Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

T4s, T4As and Relevés — what do they have in common, other than the fact that T4A and Relevé rhyme? Or, that you could easily refer to these things as “T4-ehs?” for all the confusion they cause.

Don’t worry, this article will help answer some of your most burning questions about these forms. 🔥

What are said T4s, T4As and Relevés?

In their simplest forms, these documents are used by employers to report the wages and taxes included in the business’ payroll and paid to each employee or contractor within a given calendar year.

They’re what you might call the “holy grail” of payroll documents. They’re sent to your employees, your contractors — and the Canada Revenue Agency (CRA) or Revenue Québec (RQ) by the last business day of February each year.

- If you make a mistake, there’s no hiding — both the government and your workers will know.

- Beyond trust issues, there’s the pain of correcting mistakes and the risk of fines and penalties.

Who gets a T4, T4A or RL-1?

- T4s are given to employees and the CRA.

(You need to create a T4 for each province and territory in which the employee earned income.) - T4As are given to independent contractors and the CRA.

(Same as a T4, create one for each province and territory in which the contractor was paid.) - Relevé 1s (RL-1s) are what gets submitted to RQ for workers in that province.

(Note: Relevé 1s are an additional item that gets submitted to RQ for Québec-based employees and contractors. Employers must also issue federal T4s or T4As. )

Payroll year-end?

These forms are all part of a process called payroll year-end. The end of the calendar year (and the last few months leading up to it) is when businesses close the books the previous calendar year and complete all their required compliance reports and documents — mainly T4, T4A and Relevé slips, which are probably the most well-known parts of a payroll year-end.

Year-end is also when employers must reconcile their payroll amounts. This is when you add up what you’ve paid in wages and programs, like Employment Insurance (EI) or Québec Parental Insurance Plan (QPIP) and Canada Pension Plan(CPP) or Québec Pension Plan (QPP) and report them to the Canada Revenue Agency (CRA) or Revenue Québec (RQ). This pretty much goes hand-in-hand with issuing T4s, T4As and RL-1s.

This article will help you learn the basics about T4s, T4As and RL-1s. It will also show you why automating calculations and remittances using payroll software, like Wagepoint, can help you make creating these forms a lot easier each year.

What’s a T4?

A T4 Statement of Remuneration Paid is an information slip that shows how much money an employee earned and how much was withheld and remitted to the government for tax purposes. It is also the form that your employees use to file their income taxes each year.

Every year, T4 slips are required for the following instances:

- Employees you’ve paid more than $500.

- Any deductions for CPP or QPP contributions, EI premiums, Provincial Parental Insurance Plan (PPIP) premiums or income tax from an employee’s pay.

- Every employee whether they’re current, inactive or terminated.

- T4 slips for the previous calendar year are due to employees and the CRA by the last business day in February immediately following the calendar year.

Note: You also need to create a T4 for every province and territory in which the employee earned income.

What’s included in a T4 issued by an employer?

Generally, most taxable income, allowances, benefits, deductions and pension plan contributions are included in the employer’s T4 form.

Here’s an overview of some of the main boxes within a T4:

2024 T4 Statement of Remuneration Paid

(Pro Tip: You can tell what year a form is for by looking at the description along the bottom left edge.)

Employer’s name

This is your company name. Ensure that you spell it the same way you have it in your business registration forms and reporting documents that go to the CRA.

Employee’s name and address

This field needs to be correct so that everything matches in the CRA’s system. This should be the same name you have in your payroll system. It should be formatted first name and initial. You may also use just the initials for the first and middle initial.

DO NOT include professional titles of courtesy titles, such as director, Mr., Mrs, etc.

Enter the employee’s full address, including Canadian province or territory and postal code.

Year

This is the calendar year — January through December — for which you are reporting the employee’s income. It’s the year in which you paid the wages to the employee.

Box 10 — Province of employment

In most cases, this is the province or territory where the work takes place. For example, see the CRA’s guidelines on determining the province of employment. But wait, there’s more — you also have to use the proper two-letter abbreviation. See the list below:

Box 12 — Social insurance number (SIN)

As we all know, a SIN is like a license plate. It’s an identifier. (Fun fact: SINs were first created as part of the Canada Pension Plan.) A mistake in this nine-digit code can wreak havoc. To avoid this, check your employee’s SIN number when you hire them and make time to verify this at least once a year, especially for new hires.

- For a temporary SIN that’s been replaced by a permanent SIN, enter the permanent SIN.

- If you don’t have a SIN at all, enter all zeros.

Box 14 — Total employment income

This is the box where you enter the overall total for all the income paid to the employee in the calendar year. This is the “Big Kahuna” number on the T4 that includes all the types of income, including wages, bonuses, commissions, vacation pay, etc.

The other boxes in the T4 break this number down in further detail, but this is the one that’s the sum of them all.

