Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

According to GeekWire, “Phoenix is like a popcorn bag that’s spent 60 seconds in a hot microwave. One minute has passed, but only a few pops are audible. Soon, a flurry of kernels will heat up just enough to elicit multiple explosions all at once, joining those that have already matured into white fluff.”

Some are calling it in the heartland of Silicon Desert, a once non-existent scene emerging, like desert flowers after a downpour.

Suffice to say, local entrepreneurs are feeling more supported these days. Home to world-renowned software startups – GoDaddy and InfusionSoft, there are now dozens of accelerators and investors taking a more serious look at Phoenix.

There are a number of benefits to starting up a business in Phoenix, Arizona:

-

Arizona Tech Investors (ATI) and Desert Angels are now actively supporting dozens of early-stage entrepreneurs, with investments happening every week.

-

Phoenix is a wealthy city, with 114,000 millionaires; although the bulk of that wealth is invested in real estate. However, if you want to access some of that capital you need to show real revenue and customer metrics first.

-

Lower cost of living, and given that you would be calling the sixth most populous city in the country home, there is no shortage of things to do when you aren’t busy building your company.

That said, the critical “missing component” of the startup ecosystem are venture dollars, which means you need to plan growth carefully and always put revenue first.

Later stage rounds will usually require external funding, so get talking to VC’s early if you are building a company that will need to scale quickly. With relatively few exits, don’t be alarmed if raising money takes somewhat longer when dealing with out of state investors.

Now let’s look at what you need to do as a small business owner to get your company set up in Phoenix, Arizona.

Steps for Setting up your Payroll in Arizona, Phoenix

There are three important steps to setting up payroll services in Phoenix, AZ:

-

Business registration

-

Tax payments

-

Compliance requirements

Let’s take a closer look at each one and see what’s involved in each step.

Business Registration

The first phase is to set up your business with the appropriate governmental departments, namely, the IRS, State of Arizona’s Department of Revenue and the Arizona Department of Economic Security.

-

IRS: Apply for your Federal Employer Identification Number (FEIN).

-

State of Arizona: Register with the Department of Revenue to pay Employer Withholdings.

-

State of Arizona: Register with the Department of Revenue to pay withholdings electronically using the Electronic Funds Transfer Program.

-

State of Arizona: Register with the Arizona Department of Economic Security to pay Unemployment taxes using the Arizona Tax and Wage system.

Tax Payments

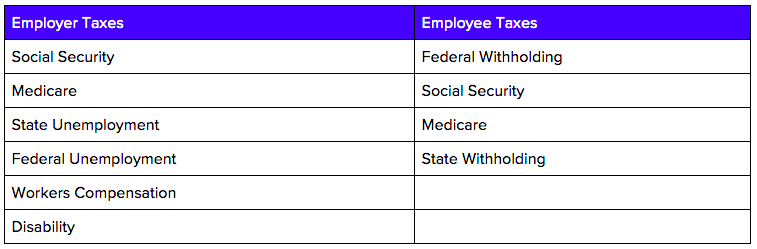

Once your register a business in Arizona, let’s look at the different tax payments you will have to pay for your business and your employees:

Federal Taxes: Payable to the IRS via electronic funds transfer (EFTPS)

-

You’ll pay Semi-Weekly, if you paid more than $2,500 in payroll.

-

You’ll pay Monthly, if you paid less than $2,500 in payroll.

-

You’ll pay Next Day, if you paid more than $100,000 in payroll.

-

For new employers, your tax liability for any quarter in the look-back period before you started or acquired your business is considered to be zero. Therefore, you are a monthly schedule depositor for the first calendar year of your business.

(Note: These are based on your previous quarterly payroll payments.)

Arizona state withholding follows the federal schedule. State deposits are due the same time that federal deposits are due.

Compliance Requirements

The final phase of setting up your business properly for Arizona payroll is to have particular government tax forms completed for all employees. Some of these forms are required right when you hire them, while you have the option to wait until year-end for some of the other forms.

For every employee you hire, complete the following forms when you hire them:

-

W4 Federal Withholding Allowance Certificate

-

I-9 Employment Eligibility Verification

Keep in mind that this second group of forms are necessary for every employee, regardless if they’re still working for you at year-end or not.

-

For every employee that works for you throughout the year, you’ll need these forms for each one at year-end: W2 Wage and Tax Statement and/or 1099 Misc. Income – Contractors.

Starting a business is complicated, but we hope this post gives you a great foundation to build on.

Your small business or startup will be registered with all the appropriate tax agencies. You’ll know what your tax payment schedule is and how to pay these taxes, assuming this is not being handled by your payroll provider. You’ll even have all the employee forms ready for your staff when they come on board.