Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Payroll automation systems are the superhero many finance teams don’t realize they need. Imagine you could recycle all those time-consuming hours spent sweating over intricate spreadsheets, panicking over whether your formulas are up to date and if you’ve remembered to account for tax. Picture yourself getting it all done within a few button clicks, confident that everything will be perfect every time.

Let’s unpack everything you need to know about payroll automation, including how to get yourself a slice of this time-saving pie for yourself.

Key takeaways

- Payroll automation is a handy suite of solutions that will save you time, effort, and costly mistakes on your payroll.

- Automation offers numerous benefits, from convenience to accuracy, that streamline and improve how you calculate payroll in your business.

- There are both partially automated and fully automated payroll processes you can explore.

- Payroll software solutions are not only the most convenient payroll automation option, but they also offer increased data security and peace of mind.

What is payroll automation?

The core idea of payroll automation is a simple one. It means using technological solutions to help streamline and simplify the many tasks associated with payroll management. Harnessing the power of automation is a simple, straightforward and cost-effective way for businesses to spend less time, effort and resources on processing payroll. In other words, it’s an efficiency booster for your organization, letting you prepare your payroll in minutes.

That’s not all you can look forward to, however. Alongside that super-speed in processing payroll, automated payroll systems help boost your accuracy, too.

When we prepare payroll by hand, the scope for human error to creep in is huge. Using the wrong tax table, transposing a number here and there — even in smaller businesses, payroll is an intricate affair. It’s easy for things to go wrong if you are still using manual processes. Payroll is the last area where you want to make these mistakes, too, given the potential for unhappy staff and even legal problems.

The wider term payroll automation covers a lot of functionality, including (but definitely not limited to):

- Automatic data processing for wage, salary and bonus calculation.

- Tax deductions for benefits, payroll taxes and other necessary withholdings.

- Generating pay stubs, tax forms and even compliance and in-house payroll reports.

- Processing direct deposits and, should you need it, paper cheque processing too.

- Integration into your wider HR and accounting systems for seamless end-to-end financial reconciliation.

In short, payroll automation takes the issue of manual payroll data calculation and associated processes off your shoulders (or your payroll manager’s) and lets technology lighten your workload so you can focus on more important tasks. What’s not to love about that?

Partially-automated payroll processes

There are numerous benefits for finance teams looking into a fully automated payroll process. However, before we dive deeper into the world of slicker, quicker payrolls, let’s touch on the idea of partial automation.

Automated payroll systems don’t have to be a zero-sum game. If you’re looking to migrate from fully manual tasks in stages, or you just don’t fancy using an end-to-end payroll solution, there’s still great value in partially automating your payroll processes to save some time and effort.

This approach lets you strike a balance between greater efficiency and control, so you can target specific pain points for automation but keep your manual oversight of other parts of your critical payroll functions.

Partial automation can, for example:

- Automate time and attendance tracking in real-time to ensure accurate hours are logged.

- Streamline overtime calculation, shift differentials, and other variable aspects of your wage cycle.

- Track tax deductions, benefits, and other more complex parts of the payroll process.

- Generate and automatically distribute tax documents and pay stubs to staff.

So partial, or selective, automation can still remove a lot of administrative burden from your shoulders and be a great addition to your business. It’ll help you minimize errors in more complex parts of your payroll calculations and boost overall accuracy without you having to give up full control over the process.

Automated payroll process

While individual payroll automation systems will look a little different in the details, here’s a basic overview of what you can expect:

- Capture your employee data to the system.

- Set up company-specific details, like pay groups and pay cycles.

- Adjust any specifics needed, like tax rates, custom income codes or employee benefits and deductions.

- When it is time to run a pay cycle, head to the pay period and employee group you need to service.

- Check the system-generated information, and fill in any missing details like specific hours worked.

- Review your payroll and address any system-generated flags. Approve payroll, and you are done!

Setting up for payroll automation

There’s a little in-house admin to run through before you can kick back, grab a coffee and let your payroll software do it all for you. This initial setup will involve you capturing the specific employee details and their wage or salary structure. How in-depth this process is will depend on the solution you’ve chosen.

