Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

There are so many rules in place for employers when it comes to payroll in Canada. And the fact that they vary across provinces or can be influenced by the federal government can make it even more confusing. Even the rules have more rules, so we don’t blame business owners for having so many questions! It’s best to get answers to these types of questions instead of just guessing.

To make things a bit easier, we’ve got the answers to some of the most common payroll questions that employers have. These should give you a good starting point to understanding the payroll basics without being a payroll professional.

A few key payroll terms.

- Payroll deductions: Amounts held back from an employee’s total earnings by their employer as a result of tax obligations, benefits and contributions (such as Registered Retired Savings Plan (RRSP) contributions).

- Payroll frequency: How often you pay your employees.

- CRA: Canada Revenue Agency. CRA regulations govern things like tax laws for the Canadian government as well as most provinces and territories.

- CPP: Canada Pension Plan. This is a plan employees pay into through payroll so that there are funds available to replace their wages when they retire. (This is similar to Social Security in the US.)

- Remuneration: The total compensation, both monetary and non-monetary, that an employee receives in exchange for their services or work.

- Remittances: The process of employers deducting and submitting certain amounts from their employees’ wages to the CRA or Revenu Québec as part of their tax obligations.

- Pay stubs: A detailed record of an employee’s earnings and deductions for each pay period provided by their employer.

- EFT: Electronic Funds Transfer. (Direct deposit is an EFT payment)

- EI: Employment Insurance. EI deductions (also called EI premiums) start right away. Depending on the reason for unemployment, EI funds are temporarily available to unemployed employees.

- ROE: Record of Employment. This gives a breakdown of someone’s employment history and is required in order for them to apply for EI benefits.

- Vacation accrued/accrual: A type of vacation time that refers to amount of paid time off that an employee has earned, but hasn’t yet used.

How frequently should I run payroll?

Each province has its own regulations with payroll frequency, but the four most common options are:

- Weekly

- Bi-weekly (once every two weeks)

- Semi-monthly (twice a month)

- Monthly

It’s generally more costly and time-consuming to run payroll every week or bi-weekly, but makes it easier to calculate overtime pay which has its own set of regulations.

The less frequently you run payroll, the less it costs you as an employer. However, it becomes much more challenging to calculate overtime pay for employees that get paid by the hour. That’s why monthly and semi-monthly frequencies are more common for employees that get paid by salary, but a lot of provinces regulate this option so employers tend to use it less.

Here’s a quick overview of payroll frequency regulations across Canada:

- In Ontario, there’s no regulated pay frequency. Employers are simply required to remain consistent with a regular pay period and pay day.

- In British Columbia, New Brunswick, Prince Edward Island and Yukon, employers are required to pay their employees every 16 days.

- In Alberta and Nunavut, employers must pay their employees once a month at minimum.

- In Saskatchewan, employers are required to pay employees that have an annually fixed salary at least once a month, and employees that receive hourly wages must be paid every 2 weeks.

- In Québec, employers must pay their employees every 16 days at minimum, and within a month of their start date for newly hired employees. Employees that hold management executive roles have to be paid at least once a month.

- In the Northwest Territories, employers must pay their employees at least once a month, unless otherwise approved.

How can I pay my employee?

You can pay your employees using any of the following methods:

