Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

The best bookkeeping apps offer a fantastic and versatile way for bookkeepers to streamline tasks when working with small business clients. If you’re in your due diligence phase, trying to find the best options, you’ll find that most advice and articles on the market focus on big players like QuickBooks Online or Sage.

While these are undeniably powerful, there’s a whole world of other apps and software options out there. Some, designed to do one thing exceptionally well. Others with a range of great features to simplify your work overall.

Key areas where apps and software make bookkeeping easier.

Every bookkeeper or accounting team member dreams of having a workflow that’s streamlined, optimized and simple to deploy. This level of efficiency is essential for those working with smaller businesses, where time is at a premium and every team member needs to work at their best.

Apps and modern bookkeeping software allow for a higher degree of automation and “always on” access through mobile devices, adding convenience and speed to the mix. They also open the door to cloud-based accounting software options, letting team members work remotely while staying agile and efficient. With a broad range of bookkeeping apps and software on the market today, some focus heavily on specific tasks, while others offer more general functionality.

There are so many great apps and alternatives for bookkeeping tasks and working with clients that we can only offer a few examples of how and where the best bookkeeping apps make a difference.

Payroll

Apps streamline payroll processing by automating calculations for wages, taxes and tax deductions, reducing errors and saving time. They also help ensure easier compliance with tax laws and labour regulations by staying updated with the latest rules and automatically applying them for you.

Time and attendance tracking

Accurate and simplified tracking of employee hours, reducing discrepancies and making payroll processing significantly easier. Many integrate directly with existing payroll systems, meaning hassle-free data transfer and minimizing the risk of errors from manual entry and long approval chains.

Document management

Many apps also centralize the storage of your financial information, making it easier to organize, retrieve, and manage important records. Some can even automatically extract and categorize the data from receipts and invoices, reducing or taking manual data entry out of the equation. Not only does this free up your workload, but it can let clients self-manage some uploads and significantly streamline the collection process. No more “hurry up and wait” when it gets close to pivotal deadlines!

Invoices and expenses

Hand-in-hand with document management, apps can streamline the creation, sending and tracking of invoices, ensuring timely payments and reducing the likelihood of missed invoices. They help you track and categorize income, expenses and tax deductions in real time, making managing budgets and preparing for tax season easier.

General accounting and bookkeeping tasks

Cloud-based accounting software and apps let bookkeepers and clients to work together in real time, providing up-to-date financial information. This makes it easier to generate detailed financial reports on the fly, offering a clear view of your business’s financial health and helping with decision-making.

Tax preparation

With the right app on your side, you can organize and categorize your financial information throughout the year, making tax preparation straightforward and reducing the risk of errors around tax deductions and other matters. Again, many apps integrate directly with your accounting software to make transferring data easier for accurate tax filing.

Best apps for bookkeepers.

While it may be tempting to grab every app that looks useful, it’s all about balance. If you’re spending more time organizing your apps than getting to work, you’ve probably gone too far! Bookkeeping apps should enhance and simplify workflows, not cause more stress and work.

Every bookkeeper has slightly different needs and focuses, but these are some of the most popular apps that offer simple solutions to the typical sticking points in the bookkeeping and accounting cycle.