Typically, each employee has their own profile of sorts, where you can adjust employment and income data as needed. You should be able to assign them to groups, too. This could be based on their pay structure (such as hourly employees, part-time and full-time), their payment date or any other convenient factor that works for your organization.

While many Canadian payroll software solutions will come preloaded with tax data and compliance information, you may have to set up a rate here and there or otherwise prime the system to your specific needs. This could be things like custom income codes you use or specific employee benefit plans and deductions you offer. With that done, you’re almost ready to experience all the convenience of automation for yourself.

Processing payroll with automation

When your next pay cycle comes along, you’ll hop back onto your payroll software. Select the employee group you’re about to pay. You’ve probably already selected the pay period you are running, but make sure you’re working on the right one. Also, look over specifics for any issues, like whether direct deposit (or alternate pay options) is enabled correctly and so on.

The system will show you a list of the workers to be paid under that group for you to review. For hourly components to your employee wages, hours worked can be filled in or imported from a real-time tracking solution you’re using. Here, you can also tweak any other fine details, like tax deductions, commissions, bonuses, employee benefits and additional income if needed.

Now, with the last of the finer details out of the way, the system can get to it. It’ll automatically calculate each employee’s pay for you, as well as put it together for your overall payroll. It’ll then show you a breakdown of what’s been calculated. Take a moment to review everything. The automated payroll software might throw up a flag or two for you to address if it encounters any issues — for example if payroll taxes due exceed the gross employee wages being paid.

When you’re happy with how everything looks, you can approve everything and let the system do the rest. Remember, it is generating payslips and tax forms, ensuring direct deposits are logged in the system and money is moved to your employee bank accounts.

Generally, it’s doing all the hard stuff in mere minutes so you don’t have to, and then you can review it all in the built-in reporting when you need to. Now’s the perfect time to enjoy that coffee.

Benefits of payroll automation

Here are a few of the many benefits that an automated payroll can bring to the table.

Time savings

The key benefit of payroll automation is the time it saves. You likely don’t even realize the amount of time you’re spending on this task every month. By automating the repetitive tasks associated with payroll – data entry, calculations, and reporting – businesses can enjoy a streamlined payroll process and free up their time for income-driving activities instead.

Cost savings

While the initial outlay on payroll software might seem like a budget-beater, the cost savings payroll automation brings will quickly make it worthwhile. With reduced manual input and the massive potential to reduce errors, businesses will soon see a lower cost burden from payroll. Plus, the costly penalties for non-compliance and payroll mistakes are avoided, too.

Accuracy and compliance

That brings us nicely to the next benefit. Payroll automation helps boost accuracy and compliance in payroll processing. Human error is reduced, and sticking to regulatory requirements is far easier.

Remember, an automated system can perform complex calculations easily, generate accurate tax withholding data, and more. Plus, it offers automatically generated reporting and an audit trail you can use for compliance and bookkeeping in general.

Enhanced data security

Need a way to protect sensitive employee information from unauthorized access? Modern payroll systems have you covered. Whether that’s someone peeking over the shoulder of your payroll manager as they work or a full-on cyber incursion by criminals, automated payroll software gives you a way to safeguard your employee data and reduce the risks of identity theft and fraud. More sophisticated payroll software allows for access control and encryption, offering superior data security.

Boosted employee satisfaction

Happy staff, happy work environment, right? When you are handling payroll processing efficiently and accurately, employee satisfaction follows. Timely, accurate payment of wages, payroll taxes, and employee benefits matters to your staff. With an automated payroll, you minimize payment errors, reduce paycheck discrepancies and keep trust and transparency high. That all translates to a better employer-employee relationship.

How to automate payroll.

While automating the payroll process still needs a small amount of human oversight, you can probably already see how much time and effort you’ll save on this time-intensive task.

Depending on how much of an automated payroll system you want, you have several options open to you.

Payroll Software

The process we described above gives you a great idea of what to expect from payroll software. In short, it’s a single, user-friendly hub providing great features and functionalities for payroll remittances, offering a fully streamlined solution. Many payroll software options will even integrate with your other time-tracking, accounting and HR system options, which makes for a fully holistic picture of everything you do on your staff’s administrative side.

Pros

- Centralized platform for all payroll-related activities.

- Automated calculations and tax withholding.

- Integration with your existing accounting and HR system.

