Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

The entrepreneurial spirit is very much alive, with deep roots, in cities all across Texas. In the words of Walter Ulrich, CEO of the Houston Technology Center, when speaking about entrepreneurs – “Risk taking is part of our DNA.”

Large firms with deep pockets in the energy sector, headquartered in Houston are investing in innovation, which in turn is creating a booming startup ecosystem. As a result, the arts, education, and medical sectors are also benefiting from the oil money.

There is also significant support from the University of Houston and Rice University, with incubators funding hundreds of startups and thousands of graduates with world-class entrepreneurial educations.

But Houston is a city sensitive to price fluctuations on the global oil markets, because downturns in the price of oil will always impact the amount of funding, whether it comes from the venture arms of Shell, Chevron, or government R&D funding.

During the recession, cities like New York found young talent leaving larger firms to join smaller upstarts, but that wasn’t the case in Houston. Finding and retaining the right talent is something that small businesses starting out in Houston should keep in mind.

And while there’s access to funding, early-stage funding is not as prevalent (apart from the Houston Angel Network), which means bootstrapping is more common among startups and small businesses until they can prove revenue.

Of course for the brave hearted entrepreneurs, none of these challenges are going to be a show stopper, so read on my fellow entrepreneurs!

We’ve got all the information you need for registering a business in Dallas, Texas correctly while staying compliant with payroll regulations in the State of Texas.

Steps for Setting up your Payroll in Houston, Texas

Every small business owner or startup founder in Houston, Texas has to follow the same three steps for setting up their payroll.

-

Business registration

-

Tax payments

-

Compliance requirements

Business Registration

The first phase is to set up your business with the appropriate governmental departments, namely, the IRS, State of Texas, and TEXNET, which is the State of Texas Financial Network.

The Texas Secretary of State has a number of helpful start-up and small business resources you can refer to when starting your small business in Texas.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of Texas: Register for Unemployment taxes

-

State of Texas: Register your business to pay Sales Tax by filling out the Texas Online Tax Registration form.

-

TexNet Online portal: Register your business so you can pay your business taxes online using the TexNet electronic payment network.

Tax Payments

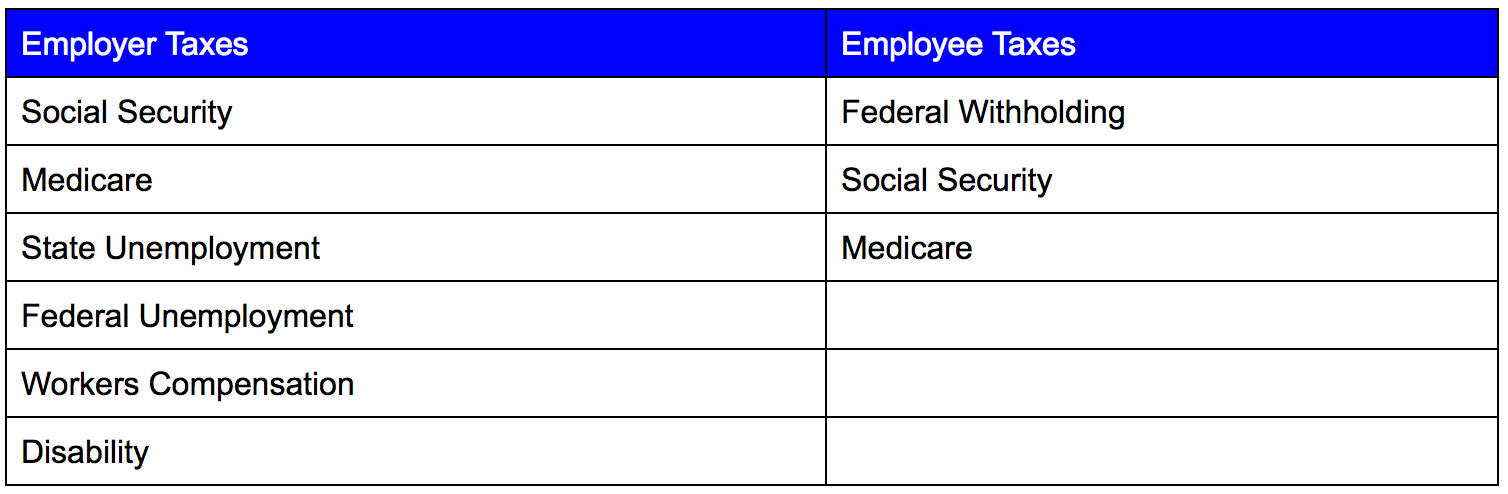

There are employer and employee taxes that you have to account for, irrespective of your business. Here’s a quick outline of all the Texas payroll taxes you need to be aware of:

In order to determine the tax payment schedule for all levels of government, you will need to know how much payroll you paid your employees in the previous year and/or quarter.

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS)

(Note: These are based on your previous quarterly payroll payments.)

-

You’ll pay Semi-weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

-

For new employers, your tax liability for any quarter in the lookback period before you started or acquired your business is considered to be zero. Therefore, you are a monthly schedule depositor for the first calendar year of your business.

As there are no state income taxes in Texas you’ll only have to worry about paying your state and Federal unemployment taxes quarterly.

Compliance Requirements

Paperwork can be a pain, but as an employer, you have to make sure that your business is keeping compliant with all the required payroll forms.

Some of these forms are required right when you hire them, while you have the option to wait until year-end for some of the other forms.

For every employee you hire, complete the following forms when you hire them:

-

W4 Federal Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that this second group of forms are necessary for every employee, regardless if they’re still working for you at year-end or not.

-

For every employee that works for you throughout the year, you’ll need these forms for each one at year-end: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

There you go! Everything you need to know to set up your company for payroll in Houston, Texas. By following these steps, you will lay the right groundwork for your business.