Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Picture this: It’s Monday morning and a bookkeeper in Halifax is already fielding calls from clients who forgot to submit their payroll hours again. Meanwhile, across the country, a bookkeeper in Saskatchewan is manually calculating stat holiday pay while simultaneously trying to remember which deduction codes apply to their newest client.

Sound familiar? You’re not alone.

In our recent webinar Reset Workshop: Modernize Your Firm’s Payroll Workflows and Systems, over 300 bookkeepers and accountants came together to tackle an uncomfortable truth: payroll isn’t the simple data entry their clients think it is, and it’s quietly consuming their most valuable resource — time.

How Much Time Is Payroll Really Taking?

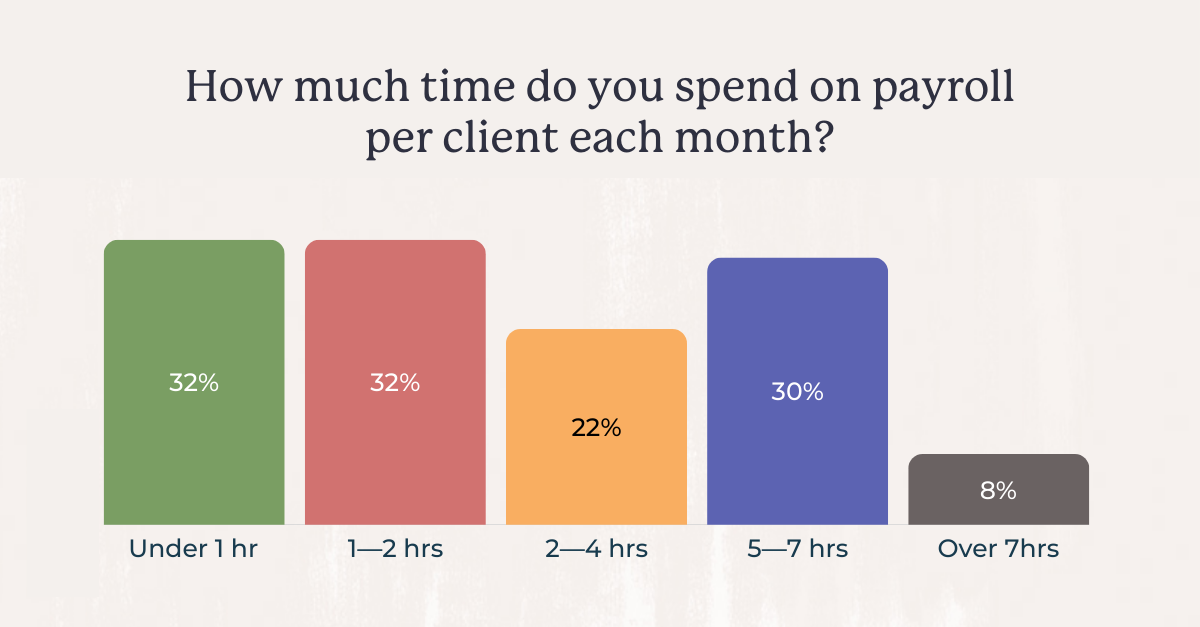

The workshop began with a simple but telling question: how much time does your firm spend on payroll for each client every month? More than 300 bookkeepers and accountants weighed in, giving us a snapshot of just how differently firms are experiencing payroll.

Nearly two-thirds (64%) of firms are finishing in under two hours, proof that with the right systems and payroll workflows, speed and accuracy are possible. But for the other third, payroll is eating up 2–7+ hours per client every month. Hours that could be spent on higher-value client work or simply getting your evenings back.

The Real Challenges Behind Payroll

Time lost is only part of the equation. To understand why payroll feels so consuming, we asked attendees about their biggest day-to-day challenges. Was it complex calculations? Clunky software? Compliance headaches? Lack of payroll workflows?

The math, the software, and even error correction weren’t the problems keeping practitioners up at night. The biggest challenges came from missed deadlines, communication breakdowns, and repetitive admin tasks that could be automated

Your Practical Payroll Reset

Firms don’t need to work harder, they need to reset how they approach payroll. That means setting boundaries with clients, making smarter use of automation, and turning payroll data into something more valuable than just paystubs.

End the Chase Game

Tanya Hilts, CPB, FCPB, CFCC, AIA, webinar co-host and CEO of Cloud Business Services, shared a boundary-setting strategy that transformed both her client relationships and her calendar: she now charges a late fee if payroll information isn’t submitted by 9 AM Monday morning.

Now her clients are never late (or at least, never twice.) It’s not about the penalty, it’s about showing that your time and the complexity of your work matters. It’s a signal that payroll prep is important work, built around systems, schedules, and compliance.

Suggested Reading: The Bookkeeper’s Playbook to Making Payroll Profitable

Automation as an Amplifier

The firms finalizing payroll in under two hours aren’t necessarily working with easier or fewer clients, they’re using automation to eliminate routine tasks and streamline their processes.

Automating tax calculations, remittances, and client intake forms doesn’t replace your expertise; it enhances it. By allowing modern payroll software like Wagepoint to handle routine calculations, you can focus on what truly matters: identifying anomalies and providing strategic insights.

Suggested Reading: Client Success Story: Saving Hours on Payroll Through Automation

Simplify Compliance

Payroll errors aren’t just minor slip-ups, they carry real consequences. Late remittances or misclassified workers can trigger penalties and erode client trust leaving you with hours of unbillable cleanup work. As Tanya reminded workshop attendees:

“The cost of one payroll mistake can exceed the cost of payroll software for an entire year.”

This is where modern payroll technology proves its worth. With built-in compliance safeguards, firms can shift from constantly firefighting to confidently running payroll on schedule with accuracy built in from the start.

Suggested Reading: Checklist: Top Payroll Mistakes to Avoid

From Processor to Strategic Advisor

Payroll is often treated as just another back-office task, but it’s actually one of the richest sources of business insight. The patterns hidden in payroll data don’t just tell you what happened last pay run, they reveal how a business is operating, where it might be leaking cash, and when it’s ready to grow.

When firms bring those insights into client conversations, payroll shifts from being a transactional service to a strategic advantage. Moving beyond “getting people paid” to helping clients make smarter decisions about the future of their business.

Suggested Reading: How Payroll Can Become a Revenue Driver

Wrapping Up

When you treat payroll as a structured process instead of a last-minute scramble, you free up time for the work that fuels growth. And when you use it as a source of insight — not just output — you position yourself as a trusted advisor who helps clients see the bigger picture.

Watch the full Payroll Reset Workshop on-demand to hear all the stories and strategies shared live: Watch Now