, ensure that you are using the right rate.)

Part V — Other expenses

- Other expenses is a catch-all category for things that don’t fit or weren’t included under the general expenses in part II or in your home office, vehicle or costs of goods sold expenses.

- Notable items include:

- Start up and organizational costs

- Research and development expenses

- Amortization and depreciation (using Form 4562) including property, vehicles and Section 179 depreciation

- Bad debts

- Improvements, repairs or equipment used for accessibility (barrier removal costs).

- For more details, see IRS Publication 535.

Don’t Let Things Get Ugly

“Tax season has a reputation for being overwhelming, which can easily lead to mistakes along the way. But if you lean on the professionals, you can guarantee an error-free process that will minimize stress and maximize your tax savings.”

— Brendon Pack, VP, 1-800Accountant

While tax season conjures up a certain existential dread, it doesn’t have to spell disaster. Be your own best friend and keep yourself out of the way of that bus.

- Be prepared — Get all the things you need together. Be organized, systematic and even a little relentless.

- Get help — Working with a professional can help you maximize your refund, prevent mistakes and let you sleep better knowing that you’ve covered all your bases. When it comes to your taxes, these are the people you want to get to know:

- Bookkeeper — A small business owner’s best friend, this is your man or woman on the ground who can make your accounting software sing. Your bookkeeper can help you get everything ready for your accountant.

- Certified Public Accountant (CPA) — Your accountant is the one who gives everything that final eagle eye before filing your return on your behalf. (Note CPA is a specific professional designation.)

- Enrolled Agent (EA) — This an individual who has been licensed by the IRS or has at least five (5) years of experience working with the IRS. If you can’t afford an accountant, an EA is a cost-effective alternative.

- A tax lawyer — This is a big gun that you’ll only need to pull out if you’ve got a serious tax problem, such as the IRS inviting you to join them in court.

- File on time — While nearly 50% of small businesses end up filing extensions, you don’t have to be one of them.

- If the worst happens, file an extension using Form 4868 submitted on or before the April deadline for personal taxes. With an extension, you’ll have until mid-October to file your Schedule C. (If you know early on that you’ll need an extension, let the IRS know as soon as possible.)

- Even with an extension, any amounts you owe are still due on the original dates.

- There are two kinds of penalties for being late:

- Failure-to-file — 5% of the unpaid taxes for each month you’re late up to 25% of the total. (For micro-businesses, the penalty if you file more than 60 days late is either $135 or 100% of what is owed if the amount is less than the fine.)

- Failure-to-pay — .5% of the unpaid taxes for each month you’re late up to 25% of the total. (In other words, the penalty for not filing at all is 10x that of paying late.)

- If you pay at least 90% of what you owe and file your extension request by the April deadline, then you will not get a failure-to-pay penalty.

Become Your Bookkeeper’s and Your Business’ Best Friend

“Regardless of whether you hire someone to do your small business bookkeeping or not, you need to have a good bookkeeping system in place, understand how it works, and track some of your day to day business activities.”

— Crystalynn Shelton, Writer, Fit Small Business

While the bulk of this guide deals with what needs to happen at tax season, best practices exist so that everything gets taken care of the right way throughout the year. Putting best practices like the ones below in place can also mean that you’re prepared for tax season well before the deadlines and the panic hits:

- Work with a bookkeeper and accountant all year long. Together you can make sure that you’re watching the things you ought and doing the things you should.

- With the rising number of cloud-based or virtual bookkeeping and accounting firms, you get added versatility and cost-effectiveness along with the needed expertise.

- Review the deductions you claimed this year and use them as a guide for setting up expense categories to track costs and receipts throughout the year. Then at tax time, all you have to do is check the balance sheet.

- Create a separate business bank account aside exclusively for taxes. Put money for taxes in this account as soon as you receive it to help keep you from falling behind on any estimated payments or tax deposits.

- Take advantage of the amazing array of small business software and financial tools, including:

- Accounting software, like Flare, FreshBooks, Less Accounting, SlickPie, QuickBooks Online, Xero and ZipBooks.

- Document scanning and storage from Hubdoc, Ledger Docs and Neat.

- Time tracking and scheduling tools like TSheets, When I Work and Jobber.

- Receipt scanning apps like Expensify, Receipt Bank and Shoeboxed.

- Mileage tracking apps like MileIQ, TripLog and TrackMyDrive.

- Easy invoicing and accounts payable from Plooto and Invoicera.

- Small business payroll software like Wagepoint.

- Back up your financial data regularly — create two digital copies (in two different locations) and one additional offline copy.

- Keep good records — Follow all the tips above and keep past tax records for a minimum of three years or as long as seven, depending on the claims you’ve made.

Take This Return and File It

See ya, Schedule C! Same time, same place next year? Now that the heavy lifting is out of the way, it’s time for a little diversion (or several, depending on how you roll).

- Skip astrology and go for foodology — find out what your choice of foods says about you.

- Get yourself a new recliner (or your first, we won’t judge).

- Relax and enjoy some serious binge watching.

Business owners, sole proprietors and tax professionals — if you have a resource, correction or clarification you’d like to provide, please share it in the comments below. All valuable knowledge is welcome. For that matter so are any funny tax season jokes or anecdotes (as long as they’re clean).

The information in this post does not constitute or replace the need for professional bookkeeping, accounting or tax advice. Wagepoint has gathered this information from several sources and has done its best to ensure accuracy. Any errors or omissions will be corrected in a timely manner. As tax laws are constantly changing, it’s important to ensure that you have the most accurate and up-to-date information.