Become an insider!

Get our latest payroll and small business articles sent straight to your inbox.

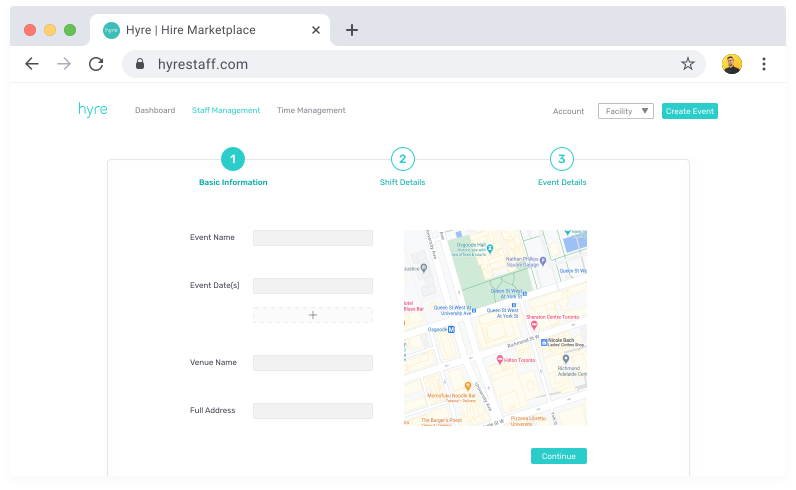

Launched in 2017, Hyre is a digital HR platform that provides employee scheduling software and temporary staffing solutions for businesses across different industries, such as healthcare, hospitality and restaurant.

Eropa Stein, Hyre’s CEO and Founder, is a firm believer in efficiency — a value that sits at the core of her small business and has guided her decision in choosing Wagepoint as Hyre’s payroll software provider.

Time is a precious commodity — especially in a small business.

Like many small business owners with a small team, Eropa initially calculated payroll using an Excel sheet and the Canada Revenue Agency’s (CRA’s) payroll deductions formulas. However, calculating payroll manually became unmanageable once she hired her fifth employee. She found that payroll was taking up too much of her time — something that she didn’t have to spare.

I used to calculate payroll on my own using the CRA website. But when I hired my fifth employee, payroll ended up taking too much time out of my day. That was one or two hours that I could’ve put into other parts of my business. Hyre is now a team of 10. With Wagepoint, the time I spend on payroll per month is minimal.

— Eropa Stein, CEO and Founder, Hyre

Hyre connects job seekers with shift work

Good things come in simple packages.

When it comes to payroll, Eropa’s number one criterion is simplicity. Hyre had initially worked with another payroll software and although it had many features, they found it to be too complicated to use. It was such a jarring experience for Eropa that she was reluctant to move forward with any software that didn’t put simplicity at the core of its product design.

Before I found Wagepoint, I used another product. It was such a negative experience that during my search, if I felt that any software remotely resembled it, I’d just say no. Given what I’d just experienced, the main thing I was looking for in payroll software was something that was simple to use and saved me time. Wagepoint checks the box for both.

— Eropa Stein, CEO and Founder, Hyre

Payroll automation saves time and reduces stress.

Since working with Wagepoint, Eropa immediately found that she was able to put more time back into her business — particularly because Hyre’s tax compliance was now automated!

Having my deductions and compliance automated is huge for me. I don’t have to think about deductions and I love that I don’t have to send T4s and T4As to my workers anymore because that required a lot of maintenance. They can access their tax slips in the Wagepoint Employee Portal and have peace of mind knowing that it was submitted automatically.

— Eropa Stein, CEO and Founder, Hyre

A win for all — Wagepoint’s Employee Portal.

Getting questions from your employees about their paystubs is not uncommon if you’re an employer. A key feature that’s benefited both Eropa and the rest of the Hyre team is Wagepoint’s online employee portal.

Whenever an employee asks me about their paystub, I just remind them that they can view their paystub in the online employee portal and that usually answers all of their questions. Every second counts when you’re a small business owner, so I’m glad I’m no longer bogged down by that.

— Eropa Stein, CEO and Founder, Hyre

To sweeten the pot, Eropa is also a fan of Wagepoint’s choice of hold music. Her favourite? Money by Pink Floyd.