- Scalability to accommodate growing business needs.

- Employees can take ownership of their payroll via self-service portals.

- Enhanced data security throughout your organization.

Cons

- Upfront costs associated with software purchase and implementation.

- The initial learning curve for users transitioning to new software.

- Ongoing subscription fees or maintenance costs.

Payroll Deductions Online Calculator

While they don’t offer all of the convenience and functionality of payroll software, free online tools such as the Payroll Deductions Online Calculator (fondly called the PDOC) can still help you with some basic automation. These calculators let you input your employee data, tax withholdings, commissions and deductions to generate an accurate payroll calculation that will minimize the workload. This could be an option for simpler payroll needs.

Pros

- Free to use with no upfront costs.

- Simple and intuitive interface.

- Basic functionality for calculating payroll deductions.

Cons

- Limited features and customization options.

- Lack of integration with other systems.

- Manual data entry increases the potential for errors.

Spreadsheet Calculations

Ah, the humble spreadsheet! What would the modern working world do without it? While their automation functionality does pale alongside the other solutions we’ve covered so far, using the built-in formulas and functions of spreadsheet software like Google Sheets or Microsoft Excel does offer a basic, cost-effective solution for businesses with more modest payroll needs.

Pros

- Familiar and widely used software.

- Customizable formulas for specific payroll calculations.

- No additional software costs.

Cons

- Prone to errors and data inconsistencies.

- Manual data entry increases administrative burden.

- Limited scalability for growing businesses.

As you can see, no matter what size your business is or what budget you have at your disposal, you can unlock some automated assistance with your payroll pretty easily.

Payroll automation software examples.

Looking for some great payroll software specifically made for the Canadian market? There’s plenty to choose from, but here are three great market leaders to try.

