Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

Today’s market features a number of payroll software pricing models. No matter what kind of business owner you are, knowing the different options and how much payroll software costs is the best way to avoid surprise additional expenses.

Different payroll software providers also offer different pricing models. Luckily, some include a handy quote generator so you can get a sense of what each pay run costs before you commit. Nonetheless, here are the common pricing models to be on the lookout for.

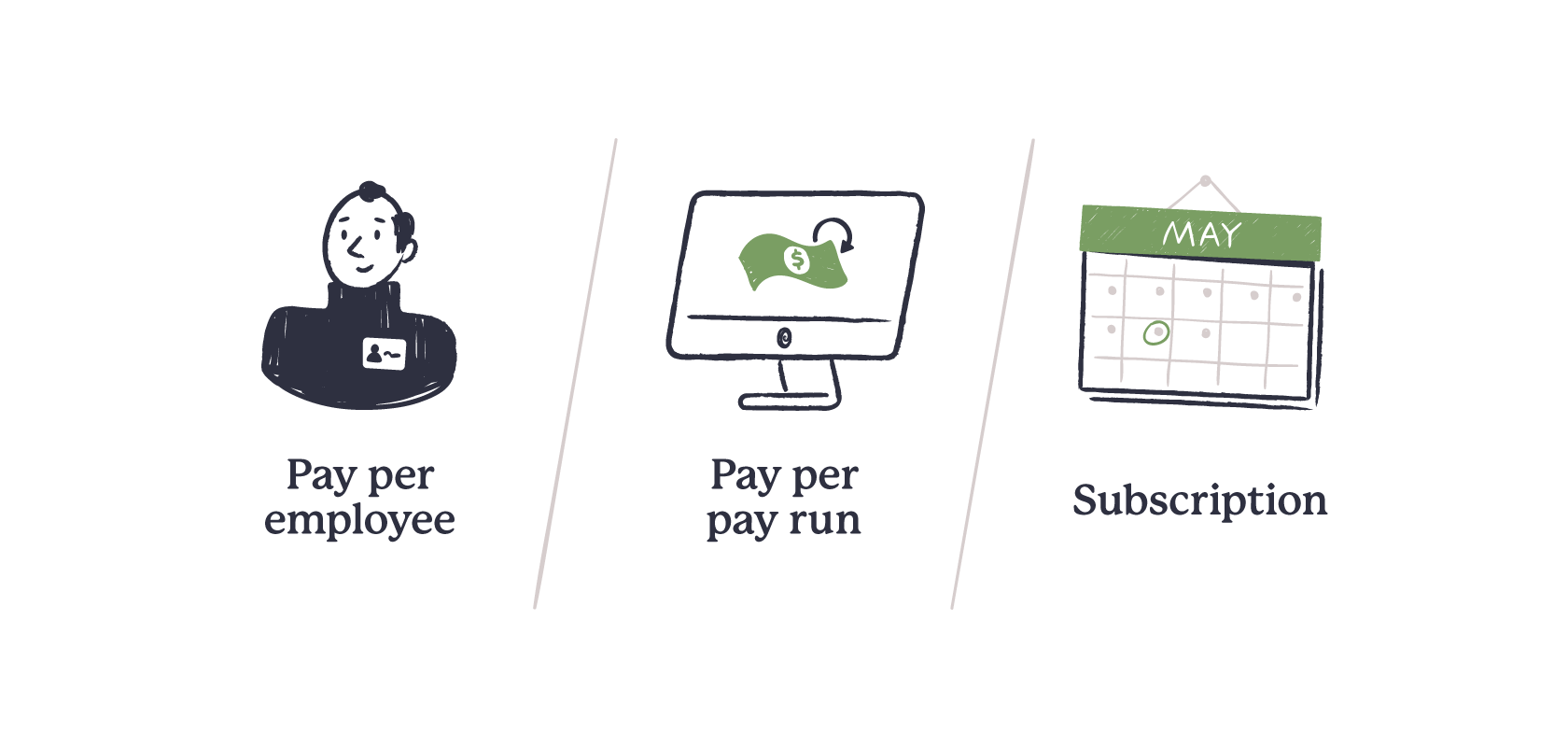

Payroll software pricing models.