Box 16/17 — Canada Pension Plan (CPP) or Québec Pension Plan (QPP) contributions

If you withheld CPP contributions for the employee, you’ll put the total amount in Box 16. If you withheld QPP contributions, you will put that total in Box 17. If an employee is exempt from CPP or QPP, you may leave these boxes empty. Note: These amounts are only the employee’s amounts, the amounts taken out at each pay — not the employer’s amounts, the amounts contributed each pay.

Box 16A/17A: Employee’s Second Additional CPP Contributions (CPP2) or Employee’s Second Additional QPP Contributions (QPP2)

These boxes report any secondary contributions to the Canada Pension Plan (CPP) or Québec Pension Plan (QPP) made by employees, where applicable. You may leave the boxes blank if the employee did not make any contributions in 2024.

Box 18 — Employee’s EI (Employment Insurance) premiums

This is the amount you withheld from the employee’s cheque each pay for EI — up to a maximum amount which is set each year. If you didn’t deduct EI from the employee’s pay, leave the box blank.

Box 20 — RPP (Registered Pension Plan) contributions

This is the total that the employee paid into an RPP. If the employee didn’t contribute or participate, you may leave this box blank. This box is for direct contributions RPP only, not amounts moved from a registered retirement savings plan (RRSP) to an RPP or employer contributions to an employee’s RRSP.

Box 22 — Income tax deducted

This box shows the total amount of income taxes deducted from the employee’s earnings, including federal and provincial (all except Quebec) and territorial income taxes.

Box 24 — Total EI insurable earnings

This is the amount in Box 14 (Employment income) up to the maximum EI allowable earnings for the year and less any non-EI insurable taxable benefits.

If the employee had no EI insurable earnings and Box 18 (Employee’s EI premiums) is blank, enter zero.

Box 26 — CPP/QPP pensionable earnings

Box 26 is usually the same as Box 14 (Employment income) up to the maximum CPP/QPP allowable earnings in the year. Notable exceptions include employees who are under 18 and those who are over the age of 70.

If the employee had no pensionable earnings and boxes 16 and 17 are blank, enter zero.

Box 28 — Exempt (CPP/QPP, EI and PPIP)

This box is to show exemption for CPP contributions, EI premiums and Provincial Parental Insurance Plan (PPIP) premiums for the entire reporting period. Enter an X into this box only if you didn’t have to withhold these amounts. You can leave it blank if you:

- Reported a retiring allowance with no other types of income.

- Reported more than 0 in boxes 16, 17 or 26.

- Reported 0 in box 26 and the employee filled out and gave to you Form CPT30.

- Reported 0 in box 26 and the employee worked employment type C to O on the back of Form CPT20.

Box 29 — Employment code

This box is for workers with specific employment codes tied to their employment. Only enter a code if one of the following applies.

- 11 – Placement or employment agency workers

- 12 – Taxi drives or drives of other passenger-carrying vehicles

- 13 – Barbers or hairdressers

- 14 – Withdrawal from a prescribed salary deferral arrangement plan

- 15 – Seasonal Agricultural Workers Program

- 16 – Detached employee – Social security agreement

- 17 – Fishers – Self-employed

Note: For code 11, 12, 13 or 17, don’t enter an amount into Box 14.

Box 44 — Union dues

Employers only need to fill in amounts if you and the union agree that the union will not issue receipts to employees. (Keep a copy of this agreement in your records.) This amount should only include what the employer deducted. It does not include initiation fees or strike pay.

Box 45 — Employer-Offered Dental Benefits

Enter the the related code to this box if you gave your employees access to dental care insurance or coverage for any dental services. These are the codes as outlined by the CRA:

- 1 Not eligible to access any dental care insurance, or coverage of dental services of any kind

- 2 Payee only

- 3 Payee, spouse and dependent children

- 4 Payee and their spouse

- 5 Payee and their dependent children

Box 46 — Charitable donations

In this box, you enter any amounts withheld for charitable donations.

Box 50 — RPP or Differed Profit-Sharing Plan (DPSP) registration number

This is the seven-digit number used for your RPP or DPSP registration. If the employee participates in more than one plan, include the registration number for the plan with the largest pension adjustment (PA).

Box 52 — Pension adjustment (PA)

- If you have an employee that worked in more than one province or territory, report this amount proportionally in the T4s. If you can’t portion it, report it on only one of the T4s.

- If the employee participates in more than one RPP and or DPSP, calculate the amount using the total credits for all the plans.

- If an employee is on a leave of absence and is still accruing pensionable service or credits, you must report these credits — even if the employee has no employment income.

Leave this box blank if:

- The calculated PA is a negative amount or zero.

- The employee passed away.

- The employee no longer accrues new pension credits in the year.

Special calculations may apply for employees who:

- Left your employment.

- Are on or return from a leave of absence.

- Participate in a salary deferral.

- Work part-time.

