Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Direct deposit is the most convenient and fast way to send money. This digital and secure process saves the hassle and time of cutting physical cheques and money easily makes its way to your employee’s bank account. A win-win for both of you!

Technology can feel daunting while tradition can feel comforting. We know that paper cheques are familiar and reliable, but when you have several employees to pay while simultaneously managing all other responsibilities of running a business, it’s time to find a more efficient way to pay your employees.

How direct deposit works.

The direct deposit process uses a payment system, which is essentially a combination of rules, procedures and technology that allows for secure and efficient exchange of money.

Digital payments are generally processed in one of the following three ways:

- Exchange

- Clearing

- Settlement

Direct deposits fall under the third category and are processed using ACSS — the Automated Clearing Settlement System — in Canada. Paying your employees in exchange for the work they do would be considered a settlement. ACSS clears cheques and electronic items, including direct deposits, pre-authorized debits and Interac debit payments.

So, for example, when a Canadian employer processes a direct deposit payment to their employee, that goes through ACSS to get the funds from the business bank account to the employee’s account.

What do employers need for direct deposit in Canada?

To pay your employees using direct deposit transactions, there are a few details you’ll need. Here’s a look at what info to gather for your business and some key banking information from your employees in order to set everything up.

What employers need for their business.

- A business bank account.

- A method of processing payroll: You may either work with the bank that handles your business bank account, find a payroll service provider that has the capability to handle direct deposit or choose a payroll software.

- Employee information (we’ll get to that in a moment).

- To upload this employee data or provide it to your service: Depending on the service you are using, your employees may be able to input this data themselves, otherwise you’ll need to make sure your employees’ information is uploaded.

- Send your direct deposits: The payment can take 1-3 business days to process, so you might want to send it ahead of payday to make sure your employees are paid on time.

What employers need from their employees.

You will need the following banking information from your employees:

- Bank name

- Transit number

- Bank institution number

- Account number

- Bank address

A void cheque or direct deposit form from your employee’s financial institution can provide the necessary information for the chequing account or savings account where the funds will be deposited. If the employee is registered for online banking, they can simply log in to their online banking account and download a digital void cheque from there. Otherwise, they can get the completed form by visiting their branch.

Many banks also have direct deposit authorization forms available online that your employee can provide to you. See the following example to get an idea of what they look like: Direct Deposit PDF – TD Canada Trust

Advantages of direct deposit.

- Convenient: After the initial set up, no other work is needed on your end unless there’s a change. Like bank account information, for instance.

- Cost effective: Cheaper than paying the fees associated with e-transfers or writing, printing and mailing pay cheques.

- Better for the environment: Reduces your carbon footprint by cutting out paper waste.

- Safe and secure: Prevents fraud as there is a reduced chance of a cheque being lost, stolen or signatures being forged.

- Employee satisfaction: Your employees are likely to be more satisfied when their income is being deposited directly into their account and wages are immediately accessible on pay day. Less work for them and for you!

- Timeliness: Ensures employees are paid on time as delays are more likely with mailing cheques during holidays, staff vacations and bad weather.

- Certainty: No more guessing when money will be withdrawn from your account, making it easier to plan for other business expenses.

Disadvantages of direct deposit.

- Cannot stop payment: Unlike paper cheques, once a direct deposit is sent, it cannot be stopped. If the payment is still pending you may be able to modify it. (You’ll have to check with your direct deposit provider.)

- Information needs to be updated: If an employee changes their bank, you will need to update their direct deposit information.

- Setup fees: The initial set up of direct deposit and using a software will involve paying some fees.

- Other fees: While often cheaper than the fees associated with pay cheques, banks will sometimes charge businesses processing or transaction fees for sending money through direct deposit.

- Employee preference: Some employees may still prefer receiving paper cheques.

