Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

While QuickBooks Payroll may be one of the more popular choices, it’s not the perfect fit for everyone.

Most of the pages you’ll read online about QuickBooks and their top competitors are more focused on the U.S. market. That’s why we’ve tailored this specifically to the needs of Canadian small business owners and bookkeepers.

So, if you’re wondering what else is out there besides QuickBooks, check out this top list of alternative solutions curated for Canadian small business payroll.

Best QuickBooks Payroll alternatives

- Wagepoint

- Payworks

- Payment Evolution (PayEvo)

- Rise People

- Knit People

- Rippling

- Dayforce

- ADP

- Wave

- Sage

Why do people look for QuickBooks alternatives?

Maybe you’re looking for alternatives because you’ve been using QuickBooks Online Payroll (or even QuickBooks Desktop Payroll) and it’s just not working out for you.

Maybe you’re just curious what else is out there.

Whichever the case, these are some of the top reasons that people are looking for alternatives to QuickBooks Payroll.

Pricing can be higher than expected

Many payroll solutions have a base and per employee fee attached to the subscription. But, if you read the fine print, QuickBooks Online Payroll plans are a bit different. It used to be that the cost of the per-employee fee was based on how many of your employees were a part of your pay runs for that month.

Now, it’s based on the number of active employees you have, whether they were a part of any pay run or not. This can lead to high costs if you have a big team that are paid on different cadences.

Can it compete with QuickBooks Business Online, as we would definitely like to get away from that platform

It’s way overpriced and support is not that good

— Valley Creative Agency (@Canada_Website) June 17, 2024

Issues with customer support

Whether you’re looking at social media or even QuickBooks’ own community boards, there are complaints from customers about the support they’ve received. Not just in general for the QuickBooks team, but about getting support for QuickBooks Payroll specifically.

I CALLED 4 TIMES TODAY AND NO ONE IS LISTENING. There has Been a mistake or bug with the accounts which it’s froze then I’ve lost 48$ today because of insuffisant funds. I am not gonna pay for that. Your agents DONT LISTEN.

— Rach (@FlyingwithRach) May 7, 2024

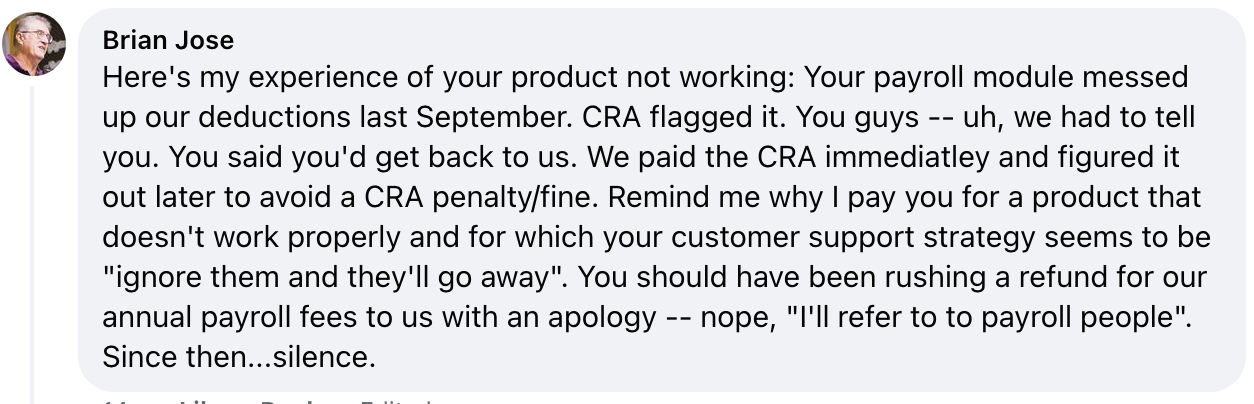

Payroll calculation errors

Anyone who’s had an issue with payroll calculations and deductions knows it leads to fines and unpleasant interactions with the Canada Revenue Agency. Small businesses in particular put their trust in payroll software to get things right so they don’t have to worry. Here’s an example of one upset user who not only had an issue with their pay run but are now also having trouble getting support.

Source: QuickBooks Canada Facebook page

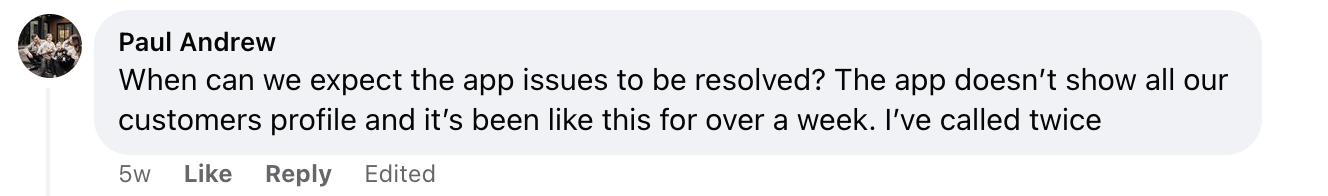

Technical issues impacting ease of use

Ever had a software solution stop working while you’re trying to take care of business? Scrolling through social media, especially QuickBooks Canada’s X account replies, will show they respond to many inquiries about the app being down. As you can see from the screenshots below, it makes for a frustrating experience.