👉 Helpful resource: CRA Pension Adjustment Guide.

Box 54 — Employer’s account number

This box is for the 15-character account number that you use to send the CRA your employees’ deductions. It’s the payroll account number you’ll find at the top of your PD7A statement of account.

Note: This number shouldn’t appear on the two T4 slip copies your give to your employees.

Box 55 — Employee’s PPIP premiums

Report PPIP premiums you deducted for employees who worked in Québec.

Box 56 — PPIP insurable earnings

Report the total amount used to calculate an employee’s PPIP premiums if they worked in Québec. Leave the box blank if:

- There are no insurable earnings.

- The insurable earnings are the same amount as the employment income in Box 14.

- The insurable earnings are over the yearly maximum.

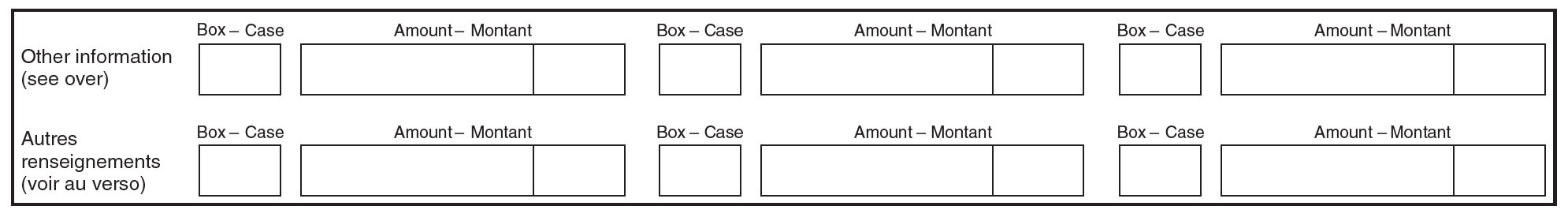

Bottom rows — Other information area

At the bottom of the T4, there are two rows of empty boxes and amounts. This is where you enter codes for “other” specific types of income that the CRA likes you to break down.

- These boxes are not pre-numbered like the boxes at the top of the T4. Instead, you enter the appropriate codes and amounts. (Full list of T4 codes.)

- If you have more than 6 codes for one employee, you’ll use a second T4. However, you only need to include your identifying business information and the employee’s identifying information at the top of the second T4.

Some of the most common codes for the other information area in the T4

Code 34 — Personal use of an employer’s car or vehicle

If you offer this benefit, use this code to note the amount here. This amount should also be included in Box 14.

Code 38 — Security options benefits

Use this code to document income from company stock (securities) or mutual funds trusts. This income is also included in Box 14.

Code 40 — Other taxable allowances and benefits

This is where you document taxable benefits and allowances (subject EI and CPP/QPP) — that you didn’t include anywhere else in the top boxes on the T4, other than Box 14 (Total Employment Income).

Code 42 — Commissions

It may be rather shocking to find that this is where you list commissions. This income is also included in Box 14.

Code 71 — Indian (exempt income) – Employment

List wages paid to a Indian employee. These wages are exempt from CPP/QPP. However, you do have to deduct EI and Québec PPIP premiums as applicable.

Code 94 – Indian Act (exempt employment income) – RPP contributions

For T4 slips submitted for the 2024 tax year and beyond, only report contributions to a registered pension plan (RPP) related to tax-exempt employment income paid to registered employees or eligible for registration under the Indian Act, using Code 94.

Code 95 – Indian Act (exempt employment income) – Unions Dues

For T4 slips submitted for the 2024 tax year and beyond, only report union dues associated with tax-exempt employment income paid to registered employees or eligible for registration under the Indian Act, using Code 95.

Where to find or calculate the amounts required to complete a T4:

If you’re using payroll software, you can find the information to fill out your T4s within the Payroll Register, a report that summarizes all your year-to-date amounts (YTD amounts). This is a fancy way of saying all the totals for wages, income tax, EI, CPP/QPP and other provincial/territorial taxes.

If you’re using Wagepoint and have run at least two (2) payrolls within the same calendar year, we’ll create and submit your T4s on your behalf at no extra charge.

General guidelines for completing a T4.

The following rules also apply to T4As and RL-1s:

- Fill them out clearly.

- Report all amounts, in dollars and cents.

- Pension adjustment, reported in dollars only, is the exception.

- Report all amounts in Canadian dollars.

- Don’t use either hyphens or dashes between numbers.

- Don’t add $ to any amount.

- Don’t show negative amounts.

- If you don’t have an amount or it doesn’t apply, leave the box blank rather than entering “nil” or all zeros, except for boxes that ask for them, such as Boxes 12, 24 and 26. (👉 Our Customer Service Team asked us to call this one out.)

- Don’t change the box headings — this is the CRA’s form, not yours.

Providing T4s to your employees.