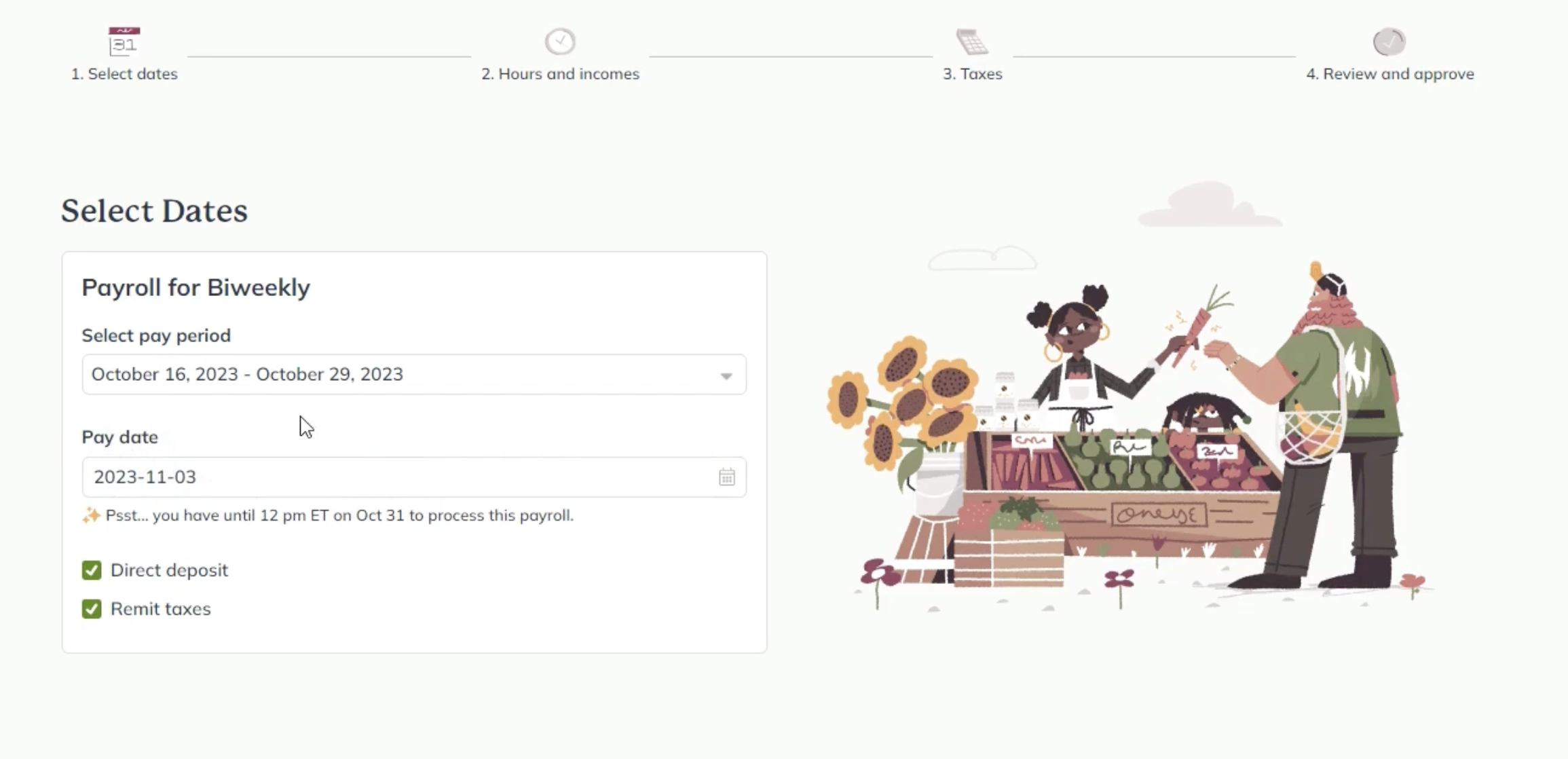

How to use direct deposit.

There are a few options for setting up and using direct deposit, including:

- Through your bank

- Through a payroll service provider that has direct deposit services

- By using an automated payroll software that can processpayroll with direct deposit

Direct deposit through your bank

Banks often have an online, self-serve option for you to set up direct deposit and pay your employees. Each bank will have their own process, features and pricing for you to review.

Let’s use RBC’s direct deposit system as an example. Direct deposit enrolment looks like this: you will first set up your profile by providing the required information, such as your company’s name, contact name, billing account number, phone number and email address. From there, you’ll input your employee’s banking information (same information we went over earlier!). Once you’ve saved your employees’ information, you can just select the employees you wish to pay each time, input the amount and date, and submit the payments for processing.

Outsource to a payroll service provider

The reason many people prefer outsourcing payroll (and direct deposit management with it) is to save time, energy and to prevent the numerous mistakes that can often happen when employers attempt to process payroll on their own. Unfortunately, it can be expensive to outsource and, if you’re looking to have more control over the payroll process, it’s not ideal.

Some examples of payroll providers include:

Full service payroll software

Full service payroll softwares handle the end-to-end payroll process for you each pay period. Afterward, they’ll provide you with the data for your bookkeeping. They may also include useful HR features like onboarding, time off requests for employees, managing group benefits and more.