@IntuitAcctsCA THOUGHTS? #AnnoyingToSeeWhenYouHaveDeadlines

(I keep getting booted from system and unable to log in) pic.twitter.com/UqyoPX5Oig— Hartley B Singer #VotePPC (@HartleyBSinger) May 21, 2024

Source: QuickBooks Canada Facebook page

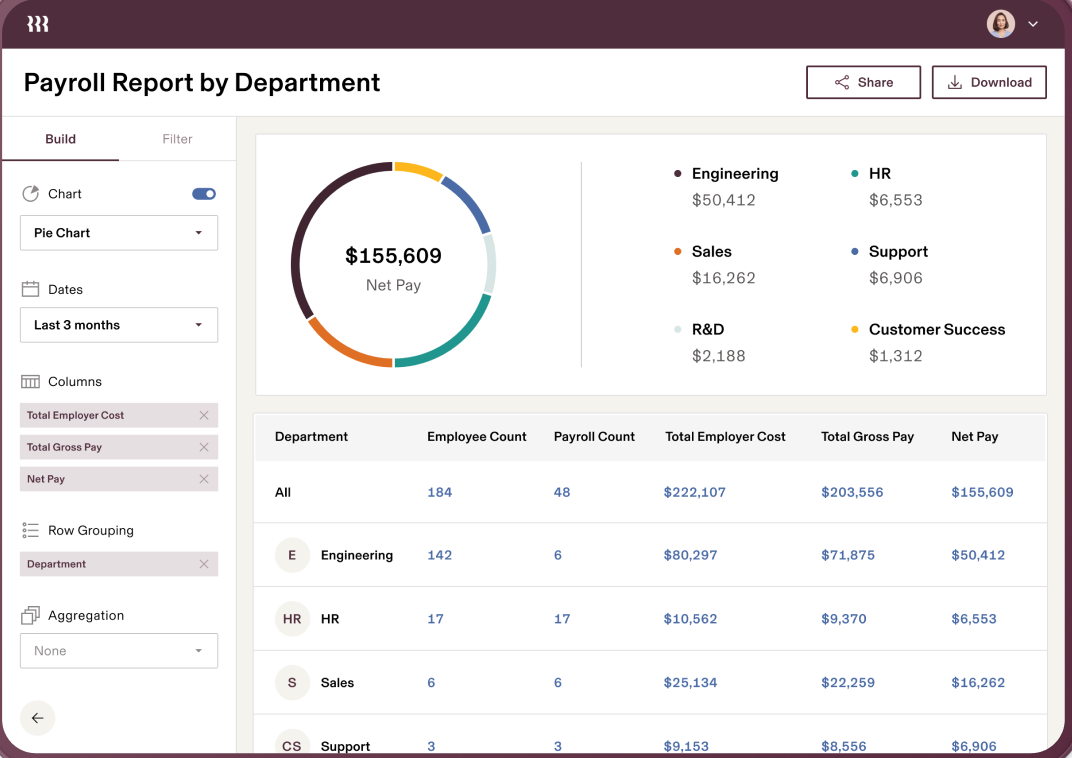

1. Wagepoint

Built in Canada, Wagepoint knows small business payroll for Canadians. You get a standalone payroll solution that you can feel confident in to get the job done. There’s no need to try to fit your small business needs into a big business solution with Wagepoint.

Key features

- Direct deposit (including to multiple accounts at no extra cost)

- Automated wage and tax calculations

- Payroll remittance filing

- Employee self-service portal

- Pay employees and contractors

- Adjustment tool for making changes to the most recent, finalized pay run yourself

“All you need to do is figure out the hours and put it in. And it does everything automatically for you. I think it is really valuable for anyone that’s really dedicated to their business.”

– Nas Neufeld, Thyme Studio

Pros

- Calculations and remittances for payroll taxes, including year-end reporting and filing

- Streamlined onboarding process for you and your employees (the employee portal has details you can let your team fill out!)

- Award-winning, Canadian customer support, including staff with Payroll Compliance Professional Certification from the National Payroll Institute

- Robust reporting capabilities and customization to see the information you’re looking for