Unless you have your employee’s permission to send their slips by mail, it’s best to issue their T4s electronically. Having a secured employee portal makes it really easy for you to distribute their tax information and for your employees to access it — a win-win!

👉 If you choose to send T4s by standard mail, you must get written permission from each employee to do so.

👉 If you’re using Wagepoint, your employees can access their T4 documents through the same online portal where their paystubs are found.

Filing T4s with the CRA.

If you have more than five T4 slips (after December 31,2023) or 50 T4 slips (if you file before January 1, 2024), the T4s have to be sent electronically.

If you’re using Wagepoint, ensure that you’ve set your “auto-submit” status to “YES” (in your account settings) so that we can file your year-end forms on your behalf.

If you choose to file your return on paper, mail it to review the CRA’s Tax Centre addresses.

If you need more paper copies, you can order a maximum of T4 forms online or by calling 1-800-959-5525. (But, isn’t it just a little ironic to order paper forms online?)

T4 Summary.

When you submit your T4s, you must also include a T4 Summary of Remuneration Paid. This is basically a top-level report summarizing all the amounts your business listed in each of the employee T4s. If you have more than one Payroll Account Number, you have to submit one for each Payroll Account Number.

If you use Wagepoint, yep — you got it — we’ll send this information for you.

Balance due.

Ok, so since payroll doesn’t fit perfectly into a 365-day calendar year box, you’ll have one final remittance or balance due for your EI and CPP/QPP payments. Regardless of your remittance frequency, this amount is due when you submit your T4s.

These payments are due January 15. Wagepoint customers, this will be included as part of your regular remittance schedule.

Amending or changing T4s.

So say after you send your T4s, you realize there’s a mistake. If it’s anything other than a change of employee address, you need to submit a change.

- Making changes electronically: Only change the fields that need updating and use summary and slip type code “A”.

- On paper: Write “AMENDED” at the top of the form to clearly identify the version. Fill out all the fields, even those that were originally correct. Include a letter explaining the change to any national verification and collection centre. You don’t need to file a new T4 Summary, but don’t forget to send two copies of the amended slip to the employee.

- If you get a PIER report: Respond to the Pensionable and Insurable Earnings Review (PIER) instead of simply amending the T4.

Pensionable and Insurable Earnings Review (PIER).

This is the part where the CRA gets to write you back. They review the amounts in your T4s to ensure they match the amounts your business withheld and remitted. If something doesn’t align with your CPP/QPP or EI amounts, the PIER will show which T4 had the discrepancy. You’ll also get a PIER if you owe any remittances.

T4 penalties.

The last business day of February is a date you don’t want to miss.

Fines are calculated based on the number of returns. Here are the fines for late T4s:

If you fail to file electronically when sending more than 50 T4s, the fines are:

If you’re late on paying any amount owing to the CRA, they can apply interest starting the very day the payment was due. The CRA updates their interest rate every quarter and interest is compounded daily.

Helpful T4 reference pages from the CRA

Writer’s aside: As I was creating this guide, these pages were almost always open in my browser. The CRA must think I’m their biggest fangirl.

- Employer’s Guide to Payroll Deductions and Remittances — The top-level document every small business with employees should know about. It has a hugely helpful, searchable table of contents.

- Employer’s Guide to Filing the T4 Slip and Summary — The CRA’s guide to completing T4s. It has a detailed, searchable table of contents.

- Breakdown of T4 Boxes and Codes — Bookmark this clickable list of all the T4 boxes and codes, just do it. The page itself is titled, “Filling out the T4 slip” — simply scroll down the page to find the information on the boxes and codes.

- Amending, cancelling, adding, or replacing T4 slips

What’s a T4A?

A T4A, also long-windedly known as the Statement of Pension, Retirement, Annuity and Other Income is issued for many types of income outside the standard employee-employer relationship.

Issuing T4As for contractors

As a small business employer, one of the most common reasons you’d issue a T4A would be to provide year-end documentation to an independent contractor. In turn, the contractor will use T4A for their self-employment taxes.

If you pay a contractor $500 or more for their services, you must issue a T4A.