Accountant

An accountant will gather and record all data needed to process payroll and make sure all standard processes and procedures are being followed, including maintaining a payroll schedule. They’ll also provide financial advice, prepare and file tax returns, calculate wages and deductions for taxes and benefits.

Bookkeeper

Some bookkeepers handle payroll processing among the day-to-day record keeping and data management of your finances, as well as preparing financial statements and handling accounts receivable and payable.

Payroll software with direct deposit

For small business owners, it can seem like adding payroll to your plate might not be manageable, but it definitely can be with payroll software. You get to have full transparency over your payroll while making use of a tool that keeps things like direct deposit simple and backs you up with customer support.

You get to save time, make things more efficient for yourself and still maintain control in a way that’s helpful to you and your business. Not to mention, you save the costs of having to hire a service to do the job. This way, you’re not really outsourcing, but you’re still getting the support where it’s needed!

It’s a good idea to still learn the basics about how payroll works and what you’ll need to set it up.

Other things payroll software helps with

Apart from direct deposit, payroll features can also help you with things like:

- Government payments for payroll taxes and year-end filing.

- Canada Pension Plan (CPP) and Employment Insurance (EI) calculations.

- Employee setup with self-serve options to fill in their own details (think social insurance number (SIN) or date of birth for instance).

- Handling of payroll forms, such as ROEs that get filed with Service Canada.

- Remaining compliant with the Government of Canada and other provincial and territorial agencies.

In short, whether you’re a newbie or a payroll expert, taking advantage of payroll software adds convenience and brings relief to your work life. Especially since you still get the peace of mind from knowing that you’re avoiding common payroll mistakes.

Final thoughts on employers’ need for direct deposit in Canada.

To sum up, direct deposit is ideal for both employers and employees. While saving time and money, you’ll also keep your employees more satisfied by ensuring payments are made on time and their income is immediately deposited. If you’re still holding on to traditional methods of paying your employees, take the leap and switch to direct deposit! Put in the time now to save your time later.

Try Wagepoint free.

Wagepoint keeps the needs of small business owners in mind. It takes care of things like payroll calculations and direct deposit. So, not only will you have more free time, but you’ll still have control over the ins and outs of payroll and maintain full transparency.

If you are ready to set up payroll using direct deposit for both employees and independent contractors, try out Wagepoint for free! Payroll Processing – Wagepoint

Direct deposit FAQs

Is direct deposit safe?

Direct deposit is more secure and safe than paper cheques. Paper cheques can be lost or stolen, but direct deposit transfers the funds directly into your employee’s bank account.

Do my employees have to pay to receive their direct deposit?

Your employees will not have to pay anything!

My employee is worried I can access their bank account. Is that possible?

The information your employee provides you with does’t enable you to withdraw money from their account, just deposit it. Also, as an employer, you are legally required to keep the confidential information your employee provides you. This includes their bank account number, safe and secure per the Privacy Act.

How long will it take for my employee to receive their money?

Your employee will receive their money on payday as long as everything is set up correctly. A direct deposit payment can take 1-3 business days to process, but employers usually process in advance so the recipients get their money on time.

Is setting up direct deposit expensive?

The fees associated with direct deposit are often cheaper than the fees associated with paying your employees in other ways, like through mailing physical cheques.

Does my employee need to have access to a computer or the Internet for direct deposit?

Nope! They can visit their financial institution to gather all the information needed to set up direct deposit and still receive an electronic payment instantly without internet access.

Is EFT different from direct deposit?

Direct deposit is a form of electronic funds transfer (EFT).

What are the payment systems in Canada?

Lynx and the Automated Clearing Settlement System are Canada’s two main payment systems. Both of these systems are owned and operated by Payments Canada. ACSS is similar to the Automated Clearing House (ACH) in the United States and clears cheques and electronic items. This includes direct deposits, pre-authorized debits and Interac debit payments. Lynx is Canada’s High Value Payment System. It launched in 2021 to replace The Large Value Transfer System (LVTS) that launched in 1999.

What is CRA direct deposit?

CRA direct deposit refers to the option to set up direct deposit payments from the Canada Revenue Agency for things like corporate income tax refunds, goods and services tax (GST) or harmonized sales tax (HST) refunds or even refunds on overpayments of payroll taxes. (Individuals can also use this service for income tax refunds, Canada child benefit payments, Canada workers benefits (CWB) and more.