1. Pay per employee model

A good option, especially for small companies with only a few team members, is payroll software that charges you based on the number of employees or independent contractors you’ll be running payroll for.

With this model, you’ll typically only be charged for the employees or contractors that were a part of pay runs for the billing period rather than your entire employee base. So, if you have 50 on your team, but only ran payroll for 20 of them within that billing period, the per employee fee would be put against those 20.

One thing to be mindful of is whether the payroll costs are per employee or for a certain amount of employees. As an example, a software might have a model where the price tiers look like: X-amount of dollars for 1-50 employees, then X-amount of dollars for 51+ employees, and so on.

This can be especially important if your business is growing quickly because the addition of just a few people could push your overall costs up by a more substantial amount than a regular pay per employee model.

2. Pay per pay run model

With a pay per pay run model, you’re getting charged based on how often you run payroll. This can be a good thing if you operate on a monthly basis, but charges can add up quickly if you’re running payroll weekly or bi-weekly.

With this in mind, think about how often you’ll be paying your employees. If you have a number of employees with different pay periods, it may not be better to look at a different payroll pricing model.

This model can sometimes also be coupled with the pay per employee model. This would mean you’d pay whatever the rate is for the payroll run, plus the rate for how many employees were a part of the billing period.

3. Subscription-based software

With a subscription-based pricing model, you pay a recurring monthly or annual fee for access to their software. You may come across a software where there’s only the subscription fee, but sometimes it’s also combined with a per employee pricing model.

In those cases, the exact amount you pay is often worked out on a per employee basis plus the additional subscription fee, and potentially other costs as well for installation and setup.

In other words, there’s a base fee (the subscription), plus potential additional fees with using and setting up the program.

A subscription model can be a good choice, but be sure to check the fine print for exactly what’s included. Especially where services are listed as a “basic plan.”

Many of the big players, like Wagepoint, QuickBooks Online Payroll and Wave Payroll, use the subscription plus per employee fee model.

Factors influencing payroll software costs.

According to Investopedia, the average cost of payroll software is $30 per month for the base fee, plus anywhere between $4 to $8 per employee per month.

That could sound like a lot. But compared to the cost of hiring someone to handle payroll or outsourcing payroll to a third-party service entirely, software can be more affordable for small business owners.

It can be helpful to understand what costs are factored into the payroll software pricing, especially when things are listed as additional features for an extra fee.

Automatic payroll calculations

Most payroll software includes automated calculation of employee wages and payroll tax deductions as a core part of the product. This is one of the biggest time-savers that many feel makes the cost of payroll software worth it. Not only does it mean not having to do the complicated calculations yourself, but that freed up time means you can spend more time on your business or work toward better work-life balance.

After moving to Wagepoint running payroll, even when there is vacation pay involved, payroll takes 15 minutes max for now twice as many employees as we had when with our old service.

— Kevin McIntosh, Business Manager at Dubbeldam Architecture + Design

Number of employees

The number of people working for your business is a bigger factor than you may think. When your payroll software has a per employee pricing model — whether actually per employee or tiered with certain thresholds — the number of employees will change the amount you’re paying.

Payroll frequency

In some cases, payroll software providers charge based on the frequency of your payroll. This will be one of the top things to keep in mind if you need unlimited payroll runs or you’re paying your employees weekly!

Tax compliance

Many payroll software will include payroll taxes in the automatic payroll calculations. However, there could be extra costs for taking the next steps of tax compliance from directly with the software. This includes:

- Producing year-end T4/T4A forms

- Filing provincial and federal payroll taxes throughout the year

- Making tax payments

Employee location

As it becomes more common to have workforces spread out geographically, it’s worth considering if the payroll software you’re looking at does everything you need it to. Remember that different provinces and territories can have different payroll taxes and regulations.