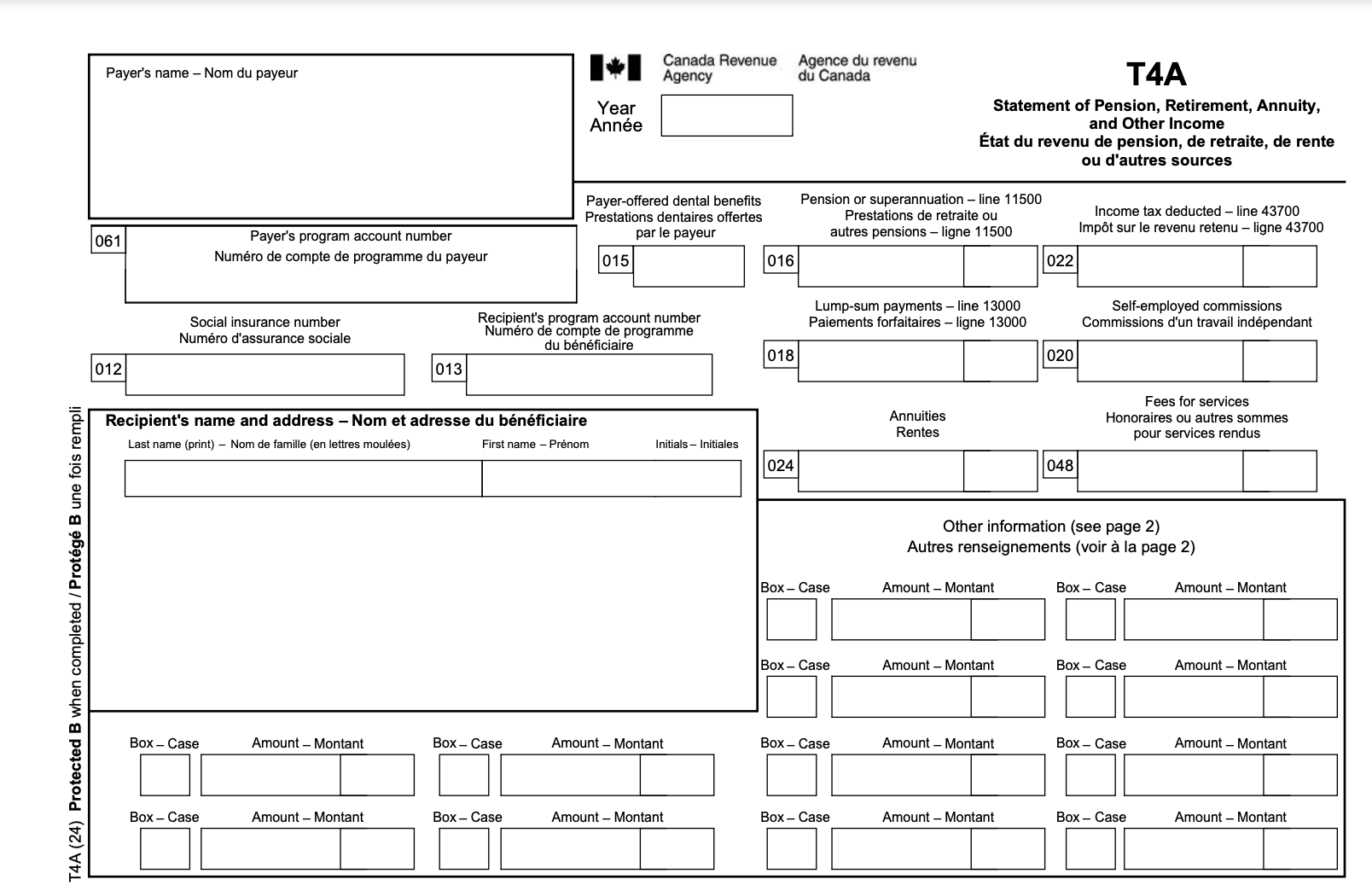

2024 T4A Statement of Pension, Retirement, Annuity and Other Income

(Pro Tip: You can tell what year a form is for by looking at the description along the bottom left edge.)

Payer’s and recipient’s information

The same rules apply here as they do for a T4. In this case, the business (you) are the payer and the contractor is the recipient. Here are a few of the common fields on the form.

Box 012 — Recipient’s SIN

Enter the contractor’s SIN. If you don’t have their number, enter nine zeros.

Box 013 — Recipient’s account number

If your contractor is registered as a business (sole proprietor, partnership or corporation), they’ll have a CRA business number that you’ll enter here.

Box 015 — Payer-Offered Dental Benefits

This box is optional unless there’s an amount in Box 016. This box is to indicate if the recipient or one of their family members were eligible on December 31 of that year to receive dental insurance or any dental service coverage that you offered. These are the codes as outlined by the CRA:

- 1 Not eligible to access any dental care insurance, or coverage of dental services of any kind

- 2 Payee only

- 3 Payee, spouse and dependent children

- 4 Payee and their spouse

- 5 Payee and their dependent children

Box 016 — Pension or superannuation

This is used in specific situations such as payments you made for registered or unregistered pension plans, disability benefits, veterans’ benefits eligible for pension splitting, First Nations, employee benefit plans or retirement compensation arrangements.

Box 018 — Lump-sum payments (Don’t fill this out.)

Unless you’re managing the contractor’s pension plan, don’t use this box.

Box 20 — Self-employed commissions

If you paid your contractor commissions as part of your relationship, enter these amounts here without GST/HST.

Box 022 — Income tax deducted

Unless you deducted income tax for the independent contractor, leave this box blank. (Typically, independent contractors are responsible for their own taxes.)

