Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

This is the Canadian version of this post. For information on managing tipped employees in the United States, click here.

If your business has a focus in the service, hospitality or restaurant industries, some, if not all, of your employees are affected by the Canadian tax laws for tips and gratuities. As a result, you are also affected when it comes to reporting tips and gratuities as income through the process of running payroll.

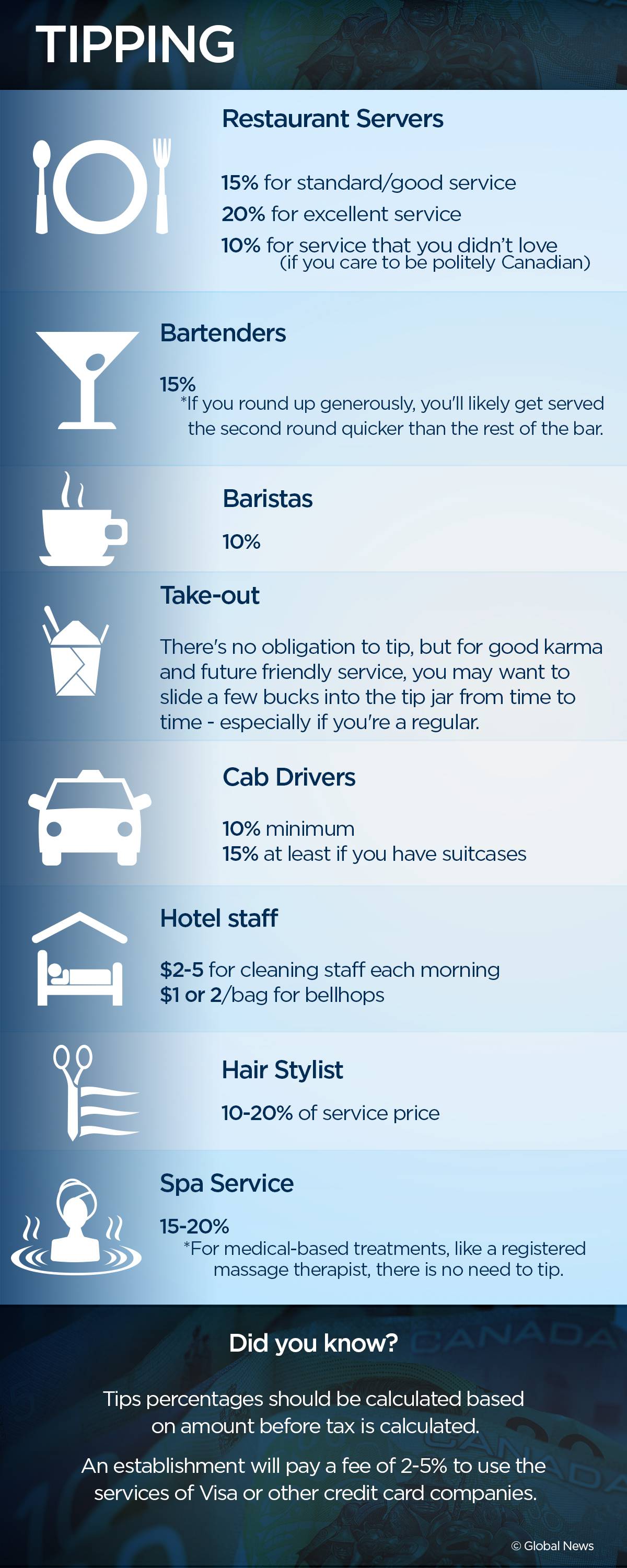

Who earns tips and how much do they get?

In October 2015, Global News included the following infographic on tipping etiquette in a report on whether tipping should be abolished. (The poll results: 2,152/4,753 voters said they’d be ok with doing away with tips, even if it resulted in higher prices. But that’s a different discussion altogether.)

The Canada Revenue Agency (CRA) guidelines for tips and gratuities.

While the CRA considers any tips and gratuities received by an employee as income, it further categorizes tips into two kinds — direct and controlled — determined by whether or not the employer had or has any control over these funds.

- Controlled Tips — Tips and gratuities that at some point have come under control or management of the employer before being paid out to the employees. Examples include:

- Automatic service charges/fees, like those for large parties, that are processed as part of the total bill.

- Tip pooling in which the employer is directly involved in distributing the funds among a group of employees.

- Tips applied to credit or debit cards that are returned electronically to employees.

- Direct Tips — Tips and gratuities that are paid directly to the employees, including:

- A cash tip left on a table or handed directly to an employee by the customer.

- Tip pools in which the employees control the distribution.

