Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

A Pensionable and Insurable Earnings Review, or PIER report, is one of those CRA notices that can make any employer’s stomach drop. It often shows up when there’s a mismatch in Canada Pension Plan (CPP) or Employment Insurance (EI) amounts reported on your employees’ T4s and T4 Summary.

The good news? A PIER is completely avoidable once you understand what triggers it and what to double-check throughout the year. This guide breaks down how a PIER works and the steps Canadian small businesses can take to prevent one.

What is a PIER Report?

A PIER report is the CRA’s way of checking whether your CPP contributions or EI premiums match what you reported on year-end T4 statements. If something doesn’t add up, even by a small amount, the CRA may send a PIER report outlining:

- The names of the affected employees and the figures the CRA used in their calculations.

- A summary that shows any balance due.

- What you need to correct before penalties or interest apply

- A remittance voucher.

This isn’t just to make sure your small business is making the correct calculations. It’s also to make sure your employees or their beneficiaries receive:

- The correct CPP benefits when they retire, become disabled, or pass away.

- The correct EI benefits if they become unemployed, take maternity or parental leave or some other type of leave of absence.

Suggested Reading: Year-End Payroll Checklist for Canadian Small Businesses

What Triggers a PIER Report?

Before we dive into the specific scenarios, it helps to understand why the CRA issues a PIER in the first place. A PIER is generated when the CRA detects a mismatch between what should have been deducted for CPP or EI and what was actually reported on your T4s and T4 Summary. With that in mind, here are the most common issues that trigger a PIER.

1. Taxable benefits not set up correctly

- If taxable benefits aren’t set up and taxed properly during your payroll processing, there can be calculation errors for EI and/or CPP contributions.

- Always double check the CRA Benefits and allowances chart to confirm they’re set up right or use the CRA’s T4130 Employers’ Guide – Taxable Benefits and Allowances.

2. Changes to the number of pay periods or pay cheques

- In order to determine the amount of CPP contributions that come off each pay cheque, the CRA formula uses the number of pay periods (based on pay frequency) that the employee is expected to be paid. From there, the contribution is prorated and spread out on each pay cheque. That means that if there are any changes to the number of anticipated pay periods or the number of pay cheques the employee actually received that calendar year, there can be a CPP variance.

3. Off-cycle or manual pay runs

- While changing a pay frequency from biweekly to semi-monthly may be obvious, it can be easy to forget if you have issued a one off (AKA off-cycle) pay cheque at some point during the year, such as a bonus or even retroactive pay. Any additional pay cheque outside of the set pay frequency can lead to an error in calculating CPP contributions.

4. Incorrect employee birthdates

- Pensionable earnings are only applicable if you’re between the ages of 18 and 70. If pensionable earnings are recorded outside that age bracket, the CPP contributions and pensionable earnings will need to be fixed. When they aren’t adjusted, that’s when the PIER might come in.

5. Year-to-date totals entered incorrectly

- Pay special attention when porting over or inputting year-to-date totals if you begin using a different payroll system or new software. If those starting numbers are entered incorrectly, it means the calculations moving forward will be off.

If you aren’t using a payroll software like Wagepoint, here are some instructions from the CRA to manually calculate and verify your CPP and EI calculations:

How Can You Avoid a PIER Report

To prevent a PIER, it helps to understand how the CRA evaluates your payroll in the first place. Most discrepancies come from CPP pensionable earnings or EI insurable earnings that were calculated incorrectly. So before we get into prevention, let’s take a closer look at how CPP works and what counts as pensionable earnings.