Box 048 — Fees for services

This is the box most small businesses will use to document the amount paid to a contractor during the calendar year. Do not include any GST/HST you paid along with these fees.

Box 061 — Payer’s account number

This is your business’ payroll account number — your business number plus the extra code that makes it a payroll account number.

Bottom of T4A — Other information area

The second most common place small business employers document amounts paid to contractors is using Code 28 — Other income. Here’s a full list of the income codes for a T4A.

If you have more than 12 codes for the same contractor, create a second T4A. The only thing you have to repeat is your business’s and the contractor’s identifying information.

Other reasons a T4A might be issued:

A T4A may also be issued when you pay any of the following types of income: (In the case of these types of incomes, you issue the T4A because you deducted CPP/QPP and/or EI from the amounts.)

- Pension or superannuation

- Lump-sum payments

- Self-employed commissions

- Annuities

- Patronage allocations

- Registered education savings plan (RESP) accumulated income payments

- RESP educational assistance payments

- Fees or other amounts for services

- Income replacement payments made under the Veterans Well-being Act

- Research grants

- Payments from a registered disability savings plan (RDSP)

- Wage-loss replacement plan payments if you were not required to withhold Canada Pension

- Plan (CPP) contributions and Employment Insurance (EI) premiums

- Death benefits

- Certain benefits paid to partnerships or shareholders

General guidelines for completing a T4A.

A friendly reminder that the same rules and guidelines that apply to a T4, apply to a T4A.

Helpful T4A reference pages from the CRA.

The following tools can help you find more detailed info on T4As, right from the source:

- T4A Information for Payers

- Guide to Filling Out the T4A Slip

- Full List of T4A Income Codes

- How to Change or Fix T4A Slips

What’s a Relevé 1 (RL-1)?

If your business is based in Québec or if you have employees work in Québec, you’ll need to issue an RL-1 Employment and Other Income slip. There are a few different groups that would have to fill out an RL-1 depending on the circumstances. These are:

- If you paid salaries, wages, gratuities, tips, fees, scholarships or commissions as an employer or payer.

- If you paid amounts as the custodian of an employee benefit plan to a beneficiary of the plan.

- If you allocated amounts as the trustee of an employee trust to an beneficiary of the trust.

- If you paid certain income that isn’t part of salary or wages as a payer.

Note: As the RL-1 only covers reporting in Québec, you also have to complete T4s and T4s for your federal reporting.

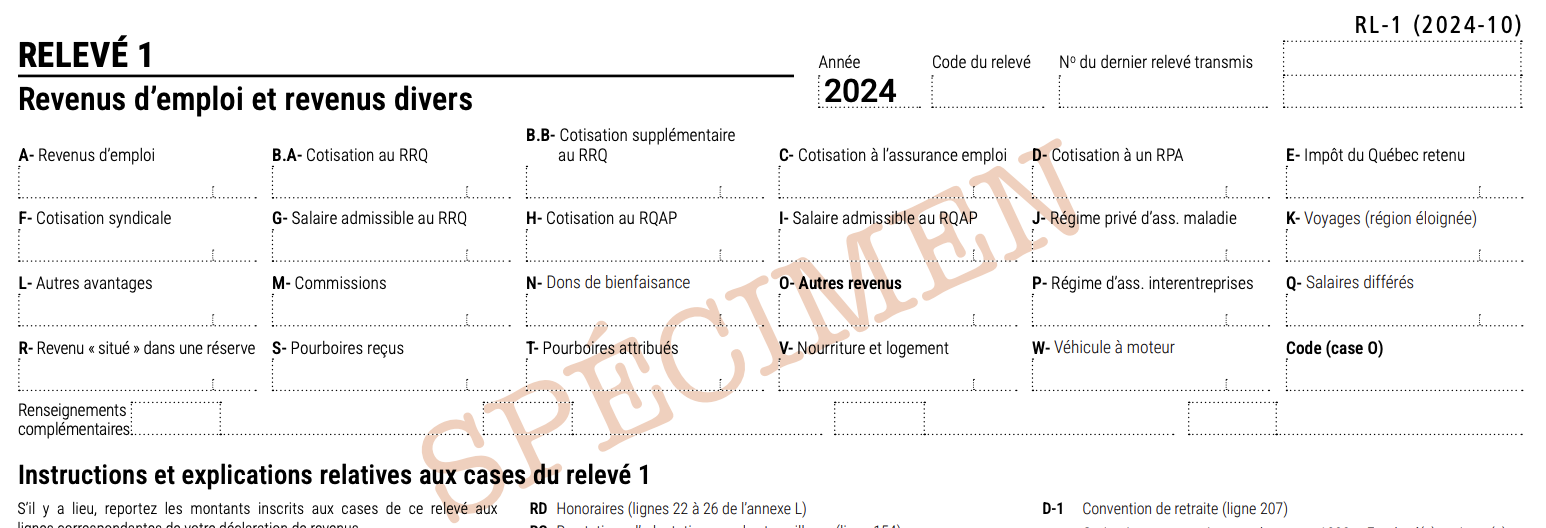

2024 RL-1 Revenus d’emploi et revenus divers

(Pro Tip: You can tell what year a form is for by looking at the top right of the document.)

