Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Of all the things that are prone to internal errors in a company, payroll is certainly the most essential. It sustains the livelihoods of all the employees, maintains a brand reputation and minimizes operating costs. But it’s easy to get it wrong.

According to a Ceridian survey, 85% of respondents struggle with payroll technologies, which impedes employee productivity, financial wellness and the company’s ability to attract talent. Ernst and Young tried to put a number behind the cost of each payroll error and found it to be $291 in direct cost and indirect labor costs.

Payroll errors drain company resources because amending pay slips for overpayment or underpayment is not easy, especially after a T4 is generated. Fixing payroll errors includes addressing CPP, EI, hourly rates, timeframes and individual policies of provinces. Plus, it’s not a good look at a company from an employee perspective. Last year, Air Canada had to cut back on wages for part-time workers after overpaying them for about 10 months, leading to a nationwide backlash.

Common payroll errors.

Payroll is a complex process that makes it error-prone to the slightest changes. Here are the most common payroll errors you should look out for:

Human error

In payroll, human intervention often does more damage than good. From data entry, reporting employee hours, calculating overtime pay and filling up forms — one instance of human error can lead to long-term issues. One of the most common human errors is miscalculating ancillary benefits, such as company-provided vehicles and adding them to income tax forms. Missing the deadlines to send out T4 at the end of the year is also a common payroll mistake.

Misclassification

Manual data entry leaves room for errors such as employee and pay misclassification. Payroll tax and salary structures vary for full-time and part-time employees; this is where Air Canada faltered last year. Misclassifications don’t stop there, though. Misclassifying an employee as an independent contractor, or vice versa, can also lead to hefty back payments and fines for incorrect payroll taxes. Plus, independent contractors don’t qualify for things like overtime pay. It also pushes payroll deadlines off track, and you end up paying for erratic schedules, which brings us to the third point.