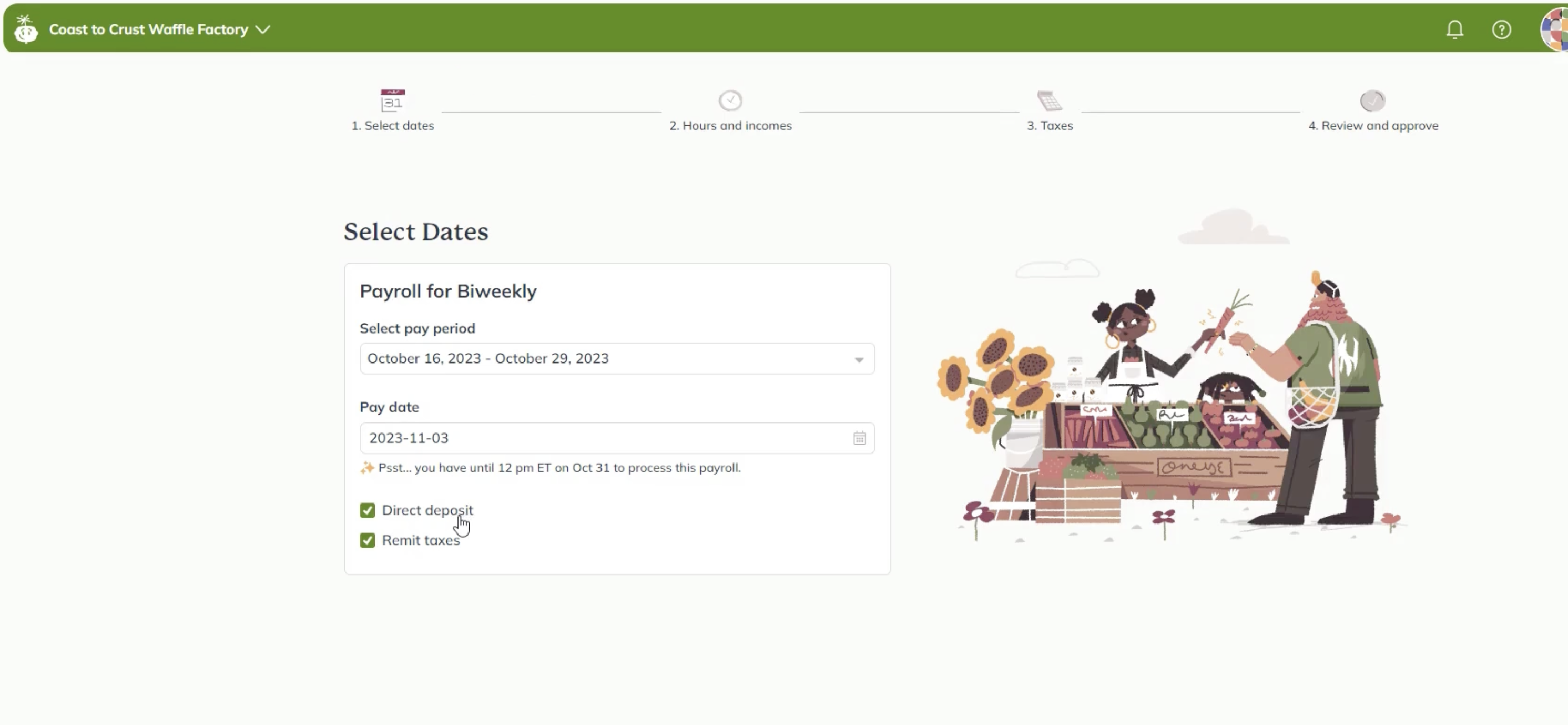

Payroll software

While the primary function of payroll software is for payroll administration, payroll processing and deductions, many also have a money movement option like direct deposit that give you the ability to pay employees alongside its other features.

Direct deposit

A convenient way of electronically transferring funds from your business bank account into your employee’s bank account. This can be done directly through your bank.

Cheque payments

The traditional method of writing and distributing paper cheques to your employees. Then they’d physically deposit the cheque into their bank accounts to get their pay.

Cash payments

Traditionally, employers tend to use cash to pay an employee for an irregular or one-time service. While this is a relatively simple method of payment, there are still legal guidelines for cash payments that need to be adhered to.

What information do I need from my employee to pay them?

To start paying your employees, especially new hires, there are a number of details get from them to make sure you’re able to properly calculate their pay.

One of the first things you’ll need from your employee is their TD1 tax forms (there’s a provincial version and a federal version — both are needed!). The TD1 Personal Tax Credits Returns form provides key details about your employees. This includes personal details and the amount for their income taxes. Here are some of the details you’ll find there:

- Full name

- Address

- Social Insurance Number (SIN)

- Marital status

- Number of dependents

These forms are for new employees and established team members alike. For new employees, it’ll give you all this starting information about them and is usually collected during the onboarding part of the hiring process. Your current employees can also submit new TD1 forms before the first payroll of the new year if there are changes to their situations that impact payroll.

Apart from that, there’s also direct deposit to consider. Again, there are a few details you’ll need, including your employees’ personal information, such as their SIN, full name and address. You’ll also need the following banking information:

- Bank name

- Transit number

- Bank institution number

- Account number

- Bank address

What is payroll compliance?