The kinds of source deductions an RL-1 documents

The amounts documented in the RL-1 tend to relate to Québec-specific taxes, including:

- Québec income tax

- Québec Pension Plan (QQP) contributions (Québec’s version of CPP)

- Québec Parental Insurance Plan (QPIP) premiums

- Contributions to:

- Health Services Fund contributions

- Labour Standards

- Workforce Skills Development and Recognition Fund (WSDRF)

- Recognition Fund (WSDRF)

What’s included in an RL-1 issued by an employer

You could skip around the RL-1 pages of the RQ site, or this PDF guide to the RL-1 is pretty helpful.

Box A — Employment income before source deductions

This is the amount you paid the employee before taxes, otherwise known as total pay.

Box B — QPP contribution

Enter the total QPP contributions withheld during the year.

- Don’t correct the amount if it is too high.

- Leave the box blank if you did not withhold QPP contributions.

Box C — EI premium

Enter the total EI premiums withheld during the year.

Box D — RPP contribution

Note any RPP contributions, including:

- Amounts withheld for current and past service.

- Interest considered to be a contribution to an RPP.

- Amounts withheld as a part of a retirement compensation arrangement.

Box E — Québec income tax

Document provincial income tax, including the health contributions, withheld at source.

Box F — Union dues

List the amount withheld as union dues during the year:

- If you have entered into an agreement with the union that it won’t issue receipts for the dues.

- If the amounts were withheld as part of an agreement you entered with an entity your employees are members of.

- If the entity is a union, an RQ-recognized employee association, a parity committee, an advisory committee or similar group or the Commission de la construction du Québec.

Don’t include membership fees in Box F.

Box G — Pensionable salary or wages under QPP

Enter the pensionable salary or wages under the QPP up to the maximum amount.

Box H — QPIP premium

Put the amount of QPIP premiums withheld in this box.

Box I — Eligible salary or wages under QPIP

Document the eligible QPIP salary or wages up to the annual maximum. If there is no amount for the year, enter zero.

Box K — Trips made by a resident of a registered remote area (Taxable, included in Box A or R as applicable)

List amount for eligible travel that the employer reimbursed.

Box M — Commissions included in the amount in box A or box R

Show any commissions that fall under Box A (Employment Income) or Box R (Income paid to a Native Canadian situated on a reserve or premises). Don’t include commissions for self-employed individuals.

Box N — Charitable donations and gifts

Note any employee donations withheld and given to a registered charity.

Box O — Other income not included in Box A (Employment Income)

This includes income, such as research grants, tax-free savings account, death benefits, financial assistance and a self-employed individual’s commissions.

👉 Check out Revenu Quebec’s RL-1 Slip — Box O page for more income types that fall under this box.

Box Q — Deferred salary or wages (Tax-exempt and not included in the amount in Box A or Box L)

These are the total of the amounts you paid to a custodian or a trustee of an employee benefit plan, a profit-sharing plan or trust.

Box R — Income paid to a Native Canadian situated on a reserve or premises

This represents income paid to a Native Canadian employee who lives on reserve or works on-site.

Box S — Tips

Includes tips reported in the employee’s Register and Statement of Tips or equivalent document, as well as tips that were distributed to the employee because they were added to the customer’s bill.

Box T — Tips allocated by the employer

These are the tips that the employer provided to an employee and added to his or her basic salary or wages — those you were required to allocate because the amount of tips the employee reported was less than 8% of their tippable sales, not including GST or QST.

Box U — Phased retirement

These are amounts deemed, under a phased retirement arrangement, to be income received from pensionable employment, on which an additional contribution to QPP is calculated.

Taxable benefits included in box A or box R (as applicable)

Box J — Private health services plan

Enter the total employer contributions to a private health services plan.

Box L — Other benefits

Include amounts not documented in Boxes J (Private health services), K (Remote travel), P (Multi-employer insurance), V (Meals and lodging) or W (Motor vehicle).

Box P — Contribution to a multi-employer insurance plan

If you contributed to a multi-employer insurance plan for the employee, list it here.

Box V — Meals and lodging

Includes the allowance you pay to an employee for meals and lodging.

Box W — Use of a motor vehicle for personal purposes

If the use of a motor vehicle is provided as a taxable benefit, it must be included here.

General guidelines for completing an RL-1.

Another reminder for you! The same rules and guidelines that apply to a T4 apply to an RL-1

Filing RL-1 slips with RQ.