Québec, for example, brings some unique payroll challenges to the table, especially regarding remittances for payroll taxes. Because of that, some payroll software won’t include it as an option. Fine if you don’t need it — but useless to you if you do!

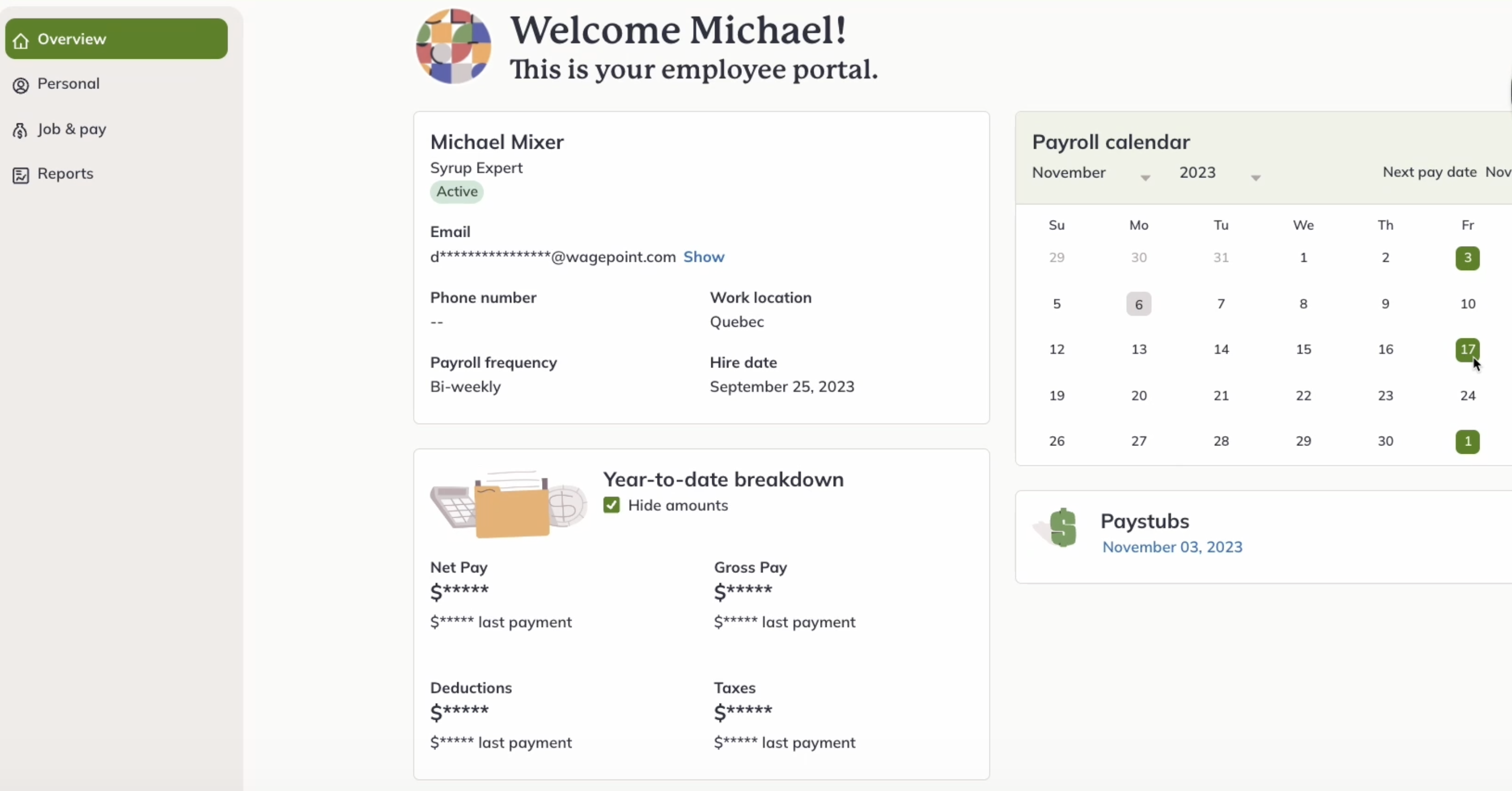

Employee self-service portal

This is another feature that’s usually a gimme with payroll software. It gives your team the access to see their pay stubs, a breakdown of their payroll details and more depending on the provider. It can usually be accessed through browser or mobile app. This is a great way for your employees to take ownership of their payroll data apart from just receiving their pay cheque each pay period.

