Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

In 2022, the Canada Revenue Agency (CRA) collected over $38 billion in payroll deductions from Canadian businesses. This significant figure highlights just how important payroll compliance for companies of all sizes is.

As a small business owner in Canada, understanding and following payroll regulations is not only a legal requirement but also a fundamental aspect of running a successful and responsible company.

Let’s dive into a comprehensive overview of payroll compliance for small business owners in Canada.

Definition of payroll compliance

Payroll compliance refers to following all rules and regulations set by the government regarding employee compensation and employment-related taxes. It encompasses a wide range of responsibilities, from accurate wage calculations to proper deductions and tax remittances.

Key points to understand:

- Payroll compliance legislation: This term refers to the collection of laws and regulations that govern how businesses should manage payroll. It includes federal and provincial laws covering areas such as income tax, employment insurance, and pension contributions.

- PCP designation: This credential, offered by the National Payroll Institute, demonstrates a high level of expertise in payroll compliance. It requires completion of specific courses and work experience in the field.

- Payroll compliance practitioner (PCP): This is a professional who specializes in ensuring businesses adhere to payroll rules correctly. PCPs are trained to understand and implement complex payroll legislation.

Payroll compliance is not a static concept. It requires ongoing attention and updates as legislation changes. Staying informed means staying compliant.

Key elements of payroll compliance

Employer compliance

As a business owner, you have several key responsibilities when it comes to payroll:

- Source deductions and remittances: This involves withholding required amounts from employees’ pay cheques for income tax, Canada Pension Plan (CPP) contributions, Québec Pension Plan, Québec Parental Insurance Plan, and Employment Insurance (EI) premiums. These deductions must be accurately calculated, withheld, and remitted to the CRA on time.

- Employer taxes, premiums, and deductions: In addition to employee contributions, employers are required to pay their share of CPP and EI for each employee. There are also others, such as workers’ compensation (WSIB/WCB), Employer Health Tax (EHT) and so on. The rates for these contributions are set annually by the government.

- Employment standards: These are rules set by both federal and provincial governments about minimum wage, overtime pay, vacation pay, statutory holidays, and other work-related rights. Compliance with these standards is crucial and varies by province.

- Canada Labour Code: It sets federal standards for industries like banking, telecommunications, and transportation, covering minimum wage, hours of work, and occupational health and safety. Employers must comply with these regulations to ensure fair treatment of employees and avoid legal penalties.

- Compliance requirements: This includes maintaining accurate payroll records, filing required reports (such as T4 slips and information returns) on time, and adhering to all payroll-related laws. Records must typically be kept for at least six years.

- Financial accounting: Your business’s financial records must correctly record all payroll transactions, including wages, salaries, bonuses, commissions, and all deductions. Accurate financial accounting is crucial for tax purposes and financial reporting.

Employee compliance

Employees also play a role in payroll compliance:

- Providing correct information: Employees are responsible for providing accurate personal details including their full legal name, current address, date of birth, and Social Insurance Number (SIN). They must promptly report any changes to this information.

- Filling out tax forms: Employees must complete forms such as the TD1 (Personal Tax Credits Return) upon starting employment and when their personal tax situation changes. This form helps determine the amount of tax to be deducted from their pay.

- Adhering to employment policies: This involves adhering to workplace policies and promptly reporting any changes that might affect their pay or benefits, such as changes in marital status or number of dependents.

- Protecting personal information: Employees should be vigilant about protecting their personal data to prevent identity theft. This includes safeguarding their SIN and other sensitive information.

Benefits of payroll compliance

Maintaining payroll compliance offers several advantages:

- Stakeholder trust: Compliance demonstrates reliability and integrity, fostering trust among employees, investors, banks, creditors and business partners. It shows that your business operates ethically and responsibly.

- Employee satisfaction: Accurate and timely pay processing leads to higher employee satisfaction (and retention!). When employees can rely on receiving their correct pay on time, it reduces stress and improves morale.

- Legal security: Compliance significantly reduces the risk of legal issues. It helps prevent costly lawsuits, audits, and penalties that can come from non-compliance.

- Smooth operations: Proper compliance procedures streamline payroll processes, leading to fewer disruptions in your business operations. It allows you to focus on core business activities rather than resolving payroll discrepancies.

- Employee financial wellness: When employees know their pay and benefits are being handled correctly, it contributes to their overall sense of financial security and well-being. Employee payment details contain highly sensitive information, so it’s essential companies handle this data with care, protecting their employees from any cyber attack or identity theft.

- First Nation considerations: If you employ First Nations individuals, compliance ensures you’re respecting any special tax considerations they may have, such as tax exemptions for on-reserve work.

Penalties for payroll non-compliance

Failing to comply with payroll regulations can result in severe consequences:

- Fines, penalties and interest charges: The CRA can impose significant fines, penalties and interest charges for late or incorrect remittances. For example, interest rates can range from 1% to 20% of the amount owing, depending on how late the remittance is.