CPP and Pensionable Earnings

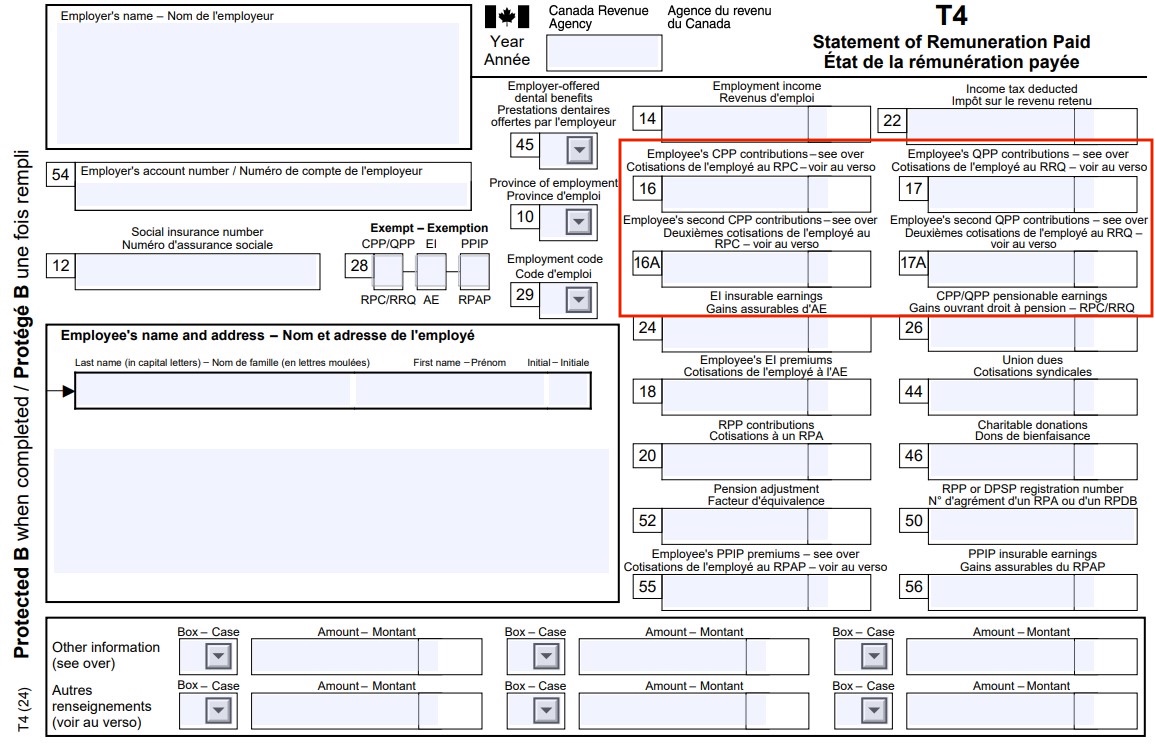

Pensionable earnings are used to calculate the amount of CPP contributions due to the CRA. It’s important to remember that CPP contribution rates, maximums and exemptions are updated annually. As of 2024, there is a second additional CPP contribution (CPP2) rate and maximum that needs to be accounted for, in boxes 16A and 17A (for QPP).

Suggested Reading: A Small Business Guide to CPP2

Pensionable earnings are recorded in box 26 on the T4 slip

CPP / QPP contributions are recorded in boxes 16, 16A, 17 and 17A on the T4 slip

If the pensionable earnings are incorrect, then the CPP contribution calculations will also be incorrect. Let’s review some tips to ensure your pensionable earnings are correct.

Determining What is Pensionable

Generally speaking, if an amount is considered taxable income, it’s also pensionable income — meaning it’s subject to CPP contributions (when calculated in accordance with the Income Tax Act).

Common Types of Pensionable Income

- Most taxable benefits and allowances count as pensionable

- Check out this handy CRA tool to determine if a benefit is taxable

- Regular earnings like wages, salary, commissions, and most forms of remuneration are pensionable

- Don’t forget tips and gratuities, the CRA offers a deeper dive on how to treat tips and gratuities here

- For those in Québec, please see Revenu Québec’s Québec Pension Plan (QPP) page for more information.

EI and Insurable Earnings

Similar to the pensionable earnings, making an error in insurable earnings will also result in incorrect EI premium calculations potentially earning you a PIER report. Insurable earnings also have EI contribution rates and maximums that change annually, so be sure to keep up to date.

Insurable earnings are recorded in box 24 on the T4 slip.