Tax mistakes

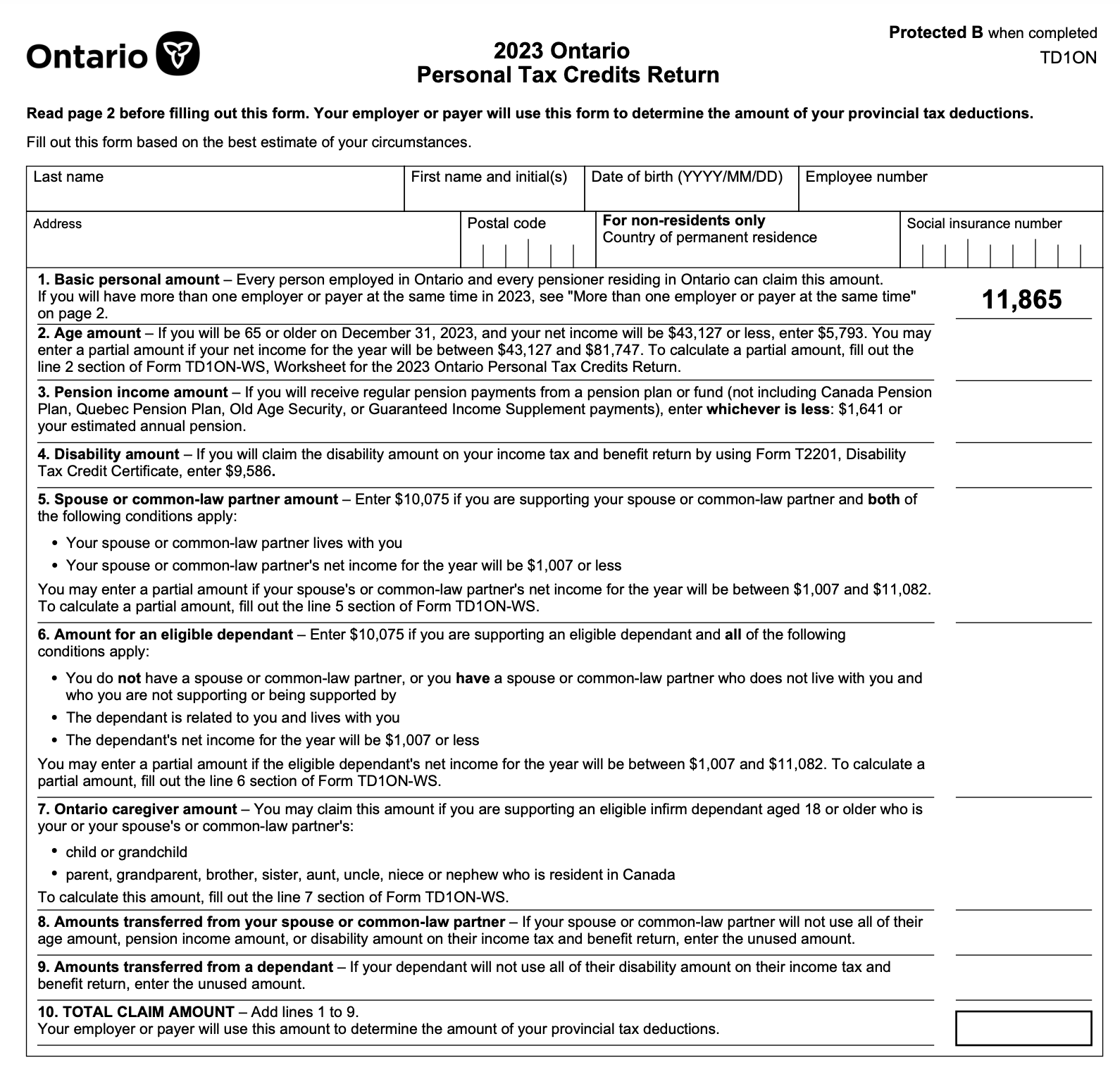

Payroll errors inevitably lead to inaccurate tax reporting, and depending on context, both parties may be held liable. Tax errors happen when TD1s (filled out by the employee outlining tax credits) and T4s (filled out by the employer outlining income and deductions) are not adjusted and factors like overtime pay are ignored. This can also happen if you don’t have the employee set up for the correct provincial taxation, as minimum wages and tax policies vary across the country.

Ontario 2023 TD1 form

Consequences of payroll errors.

Financial impact

The impact of payroll mistakes is felt on the bottom line, especially if you’re a small business. Here are some examples of problems that can occur:

- Payment irregularities

- Payment amend after it’s already been issued to the employee.

- The CRA might ask for supporting documents and fine you as much as 10% of the CPP or EI you failed to report.

- It’s a double setback because you not only spend resources to correct the mistake but also pay fines.

But that’s just the business perspective. According to Payments Canada, 50% of Canadians don’t check the details of pay stubs, and 38% admit they’re unlikely to spot a pay cheque error.

With a major chunk of Canadians living pay cheque to pay cheque, a small error can push a lot of employees into bankruptcy. According to Paycom, 58% of workers would struggle if $100 goes missing from a cheque.

Legal repercussions

When the CRA gets involved in pay discrepancies, it could mean a lot more effort and time from both employer and employees to agree on a solution.

According to the Canada Labour Code (CLC), in case of underpayment, employees can file a suit with the Ministry of Labour against the employer. Each province views payment violations differently and can penalize the employer for thousands of dollars.

Employee trust

Payroll errors can also have a long-term impact on your reputation in the job market.

When most Canadians struggle with the cost of living, irregular payments may feel like you are pulling the rug from under their feet. This means new candidates will be wary of joining your company, and existing employees probably won’t recommend you to others and are more likely to switch to other companies if given a chance.

This type of gaffe weakens your ability to attract and retain talent, which may become a much bigger issue going forward.

Data leaks

One of the worst unintended consequences of payroll errors is sensitive data exposure as a result of social engineering attacks like phishing, smishing and executive impersonation.

Earlier this year, cybercriminals launched a large-scale hack of payroll data, leading to the stolen payroll data of more than 100,000 employees at firms including the BBC, British Airways and high street pharmacy Boots.

This is why choosing a secure payroll software is absolutely critical in order to prevent identity theft of employees, which can become a legal nightmare for any company.

Case study: Real-life impacts of payroll errors.

If you thought last year’s Air Canada mishap was tragic, you’d be surprised to know the consequence of the Workplace Safety and Insurance Board’s (WSIB) payroll errors.