Employers can file RL-1 slips and summaries using:

- Software authorized by RQ, such as Wagepoint.

- Software you developed that meets RQ requirements.

- RQ’s online services.

- Fillable PDF forms.

- Paper forms provided by RQ.

- Documents not filed online must be mailed to:

- Montréal, Laval, Laurentides, Lanaudière and Montérégie:

Revenu Québec

C. P. 6700, succursale Place-Desjardins

Montréal (Québec) H5B 1J4 - Québec City and other regions:

Revenu Québec

3800, rue de Marly

C. P. 25666, succursale Terminus

Québec (Québec) G1A 1B6

- Montréal, Laval, Laurentides, Lanaudière and Montérégie:

- Documents not filed online must be mailed to:

👉 If you have more than 50 RL-1s, you must submit them online.

👉 Wagepoint automates RL-1 creation and submission. For the RL-1 summary, we provide you with the payroll information you need. However, due to additional requirements, the employer must submit the RL-1 summary.

Providing RL-1s to your employees.

Just like with a T4, the preference is that you provide RL-1s electronically to your employees. If you are unable to do so, you must get written consent from each employee to send the RL-1s by mail.

RL-1 penalties.

You could receive a financial penalty if you:

- Leave out key information, which is a $100 fine.

- Send your RL-1s to RQ late.

- Send your RL-1s to your employees late.

- Don’t use online filing for more than 50 RL-1 slips.

Helpful RL-1 reference pages from the CRA and RQ.

If you need to complete RL-1s for your employees, these guides from the CRA and RQ can help:

- Employer’s Guide to Payroll Deductions and Remittances (CRA)

- RL-Guide PDF — English | French (RQ)

- RL-1 Employer’s Kit — English | French (RQ)

- RL-1 Slip Overview — English | French (RQ)

Why are T4s, T4As and RL-1s so important?

There are several reasons why these forms matter:

- These forms are what your employees use to file their income taxes.

- If you fail to meet the end of February deadline, your employees can report you to the CRA or Revenu Québec.

- If an employer is found to be at fault for causing a delay or failing to provide these forms, penalties may be assessed.

- T4s, T4As and Relevé 1s are also used to show how much employers have paid in employer taxes, like CPP contributions and EI premiums, which in turn determines your schedule for making these payments.

- If an employer doesn’t deduct taxes, the CRA can fine 10% of the amounts that weren’t deducted or 20% of the amount that wasn’t deducted for two or more instances in the calendar year.

- It is also the responsibility of the employer and the employee to ensure that the information on these forms is accurate.

- If there’s a mistake, you’ll have to go through the process of amending, cancelling, adding or replacing them.

Year-to-date amounts and year-end.

You may already be well acquainted with the term year-to-date amounts, also known as YTD amounts. This is a running total of your payroll figures throughout the year, and they come in big-time during year-end. After all, the final YTD total is what you’ll be reporting on these year-end forms.

If your YTD amounts are incorrect, you might end up either over- or underpaying taxes and other source deductions.

- Every time you run payroll, you’re not just issuing pay cheques. As an employer, you also have to withhold income tax, manage EI and CPP/QPP deductions and contributions and allow for other mandatory payroll taxes, like Workers’ Compensation, Employer Health Taxes and other provincially or territorially required programs.

- You also need to keep track of these amounts for reporting and paying (remitting) to the appropriate tax authorities. This fun part of the program is called compliance, which means following the rules and staying out of trouble with the people who can issue fines or worse if you don’t colour within the lines.

- From the first payroll you run in a calendar year to the last, you need to have accurate YTD amounts to be compliant with the tax laws related to payroll.

YTD amounts and compliance are key areas where online payroll software, like Wagepoint, makes a world of difference for small businesses.

Whenever you start using payroll software or switch to new payroll software, you’ll also be asked about YTD amounts. It’s a term that goes on and on.

Back to year-end, did you know that the start of a new calendar year is the best time to start using new payroll software? This is because your year-to-date amounts are either zero for the very first payroll or you’ll have smaller amounts the earlier in the year you switch.

Every day is year-end.

In payroll, there’s an expression, “Every day is year-end.” While a lot of focus is given to pulling things together at the end of the calendar year and issuing T4s, T4As and RL-1s by the end of February, the truth is, in a perfect world, you want to set your payroll up right from the start.

If you begin the year with the right pay rates, tax rates and a system for reporting and remitting those taxes, you’re ahead of the pack.

Standard legal disclaimers.

Someone’s gotta make the lawyers happy. (Yep, there’s something out there that’s even more painful than payroll, childbirth or gardening documentary marathons.)

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals or the responsibility of the business owner to ensure compliance.

To qualify for complimentary T4s with Wagepoint (included as part of your standard fees) — a business must run a minimum of two payrolls in the current calendar year.

Remittance and reporting capabilities within Wagepoint vary by location. Authorization to submit ROEs required during setup.