- Transparent pricing — what you see is what you get…and what you’re charged

- Time by Wagepoint time and attendance tracking add-on

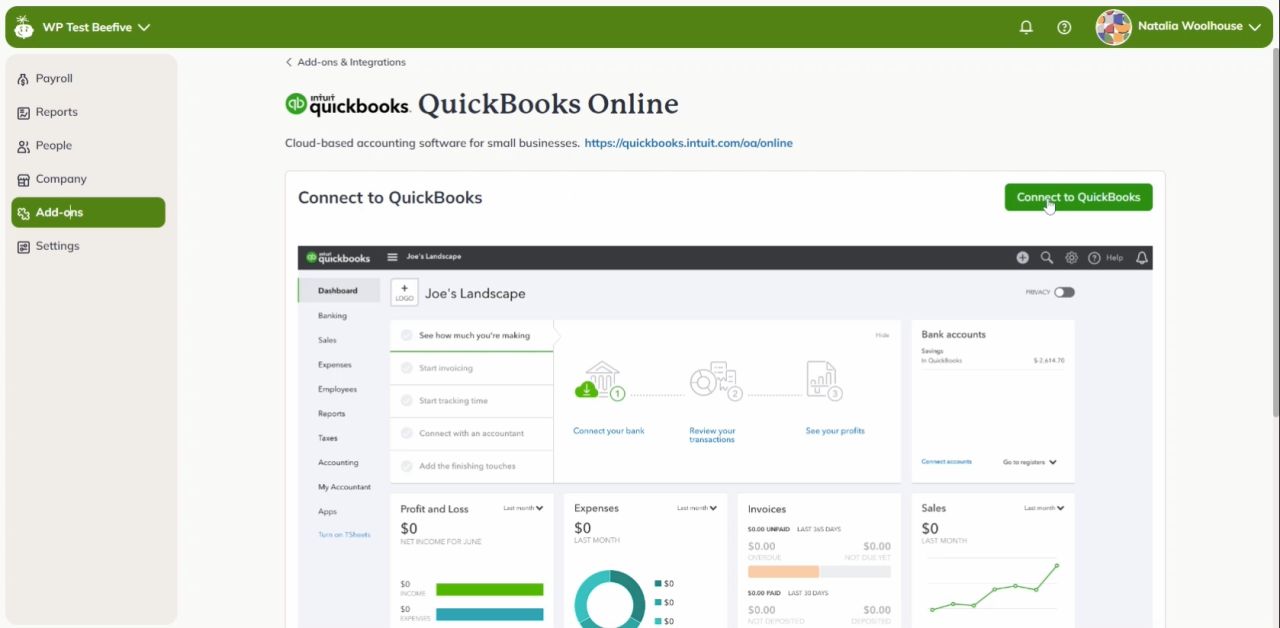

- Integrates with QuickBooks Online (for those who like the accounting software and not so much the payroll side of QuickBooks) as well as Xero.

Cons

- Not suited for those who own very large businesses

- Integrations limited (but more to come!)

Pricing

14-day free trial

Solo: $20 CAD per month + $4 per employee per month

Unlimited: $40 CAD per month + $6 per employee per month

Who is Wagepoint best for?

Wagepoint is the perfect match for small businesses looking for a modern payroll solution with features tailored to them, top-tier customer support, and transparent pricing that

2. Payworks

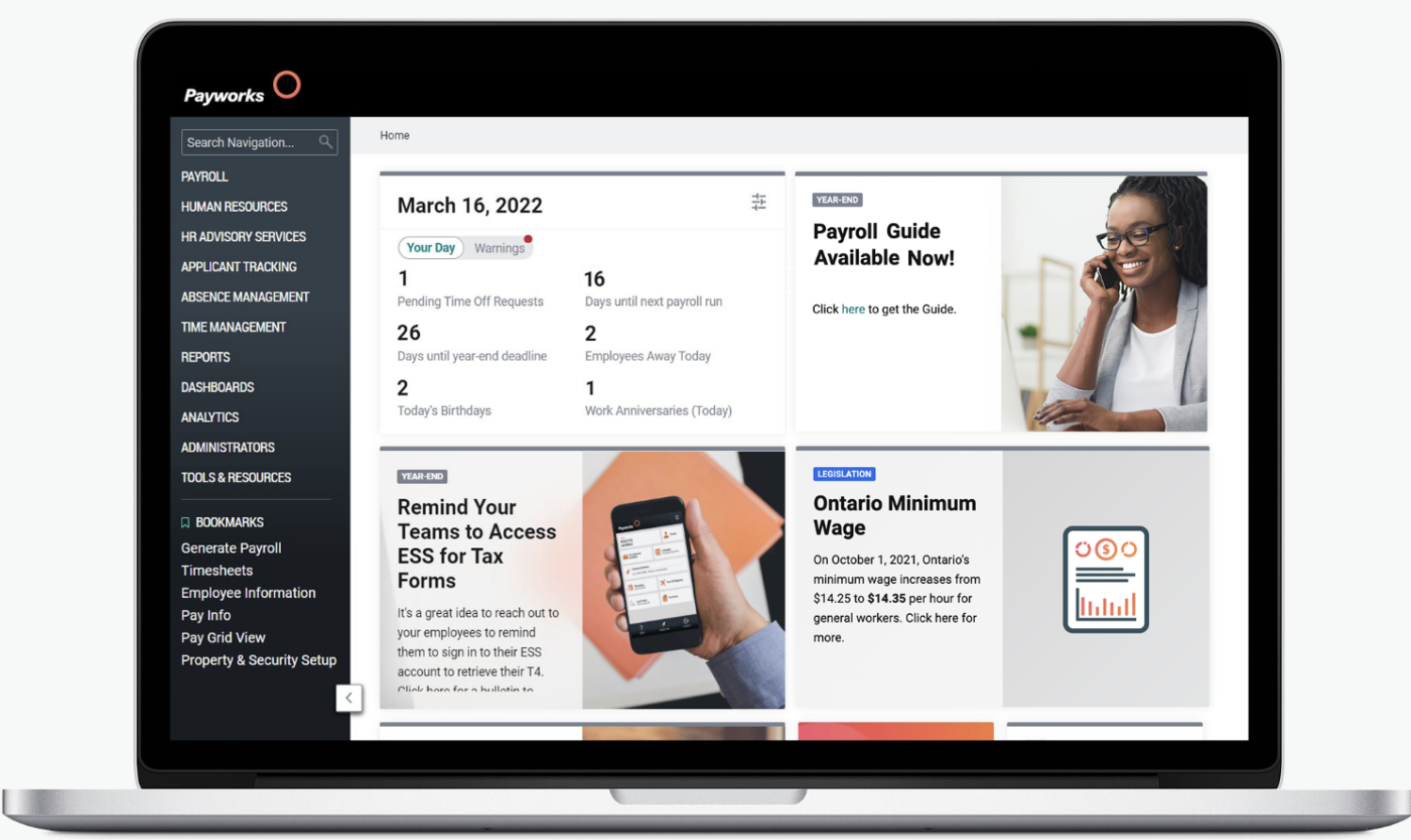

Payworks is a user-friendly software designed to simplify the payroll process for businesses of all sizes. It comes with a range of features and functionalities, including those outside the payroll space, like human resources.

