Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

What are some benefits of payroll software for small businesses like you? At first, paying employees for the work they do is something many small business owners do with a spreadsheet or a basic online tool. However, even at this beginning stage, compliance, accuracy, nuance and accessible tools play a role in the success of your business.

Quite simply, if you are looking for a better solution to manual payroll processes, now may be the right time to add payroll software to your technical toolkit.

Key takeaways

- You don’t have to be a payroll expert.

- Time and money savings from payroll automation mean you can invest in other areas of your business.

- Security features help you protect your business and employee data to remain compliant.

- The risk of errors in your pay runs goes down.

- Well-organized payroll data can help with decision-making for your business overall.

The benefits of payroll software for small businesses.

Think of payroll software as a lever you can pull to amplify the work your team does. The right payroll system can automate and handle time-consuming tasks and routine parts of the payroll process.

Take tax deductions, overtime and bonus pay — these are all pretty common parts of running payroll that can be simplified without sacrificing compliance with Canada Revenue Agency regulations.

Here’s how.

1. You don’t need a payroll expert.

Not needing to be a payroll expert is probably the most obvious benefit of using payroll management software.

Payroll software for small businesses is designed for business owners or others within the company who aren’t trained in payroll but need to get the job done. You don’t need to be an expert or to have taken an accounting course to understand your company’s payroll processing needs when the complexities are hidden behind the scenes.

Many small businesses feel they have to have an on-site accountant or payroll expert to ensure the job is done correctly. But, this type of contractor can be costly. They only need to do a few hours of work each month to keep up with the typical payroll matters of a small business.

One way to have lower costs without worrying that your lack-of-expertise will bring about legal issues is to use payroll software. That’s not to say you should ditch payroll, bookkeeping or accounting professionals forever. It always helps to have an extra set of eyes just to be sure, but payroll software will make it easier to check this item off your to-do list.

2. Save time and money.

The short version of this is less time spent on payroll thanks to payroll software can mean more money saved.

Handling payroll can be a time-consuming process, especially when doing manual payroll processing, manual data entry or when you’re trying to figure it all out yourself.

Many small business owners lose so much time every week or month tabulating payroll, double-checking the numbers and preparing the relevant paperwork. And then let’s not forget the employee payment process. Even if you don’t write manual cheques and have direct deposit to your employees set up through your bank, not having that integrated process as a part of a pay run can take up your time.

With payroll software, everything is much faster, smoother and can be a seamless part of your overall workflow. Small companies in particular can save a metric ton of time each month and throughout the year by using an automated system that:

- Does the hard payroll calculations for you

- Securely stores employee data

- Generates pay stubs and reports

- Generates year-end forms like T4s, T4As and RL-1s

- Calculates and remits payroll taxes on your behalf

On the money side, that means things like avoiding late fees for late taxes or even just the labour costs for having someone spend all that time on payroll when they could be putting their work hours into other important tasks for your business.

3. Better work-life balance.

Because of not needing to be an expert and because of time and cost savings, those who use automated payroll software also feel a better work-life balance. No more stressing over your employees’ payroll and thinking about those CRA remittances even after you’ve closed up shop or left for the day. Payroll software gives you the confidence to know it’s been taken care of and it’s off your plate.

Not only that, but because you’re able to get through the entire process for payroll at a greater speed, you’re able to do more with your work day. This can help with preventing the need to spend extra hours “catching up” on tasks that couldn’t get done before.

4. Built-in data security.

Payroll deals with so much sensitive information — of both the financial and personal variety. Software’s built-in data security helps protect details like income information, bank details and identifying personal information, like Social Insurance Numbers, full names and dates of birth.

Payroll software is designed to withstand modern threats and pass the latest global compliance regulations. This means using comprehensive encryption, strong passwords, MFA (multi-factor authentication) and superior firewalls. Some systems may even have other security features or recommendations to keep your payroll data secure.

Payroll software developers also make it internally defensive and challenging to crack. Regular security updates usually happen behind the scenes to ensure that your payroll data, staff and company information remain safe from unauthorized access or other security issues.

5. Compliant payroll management.

Whether you want to give compliance a corporate-sounding description like “business-critical operation” or simply understand that it’s ultra important to organizations of all sizes, just know compliance is not something to take lightly.