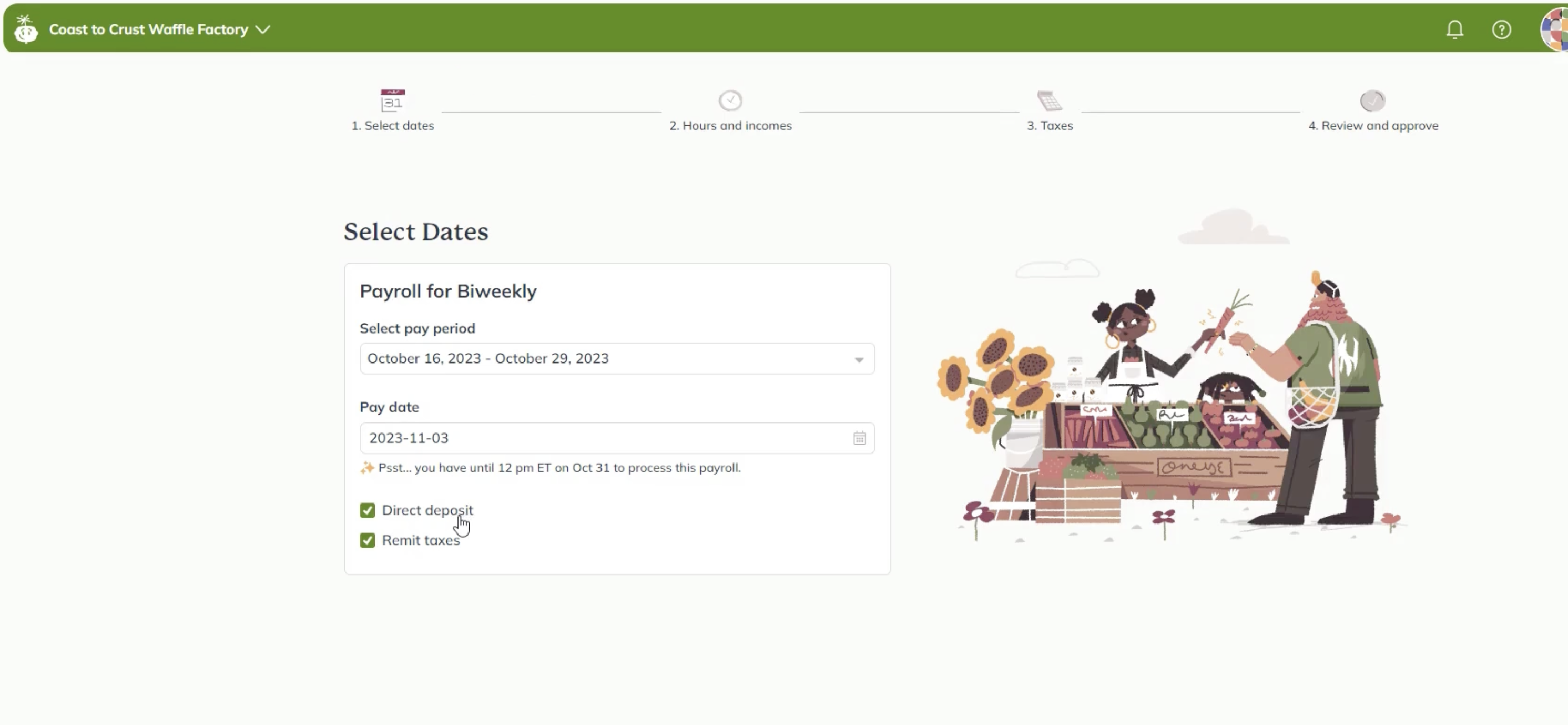

1. Wagepoint

For over a decade, Wagepoint has been one of the primary payroll software options for Canadian small businesses. Designed as a standalone product, it has integration capabilities with other preferred platforms and Wagepoint products and works primarily in the cloud.

Key features

- Automatic payroll and tax calculation.

- Customizable income and deduction options.

- A self-service portal that workers can use for tax documents and pay stubs.

Pros

- 2048-bit banking-grade encryption and multi-factor authentication to protect personal information.

- Transparent pricing and simple user experience that is ideal for small business owners.

- Some of the best support in the market, according to users.

Cons

- Wagepoint is specifically designed for the needs of SMBs and may lack additional functionality for enterprise customers.

- No in-built HR or time-tracking solution, although Wagepoint also offers the People by Wagepoint and Time by Wagepoint products to cover this.