Image: Payworks

Key features

- Multiple payment options

- Compliant with regional tax laws

- Employee benefits administration

- Time and attendance tracking

Pros

- Payroll and HR capabilities built into one platform

- Customizable reports

- Payroll tax calculation and remittances

Cons

- Some users may find the interface overwhelming

- May not be an affordable price range for small businesses

- Users may have trouble contacting customer service for help using the software

Pricing

Use their online calculator or contact their team to get a quote.

Who is Payworks best for?

Payment Evolution can be a good choice for small businesses looking for a basic payroll solution with HR capabilities.

3. Payment Evolution (PayEvo)

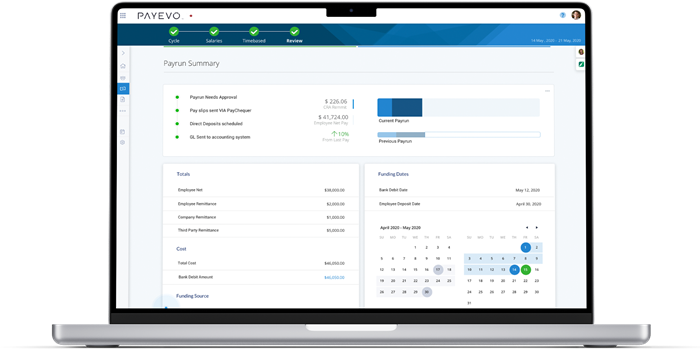

Payment Evolution, also known as PayEvo, is a payroll software solution aimed at streamlining payroll management for businesses in Canada.

Image: Payment Evolution

Key features

- Pay employees by direct deposit

- File payroll taxes and remittances

- Self-service portal for employees

- Add-on features to manage your business

Pros

- Offers an efficient direct deposit system

- Simplified tax filing process

- User-friendly interface

- Great value for price

4. Rise

- Limited customization options for payroll settings

- Using PayEvo comes with a learning curve

Pricing

15-day free trial

Growth: $3.50 CAD per employee per month (max 3 employees, no base fee)

Business Basic: $2.50 CAD per employee per month ($25 CAD minimum per month)

Business Plus: $2.00 CAD per employee per month ($75 CAD minimum per month)

Who is Payment Evolution best for?

Payment Evolution is geared toward small businesses looking for a payroll solution that’s straightforward and cost-effective.

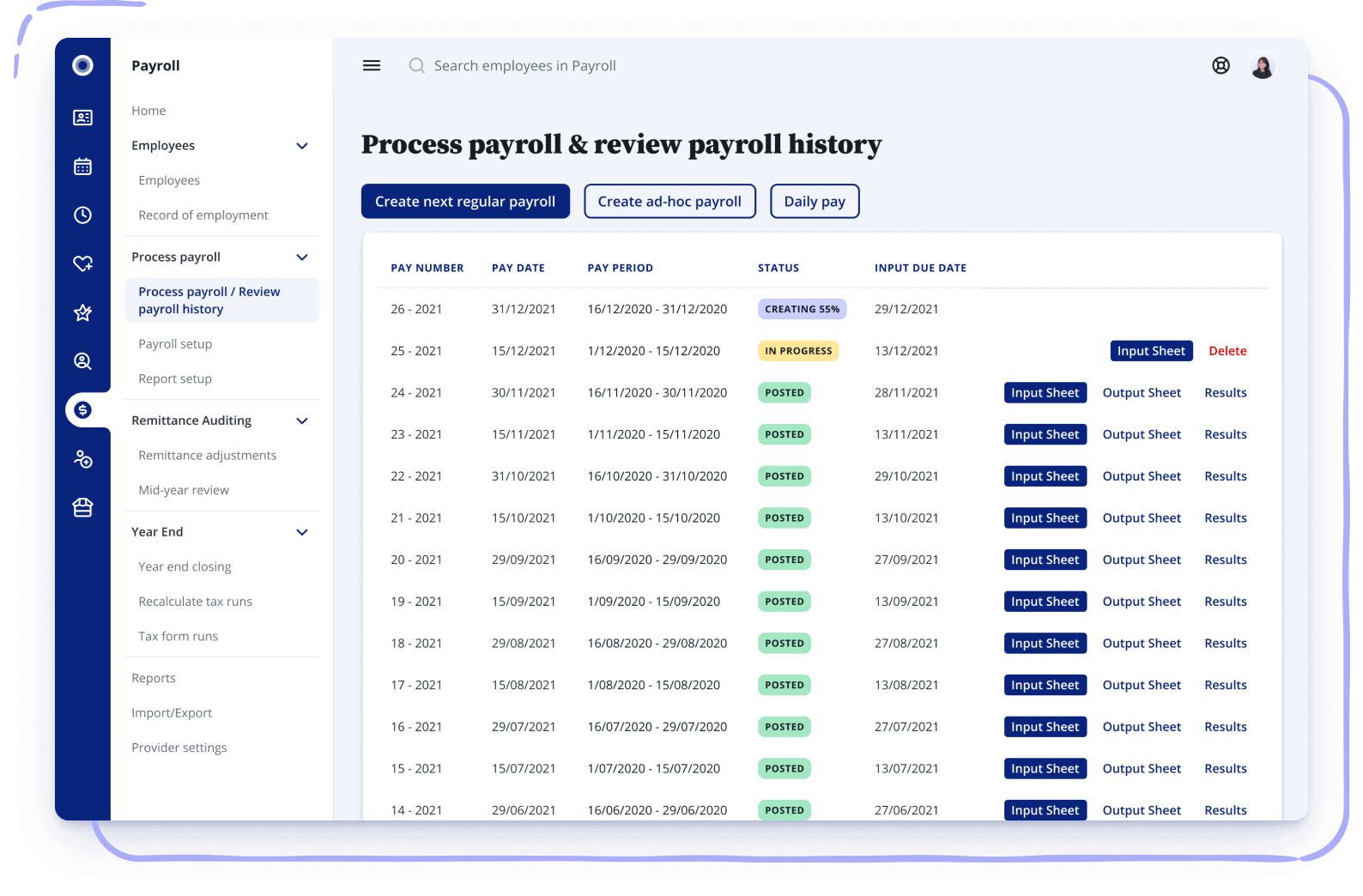

4. Rise

Rise brings your HR, benefits, payroll and time off solutions together in one place so you can focus on growing your business.