- Legal action: Non-compliance can lead to lawsuits from employees or government agencies. These legal battles can be costly and time-consuming.

- Reputation damage: Non-compliance can severely damage your business’s reputation with employees, customers, and the broader business community. This can lead to difficulty in hiring and retaining employees, and even loss of business.

- Operational disruptions: Dealing with compliance issues can consume significant time and resources, diverting attention from core business operations.

- Personal liability: In some cases, business owners can be held personally responsible for payroll violations. This means your personal assets could be at risk.

How is payroll compliance audited?

Various government agencies can conduct audits to ensure payroll compliance:

- Canada Revenue Agency (CRA) audit: The CRA conducts audits to verify if you’re correctly calculating, deducting, and remitting payroll taxes. They examine your books and records, including T4 slips, payroll journals, and general ledgers.

- Workers’ Compensation Board audit: This ensures you’re properly insuring your workers against workplace injuries. They verify if you’ve reported all required information and paid the correct premiums.

- Union/Collective Agreement audit: If you have unionized employees, audits may be conducted to ensure you’re sticking to the terms agreed upon in collective bargaining agreements.

- Employment Standards Board audit: This verifies you’re meeting minimum employment standards set by provincial laws. They check for compliance with rules on minimum wage, overtime, vacation pay, and more.

- Ministry of Finance Provincial Health Tax audit: In some provinces, such as Ontario, this audit checks if you’re correctly handling health-related payroll deductions.

These audits can be triggered randomly, based on industry-specific factors, or due to complaints or discrepancies in reported information.

How payroll tax varies across provinces

Payroll taxes are a significant cost for any business, and they vary dramatically depending on where you operate in Canada. Each province has its own payroll taxes, impacting your overall cost.

Take Ontario, for instance. The province imposes an Ontario Health Premium (OHP) which acts like an additional tax on top of regular income tax. This OHP is a percentage of your employee’s taxable income, so higher salaries will lead to a higher OHP contribution from both the employer and employee. Additionally, Ontario has the Employer Health Tax (EHT), a separate tax on payroll that varies depending on the total annual payroll of the business.

There’s also the Workplace Safety and Insurance Board (WSIB) that employers contribute to. This program provides workplace insurance coverage for employees, but the rates can vary significantly depending on your industry and the company’s claims history. Businesses in high-risk industries with frequent claims will see a higher WSIB premium.

In Toronto, while there are no separate payroll taxes, the high cost of living can significantly impact your business. Competitive salaries in Toronto will likely be higher than other Ontario regions, leading to increased payroll taxes due to the OHP structure.

Tips for keeping up with payroll compliance

Staying compliant requires ongoing effort. Here are some strategies:

- Stay informed: Regularly check official government websites, subscribe to updates from the CRA and your provincial labour ministry. Pay attention to announcements about payroll tax changes and minimum wage adjustments.

- Consult experts: Consider working with a payroll practitioner or payroll tax professional. Their expertise can be invaluable in navigating complex compliance issues.

- Use payroll software: Automated systems can help you calculate deductions accurately, keep records, and stay up-to-date with changing regulations. However, ensure you choose software that’s specifically designed for Canadian payroll.

- Invest in education: Consider courses from the National Payroll Institute, such as Payroll Fundamentals 1 & 2 and Payroll Management. These courses provide in-depth knowledge of payroll processes and compliance requirements.

- Explore micro-credentials: These shorter, focused courses can help you quickly gain specific payroll skills. They’re a good option if you need targeted knowledge in a particular area of payroll compliance.

Automated payroll compliance systems.