Many small business owners learn about payroll compliance after opening shop and paying employees. However, compliance is critical for payroll management systems in order to remain on the right side of federal and provincial payroll regulations and labour laws.

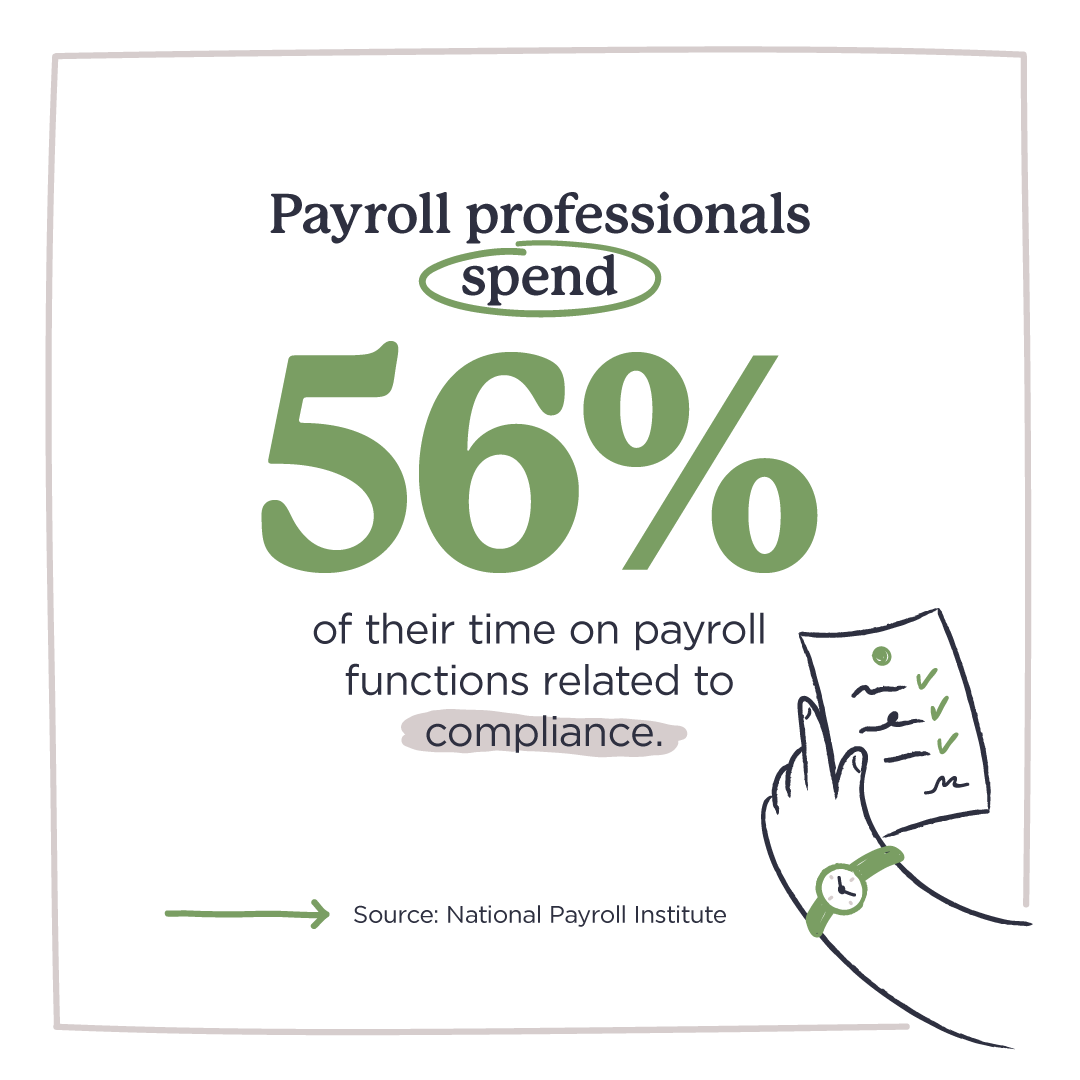

According to a 2020 study published by the National Payroll Institute, payroll professionals (both those in the payroll industry and employees acting as payroll admins for a company) spend, on average, 56% of their time on payroll duties related to compliance. The study goes on to say, “the total cost of these functions to employers is approximately $9.9 billion, based on the average salary for payroll professionals.”