Toronto Star first discovered a WSIB payroll error that underpaid over 100,000 injured workers for 20 years!

From 1998 to 2018, WSIB underreported injury-related benefits that should be revised according to the rising cost of living. It wasn’t until 2019 when worker lawsuits at the Workplace Safety and Insurance Appeals Tribunal (WSIAT) brought this to the Ontario Federation of Labour’s notice, leading to a wider coverage of new cases.

WSIB may have to pay as much as $40,000 in back payments and interests per worker, totaling a package of $42 million. A lot of injured workers could never work after their accident, and some even died before they could receive their due.

Figuring out a payroll error and acting on it immediately can save you a lot of pain. WSIB let complacency get the better of it, and Canadians are now enraged by the systemic negligence in the organization.

Preventing payroll errors.

Making sure payroll mistakes don’t harm your business or employees is a multi-step process. Here are some ways you can go about it:

Automation

Automation’s job is to minimize human involvement and improve the reliability of the reporting system. With automated apps and custom-built software, you can sift through highlighted issues, use bulk processing and maintain a reporting schedule. Automation also bridges and maintains communication between employees, contractors and vendors, making the system and data more transparent and easily accessible. These tools can also translate myriads of data points into insights, which helps in better decision-making within the company.

Outsourcing

A lot of payroll errors simply come down to lack of skills. If you’re running a small business or bootstrapped startup, you might not be able to invest in a high-quality human resource team. But you can’t take risks with payroll either. In such cases, try delegating the tasks to experts who work in your industry and charge only for the service. Outsourcing to a good payroll team also means you’ve covered the compliance part of the region.

Having said that, your success with outsourcing depends a lot on your vetting process, documentation for data security management, proper SLAs and contracts.

Employee training

To avoid costly mistakes, it’s crucial to ensure employees are well-trained and equipped to manage payroll in a compliant manner. Some companies use a compliance training system to standardize security training across their workforce. Most companies today elect to integrate their HR and payroll software to create smoother workflows. When dealing with payroll software and various integrations, employees must be comfortable using all the features, which should be updated with the latest security measures such as a VPN, firewall and password management. Data breaches and data leaks can cripple an organization, especially if employee payroll data gets stolen or exposed to criminals.

Best practices in the payroll process.

Here are some best practices that should minimize the risks of payroll errors:

Time tracking

Human errors in payroll are often triggered by inaccurate time tracking and reporting. Things like buddy punching and a general lack of awareness about time reporting can lead to inaccurate data, especially in companies that don’t have a lot of head counts in upper management. Time reporting software can help streamline payroll management by reducing manual, time-consuming tasks and freeing up finance teams to focus on the essentials such as fixed schedules, hours and overtime reminders and weekly reports. This way, you can understand how your workforce operates and the payroll required to keep the business running.

Record keeping

Most executives are not thrilled about maintaining books and payroll data, but they are crucial to business. Record keeping should include all the documents related to role, benefits and tax deductions. Canada requires employers to keep written employment data, including internships, for at least 36 months and another 36 months after employment ends. If you want to modify or destroy records before the specified period, you must fill in Form T137 to ask for permission.

Regular audits

Next, you should run regular payroll checks to identify and correct errors in the payroll service. The audit report should clarify your record-keeping process and what you can do to improve data hygiene.

Choosing the right payroll solution.

Payroll software

Ceridian’s report highlights that only 54% of businesses use cloud-based payroll software. Canadian business owners still have a long way to go to embrace payroll technologies and eliminate data silos.