Image: Rise

Key features

- Automated payroll processing

- Comprehensive HR management

- Performance management tools

- Automated tax remittances

Pros

- Employee self-service features

- Strong data security

- Integration with accounting software

Cons

- An extensive range of features that small businesses may not need

- One user noted that it’s not super user-friendly

- Pricing may not be the most budget-friendly for small businesses

Pricing

Start: $8 CAD per employee per month (required base fee not listed)

Grow: Contact sales

Optimize: Contact sales

Who is Rise best for?

Rise can be the top choice for small businesses looking for a full-suite HR management and payroll processing solution.

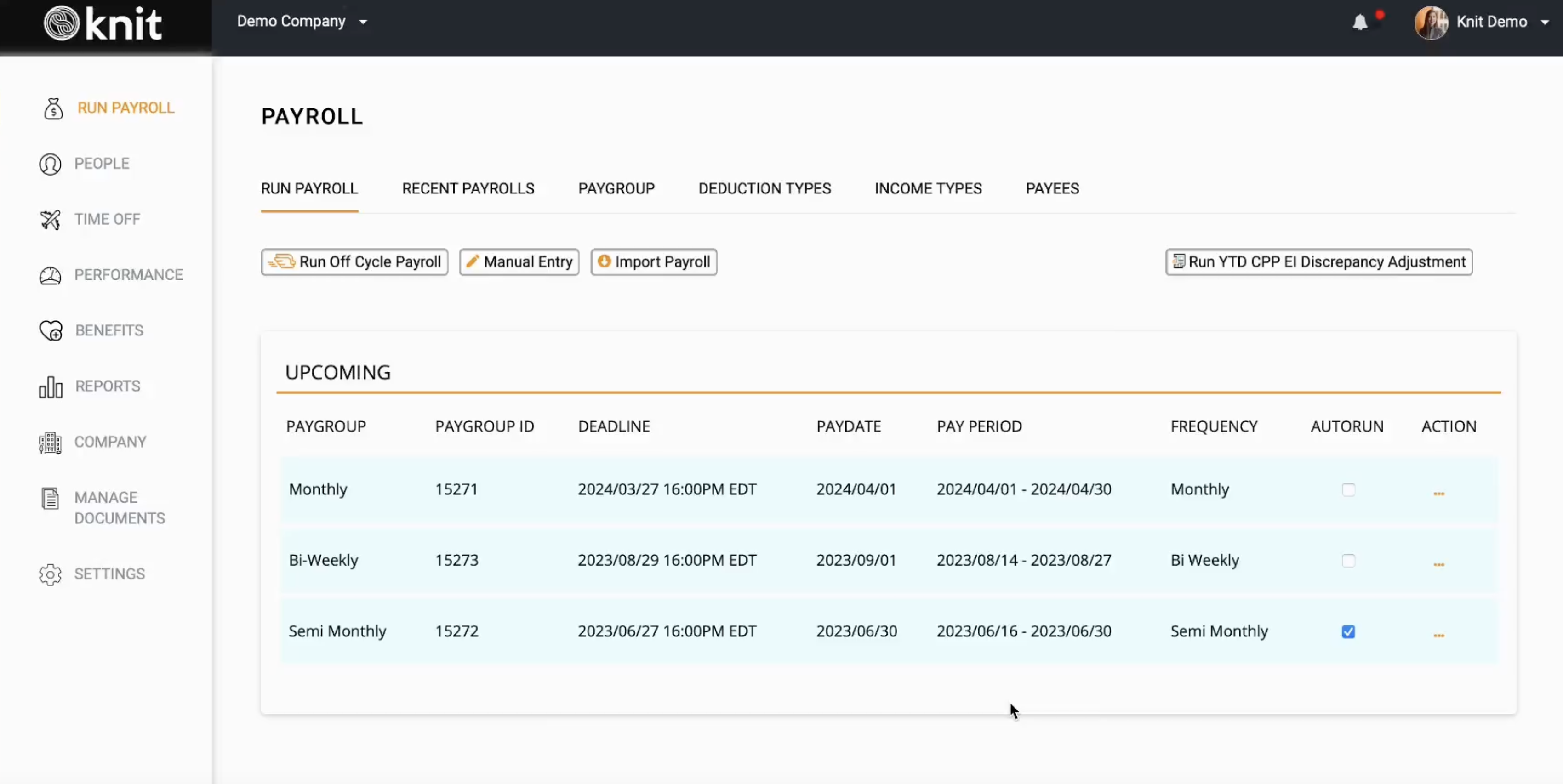

5. Knit People

Knit People is another solution that comes with more than just payroll. This platform is geared toward small and medium-sized businesses.

Image: Knit

6. Rippling

- Employee self-service portal

- Access to benefits, HR and payroll features

- Easy to use

- Unlimited pay runs

- New hire self-onboarding

Pros

- Acts as an HR, benefits, and payroll app rolled into one

- All of your information and data conveniently organized in one place

- Easy-to-run payroll

Cons

- HR features, while useful, can be quite basic

- Can be clunky with the need to do some manual work

Pricing

30-day free trial

Lite: $40 CAD per month + $6 CAD per employee per month

Complete: $50 CAD per month + $8 CAD per employee per month

Concierge: Contact sales

Who is Knit People best for?