Payroll compliance boils down to following the payroll rules and regulations set out by the Canadian and provincial governments. It involves employee compensation (aka, paying them for their work), employment-related taxes, accurate wage calculations, proper payroll tax deductions, filing payroll taxes and more.

It’s often one of the most intimidating parts of payroll, and, when not followed, can land you in some stressful situations. But, with the right tools, guidance and know-how, it’s possible for even brand new business owners to be compliant.

What’s the difference between federally regulated and non-federally regulated businesses?

If a business or industry is federally regulated, it means that employers need to follow employment standards in the Canada Labour Code. To name a few examples of federally regulated industries:

- Banks

- Postal services

- Telecommunications

- Broadcasting — both radio and television

Non-federally regulated industries and businesses follow provincial employment standards. Keep in mind that each province has its own standards to follow. These can typically be found on each province or territory’s website.

Whether a business is federally or non-federally regulated impacts and dictates minimum requirements for things like compliance, minimum wage, terminations and holiday entitlements, but there are other areas to consider as well.

What is the difference between gross and net pay?

Gross pay is the total wages that an employee earns for the work they do over a certain period of time, such as an annual base salary you’ll find on a job posting. For Canadian employers, gross wages don’t include employee contributions for things like CPP and EI.

Net pay, on the other hand, is the amount an employee receives after income tax has been deducted from their earnings, as well as all other deductions and contributions.

What are statutory payroll deductions?

A payroll deduction, like the name suggests, is an amount that is withheld from an employee’s pay cheque. CPP and EI are two important statutory deductions. Meaning, unless an employee is exempt, you have to deduct these as a part of the payroll process.

If you’re based in Québec, you’ll need to deduct the Québec Pension Plan (QPP) contributions instead of CPP contributions.

An employee is exempt from CPP/QPP contributions if: they qualify for CPP or QPP disability benefits, they are not in pensionable employment during the year, or if the employee is at least 65 years of age, but under 70, and gives you Form CPT30. (Note that the government changes these ages from time to time, so it’s best to double check on the Form CPT30 page directly, just to be sure.)

If an employee is working a job that’s covered by EI during the year, you also have to deduct EI premiums from their insurable earnings. You’ll need to deduct EI premiums from each dollar of insurable earnings up to the yearly maximum. Employees living in Québec are required to contribute to the Québec Parental Insurance Plan (QPIP) as well as EI (at a Québec’s rate).

What are taxable benefits?

Taxable benefits are benefits that you as an employer pay for on behalf of your employee. This can include allowances or reimbursements. It could also be an employee perk or advantage that’s not related to the job.

An allowance could be an arbitrary amount of money that’s provided in advance for an anticipated company related expense the employee will be making.

A reimbursement is money given back to the employee for something related to the company that the employee paid for.

When it comes to allowances and reimbursements, it’s important to note that amounts paid to employees can become taxable if an employer does not follow prescribed rates set by CRA. This commonly affects mileage and meal payouts and impacts amounts paid both under and over the rates set by CRA.

It’s important to know which benefits are taxable and which are non-taxable when it comes to payroll. This is one area it can be especially handy to know a payroll specialist because it’s pretty tricky.

Some examples of taxable benefits include:

- Use of a company provided car

- Lodging or boarding that’s paid for by the employer

- Housing and utilities for an employee’s permanent residence that’s paid for by the employer

- Accident insurance and life insurance premiums

- Trips, prizes and gifts that exceed over $500 annually

There are cash, non-cash (you might also hear this called “in-kind”) and near-cash benefits that are taxable as well. Physical currency, cheques and direct deposit are all considered cash, and near-cash benefits would be anything that can easily be converted to cash. For instance, gold, stocks and certain gifts, awards and gift-cards are near-cash benefits. A non-cash benefit is any good, service or property that is provided to an employee, or a payment that you make directly to a third party when providing a company related good or service to an employee.

How do I calculate payroll taxes and how do I pay them?

Payroll taxes are calculated based on something called tax tables provided by the CRA. These tables can be found in the CRA’s guide on how to calculate income tax deductions and are updated twice a year. Some people choose to manually calculate the amount of tax during pay runs, while others use tools like the CRA’s online calculator or payroll software.