Pricing

Solo: $20 per month + $4 per employee/contractor

Unlimited: $40 per month + $6 per employee/contractor

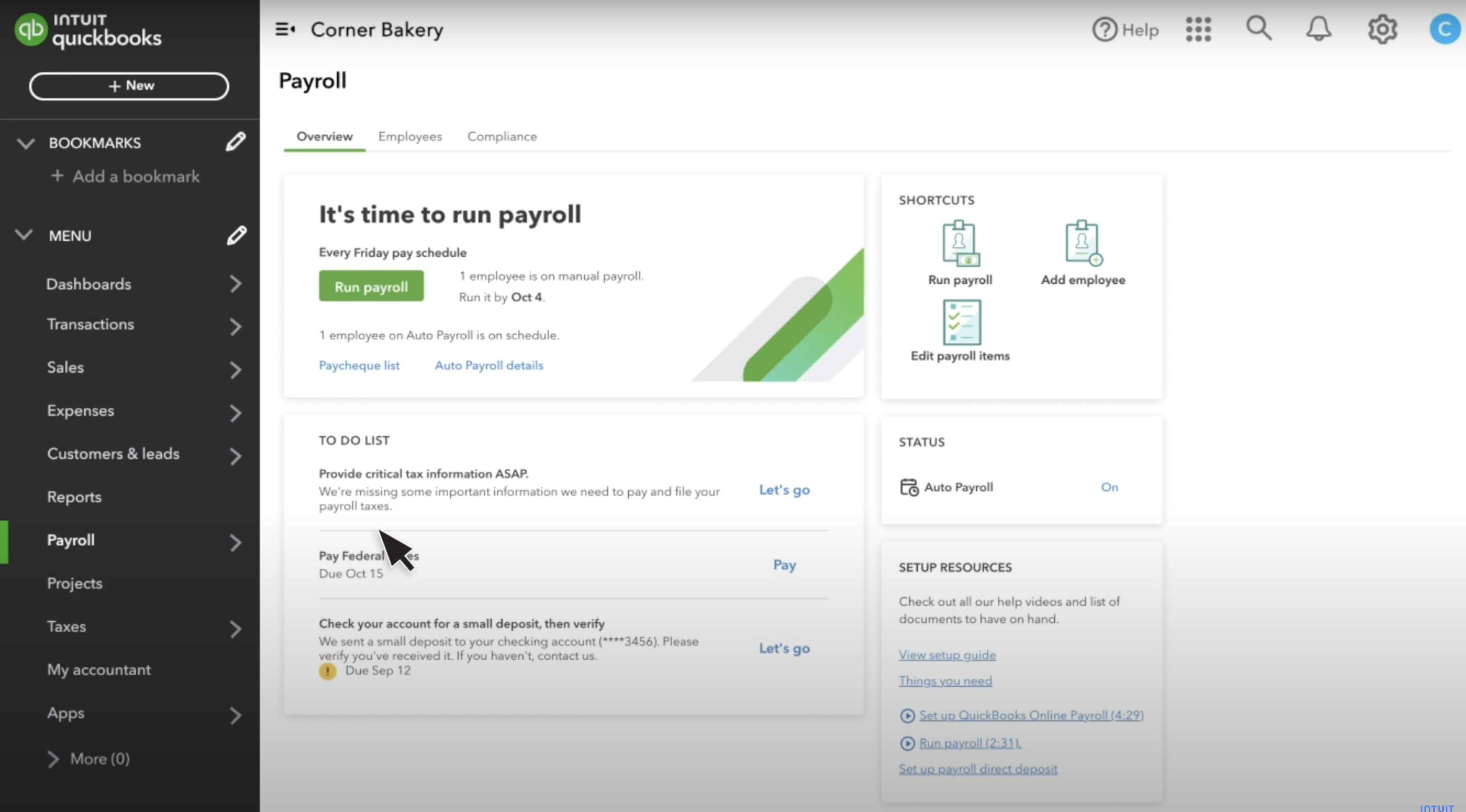

2. QuickBooks Payroll

Image: QuickBooks

Many Canadian businesses are using QuickBooks accounting packages already. QuickBooks Payroll is an add-on, non-standalone product that works within the QuickBooks ecosystem for a holistic single-platform solution.

Key features

- Integrates with existing QuickBooks accounting for a one-stop solution.

- Cloud and desktop options.

- Time-tracking and basic HR features.

Pros

- Unlock basic or advanced payroll features as needed through tiers.

- Manage taxes as part of the payroll platform.

- Robust reporting and automated tax filing.

Cons

- Support levels depend on the subscription tier you are using, with basic customers deprioritized.

- Non-intuitive interface, according to some users.

Pricing

Core: $25 per month + $4 per employee per month

Premium: $55 per month + $8 per employee per month

Elite: $80 per month + $15 per employee per month

As this is a non-standalone product, you will also need to have a subscription for the QuickBooks Online accounting software.