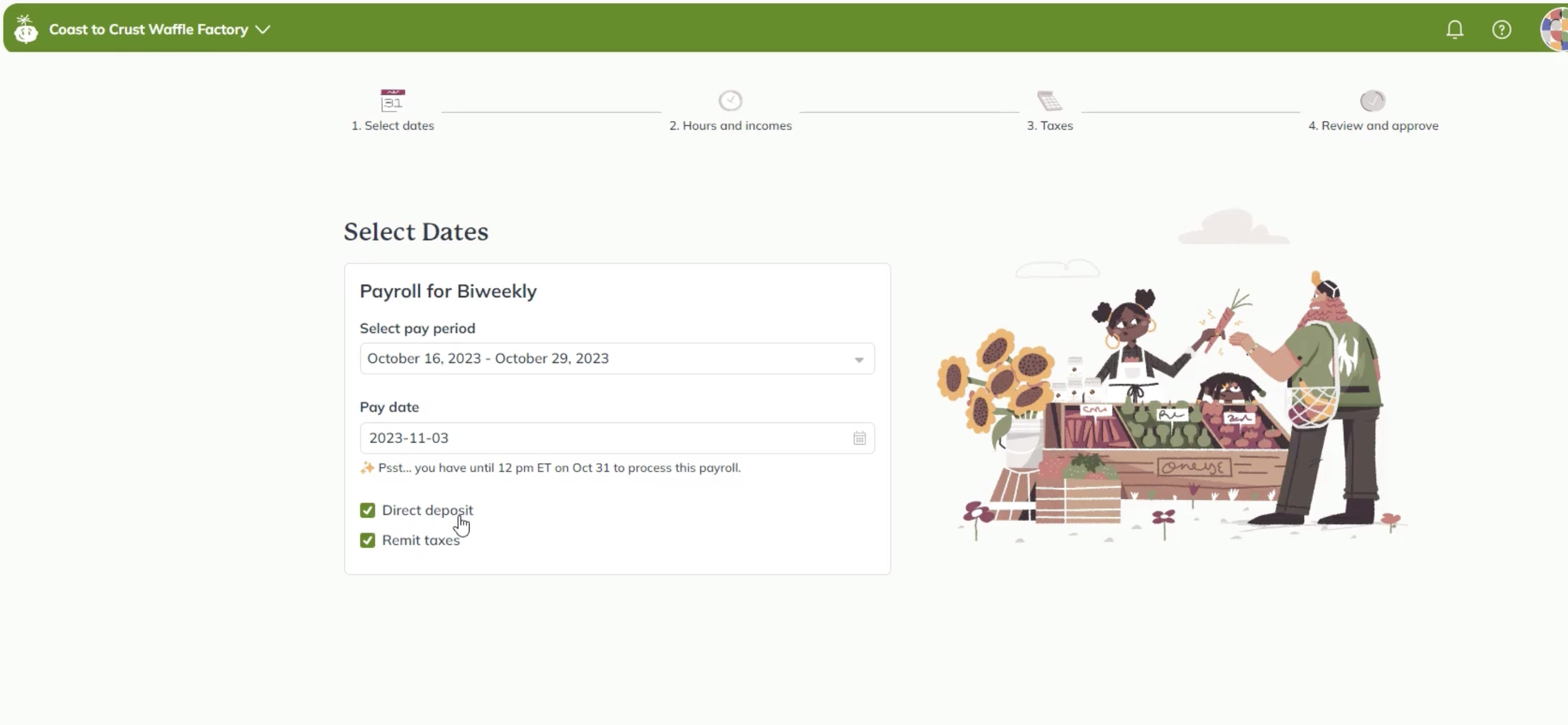

Wagepoint: Your payroll compliance tool

Wagepoint is a payroll software designed to help small businesses stay compliant with CRA regulations. Here’s how it can assist:

- Automatic calculations: Wagepoint calculates the correct deductions based on the latest tax rules. This includes federal and provincial income tax, CPP, and EI deductions.

- Timely remittances: The software ensures you send the right amounts to the government on time, helping you avoid late remittance penalties.

- Record keeping: It stores all your payroll records securely, making it easy to retrieve information for audits or employee inquiries.

- Year-end reporting: Wagepoint helps prepare T4s and other required forms, simplifying your year-end processes.

While Wagepoint can automate many aspects of payroll compliance, it’s important to remember that the output’s accuracy depends on the input. You still need to ensure all employee information and pay details are entered correctly and kept up-to-date. Think of Wagepoint as your reliable compliance teammate. Try it free for 14 days.

Wrapping up.

In conclusion, mastering payroll compliance is crucial for the success and longevity of your small business in Canada. By understanding the rules, staying informed about changes, and using the right tools and resources, you can ensure your business remains compliant, your employees are satisfied, and you avoid costly penalties. Remember, payroll compliance is not just about following rules—it’s about establishing a foundation for long-term business success and ethical operations.

Payroll compliance FAQ

What is a payroll compliance professional?

A payroll compliance professional, called a Payroll Compliance Practitioner (PCP), is an expert in payroll regulations with a PCP certification. Their responsibilities include:

- Ensuring businesses follow all payroll laws and regulations

- Managing payroll systems and processes

- Staying updated on changes in payroll legislation

- Helping businesses avoid costly mistakes and penalties

- Conducting internal audits to identify and correct compliance issues

- Preparing and submitting required government forms and reports

What is the Payroll Compliance Legislation Course?

The Payroll Compliance Legislation Course is a comprehensive training program offered by the National Payroll Institute. Here’s what you need to know:

- Course details: It covers federal and provincial legislation related to payroll, including employment standards, payroll taxation, and year-end requirements.

- Prerequisites: Generally, you need some basic understanding of payroll processes. Some work experience requirement application in payroll or completion of introductory payroll courses may be required.

- Course materials: These are usually included in the tuition and cover all aspects of payroll compliance. Materials are regularly updated to reflect current legislation.

- Tuition fees: Course fees vary, so check www.payroll.ca for current pricing and start dates. The investment can be significant but is often worthwhile for the depth of knowledge gained. Depending on your status as an international student or part-time or full-time student, you might be eligible for financial aid.

- Continuing education: The course counts towards continuing professional education credits for payroll professionals, helping them maintain their certifications.