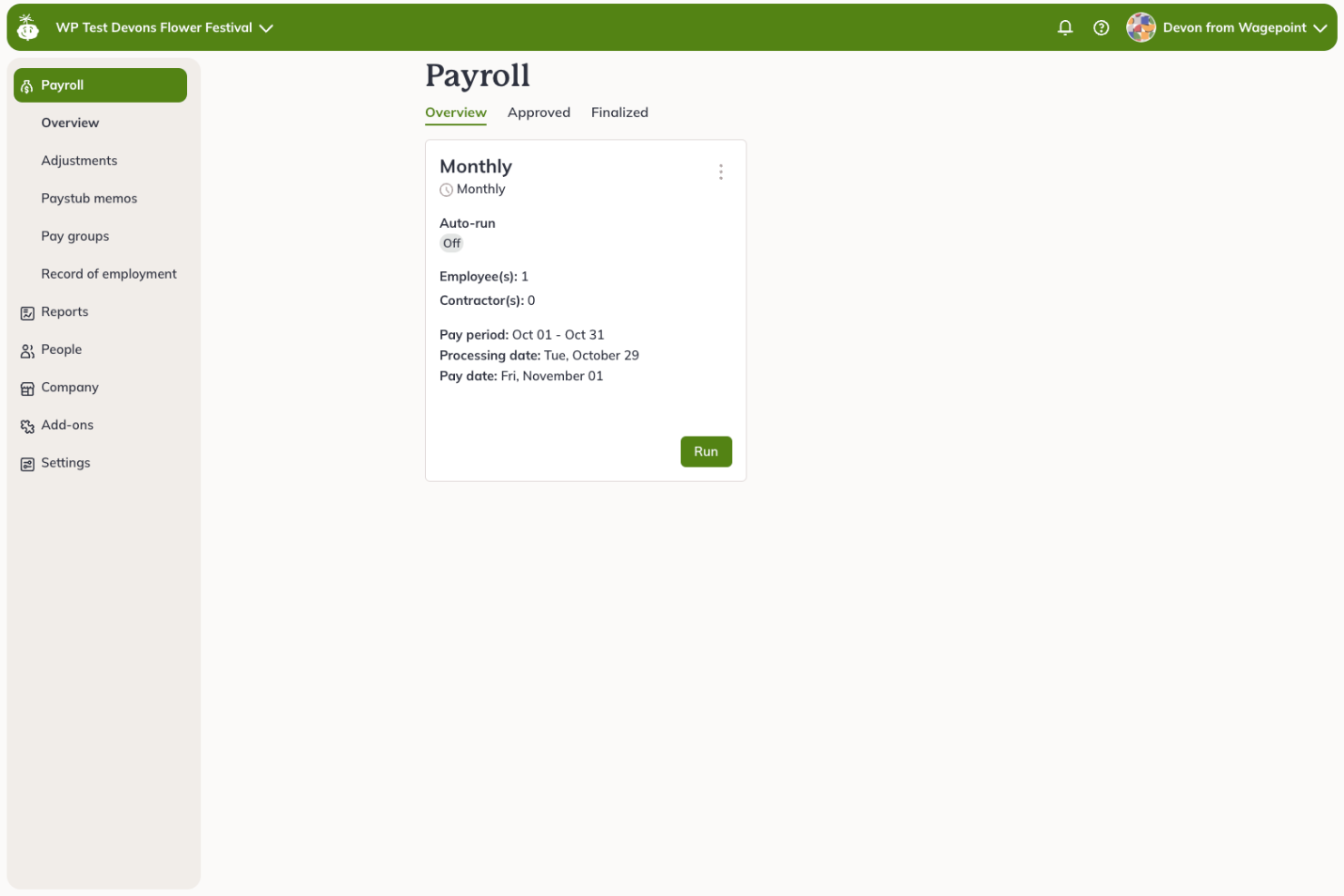

Wagepoint

Task: Payroll

Key features

- Integrates with both Xero and QuickBooks Online for a simplified bookkeeping suite.

- Bookkeeper users can pay subscription fees for client accounts, allowing them to charge the client separately. This is useful for bookkeepers who want to wrap the price of their service and the cost of using the software all into one.

- Auto-run for salaried and fixed-hourly employees makes monthly admin tasks automated and effortless because you can set it and forget it.

- The adjustment feature gives you the chance to fix a mistake yourself instead of needing to reach out to customer support. You can adjust either your most recent pay period or year-to-date values in the most recent report.

- Automated payroll tax calculations and remittances so you and your clients never miss critical deadlines.

Pricing

Solo: $20 CAD/month plus $4 per employee/contractor

Unlimited: $40 CAD/month plus $6 per employee/contractor

Special partner billing rate:

- Bronze – 1-4 clients – 0%

- Silver – 5-14 clients – 5%

- Gold – 15-49 clients – 10%

- Platinum – 50-199 clients – 15%

- Premier – 200+ – 20%

QuickBooks Online Accountant

Task: Accounting firm management and collaboration with both new clients and existing ones.

Key features

- The client dashboard provides an overview of all clients’ financials, making it easy to manage multiple accounts from one place.

- Offers training, certification and support for accountants, helping them become QuickBooks experts.

- Send invoices to multiple clients at once, saving time on repetitive tasks.

- Track and manage tasks, deadlines and projects within the app.

- Connects with over 650 third-party apps to extend functionality, including time tracking, payroll and CRM systems.

Pricing

Free: This is free accounting software offered to accounting professionals who join the QuickBooks ProAdvisor program, with convenient access to the full suite of tools. However, there are costs associated with running the wider QuickBooks software suite. You can also take on the cost of client accounts if you’d like to include it in your own bookkeeping service pricing.

Xero

Task: Collaborating with clients on their books.

Key features

- All client information in one place to get the bigger picture of your practice.

- Automate admin tasks to reduce the amount of paperwork you have to do with each of your clients.

- Tools for collaborating with your practice’s team as well as your clients and even Xero support to get the job done more quickly.

- Additional features to tailor how you work with your clients and manage your practice, such as Xero Cashbook or Xero Ledger for smaller client accounts.

- Advertise to businesses looking for a pro to help them with their books to continue to grow your client base.

Pricing

Free: When signed up for the partner program

Financial Cents

Task: Bookkeeper task management for working with clients.

Key features

- Get documents from your clients faster by securely requesting and receiving it right in the software.

- Keep on top of client work, including who on your team is working on what and any upcoming deadlines to be aware of.