“Additional services” and “add-ons”

You may also find that some providers charge added fees for anything but the most basic payroll features. This customized solution approach may be great for meeting your unique payroll needs. However, you’ll want to keep total cost in mind when looking software that lists some things as advanced features.

So, handling standard payroll processes, like deductions, might be included. But there may also be charges for requests to fix payroll errors, to do direct deposits or even take advantage of same-day processing times. Some software even charge support fees when you need a hand.

There are also payroll software that have add-ons for things like time-tracking and HR services or features.

Hidden costs

Another factor employers should keep a sharp eye on is that some payroll software providers have hidden fees associated with their service that you won’t necessarily know about until you’re charged. In other words, they’re not giving you everything you need to run payroll from start to finish.

For example, it may not be transparent if additional pay runs for bonuses or just general off-cycle payroll or even your year-end tax filing with the Canada Revenue Agency (CRA) are considered additional features that incur an additional cost.

Which isn’t to say that you should look for a payroll software provider that does absolutely everything for you (after all, that may not suit your budget or objectives). But your provider should be perfectly transparent about what functionality you get for your money.

In short: Your payroll software package should be an open book, without any extra hidden costs.

Final thoughts on payroll software pricing.

In a lot of cases, payroll software providers have offerings that are a mix of some (or all) of the above pricing plans. This can work very well for small businesses. But be sure to opt for something where all the relevant information is crystal clear upfront and your specific needs are met.

Also take advantage of payroll software that offers a free trial period before you commit. This can help you see what features are available, if they fit your needs and even ask questions of support before ever spending a dime.

Remember, the best payroll software is one that doesn’t just save you time. It helps you to stay legislatively compliant, gives you insight into exactly what’s happening with your business finances and meets your unique business requirements.

In other words, it helps make payroll processing easier than ever.

Wagepoint: Priced with small business in mind

Using Wagepoint’s software, you get just that. This standalone small business payroll software has two pricing plans to choose from. Each give you the option to harness the full potential of Wagepoint, with a slight difference based on how often you run payroll.

Whether you need one pay run per month or unlimited pay runs, you’ll know what tools you have at your fingertips. Add on a dedicated support team, an employee self-service portal and all around ease of use, you can make the payroll magic happen.

Interested in learning more about Wagepoint’s payroll solution? Get started with a 14-day free trial!

FAQ

What is payroll software?

Payroll software is any on-premises or cloud-based software solution that gives you hands-on management of the payroll process. It also helps you deal with complex calculations (like benefits deductions) and stay tax compliant.

What payroll software doesn’t do is completely remove payroll from your to-do list. While it lightens your administration load in the long-run, you still have to enter the data. It’s a lot simpler and a reliable way to ensure an accurate payroll. But it’s not the same as outsourcing to a payroll service (which comes with a lot of other considerations).

Does business size matter when choosing payroll software?

Yes! If you have a small business, payroll software that’s geared more toward medium-sized businesses or large companies, it could have features that you don’t need. It’s better to look for a software geared toward small businesses. That way, you’re only paying for the tools you’ll need for processing payroll.

What payment options does payroll software have?

Each payroll software company will have different payment options. Paying by credit card is a common option, although some also have a direct debit option.

What alternatives are there to payroll software?

Alternatives to payroll software include having someone that processes payroll in-house for you, outsourcing to accountants or bookkeepers and full-service payroll providers.

Is payroll software secure?

Yes! Many payroll software solutions take measures to protect both business and employee information. This includes features like two-factor authentication, industry- and bank-grade processes, data encryption and more.