When it comes to paying (remitting) your payroll taxes, there are different methods available based on your remitter type, which is determined by the CRA. In most cases, you can make your payments electronically or at a Canadian bank. More information about types of remitters and how to pay can be found here: Remit (pay) payroll deductions and contributions – Canada.ca

Payroll software like Wagepoint can help with both calculating and paying Canadian payroll taxes!

What’s the difference between regular pay, overtime pay and holiday pay?

Regular pay or regular wages is the agreed upon salary or hourly wage that an employee receives for the work performed.

Overtime pay is the pay that an employee receives based on how many extra hours they worked beyond their standard hours. In most cases, the maximum hours of work allowed in a week is 48. When employees work overtime, they are typically eligible to get paid at 1.5 times their usual hourly wage or receive 1.5 hours of paid time off for each hour worked.

Holiday pay is pay with a day off that an employee is entitled to for Canadian public holidays. If the employee doesn’t have the day off, they’d receive a day in lieu or typically 1.5 times their pay for that day’s work.

There are 10 general holidays, commonly called public holidays, in Canada for which employees can receive holiday pay:

- New Year’s Day

- Good Friday

- Victoria Day

- Canada Day

- Labour Day

- National Day for Truth and Reconciliation

- Thanksgiving Day

- Remembrance Day

- Christmas Day

- Boxing Day

Statutory holiday pay has its own set of calculations and each province has specific regulations around this as well. Be sure to look into rules for your province when making your calculations!

How long do I need to keep payroll records?

This depends on your province or territory and whether you’re in a federally regulated industry.

The Canadian Government states that payroll records and employee data can be destroyed three years after employment ends for federally regulated industries.

Provinces and territories have their own timeframes for keeping payroll data. For instance, the Ontario government also says to keep records for three years, but Saskatchewan wants employers to keep payroll records for five years.

Are employees and contractors different?

Yes, they are! Generally, the difference between employees and independent contractors has to do with the intent of the relationship.

An employee is of service to you as an employer. A contractor is performing a service for you or your business. If the employer is controlling the work that is being performed, this is indicative of an employee relationship. Contractors, on the other hand, perform their work independently. Some key differences are:

- An employee will have work hours set by their employer while a contractor will set their own hours.

- An employee uses tools and equipment provided by their employer while a contractor uses their own.

- An employee receives a salary or wage while a contractor will charge you or invoice you their own rate.

- An employer will manage an employee’s payroll taxes while a contractor is responsible for their own taxes, EI, CPP, etc.

When do I need to issue a Record of Employment (ROE)?

An ROE is an important document that employees need when applying for EI benefits. It provides detailed information on employment history. As an employer, you need to issue an ROE each time an employee experiences an interruption of earnings or if Service Canada or your employee requests one.

There are two situations in which an employee may experience an interruption of earnings. The first is called the “7 Day Rule.” This is when an employee experiences or anticipates to experience seven consecutive calendar days with no work and no insurable earnings from their employer. The 7 Day Rule also applies to when an employee quits or is terminated, although there are some exceptions around that.

The second situation is when an employee’s salary falls below 60% of their regular weekly earnings and is a result of either sick leave, parental leave or family caregiver leave.

What’s the best way to do payroll? (In other words, how do I make it as easy as possible?)

Overall, payroll software definitely makes things a lot easier when it comes to dealing with all the little moving pieces that go into processing payroll. It’s a great option for many small business owners. In particular because you get to do less of the work without completely outsourcing the process, so you still maintain control over what happens.

Most payroll systems handle the basics like payroll calculations and then there are others that take payroll management to the next level. Plus, they’re built with data security features that safeguard all that sensitive information that comes with the payroll process.

This is different from managed payroll, such a payroll service provider or full-service payroll. In those cases, you typically hand off your payroll information to someone else to manage and run it.

Reduce the payroll stress with Wagepoint

Wagepoint is a standalone payroll software built just for small businesses. It has key features and functions that handle some of the most tedious parts of Canadian payroll for you. Especially for small business who might not have a human resources (HR) or payroll team just yet.

It’s built based on the rules and processes that go into calculating wages, deducting contributions and premiums, submitting ROEs, paying your employees and contractors, filing payroll taxes and making your payments to the CRA.

Wagepoint is your partner in payroll processing and compliance. Spend less time dealing with payroll and more time to focus on running your business!

Sign up for a 14-day free trial to see if it’s the right choice for you.