Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

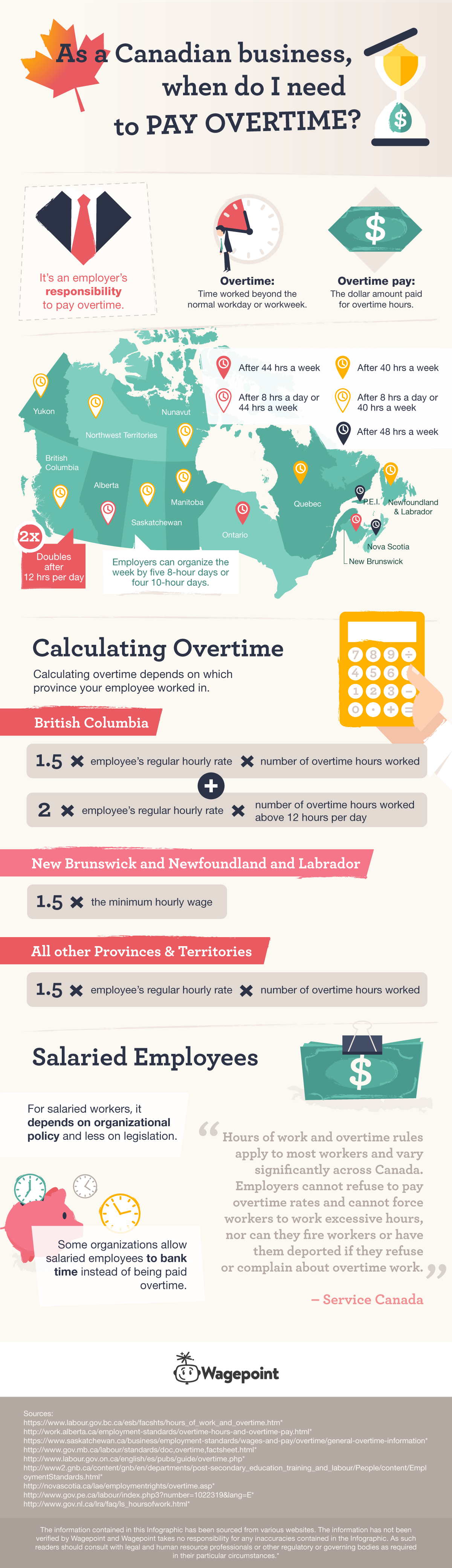

The normal rule is that when employees work overtime, employers have to pay that out in the same pay period as worked. However, in some jurisdictions, there may be other options. Two options that are sometimes available are averaging and banking.

When weekly hours worked are averaged for overtime purposes, overtime is only recognized if total hours worked exceed overtime thresholds, multiplied by the number of weeks in the averaging cycle. For example:

- If hours worked are averaged over 3 Sunday to Saturday weeks;

- The weekly overtime threshold is 40 hours; and

- The hours worked in one averaging cycle are 47, 38, 36 hours/week;

- 121 hours have been worked over 3 weeks;

- There are 120 regular hours and 1 overtime hour in this cycle.

Averaging doesn’t mean changing the applicable weekly overtime threshold. If this is 40 hours/week, it remains that. However, in averaging weekly hours, overtime can only be calculated at the end of each averaging cycle. Without averaging, there would be 7 overtime hours in the 1st week above; if employees are paid bi-weekly, this cycle would fall across 2 pay periods, with the 7 overtime hours owing at the end of the 1st of these. With averaging, overtime hours have been reduced from 7 to 1 and delayed in payment by one pay period.

Overtime averaging is supported in the following jurisdictions: federal, BC, SK, ON, QC, NT and NU. Of these, there are both daily and weekly overtime in the federal, BC, SK, NT and NU jurisdictions.

How does averaging affect daily overtime in those jurisdictions?

In BC, the 12-hour threshold for double time is unchanged. The regular 8-hour threshold for time and a half is unchanged, except where scheduled hours per day are greater than 8. Where scheduled daily hours are greater than 8, time and half only applies for any hours between those scheduled and 12.

Assume the following scheduled and worked hours in a 3-week averaging cycle:

In the federal jurisdiction, when overtime is averaged, daily (8 hours) and weekly (40 hours) overtime thresholds are replaced with a single threshold on the total hours worked in each overtime cycle. In the table above, if the employment standards jurisdiction had been federal, there would have been 20 weekly overtime hours owing, at time and a half.

In SK, NT and NU, there is no general rule for the impact of averaging on daily overtime calculations. Instead, you have to look at the rules specified in each averaging permit or authorization issued by the applicable employment standards authority.

As with averaging, employers are not allowed to bank overtime hours in all employment standards jurisdictions. Banking overtime is permitted in BC, AB, MB, ON, QC, PE, NL, YK and NT.

Where overtime may be banked, the main distinction is whether the bank must be measured in time or dollars.

BC is the only jurisdiction that specifies overtime dollars be banked. For example, if an employee works 2 overtime hours, payable at time and a half, when $12 is the regular hourly rate, $36 must be banked (2 x $12 x 1.5). In effect, banking dollars means the ultimate requirement to pay is at rates in effect when overtime hours were worked.

Banking time, by contrast, means time taken in lieu, as time off for overtime worked, must be paid using hourly rates in effect when time off is taken. In the example above, if lieu time was taken when current hourly rates were $13, the employee would be entitled to 3 hours in lieu (2 overtime hours at 1.5), for which the pay owing would be $39 (3 hours at $13/hour).

However, there are two exceptions to this description of banking time.

First, in AB, overtime hours are banked and taken at straight-time rates. In all other jurisdictions where the banking of overtime hours is permitted, the bank must reflect overtime rates, i.e. 2 hours at time and a half must be banked as 3 hours owing. However, AB only requires that the overtime bank reflect the actual hours worked, i.e. 2 hours.

Second, when overtime hours are banked, banked time may be cashed out, as dollars paid without time off being taken. In every jurisdiction, including AB, when no time is taken, cashing out the bank means employees must be paid just as if there had been no banking. If the employee above, who banked 2 hours overtime, when regular hourly rates were $12, but cashed these hours out when regular hourly rates had risen to $13, the overtime payable would be $36 (2 hours at 1.5 x $12/hour), the same as if the overtime had been paid when worked.

Both of these options may be combined. In other words, weekly overtime could apply based on the hours worked over a 3 week averaging cycle and then any resulting overtime could be banked, to be taken later as paid time off.

Syndicated content from author Alan McEwen for the Wagepoint Payroll Academy.

Alan McEwen is a Vancouver Island-based HRIS/Payroll consultant and freelance writer with over 20 years’ experience in all aspects of the industry. He can be reached at armcewen@shaw.ca, (250) 228-5280 or visit www.alanrmcewen.com for more information.

![]()