EI premiums are recorded in box 18 on the T4 slip.

Determining Insurable Earnings

Before you can tell whether certain payments should have EI premiums deducted, you first need to understand how the CRA classifies those payments. Insurable earnings depend on whether the compensation is considered cash or non-cash.

Non-Cash

A benefit is considered non-cash (also referred to as “in kind”) when a good or service is provided by the employer. For example, a bus pass would fall under this category. Benefits in kind and non-monetary benefits are considered to be non-cash benefits and not included in insurable earnings.

Cash

A benefit is considered cash when an employee is reimbursed for the cost of a good or service. To be considered insurable, the earnings have to be:

- Paid in cash or convertible to cash

- If the employee is paid partly in non-cash, only the cash benefit part is insurable

- Example: An employee receives a $200 signing bonus via direct deposit: An employee receives a $200 signing bonus via direct deposit

- Note: Gift certificates and cards don’t factor into insurable earnings since they can’t be converted into cash.

- Paid by the employer

- Received and used or enjoyed by the person in relation to the employment.

- Examples: Sick pay, wage loss, stand-by pay, signing bonuses and incentive payments.

Suggested Reading: Taxable Benefit Mistakes You Can’t Afford to Make

What Happens If You Receive a PIER Report?

A PIER isn’t a penalty, it’s a notification that something needs correcting. When a discrepancy is found, The CRA will send a PIER report electronically. You can view, download and reply to the PIER if you’re registered for a My Business Account (or, if you’re representing a small business client, the Represent a Client (RAC) portal).

You Agree With the CRA’s Calculations

If you review the PIER and agree with the CRA’s calculations, you can simply pay the balance owing by the deadline. Once the payment is made, no further action or response is required.

You Don’t Agree With the CRA’s Calculations

If you don’t agree with the discrepancies outlined in the PIER, you’ll need to respond to the CRA. Send any corrected information, supporting details, and a brief explanation of why your calculations differ.

When you receive a PIER, the CRA follows a set timeline. Here’s how it works:

- Day 1: The initial PIER package is sent and you have 30 calendar days to reply.

- Day 45: If you don’t reply or send a payment for the balance due, a notice of assessment will be sent.

- Day 65: The CRA will issue and send you amended T4 slips based on their assessment

What Happens If You Make a CPP or EI Deduction Mistake?

You deducted more CPP contributions or EI premiums from the employee (overpayment)

If you realize that you’ve mistakenly over-deducted CPP or over-deducted EI from an employee’s payroll, don’t worry. You can adjust it on the employee’s next cheque as long as it’s during the same calendar year as the earnings in question. Ensure the correction is reflected in both the employee and employer contribution amounts, and that everything is submitted accurately and on time with your source deductions to the CRA.

If you don’t catch the overpayment during the year that the earnings were paid in, employees will be refunded when they file their income tax and benefit returns. Employers can also apply for a refund of EI and CPP overpayments directly from the CRA by filling out Form PD24, Application for a Refund of Overdeducted CPP Contributions or EI Premiums.

You under-deducted CPP contributions or EI premiums from the employee (recovering)

If you under-deduct EI or CPP on an employee’s payroll, you can recover the employee’s contributions from later payments to the employee. The recovered contribution can be equal to, but not more than, the amount you should have deducted from each payment.

NOTE: You cannot adjust the employee’s income tax deduction to cover the CPP or EI shortfall.

How Payroll Software Helps Prevent PIER Reports

Payroll can be daunting. But when you keep these things in mind before your year-end review, you’re more likely to avoid a PIER report.

Closing out the year and staying compliant along the way gets a whole lot easier when you’re not doing it alone. With the right software, you don’t have to second-guess your calculations or scramble for updated tax tables. Wagepoint handles the math, keeps everything current and puts your employee forms and employer summaries right where you need them at year-end.

You stay focused on your team, and Wagepoint keeps the payroll worries off your plate. Learn more about Wagepoint or book a demo to see how we can support your small business throughout the year.