In short: Compliance is a costly thing in the payroll space. And this isn’t even taking into account fees for lack of compliance.

Payroll compliance covers two important factors. The first is compliant compensation policies. For example, payroll must always add up to minimum wage or more, overtime must be compensated in specific ways that may change by province and pay may need to be delivered in a particular pattern, such as twice a month.

The second factor of compliance is in the paperwork (which isn’t always paper anymore). Payroll software ensures that the right records and reports are prepared for filing with each pay cheque distributed and also for Records of Employment. Some even do the filing for you.

6. Error reduction.

On the topic of compliance, one way to remain compliant is to avoid errors. Which makes the ability to reduce the risk of human error one of the most important features of payroll software. Even the most precise accountant can occasionally miss a record or transpose a number. While transposing numbers could still happen from time to time if you have to manually enter any data, when the numbers are right, automated payroll systems will have accurate payroll calculations.

Your payroll records will be flawless, kept expertly based on standardized templates and with data pulled directly from the company systems. This ensures that each of your employees is paid accurately and on time. This also makes your records ready for taxes and compliance audits at any time without hiccups that might cause trouble.

7. Integrated tax filing makes life easier.

This relates to both business taxes and employee taxes. On the business side, you’ll have items like your regular payroll tax payments and reporting as well as year-end tax report filing. On the employee side, that means having the right tax forms (T4s, T4As, RL-1s) to give your employees for them to file.

When a payroll software has integrated tax filing, that means it’ll be able to generate the reports, forms and overall data you’ll need to take care of these tax items. All without you having to figure out what goes in Box 22 of a T4 or how to pay your payroll taxes.

Payroll software will automatically create and fill out the necessary tax documents and records for you (again, if it has this feature; some payroll packages don’t!).

