Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Whether it’s your 1st pay cheque or your 101st, it always feels good to get paid.

But aside from the final amount, do you know what all the numbers mean?

Here’s why it’s important for everyone — both employers and employees — to understand the information provided on every pay cheque…

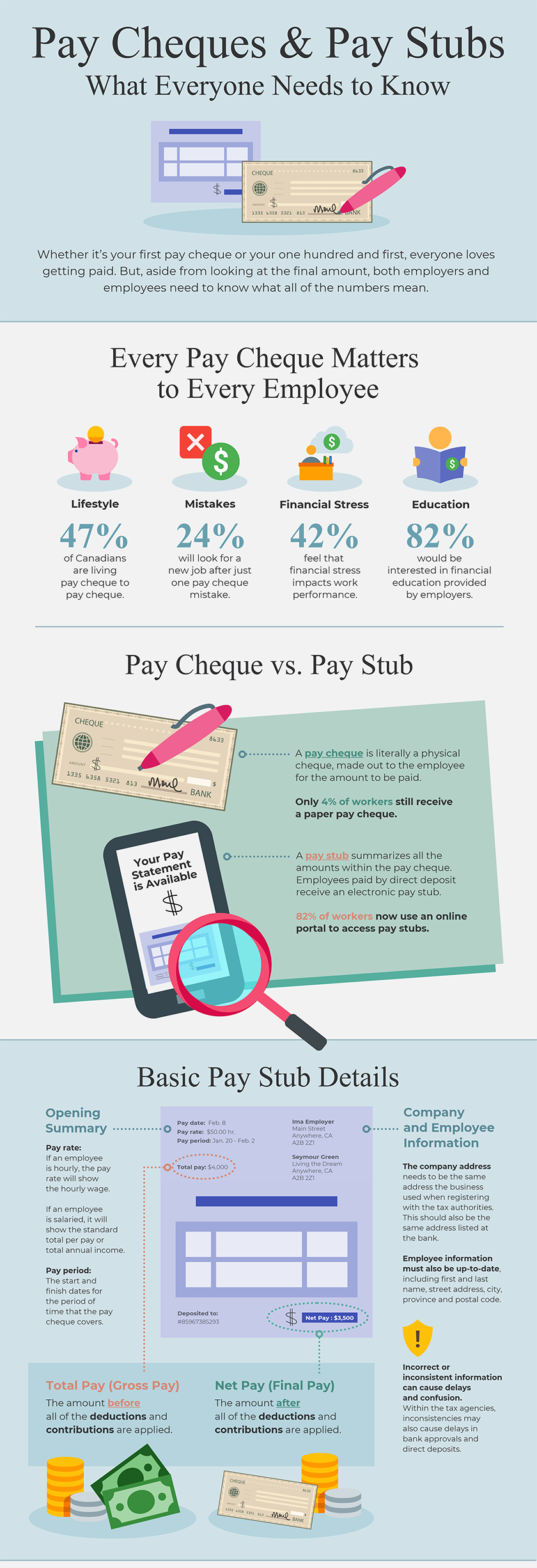

- 47% of Canadians are living pay cheque to pay cheque.

- 24% of employees will look for a new job after just one pay cheque mistake.

- 42% of Canadians feel that financial stress impacts work performance.

- 82% are interested in financial education provided by employers.

Let’s dig in and take a closer look at the average pay cheque.

Pay Cheques & Pay Stubs: What Everyone Needs to Know

Download the PDF

Pay Cheque vs. Pay Stub

A pay cheque is a physical cheque given to an employee by the employer. It’s made out to the employee for the amount to be paid and can be deposited in the bank by the employee.

Here’s a bit of trivia: Only 4% of workers still receive a paper pay cheque. Most employers now pay their workers electronically with direct deposit.

A pay stub summarizes all the amounts within the pay cheque. Employees paid by direct deposit receive an electronic pay stub. 82% of workers now use an online portal to access pay stubs.

Basic Pay Stub Details

What are the details listed on a pay stub?

The opening summary includes:

- Pay rate. For hourly employees, this shows the hourly wage. For salaried employees, it lists the rate per pay period or the total annual income.

- Pay period. This documents the start and end dates for the pay period covered by this cheque.

Company and employee information must be listed, and both must be up-to-date:

- The company address must be the same as the business address when registering with the tax authorities. It should also be the same address listed at the bank.

- Employee information must include the first and last name, street address, city, province, and postal code.

It’s important that this information is accurate and up-to-date. Otherwise, you may experience delays in bank approvals and direct deposits.

Payment amounts can be shown in two ways:

- Total pay, also known as gross pay. This is the total amount before deductions and contributions are applied.

- Net pay, or final pay. This is the payment amount on the cheque and reflects the salary amount after deductions and contributions are applied.