Knit People could be a good choice for small to medium-sized businesses who are looking for an all-in-one solution with basic HR tools and payroll management.

6. Rippling

Rippling is an all-inclusive workforce management platform that gives users a one-stop shop to run their global operations, including global payroll, expenses, employee data and financial management.

Image: Rippling

Key features

- Full-service HR and payroll solution

- Employee benefits administration

- Time tracking

- Integration with other apps and services

Pros

- HR and payroll capabilities

- Seamless onboarding process

- Mobile app for employees

Cons

- Pricing might be out of budget for small businesses

- The large range of features may not be needed by all small businesses

- Connecting with support is a challenging and painful process according to some users

Pricing

For a full, custom quote, contact sales

Who is Rippling best for?

Rippling is ideal for businesses in need of a complete HR and payroll management platform.

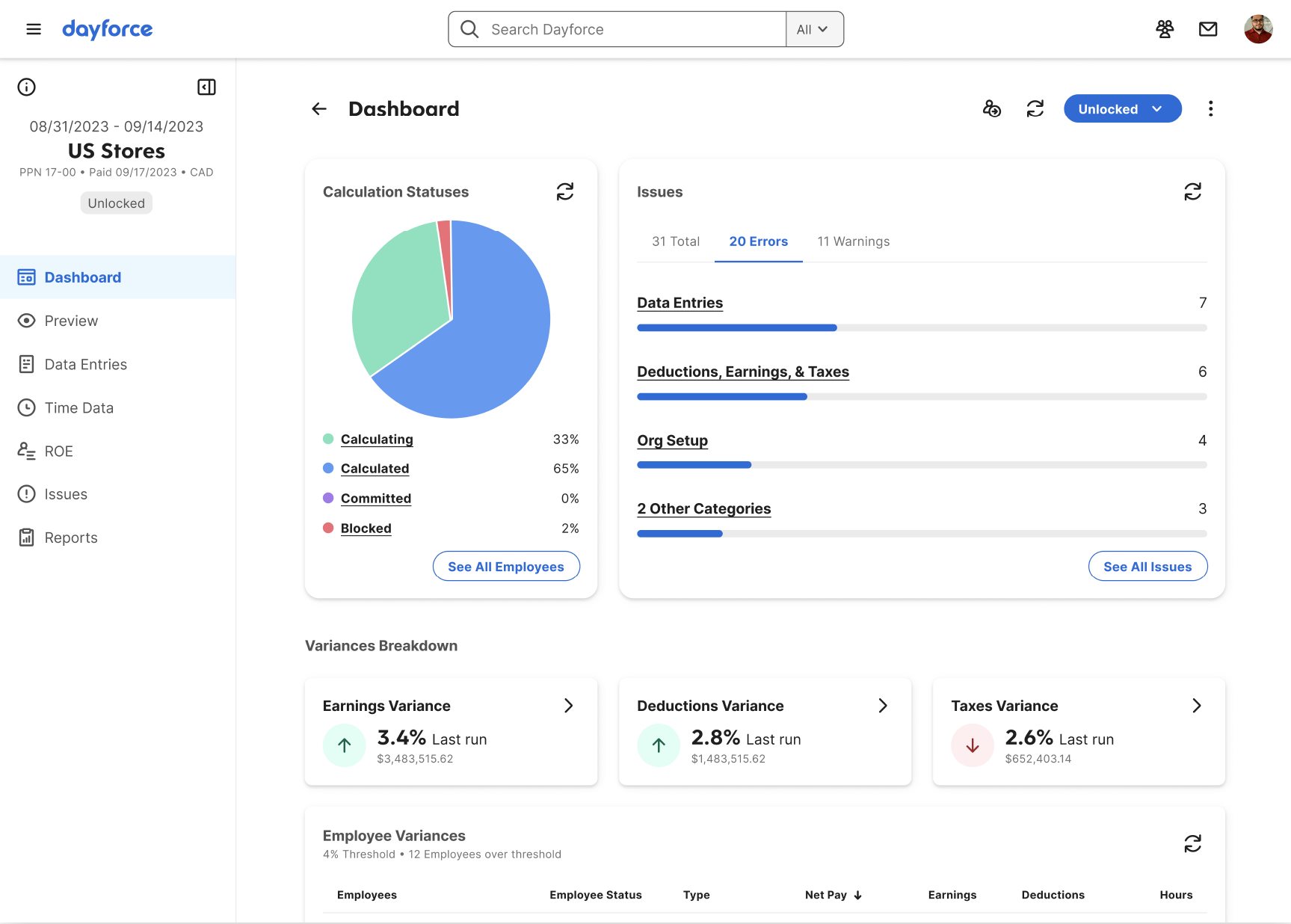

7. Dayforce

Dayforce (formerly Ceridian) is a payroll software solution that gives users global visibility in real-time and allows for efficient payroll and compliance processes, all in a highly automated fashion.

Image: Dayforce

Key features

- Pay and manage employees

- Automated payroll process

- Managed payroll services (for those who prefer a hands off approach to payroll)

- Software integrations

Pros

- Manage and process employee payroll and benefits in one place

- Calculate and issue pay cheques

- Includes tools to manage employee benefits like health insurance

- Includes employee time-tracking features

Cons

- Support is difficult to connect with

- One user noted that this is a complex system that may not be suited for all businesses

Pricing

Contact sales.

Who is Dayforce best for?

Dayforce is a good choice for businesses needing a full-suite of HR and payroll software.