8. Payroll reports keep your business informed.

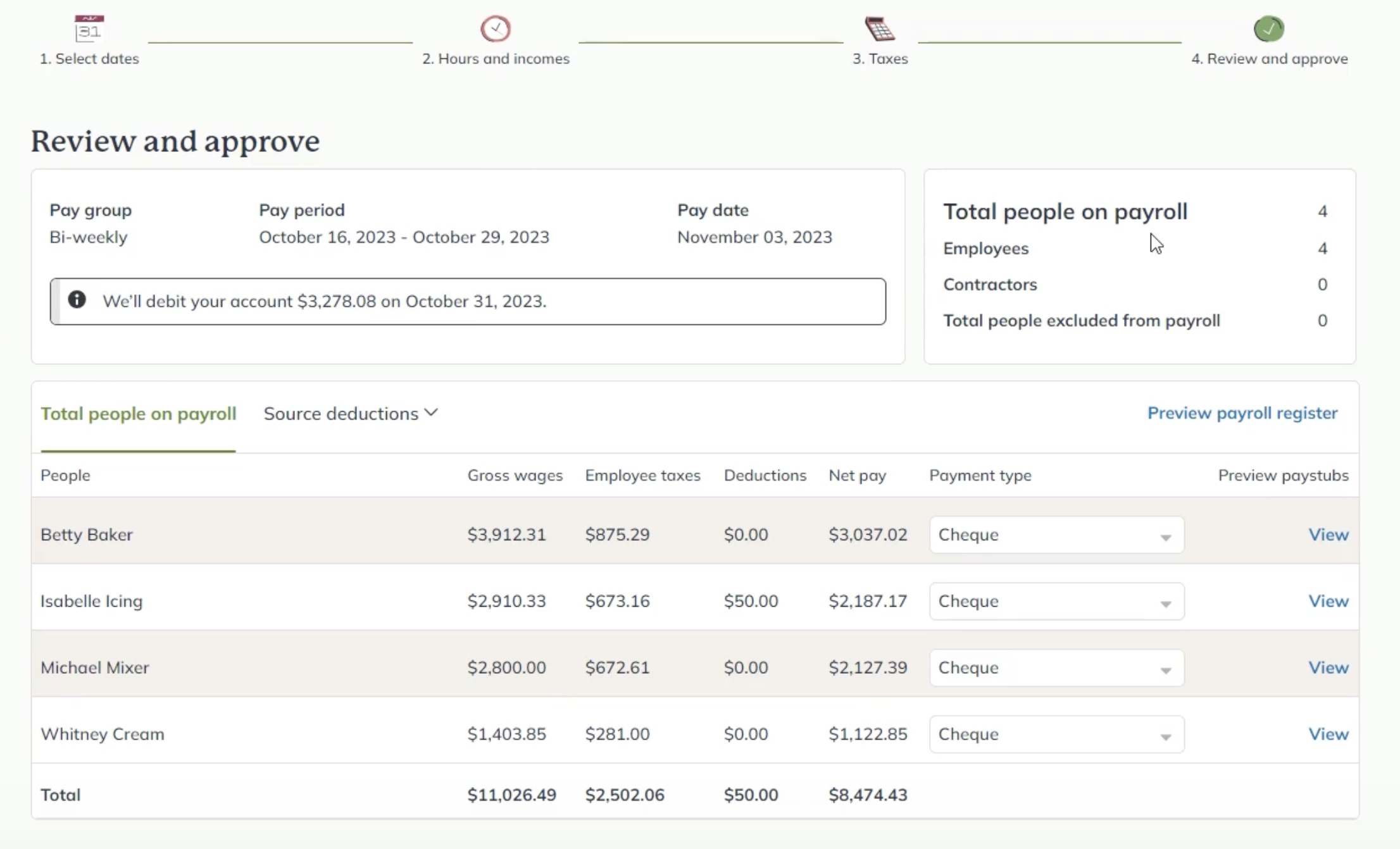

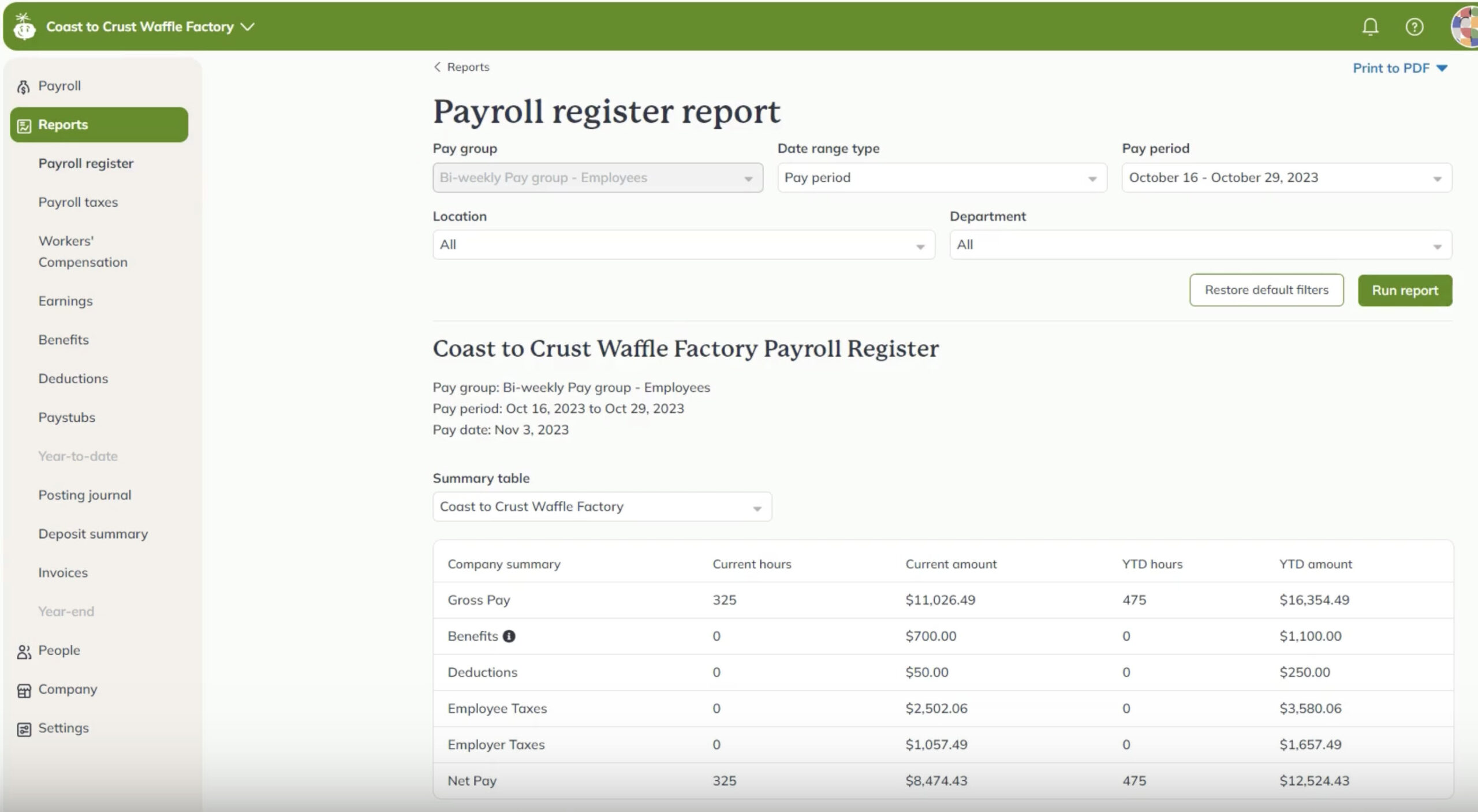

Pretty much all payroll software has built-in reports to show you basic payroll data like pay run break downs, payroll taxes and employee pay stubs. There are others that have a wealth of other payroll reports that you can run and customize to see exactly the information you’re looking for.

For instance, a good payroll software will give you the option to filter your reports to see specific pay periods, pay groups, employees and other details like that. That way, you’re not just looking at a long report of text trying to scroll to find or CTRL-F your way to the information you need.