Additional Pay Stub Details

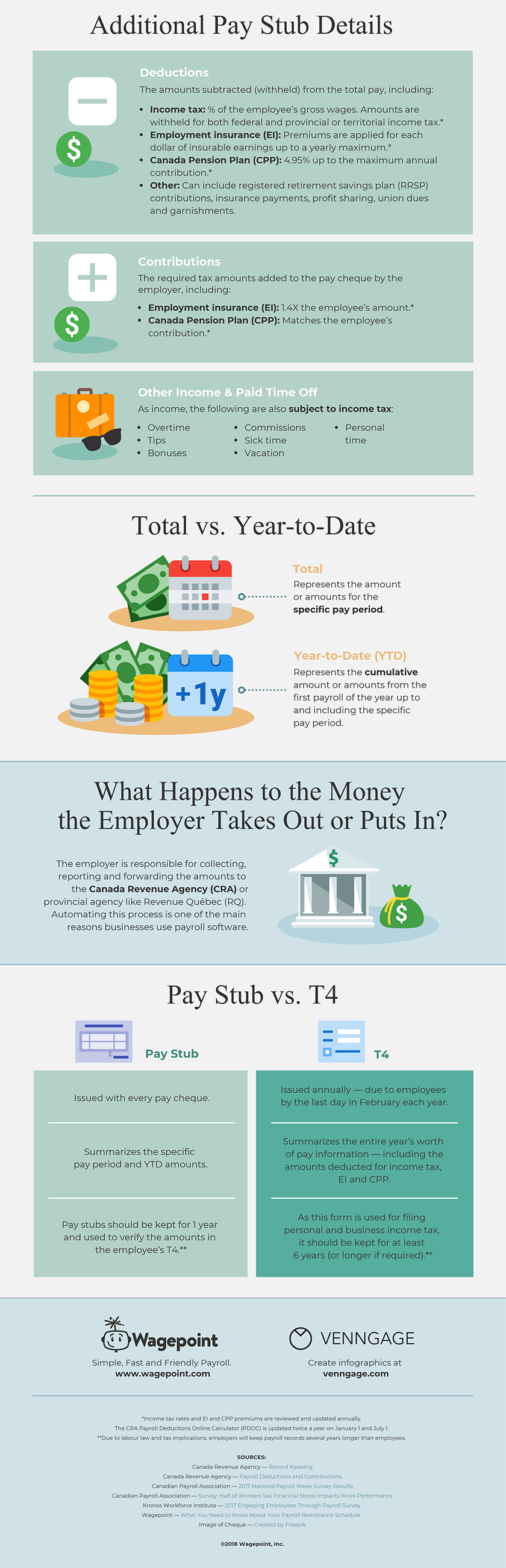

In addition to the details listed above, you’ll also see a list of deductions and contributions, as well as other income and paid time off.

Deductions are the amount subtracted (withheld) from the total pay. They include:

- Income tax. This is a percentage of the employee’s gross wages, withheld for both federal and provincial or territorial income tax.

- Employment insurance (EI). Premiums are applied for each dollar of insurable earning up to a yearly maximum.

- Canada Pension Plan (CPP). This deduction will be 4.95% of the gross pay, up to the maximum annual contribution.

There may be other deductions as well, including insurance payments, profit sharing, union dues, and garnishes.

Contributions are required tax amounts added to the pay cheque by the employer. They include:

- Employment insurance (EI), which is 1.4 times the employee’s amount.

- Canada Pension Plan (CPP), which matches the employee’s contribution.

You may also see other income and paid time off that are subject to income tax, including:

- Overtime

- Tips

- Bonuses

- Commissions

- Sick time

- Vacation

- Personal time

The Difference Between Total and Year-to-Date

Total (or gross pay) is the amount an employee is paid for the specific pay period listed on the pay cheque.

Year-to-Date (YTD) represents the cumulative amount earned to date during this calendar year — from the first payroll of the year up to and including the current pay cheque.

What Happens to the Money the Employer Takes Out of a Pay Cheque?

The employer is tasked with collecting, reporting, and forwarding the amounts taken out of each pay cheque to the Canada Revenue Agency (CRA) or provincial agency like the Revenue Québec (RQ).

Payroll software like Wagepoint automates this process, which is one of the biggest benefits of using it.

Pay Stub vs. T4

What’s the difference between a pay stub and the T4?

A pay stub is issued with every pay cheque. The T4 is issued annually before the last day in February.

A pay stub summarizes the specific pay period and YTD amounts paid to an employee. The T4 summarizes the pay information for the entire year, including the amounts deducted for income tax, EI and CPP.

Pay stubs should be kept for 1 year and used to verify the amounts in the employee’s T4. The T4 is used for filing personal and business income tax and should be kept for 6 years (or longer, if required).

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.