8. ADP

ADP, short for Automatic Data Processing, is a globally-recognized payroll software solution empowering businesses with effective payroll management.

Image: ADP

Key features

- Efficient direct deposit services

- Tax calculations and filings

- Employee benefits administration

- Time and attendance tracking add-on

Pros

- Payroll and HR capabilities

- Seamless direct deposit services

- Great customer support

Cons

- Customer support can be difficult to reach

- The interface feels outdated to some users

Pricing

Contact sales.

Who is ADP best for?

ADP is for businesses of all sizes, but it’s popular among larger enterprises looking for comprehensive payroll and HR capabilities. So, in this case, it might not be the best fit for small businesses unless you’re looking to grow.

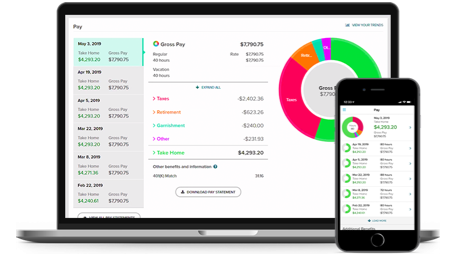

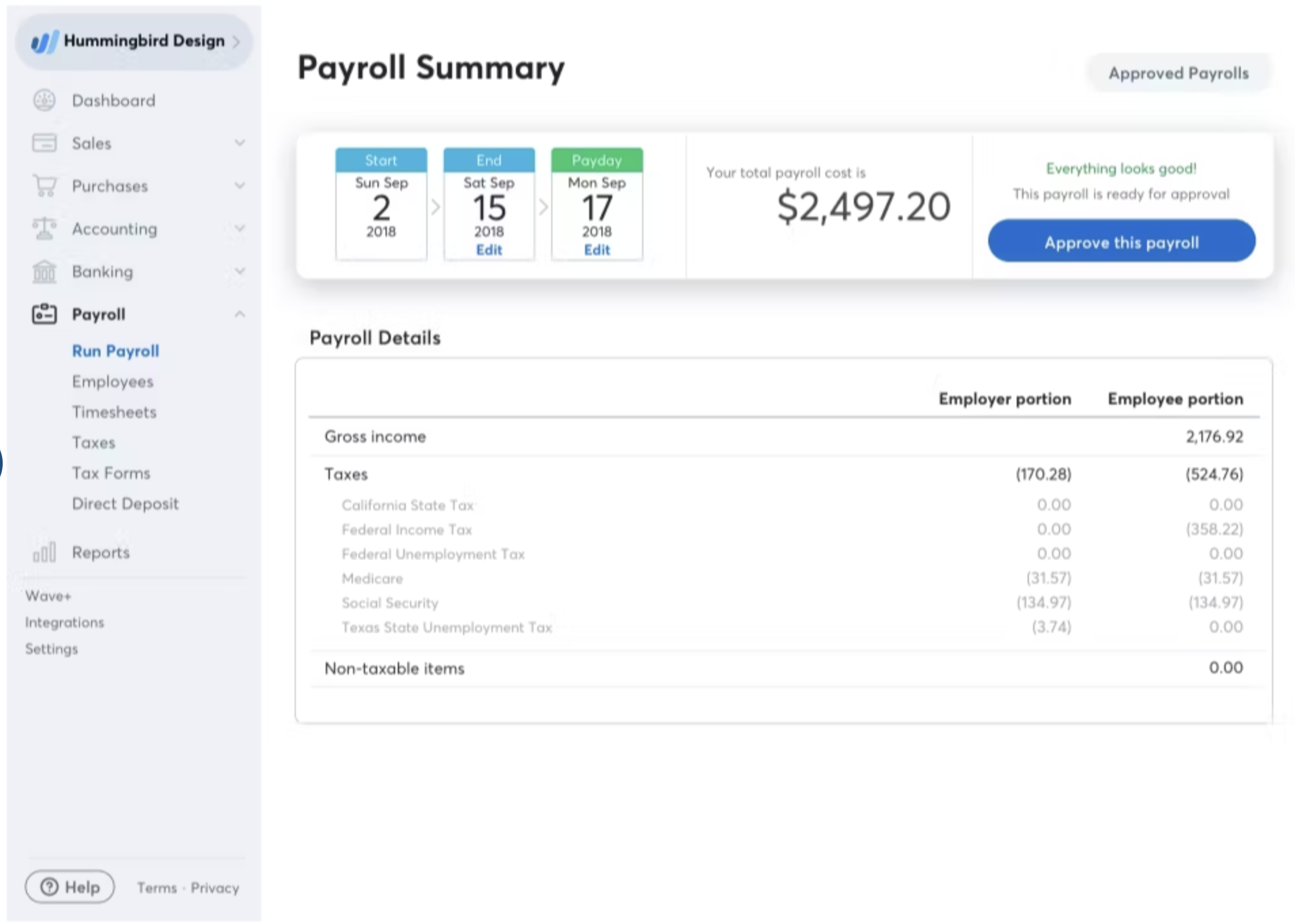

9. Wave

Wave, known for it’s free accounting software (Wave Accounting), also has an add-on payroll solution at a monthly fee for its small business users.

Image: Capterra

Key features

- Quick and efficient direct deposit

- User-friendly platform that simplifies payroll management

- Handles tax calculations and filings

- Pay employees and contractors

Pros

- Simple to use interface

- Employee portal access

- Streamlined tax processing

- Longer free trial than most

Cons

- There are limited customization options

- Does not support Québec payroll

- There are a number of features that small businesses won’t need

Pricing

30-day free trial

$25 CAD per month + $6 CAD per employee/contractor per month

Who is Wave best for?