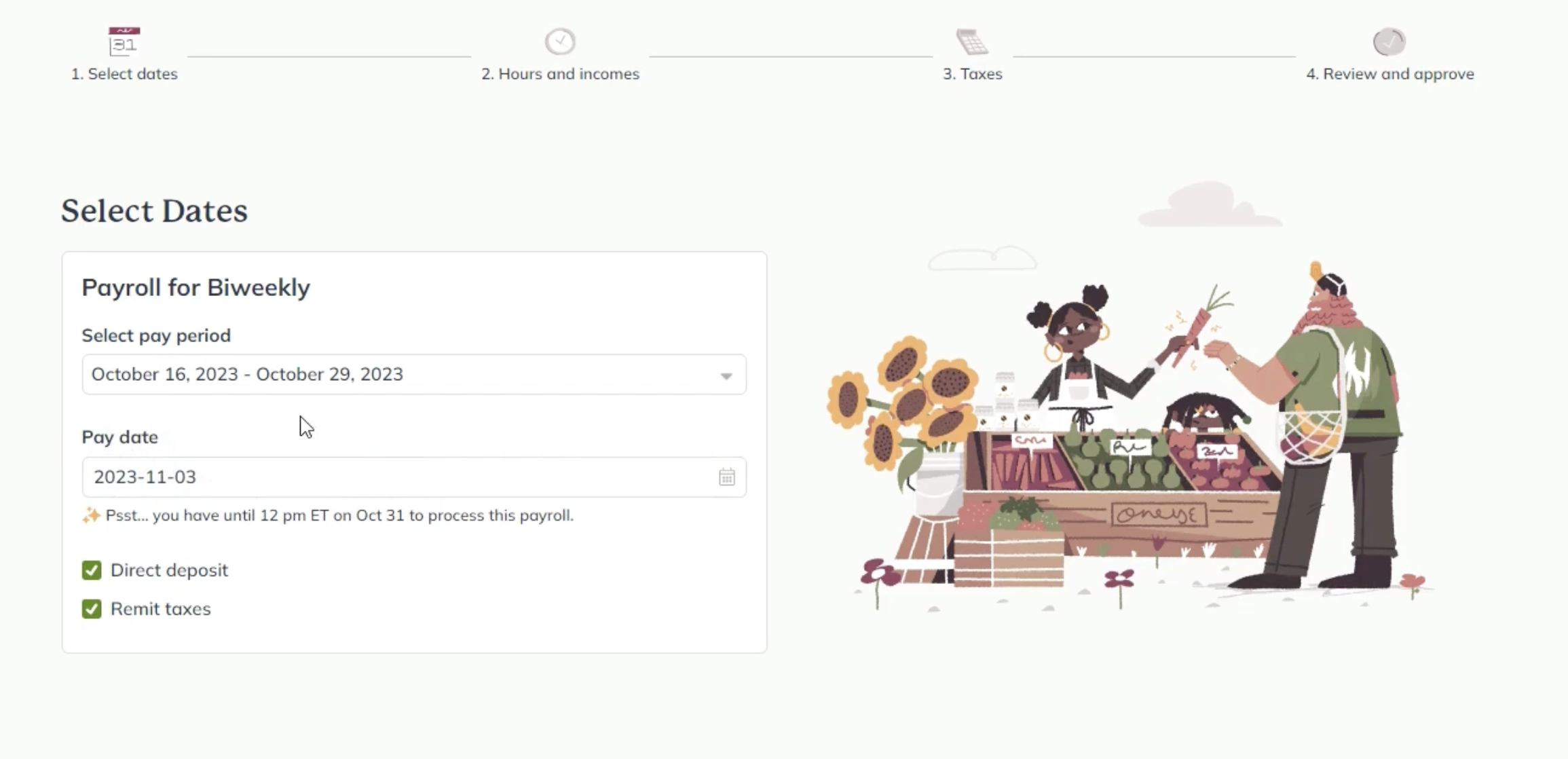

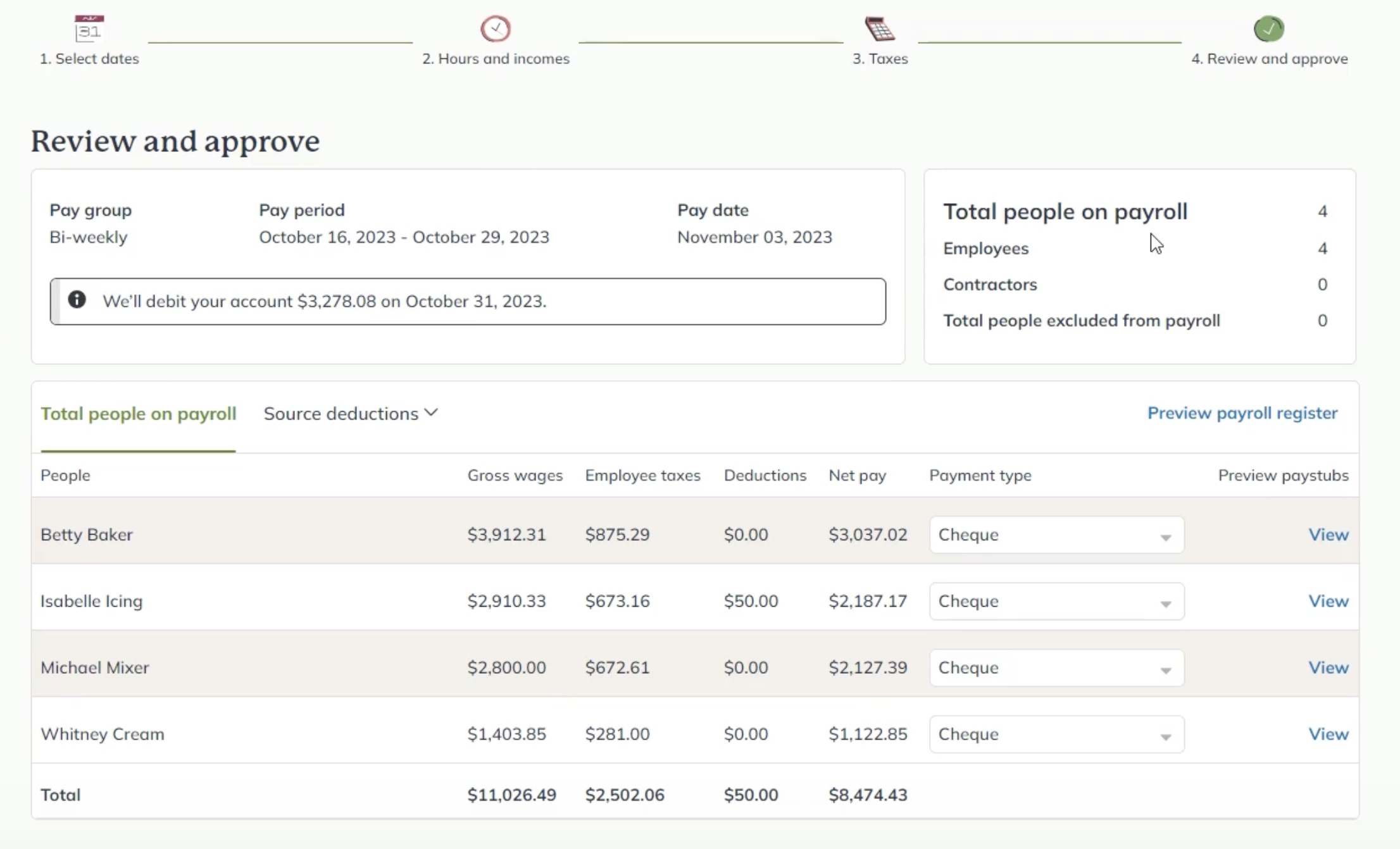

Wagepoint was created to make payroll more accurate and streamlined for Canadian businesses that don’t have the expertise or want to spend too much on it. Wagepoint takes the fear out of payroll by organizing and automating employee details, setting up calendars and creating an all-in-one dashboard to derive insights. This is the new-age payroll software that lets you get back to running your business.

Payroll providers

While picking the right payroll provider that suits your business, you have to focus on five things: the costs, the control over data, how accurate and clear the data is, data security measures and customer feedback. Wagepoint aims to balance all the features customers ask for by providing you with a fully featured and affordable option.

Customization

No two businesses are run the same way, and payroll certainly requires customizability. Make sure you pick a payroll system that can be tweaked to address the unique needs of your business.

The bottom line on payroll mistakes.

Payroll is a never-ending challenge for most Canadian businesses. You can blame it on a lack of accountability and financial awareness, but the excuses don’t hold up if your business allows payroll errors to creep in. The good news is you can always strive to improve your system and tech stack to have a more accurate, transparent and compliant payroll process. Get in touch with Wagepoint to learn more.