- Tips applied to credit or debit cards that are returned as cash to employees.

The current rules for credit card processing fees.

At the moment, employers may not deduct credit card processing fees from employees’ tips. For instance, if a customer places a $10 tip on a credit card, which in turn charges the business a 2% fee, 100% of the tip, the entire $10 goes to the employee. Currently, Ontario is the only province that is considering changing this rule and allowing employers to deduct credit card processing fees under an amendment to Bill 12.

The tax implications of controlled tips for employers.

Because they have come under the physical control of business, controlled tips are considered part of the business’ income.

- Controlled tips are subject to Canada Pension Plan (CPP), Employment Insurance (EI) and income tax deductions, also known as source deductions or remittances, applied during payroll.

- Any deductions that an employer takes for tips paid out must be documented.

- Controlled tips are reported in Box 14 on the employee’s T4.

When employers intentionally fail to report controlled tips.

Canadian Restaurant Tax Advisor, Paul S. Hewitt, writes that failure to report controlled tips and remit related source deductions is considered unreported income, subject to income and sales tax along with interest and penalties.

- As in sales tax cases, the restaurant owner might also be held liable for these business penalties.

- If an audit results, it’s an administrative nightmare requiring the review of all of your employees’ records.

- If you have to go back and redo payroll remittances, you may only go back a maximum of 12 months.

In a May 2016 Globe and Mail interview, Hewitt advises that the best way for employers, restaurants in particular, to manage tips is to avoid as many instances in which they take control of tips. In other words, he recommends that employers be hands off, putting employees in charge of tip pools, etc.

The tax implications of direct tips for employees.

As direct tips go straight to the employee, employers are not required to make CPP, EI or income tax deductions.

- Employees are required to keep a record of direct tips and gratuities in order to file personal income taxes.

- At the end of the year, employees can report direct tips in Line 104 on their income tax form.

- If desired, the employee can elect to make CPP contributions on direct tips through payroll by filing an Election to Pay CPP Contributions, known as Form CPT20.

- In a blog post on reporting tipped income, Intuit TurboTax recommends that tipped employees set aside approximately 25% of their tipped income to allow for taxes.

Keeping a tip log.

All that’s required of an employee in a tip log is a record of the days worked and the amount of direct tips earned. This can be kept as a written document or spreadsheet. Smartphone savvy employees may also use tip tracking apps and software, like GrataSoft, Just The Tips, ServerLife, Tip Counter , Tip Bucket, Tip Jar, TipMe, Tip$ee and Tip Sheet.

Why following the laws is the right way to go.

The accounting firm LL Brougham advocates for the proper reporting of tips by both employers and employees in order to:

- Prevent audits and sometimes substantial penalties for employers.

- Establish higher levels of income that are more favourable to employees when applying for credit and loans at financial institutions.

- Maximizing individual CPP and Registered Retirement Savings Plan (RRSP) contributions, which are based on income.

For individuals who plan a long-term career in service industries, they also recommend working with a professional accountant or advisor in order to ensure that their income is reported the right way throughout their lifetimes.

Declared tips in Québec.

Declared tips are direct tips that employees must declare to their employers. Right now, Quebec is the only province that requires that employees report direct tips to employers. Detailed information on this process can be found in French and English on the Revenu Québec website.

Ontario’s Bill 12 — Protecting Employees’ Tips Act

With the passing of this law, as of June 10, 2016, Ontario has made it illegal for employers to take employees’ tips and gratuities.

Under this rule, employers MAY NOT:

- Dock employees’ tips for breakage, spillage or any other similar kinds of loss or damage.

In certain instances, employers MAY collect a portion of tips:

- If the employer is overseeing the process of tip pooling.

- If a specific law, court or labour agreement authorizes the deduction.

Based on Ontario’s Employment Standards Act, 2000 (ESA) in workplaces where tips and gratuities are received, the workers covered by this act include employees at bars, restaurants, hair and nail salons, catering firms and taxis.

Get the full details from the Ontario Department of Labour’s official press release and Restaurants Canada’s official notice.

Why a great payroll solution makes all the difference.

More than 30 cents of every dollar spent at a restaurant goes directly to payroll costs.

Of course, this statistic above doesn’t include the sheer amount of time it takes to attempt to do payroll manually. With razor-thin margins and no room for error, the proper processing of payroll and payroll taxes is essential. This is why we are here. Wagepoint is simple, fast and friendly payroll for small business, including restaurants. Our software has rules for relevant taxes and withholdings — which can be applied and processed automatically, saving you guesswork and frustration while helping ensure compliance.

Disclaimer: The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.