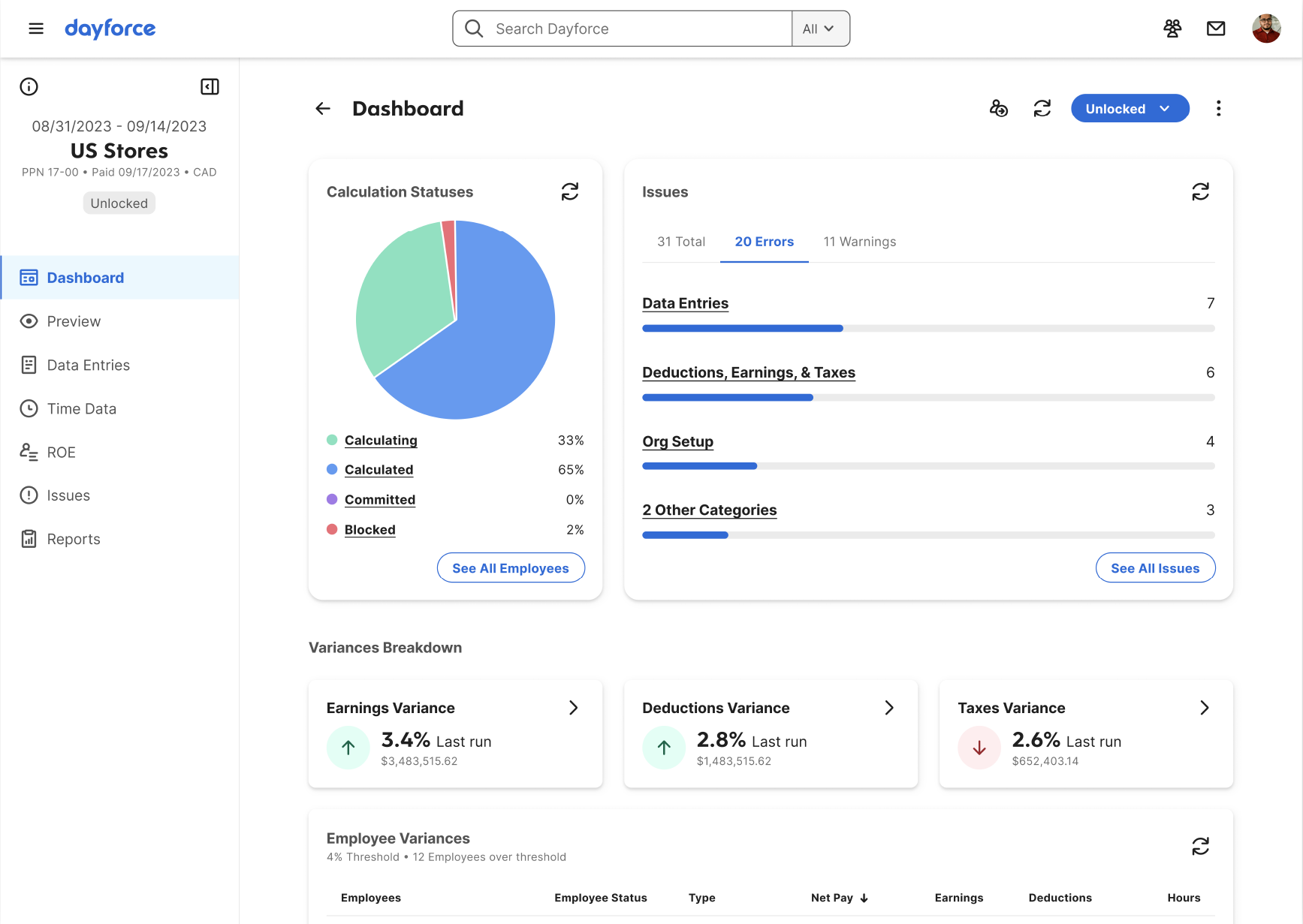

3. Ceridian Dayforce

Image: Ceridian

Another well-known payroll solution for the Canadian market, Ceridian Dayforce, also offers a suite of HR tools that might appeal to larger businesses and enterprises looking for an all-in-one solution.

Key features

- Workforce management, such as new-hire onboarding and time-tracking.

- Comprehensive payroll processing.

- Works over borders, so ideal for global companies working in Canada or those working in different states.

Pros

- Benefit management and time-tracking included.

- A one-stop option for employee management with more advanced HR features included.

- A mobile app is available.

Cons

- Many users report a difficult implementation process and lack of support, although they are happy after that.

- This is a complex “does everything” product best suited to the needs of enterprises. It is not the best option for small business owners.

Pricing

Ceridian Dayforce doesn’t offer standard pricing. You will need to contact them directly for a quote tailored to your needs.

Final thoughts on payroll automation.

As you can see, payroll automation is the ideal way for businesses to save time and effort across their payroll remittance. You can use technology to streamline your payroll operations, reduce your administrative costs, and improve your business’s overall productivity.

While the initial investment in an automated payroll system may require a small amount of time, resources and training, the long-term benefits far outweigh the costs. If you truly don’t want to explore a full payroll software, then using partial automation or opting for no-cost options like an online payroll calculator will at least let you leverage their automatic calculations for a slicker, more error-free payroll option. However, many modern businesses will love the full-suite functionality of payroll software to do it all for them.

Automate your payroll with Wagepoint

Are you ready to explore everything a great payroll automation software solution can do for your business? Wagepoint is confident that our payroll products will revolutionize how you handle payroll in your business. So confident, in fact, we’re happy for you to try out our flagship product for free for 14 days.

Get started with your free Wagepoint trial

You’ll soon wonder how you ever did payroll any other way.