Wave may be a good choice for small businesses looking for straightforward and user-friendly payroll services connected with a free plan cloud-based accounting software.

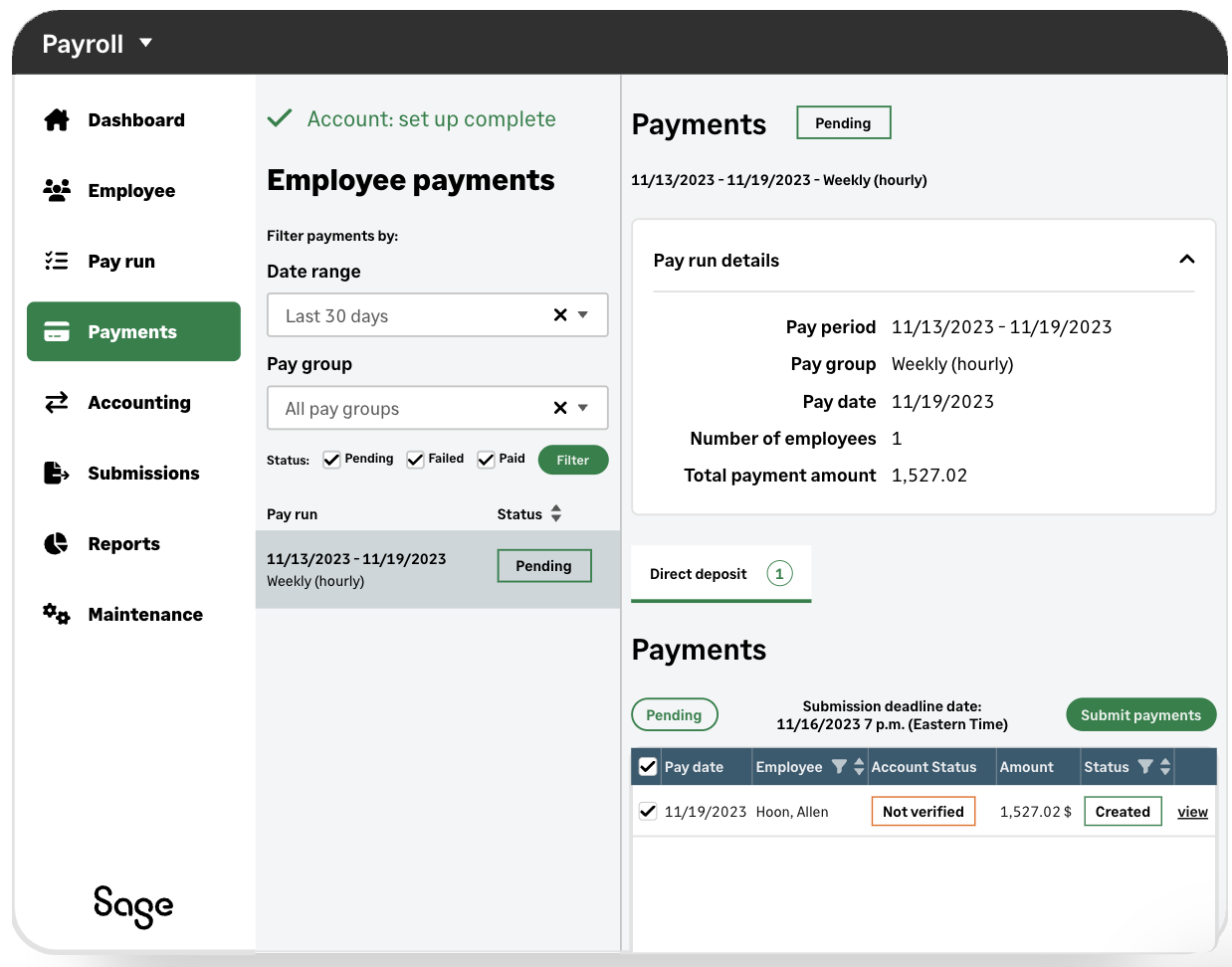

10. Sage

Sage’s payroll solution helps you reduce paperwork, pay your team on time and make decisions faster with their reporting options.

Image: Sage

Key features

- Seamless direct deposit

- Tax calculations and filings

- Employee self-service portal

- Generates year-end forms

Pros

- Robust reporting features

- Able to meet basic HR needs

- Simple user interface

Cons

- Pricing may be higher than other alternatives

- One user noted that using the product at first was difficult because there wasn’t much support and help documents had jargon

Pricing

2-month free trial

Payroll Essentials: $20 CAD per month + $3 CAD per employee per month

Payroll Standard: $20 CAD per month + $10.50 CAD per employee per month

Payroll Premium: $20 CAD per month + $16.50 CAD per employee per month

Who is Sage best for?

Sage is a good choice for businesses looking for a payroll solution with basic HR capabilities, although if you’re looking for more advanced HR options, they have a plan for that as well.

The bottom line on QuickBooks Payroll alternatives.

By exploring the best QuickBooks alternatives for payroll we’ve listed in this post, you’re sure to find the payroll solution that fits your business like a glove.

Wagepoint vs QuickBooks Payroll

Thinking back to the reasons people look for QuickBooks Payroll alternatives, Wagepoint is here to say we’ve got:

- Transparent pricing, so there are no surprises when it comes to costs of running payroll.

- A sharp focus on accuracy. We know payroll is stressful, and we want to avoid that at all costs.

- The world’s friendliest support team, who’s there when you need them.

- An easy to use platform that’ll make payroll a breeze.

Get started today to see the difference for yourself! Start your 14-day free trial.