- Organize all your client information in one place, plus get a high level look with the dashboard view.

- Stay on top of client interactions with the audit trail showing you your team’s interactions with clients.

- Invoice your clients right through the platform.

Pricing

Solo Plan: $9 USD/month when billed annually

Team Plan: $39 USD/month when billed annually

Scale Plan: $59 USD/month when billed annually

Microsoft Teams

Task: Team collaboration and communication, often used alongside bookkeeping apps by accounting firms.

Key features

- Integration with Office 365 apps like Excel, Word and SharePoint for easy document sharing and collaboration.

- Dedicated channels for different clients or projects, keeping communications organized.

- Securely share and collaborate on financial documents directly within the app.

- Host virtual meetings to discuss financials with clients or team members for improved remote collaboration.

- Integration with many bookkeeping and project managementapps, like QuickBooks and Trello.

Pricing

Free: Basic plan with limited features.

Microsoft Teams Essentials: $5.40 CAD/month per user

Microsoft 365 Business Basic: $8.10 CAD/month per user

Microsoft 365 Business Standard: $17 CAD/month per user

Sage Accounting (Sage Business Cloud Accounting)

Task: Client accounting management.

Key features

- Automatically imports transactions from bank accounts, reducing time-consuming manual data entry.

- Create and send invoices and receive credit card and online payments directly through the app.

- Provides real-time insights into cash flow, profits and losses, helping businesses stay on top of their finances.

- Automatically calculates taxes and helps with tax filing, ensuring compliance with Canadian regulations.

- Manages transactions in multiple currencies, which is useful for businesses with global clients.

Pricing

Essentials: Free

Standard: $45 CAD/month

Premium: $120 CAD/month

Ignition (Practice Ignition)

Task: Onboarding new clients and proposal management for accountants and bookkeepers.

Key features

- Quickly create and send digital proposals to clients, complete with e-signature capabilities.

- Generate legally binding engagement letters that clients can sign digitally, streamlining the onboarding process for new clients.

- Automated billing for recurring services, ensuring you never miss out on money due to you.

- Centralizes client information, documents and communications in one platform for easier management.

- This cloud-based accounting software integrates with apps like QuickBooks, Xero and Zapier for easy workflow management.

Pricing

Free trial

Core: $149 CAD/month

Pro: $274 CAD/month

Pro+: $599 CAD/month

Dext (formerly Receipt Bank)

Task: Receipt and invoice management for accountants and bookkeepers.

Key features

- Automatically extracts data from income, receipts and invoices, reducing the need for manual data entry.

- Process, categorize and track expenses to keep financial records up-to-date, including across credit cards and other accounts.

- Encryption and security protocols for sensitive financial data.

- Syncs with QuickBooks, Xero and Sage for simplified data transfer to full bookkeeping and accounting software.

- On-the-go receipt scanning and expense tracking.

Pricing

Build your own plan: Use the pricing calculator on their website to get a quote

Dext Essentials: $281.74 CAD/month

Dext Advanced: $304.74 CAD/month

Google Workspace (formerly G Suite)

Task: Cloud-based productivity and collaboration tools for managing client communications and internal communications for bookkeeping/accounting firms.

Key features

- Centralizes document storage through Google Drive, allowing easy access and sharing of financial documents, income, spreadsheets and reports with clients and team members.

- Powerful spreadsheet tool in Google Sheets, with real-time collaboration, ideal for managing budgets, creating financial models and to track expenses.

- Integrated video conferencing tool for meetings with clients and team members, facilitating remote bookkeeping and consultations.

- Integrates with a wide range of third-party accounting and bookkeeping apps, such as QuickBooks, Xero and Expensify.

- Offers enterprise-grade security with features like two-factor authentication, data encryption and compliance with international data protection standards.

Pricing

Business Starter: $7.80 CAD/month per user

Business Standard: $15.60 CAD/month per user

Business Plus: $23.40 CAD/month per user

Enterprise: Contact sales

Wave

Task: Free accounting tool.

Key features

- Offers accounting and invoicing features at no cost, making it accessible for small business owners with tight budgets.

- Create and send invoices directly from the platform, with options for online payments.

- Use the mobile app to scan receipts and automatically categorize expenses.

- Automatically imports and matches transactions from bank accounts and credit cards, reducing manual work.

- Generates financial statements like profit and loss reports, balance sheets and cash flow statements.

Pricing

Free: Free accounting software and invoicing features across core services.

Additional fees: Transaction fees for online payments and payroll services.

Final thoughts on apps for bookkeepers.

As you can see, there are many apps and software suites on offer to bookkeepers and accountants looking to streamline and simplify their workloads and interactions with new clients and existing ones. We probably even mentions some you may not have thought of as apps for bookkeepers at first, like Google Suite and Microsoft Teams. In the end, it’s about simplifying the whole process for both you and your clients.