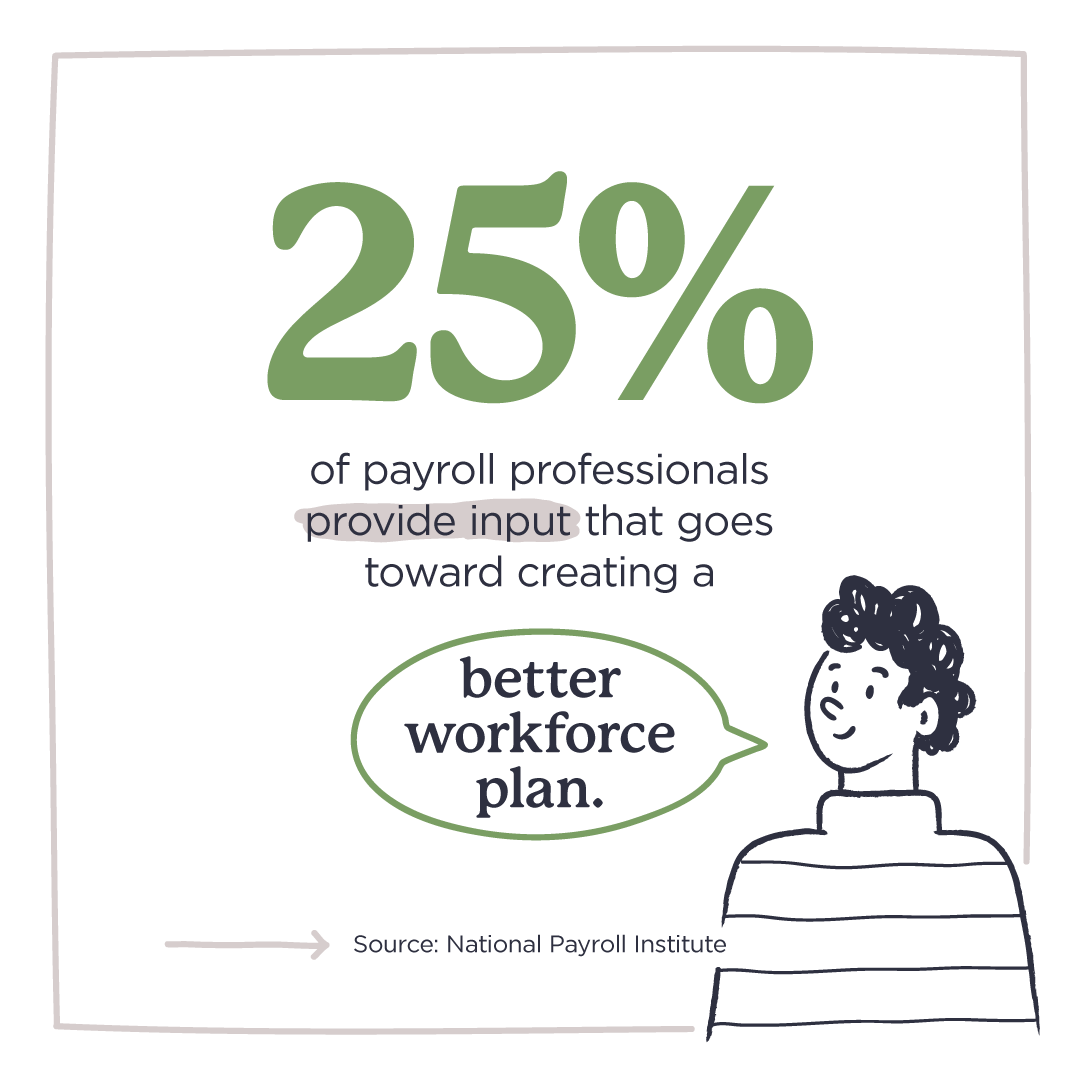

This isn’t just useful within the realm of payroll though. Another National Payroll Institute study, also from 2020, notes that 25% of payroll professionals said they provide input that goes toward creating a better workforce plan.

Say you’re looking at your business’s budgets and want to assess labour costs, productivity, attendance and other details like that. Reviewing your payroll reports can help you with analyzing those details because it’ll show things like:

- How much your employees are being paid

- Who had an employee reimbursement on their pay cheque

- Who was left off a pay run or had less pay because they were absent

- Who got paid sick leave

- What employee benefits are costing

All of that and more can be found in payroll reports and factored into any in-depth analysis of staff costs.

9. Payroll management from anywhere.

Running a modern small business doesn’t always occur in your office with access to a desktop computer. It may occur in many home offices with a remote team.

One of the significant advantages of payroll software is flexibility. In fact, 53% of organizations have switched to using a cloud-based payroll management system over desktop software. This makes it possible for small business owners who are always on the go or have remote offices to manage payroll from anywhere.

Many traditional and manual processing systems are installed on your desktop. However, today’s payroll software is based on a secure cloud infrastructure, enabling access to manage your company’s payroll operations anywhere with a secure internet connection. So regardless of whether all your departments are under one roof or many, you’ll have access to payroll.

10. Empower employees with self-service.

Of course, payroll software isn’t just for the benefit of a small business owner or managing staff. Payroll can also positively or negatively impact the employee experience.

Employees like having access to look up their past pay stubs, see the breakdown of their pay and print out the relevant payroll data that belongs to them. Plus, employee self-service portals also give them access to their year-end forms. Meaning they don’t have to wait for it in an encrypted email or via snail mail.

Employees also benefit from being able to enter and update their payment profile information. If they change addresses or change bank accounts, the right payroll software makes it easy for employees to update their information without going through a two-week email exchange with your human resources person.

Employee self-service features provide desktop and mobile access to payroll information and personal account management. Having employee self-service options can empower them and contribute to employee satisfaction and morale.

11. Bring tools together with multi-platform integration.

Another concern for business owners is the ability to integrate payroll with their other business management software. Integration ensures that all your software solutions share the same core data set. This prevents double entries and ensure across-the-board accuracy with the most efficiency. You also want to provide precise data communication and shared data security.

When your payroll solution has integration options, it’s much easier to sync up your payroll with your HR system, employee time management software, accounting software and beyond.

12. Cost-effective solutions for your budget.

The price range for good payroll software is quite broad. However, small business solutions are typically priced for small business affordability. Compared to hiring a professional accountant or the cost in time of manually calculating your payroll by hand, payroll software offers both a comprehensive and cost-effective solution.

You can compare package prices based on the size of your team and the features your payroll software offers versus the same quality services from a human accounting professional.

13. Ease of overall bookkeeping.

When your payroll records are impeccably kept, and human error is eliminated from the equation, you’ll find that bookkeeping is so much easer. This is especially true if your payroll and bookkeeping software talk to each other through integration.