👉Jam out to other money-related songs from the Ultimate Payroll Playlist

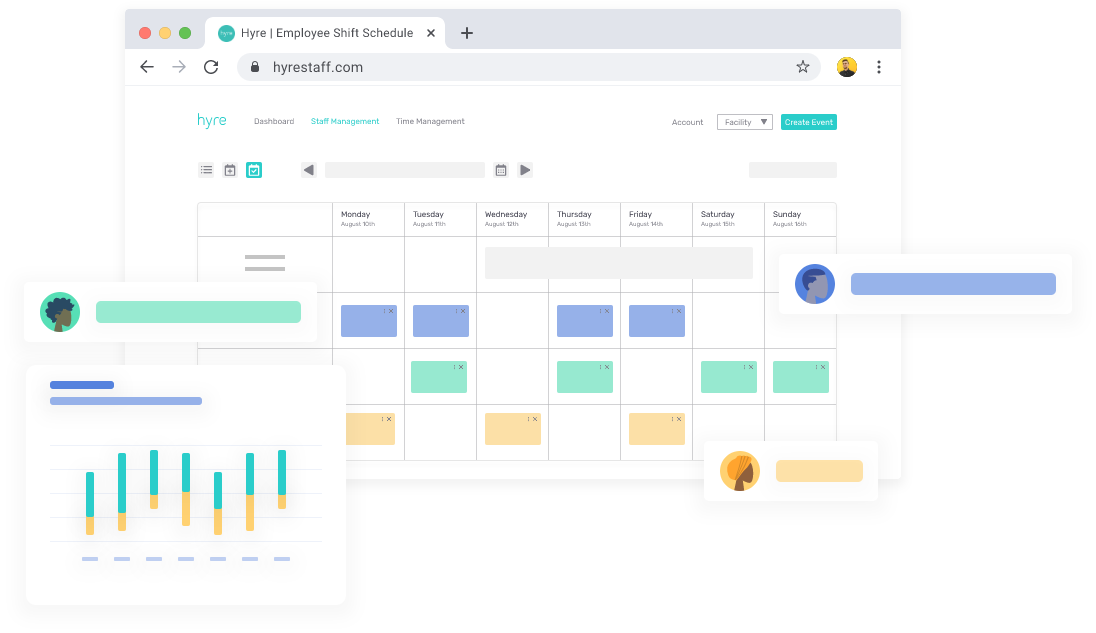

Businesses can use Hyre’s online marketplace dashboard to find temp employees

The gift of simple payroll for other small business owners.

Wagepoint came to Eropa as a recommendation by a friend at the DMZ. Given her experience, she was hesitant at first but she took the plunge because Wagepoint didn’t require much commitment. Since then, she’s been a big Wagepoint advocate.

I was recommended to Wagepoint by a friend at the DMZ. Since I got my first two months of payroll for free, I figured if I didn’t like the software, I’d just change — it wasn’t a big commitment. Now, I recommend Wagepoint to other founders whenever I can. I joke around about giving them their money back if it doesn’t work out, but that’s how much value I think Wagepoint brings to small business owners.

— Eropa Stein, CEO and Founder, Hyre

The benefits of payroll automation — advice from a small business mentor.

Eropa is a member of the DMZ’s Alumni-in-Residence (AiR) program and regularly provides advice and mentorship to current DMZ startups. Understanding that founders often believe payroll automation is too big of a learning curve, here’s what she says about using Wagepoint’s payroll software:

Wagepoint is very easy to use, onboarding is pretty straightforward and it’s simple to automate your source deduction remittances. You don’t need an accountant to do your T4s because Wagepoint submits it automatically for you. This saves so much time and money. Payroll can be done in minutes and if you have salaried employees, it can even be automated. I love that I can set and forget my payroll.

— Eropa Stein, CEO and Founder, Hyre

Hyre also offers employee scheduling software for businesses

Schedule permanent payroll wins into your work day.

Thank you for taking the time to share your story with us, Eropa! We’re grateful that you found a permanent payroll solution in Wagepoint and are fortunate to call Hyre a loyal customer.

👉Read more small business stories, like Clothes-ing The Door On Payroll Pains With Hilary MacMillan

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals. Remittance and reporting capabilities within Wagepoint vary by location. To qualify for complimentary T4s, a business must run a minimum of two (2) payrolls in the current calendar year.