This is a massive benefit for many small businesses in a growth cycle where bookkeeping processes become more complex as the company grows.

Key features of payroll software.

With the number of payroll software out there these days, it’s important to really dive into the features. Even if two seem to have the same features, do they do exactly the same thing? Is there an extra cost for one over the other?

The specific needs of your business will really come into play here so that you get the features you need without being overwhelmed by ones you don’t.

1. Automated calculations

Automated payroll calculations include translating employee hours into wages, calculating overtime pay, including automatic tax withholding, managing retirement contributions and including bonuses with absolute accuracy. This lets business owners enter the relevant information, and the software does the rest.

2. Employee self-service portal

Employee self-service portals give employees the chance to take ownership by keeping their profiles up-to-date and tracking their earnings. The software can also provide employees with easy access to their pay records when needed for personal paperwork and their yearly tax documents.

3. Payroll tax filing

Speaking of taxes, every good payroll software offering should help business owners smoothly prepare and handle tax filings. Look for payroll software that maintains up-to-date tax requirements and documents, generates the necessary tax records. Even better if the software platform can streamline tax payments and filing by doing it on your behalf.

4. Direct deposit

One of the things that makes payroll software truly useful is its ability to pay employees via direct deposit. Payroll software with built-in direct deposit capabilities ensures that your team is paid on time. Once you approve your pay period’s pay run, the system can initiate bank transfers automatically.

5. Flexible customization

Look for payroll software that has more than just the bells and whistles: It should also be adaptive to your unique business needs. Flexibility is key because each small business is different. Your pay scale, bonus structure and other custom elements of your compensation packages should be easily integrated into your payroll software functionality. Customization also factors into user accesses and reporting filters.

6. Advanced security

Take the time to review what security features the payroll software you’re interested in uses. Data management means protecting business and employee information. So knowing what safeguards and tools are in place to help you do that means you can do so even better.

7. Integration options

Whether you’re looking for a single platform to manage your business operations or are happy to have separate software packages to get the job done, knowing if and how everything works together makes life easier and reduces manual tasks across the board.

Final thoughts on the benefits of payroll software.

Small businesses often begin by handling every step manually. But as your business grows, the need to automate and discover useful software toolkits will also grow. With the addition of a competent and feature-rich payroll software solution, employers can get back time and money from doing payroll manually or outsourcing to an accounting service while also enjoying the many benefits of payroll software’s well-designed feature set.

Get started with Wagepoint today.

Wagepoint payroll is designed specifically for small businesses, meaning this standalone payroll platform has no fluff and only the tools that’ll get the job done fast and efficiently.

See the magic for your small business with a 14-day free trial.

Payroll software FAQs

What does payroll software do?

Payroll software is a self-service solution that gives the user the tools to manage, maintain and do the calculations for payroll-related tasks. this includes paying employees, calculating payroll taxes, managing year-end payroll processes and generating reports.

What is the difference between payroll software and a payroll service?

Payroll software is a self-serve solution provides the user with tools to complete pay runs and manage the payroll process overall. It also provides expertise built into the software through best practices, accurate reports and valuable features. A payroll service is where you hire a payroll provider or use a service that completes payroll on your behalf externally and then sends the data back. Some payroll software companies do offer a full-service payroll option as well, so it’s important to be mindful of which you’re signing up for.

How does payroll software stay compliant?

Payroll software stays compliant by being regularly updated for things like tax updates, new government regulations and storing of financial and personal data. Especially when using cloud-based payroll software, the developers will make updates so that the program properly calculates, remits and stores your data.

When should I invest in payroll software for my small business?

Payroll software can be beneficial from the moment you begin the process of bringing on your first employee. Because payroll software is built to be accurate, efficient and compliant, it can immediately take the load of manual payroll processing off your plate.

Should I outsource payroll or do it myself?

Outsourcing payroll and in-house payroll both have their benefits and downsides. Outsourcing payroll to an accounting service allows you to focus on other things. But the price is high, and oversight is low. Choosing to DIY your payroll gives you complete control and oversight at the cost of your own time. You can also empower yourself when performing payroll with a better software toolkit. Contact us for more regarding the benefits of payroll software.